| 4) | Proposed maximum aggregate value of transaction: |

__________________________________________________________________________________________

| 5) | Total fee paid: |

__________________________________________________________________________________________

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

__________________________________________________________________________________________

| 2) | Form, Schedule or Registration Statement No.: |

__________________________________________________________________________________________

| 3) | Filing Party: |

__________________________________________________________________________________________

| 4) | Date Filed: |

__________________________________________________________________________________________

KLA-TENCOR CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOVEMBER 8, 2002

To the Stockholders:

|

All stockholders are cordially invited to attend the meeting in person; however, to assure your representation at the meeting, you are requested to complete, sign and date the enclosed proxy card and return it in the enclosed envelope or follow the instructions on the enclosed proxy card to vote by telephone or via the Internet. Any stockholder attending the meeting may vote in person even if he or she returned a proxy. |

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of KLA-Tencor Corporation (the “Company”), a Delaware corporation, will be held on Friday, November 8, 2002 at 11:00 a.m., local time, at the Company’s offices located at Three Technology Drive, Milpitas, California 95035, for the following purposes:

1. To elect three Class I directors to each serve for a three-year term, to elect one Class III director to serve the remaining two years of a three-year term, and until their successors are duly elected.

2. To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants of the Company for the fiscal year ending June 30, 2003.

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on September 16, 2002 are entitled to notice of, and to vote at, the meeting and any adjournment thereof.

| Sincerely, | ||

| ||

| Stuart J. Nichols | ||

| Assistant Secretary |

San Jose, California

September 27, 2002

2002 ANNUAL MEETING OF STOCKHOLDERS

OF

KLA-TENCOR CORPORATION

To be held on November 8, 2002

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of KLA-Tencor Corporation (the “Company”) for use at the Annual Meeting of Stockholders to be held on Friday, November 8, 2002 at 11:00 a.m., local time, or at any adjournment thereof (the “Annual Meeting”), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company’s offices at Three Technology Drive, Milpitas, California 95035. The Company’s principal executive offices are located at 160 Rio Robles, San Jose, California 95134, and its telephone number is (408) 875-3000.

These proxy solicitation materials were mailed on or about September 27, 2002 to all stockholders entitled to vote.

Record Date

Only stockholders of record at the close of business on September 16, 2002 are entitled to notice of and to vote at the Annual Meeting. As of September 16, 2002, 189,113,780 shares of the Company’s Common Stock, $0.001 par value, were issued and outstanding.

Revocability of Proxies

Any Proxy given pursuant to this solicitation may be revoked by the person giving it at any time before the proxy holders vote the shares by delivering to the Assistant Secretary of the Company at the principal executive offices of the Company a written notice of revocation or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Quorum; Abstentions; Broker Non-Votes

The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of Common Stock issued and outstanding on the record date. Shares that are voted “FOR,” “AGAINST,” “ABSTAIN” or “WITHHELD FROM” are treated as being present at the Annual Meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the Annual Meeting (the “Votes Cast”) with respect to such matter.

Abstentions will be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of Votes Cast with respect to a proposal (other than the election of directors). Accordingly, abstentions will have the same effect as a vote against the proposal (other than the election of directors).

Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but will not be counted for purposes of determining the number of Votes Cast with respect to the particular proposal on which the broker has expressly not voted. Accordingly, broker non-votes will not affect the outcome of the voting on a proposal that requires a majority of the Votes Cast.

Voting and Solicitation

On all matters to be voted upon, each share held by stockholders as of the record date has one vote.

Stockholders of record entitled to vote at the Annual Meeting may attend the Annual Meeting and vote in person, or instruct the proxy holders how to vote their shares of Common Stock by using the Internet voting site or the toll free number listed on the proxy card, or by signing, dating and mailing the proxy card in the postage paid envelope that has been provided. Specific instructions for using the Internet and telephone voting systems are on the proxy card. Proxy cards voted using any of these methods without giving specific voting instructions, will be voted as recommended by the Board of Directors.

The cost of soliciting proxies will be borne by the Company. The Company has retained the services of Automatic Data Processing (“ADP”) to aid in the solicitation of proxies from brokers, bank nominees and other institutional owners. The Company estimates that it will pay ADP a fee of approximately $100,000 for this solicitation activity and for forwarding solicitation material to beneficial and registered stockholders and processing the results. Proxies may be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone.

A copy of the Company’s Annual Report to Stockholders on Form 10-K for the year 2002 (the “Annual Report”), including financial statements, has been sent simultaneously with this Proxy Statement or has been previously provided to all stockholders entitled to vote at the Annual Meeting. In addition, upon written request to the Company at its principal executive offices, attention Assistant Secretary, the Company will provide without charge to each person solicited a copy of the Company’s Annual Report. It is also available on the Internet from the Securities and Exchange Commission at www.sec.gov , as well as on the Company’s website at www.kla-tencor.com.

SECURITY OWNERSHIP

Principal Stockholders

During the last fiscal year, the following persons were known to the Company to be the beneficial owners of more than 5% of the Company’s Common Stock:

| Name and Address | Number of Shares Owned | Percentage Total (1) | |||||

| FMR Corp. (2)(3) 82 Devonshire Street Boston, MA 02109 |

14,785,750 | 7.80% | |||||

| Capital Research & Management Co. (2) 333 South Hope Street Los Angeles, CA 90071 |

10,751,675 | 5.70% | |||||

| Capital Guardian Trust Co. (2) 333 South Hope Street Los Angeles, CA 90071 |

10,467,804 | 5.50% | |||||

______________

| (1) | Based on 189,113,780 outstanding shares of Common Stock as of September 16, 2002. |

| (2) | Based on information provided pursuant to Schedule 13F filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2002. |

| (3) | FMR Corp. is a parent holding company and includes shares held by Fidelity Management Research Company, Fidelity Management Trust Company and Fidelity International Liberty. |

Security Ownership of Management

The following table sets forth the beneficial ownership of Common Stock of the Company as of September 16, 2002 by all directors and director nominees, each of the named executive officers set forth in the Summary Compensation Table and by all directors and current executive officers as a group:

| Name | Amount Owned | Approximate Percentage Owned* | |||||

| Kenneth Levy (1) | 3,490,247 | 1.85% | |||||

| Kenneth L. Schroeder (2) | 1,446,566 | ** | |||||

| Edward W. Barnholt (3) | 65,832 | ** | |||||

| H. Raymond Bingham (4) | 30,000 | ** | |||||

| Robert T. Bond (5) | 32,000 | ** | |||||

| Richard J. Elkus, Jr. (6) | 132,500 | ** | |||||

| Jon D. Tompkins | 31,416 | ** | |||||

| Lida Urbanek (7) | 1,362,710 | ** | |||||

| Gary E. Dickerson (8) | 402,573 | ** | |||||

| John H. Kispert (9) | 173,663 | ** | |||||

| Dennis J. Fortino (10) | 197,593 | ** | |||||

| All directors and executive officers as a group (15 persons) (11) |

7,651,173 | 4.05% | |||||

______________

| * | Based on 189,113,780 outstanding shares of the Common Stock of the Company as of September 16, 2002. |

| ** | Less than 1% |

| (1) | Includes 901,486 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002, 1,871,522 shares, which are held in trust for the benefit of Mr. Levy’s family, 40,000 shares which are held by the Levy Family Foundation, and 588,000 shares which are held by the KGMW, L.P. |

| (2) | Includes 822,787 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (3) | Includes 65,832 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (4) | Includes 30,000 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (5) | Includes 30,000 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (6) | Includes 32,500 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (7) | Includes 53,892 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002, 1,271,414 shares which are held in trust for the benefit of Mrs. Urbanek’s family, 32,924 shares which are held by the Urbanek Family Foundation, and 4,480 shares which are held by the LIMAK Partners LLC. |

| (8) | Includes 225,822 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (9) | Includes 71,875 shares subject to options which are presently exercisable or will become exercisable, within 60 days of September 16, 2002. |

| (10) | Includes 95,447 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

| (11) | Includes 2,425,533 shares subject to options which are presently exercisable or will become exercisable within 60 days of September 16, 2002. |

PROPOSAL ONE

TO ELECT THREE CLASS I DIRECTORS TO EACH SERVE FOR A

THREE YEAR TERM, TO ELECT ONE CLASS III DIRECTOR TO SERVE

THE REMAINING TWO YEARS OF A THREE-YEAR TERM, AND UNTIL

THEIR SUCCESSORS ARE DULY ELECTED.

Nominees

The Company has a classified Board of Directors comprised of nine director positions consisting of three incumbent Class I directors (Kenneth Levy, Jon D. Tompkins and Lida Urbanek), three incumbent Class II directors (H. Raymond Bingham, Robert T. Bond and Richard J. Elkus, Jr.), two incumbent Class III directors (Edward W. Barnholt and Kenneth L. Schroeder), and one Class III vacancy, as a result of Dean O. Morton’s resignation effective July 31, 2002. The Class II directors and the Class III directors will serve until the annual meetings of stockholders to be held in 2003 and 2004 respectively, or until their respective successors are duly elected and qualified. At each annual meeting, directors are elected for a full term of three years to succeed those directors whose terms expire at the annual meeting.

The term of the three current Class I directors will expire on the date of the Annual Meeting. Three Class I directors of the Board of Directors are to be elected at the Annual Meeting. The nominees for election by the stockholders to these three positions are Kenneth Levy, Jon D. Tompkins and Lida Urbanek. If elected, the nominees will serve as directors until the Company’s annual meeting of stockholders in 2005, or until their successors are duly elected and qualified. One Class III director of the Board of Directors is to be elected at the Annual Meeting. The nominee for election by the stockholders to this position is Stephen P. Kaufman. If elected, the nominee will serve as director until the Company’s annual meeting in 2004, or until his successor is duly elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or a vacancy occurs before the election, the proxies may be voted for such substitute nominees as the Board of Directors may designate.

If a quorum is present and voting, the three nominees for Class I directors receiving the highest number of affirmative votes will be elected as Class I directors and the one nominee for Class III director receiving the highest number of affirmative votes will be elected as a Class III director. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum but have no other legal effect under Delaware Law.

The following table sets forth certain information with respect to the Company’s Board of Directors.

| Name | Age | Position | Director Since | |||||||

| Class I | ||||||||||

| Kenneth Levy | 59 | Chairman of the Board | 1975 | |||||||

| Jon D. Tompkins | 62 | Director | 1997 | |||||||

| Lida Urbanek | 57 | Director | 1997 | |||||||

| Class II | ||||||||||

| H. Raymond Bingham | 56 | Director | 2000 | |||||||

| Robert T. Bond | 59 | Director | 2000 | |||||||

| Richard J. Elkus, Jr. | 67 | Director | 1997 | |||||||

| Class III | ||||||||||

| Edward W. Barnholt | 59 | Director | 1995 | |||||||

| Kenneth L. Schroeder | 57 | Chief Executive Officer | 1991 | |||||||

| Nominee for Class III | ||||||||||

| Stephen P. Kaufman | 60 | Nominee for Director | — | |||||||

There are no family relationships between or among any directors or executive officers of the Company.

Kenneth Levy is a co-founder of KLA Instruments Corporation and since July 1, 1999 has been Chairman of the Board and a Director of KLA-Tencor. From July 1998 until June 30, 1999, he was Chief Executive Officer and a Director. From April 30, 1997 until June 1998, he was Chairman of the Board. From 1975 until April 30, 1997, he was Chief Executive Officer of KLA Instruments Corporation. He currently serves on the boards of directors of Ultratech Stepper, Inc., SpeedFam-IPEC, Inc., Extreme Networks, Inc., and is a Director Emeritus of SEMI, an industry trade association.

Kenneth L. Schroeder joined KLA Instruments in 1979 and left in 1987 to pursue personal and other business interests. He returned to KLA Instruments in 1991. Mr. Schroeder has been Chief Executive Officer and a Director of KLA-Tencor since July 1, 1999 and was our President as well until August 2002. From November 1991 until June 1999, he was President and Chief Operating Officer and a Director. He currently serves on the board of directors of SEMI.

Edward W. Barnholt has been a Director of KLA-Tencor since 1995. Since May 1999, Mr. Barnholt has been President, Chief Executive Officer and a director of Agilent Technologies, Inc. (“Agilent”). Before being named Agilent’s Chief Executive Officer, Mr. Barnholt served as Executive Vice President and General Manager of Hewlett-Packard Company’s Measurement Organization from 1998 to 1999. From 1990 to 1998, he served as General Manager of Hewlett-Packard Company’s Test and Measurement Organization. He was elected a Senior Vice President of Hewlett-Packard Company in 1993 and an Executive Vice President in 1996.

H. Raymond Bingham has been a Director of KLA-Tencor since August 2000. He has served as President and Chief Executive Officer of Cadence Design Systems, Inc. (“Cadence”) since May 1999. Mr. Bingham has been a director of Cadence since November 1997. From 1993 to April 1999, Mr. Bingham served as Executive Vice President and Chief Financial Officer of Cadence. Prior to joining Cadence, Mr. Bingham was Executive Vice President and Chief Financial Officer of Red Lion Hotels, Inc. for eight years. Mr. Bingham also serves on the boards of directors of Legato Systems, Inc. and Onyx Software Corporation.

Robert T. Bond has been a Director of KLA-Tencor since August 2000. Mr. Bond has been a private investor since February 1998. From April 1996 to January 1998, Mr. Bond served as Chief Operating Officer of Rational Software Corporation. Prior to that, he held various executive positions at Rational Software Corporation. Mr. Bond was employed by Hewlett-Packard Company from 1967 to 1983 and held various management positions during his tenure there.

Richard J. Elkus, Jr . has been a Director of KLA-Tencor since April 1997. He was Executive Vice President and Vice Chairman of the board of directors of Tencor Instruments from February 1994 until April 1997. He is the Chairman of the Board and a director of Voyan Technology. He currently serves on the boards of directors of Sopra SA, Lam Research Corporation, Virage Logic Corporation, the Palo Alto Medical Foundation and the National Medal of Technology Foundation.

Jon D. Tompkins has been a Director of KLA-Tencor since April 1997. He was Chairman of the Board from July 1998 to June 1999, when he retired from such position. From May 1997 until July 1998, he was Chief Executive Officer and a Director. From April 1991 until April 1997, Mr. Tompkins was President and Chief Executive Officer of Tencor Instruments prior to its merger with KLA Instruments Corporation. He was a director of Tencor Instruments from 1991 until April 1997 and was appointed Chairman of the Board of Directors of Tencor Instruments in November 1993. Mr. Tompkins currently serves on the boards of directors of Cymer, Inc., Electro Scientific Industries, Inc., Credence Systems Corporation, Logic Vision, Inc. and the Community Foundation of Silicon Valley.

Lida Urbanek has been a Director of KLA-Tencor since April 30, 1997. She is a private investor. She was a director of Tencor Instruments from August 1991 until April 30, 1997.

Stephen P. Kaufman is a nominee for Director. He has been a Senior Lecturer at the Harvard Business School since January 2001. He has been a member of the board of directors of Arrow Electronics, Inc. (“Arrow”) since 1994. From 1986 to June 2000, he was Chief Executive Officer of Arrow. From 1985 to June 1999, he was also Arrow’s President. From 1994 to June 2002, he was Chairman of the Board of Arrow. Mr. Kaufman also serves on the board of directors of Harris Corporation.

Board Meetings and Committees

The Board of Directors of the Company held a total of four meetings during the fiscal year ended June 30, 2002. The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating Committee.

The Audit Committee consists of Mr. Bingham, Mr. Bond, and Mr. Elkus. Prior to Mr. Bond’s appointment, Mr. Morton served on the Audit Committee. The Audit Committee is responsible for appointing, compensating and overseeing the work of the Company’s independent accountants, approving the services performed by the Company’s independent accountants and for reviewing and evaluating the Company’s accounting principles and its system of internal accounting controls. The Audit Committee held four formal meetings during the last fiscal year.

The Compensation Committee, which consists of Mr. Barnholt, Mr. Bond and Mrs. Urbanek, held two meetings during the last fiscal year. The Compensation Committee reviews and approves the Company’s executive compensation policy and makes recommendations concerning the Company’s employee benefit plans.

The Nominating Committee, which consists of Mr. Barnholt, Mr. Levy and Mr. Schroeder, held no formal meetings during the last fiscal year. A unanimous group of the independent disinterested members of the Board of Directors nominated the three Class I directors and Mr. Kaufman for election at the Annual Meeting. The Nominating Committee is primarily responsible for identifying and evaluating the qualifications of all candidates for election to the Board of Directors. The Nominating Committee will consider nominations recommended by stockholders. Stockholders wishing to submit nominations must notify the Company of their intent to do so and provide the Company with certain information set forth in the Company’s bylaws, or as otherwise requested by the Nominating Committee on or before the date on which stockholder proposals to be included in the proxy statement for the next annual stockholder meeting must be received by the Company.

During the fiscal year ended June 30, 2002, all incumbent directors attended at least 75% of the aggregate number of meetings of the Board of Directors and meetings of the committees of the Board on which they served.

Compensation of Directors

Members of the Board of Directors who are not employees of the Company receive benefits under the 1998 Outside Director Plan (“1998 Director Plan”), which was approved by the stockholders at the 1998 Annual Meeting of Stockholders. In fiscal years 2001 and 2002, each non-employee director (“Outside Director”) received a nonstatutory stock option to purchase 20,000 shares of Common Stock as of the date on which such director first became an Outside Director (the “First Option”). In fiscal year 2003, the Board approved a change in the amount of the First Option, reducing the size of that grant to 10,000 shares of Common Stock to be effective when a new Outside Director first joins the Board. If the new Outside Director does not join the board at the beginning of the Company’s fiscal year, the First Option will be pro rated to reflect the quarter in which such new Outside Director joins the Board. In addition, each Outside Director is automatically granted a nonstatutory stock option to purchase an additional 10,000 shares of Common Stock on the date of the subsequent annual meetings on which he or she remains an Outside Director (the “Subsequent Option”). The term of options granted under the 1998 Director Plan may not exceed 10 years. The 1998 Director Plan provides that the exercise price shall be equal to the fair market value of the Common Stock on the date of grant of the option. Options granted under the 1998 Director Plan become exercisable immediately upon the date of grant. Each Outside Director receives an annual fee of $20,000 and $1,000 for each meeting they attend ($500 if participation is by telephone), plus expenses. Committee members receive $500 per committee meeting they attend ($250 if participation is by telephone).

Required Vote

Directors shall be elected by a plurality of the votes of the shares of the Company’s Common Stock entitled to vote and represented in person or by proxy at the Annual Meeting. Votes against, votes withheld and broker non-votes are counted for purposes of determining the presence or absence of a quorum but have no other legal effect on the election of directors due to the fact that such elections are by a plurality.

The Board of Directors unanimously recommends a vote FOR each of the Class I and Class III nominees listed above.

PROPOSAL TWO

TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE

INDEPENDENT ACCOUNTANTS OF THE COMPANY FOR THE FISCAL YEAR ENDING

JUNE 30, 2003.

After recommendation by the Audit Committee, the Board of Directors has selected PricewaterhouseCoopers LLP, independent accountants, to audit the consolidated financial statements of the Company for its 2003 fiscal year and recommends that the stockholders vote for ratification of such appointment. If there is a negative vote on such ratification, the Board of Directors will reconsider its selection. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Accountants of the Company for the fiscal year ending June 30, 2003.

Executive Compensation

The following table shows, as to the person who served as Chief Executive Officer during the fiscal year ended June 30, 2002 and each of the four other most highly compensated executive officers whose salary plus bonus exceeded $100,000, information concerning all reportable compensation awarded to, earned by or paid to each for services to the Company in all capacities during the fiscal year ended June 30, 2002, as well as such compensation for each such individual for the Company’s previous two fiscal years.

SUMMARY COMPENSATION TABLE

| Long-Term Compensation | |||||||||||||||||||||||||

| Annual Compensation | Other Annual Compensation |

Awards Restricted stock Award(s) |

Securities Underlying Options/ |

LTIP Payouts |

All Other Compensation |

||||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | ($) | ($)(1) | SARs (#)(2) | ($)(3) | (4) | |||||||||||||||||

| Kenneth Levy | 2002 | $ | 246,325 | $ | 109,020 | $N/A | -0- | 28,425 | -0- | $ | 1,000 | ||||||||||||||

| Chairman of | 2001 | $ | 287,066 | $ | 498,049 | $N/A | -0- | 75,803 | -0- | $ | 42,564 | ||||||||||||||

| the Board | 2000 | $ | 341,483 | $ | 502,196 | $N/A | -0- | 90,000 | -0- | $ | 79,681 | ||||||||||||||

| Kenneth L. Schroeder | 2002 | $ | 492,649 | $ | 218,040 | $N/A | -0- | 341,100 | -0- | $ | 1,000 | ||||||||||||||

| Chief Executive | 2001 | $ | 554,403 | $ | 959,894 | $N/A | -0- | 151,600 | -0- | $ | 84,128 | ||||||||||||||

| Officer | 2000 | $ | 505,246 | $ | 737,827 | $N/A | -0- | 150,000 | -0- | $ | 95,600 | ||||||||||||||

| Gary E. Dickerson | 2002 | $ | 378,269 | $ | 159,046 | $N/A | -0- | 105,000 | -0- | $ | 1,000 | ||||||||||||||

| President & Chief | 2001 | $ | 422,391 | $ | 653,479 | $N/A | -0- | 130,000 | -0- | $ | 64,828 | ||||||||||||||

| Operating Officer | 2000 | $ | 366,288 | $ | 418,371 | $N/A | -0- | 100,000 | -0- | $ | 58,504 | ||||||||||||||

| John H. Kispert | 2002 | $ | 238,350 | $ | 166,843 | $N/A | -0- | 60,000 | -0- | $ | 1,000 | ||||||||||||||

| Executive Vice | 2001 | $ | 270,577 | $ | 291,170 | $N/A | -0- | 80,000 | -0- | $ | 43,742 | ||||||||||||||

| President & Chief | 2000 | $ | 190,915 | $ | 115,102 | $N/A | -0- | 30,000 | -0- | $ | 25,831 | ||||||||||||||

| Financial Officer | |||||||||||||||||||||||||

| Dennis J. Fortino | 2002 | $ | 230,048 | $ | 86,209 | $N/A | -0- | 45,000 | -0- | $ | 1,000 | ||||||||||||||

| Executive Vice | 2001 | $ | 264,490 | $ | 280,752 | $N/A | -0- | 90,000 | -0- | $ | 41,513 | ||||||||||||||

| President | 2000 | $ | 228,731 | $ | 197,937 | $N/A | -0- | 60,000 | -0- | $ | 23,929 | ||||||||||||||

______________

| (1) | The Company has not granted any restricted stock rights. |

| (2) | The Company has not granted any stock appreciation rights. |

| (3) | The Company does not have any Long Term Incentive Plans as that term is defined in the regulations. |

| (4) | “All Other Compensation” is itemized as follows: In fiscal 2002, Messrs. Levy, Schroeder, Dickerson, Kispert and Fortino each received $1,000.00 which was contributed by the Company as a matching contribution to the 401(k) Plan. |

Stock Option Grants and Exercises

The following tables set forth the number of securities underlying stock options granted to the named executive officers under the Company’s stock option plans and the options exercised by such named executive officers during the fiscal year ended June 30, 2002.

The Option/SAR Grant Table sets forth hypothetical gains or “option spreads” for the options at the end of their respective ten-year terms, as calculated in accordance with the rules of the Securities and Exchange Commission. Each gain is based on an arbitrarily assumed annualized rate of compound appreciation of the market price at the date of grant of 5% and 10% from the date the option was granted to the end of the option term. Actual gains, if any, on option exercises are dependent on the future performance of the Company’s Common Stock and overall market conditions.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

KLA-Tencor Corporation 1982 Stock Option Plan4

| Individual Grants | |||||||||||||||||||

| Number of Securities Underlying Options/ SARS |

Percent of total options/ SARS granted to employees in fiscal |

Exercise or base price |

Expiration | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term |

|||||||||||||||

| granted (#) (1) | Year (2) | ($/share)(3) | Date | 5% | 10% | ||||||||||||||

| Kenneth Levy | 28,425 | 0.29% | $29.31 | 10/2/2011 | $ | 523,955 | $ | 1,327,805 | |||||||||||

| Kenneth L. Schroeder | 341,100 | 3.49% | $29.31 | 10/2/2011 | $ | 6,287,463 | $ | 15,933,665 | |||||||||||

| Gary E. Dickerson | 105,000 | 1.08% | $29.31 | 10/2/2011 | $ | 1,935,455 | $ | 4,904,822 | |||||||||||

| John H. Kispert | 60,000 | 0.61% | $29.31 | 10/2/2011 | $ | 1,105,974 | $ | 2,802,755 | |||||||||||

| Dennis J. Fortino | 45,000 | 0.46% | $29.31 | 10/2/2011 | $ | 829,481 | $ | 2,102.67 | |||||||||||

______________

| (1) | The Company has not granted any stock appreciation rights. |

| (2) | Based on a total of 9,760,303 options granted to employees in FY 2002. |

| (3) | Options were granted at an exercise price equal to the fair market value of the Company’s Common Stock on October 2, 2001. |

| (4) | The material terms of the grants are: (i) options granted in fiscal year 2002, the options vest on a five year schedule with 20% vesting after one year and the remaining option shares vesting 1/48 per month for the remainder of the vesting term. Options granted prior to fiscal year 2002 vest on a four year schedule with 25% vesting after one year and the remaining option shares vesting 1/36 per month for the remainder of the vesting term; (ii) to the extent unexercised, the options lapse after ten years; (iii) the options are non-transferable and are only exercisable during the period of employment of the optionee for 30 days following the termination of employment, subject to limited exceptions in the cases of certain terminations, death or permanent disability of the optionee. In addition, Mr. Schroeder’s grant in the table above includes options with the following vesting schedules: 113,700 shares, of which 20% vests on October 2, 2002 with 1/48th of the balance each month thereafter; 75,800 shares, of which 20% vests on October 2, 2003 with 1/48th of the balance each month thereafter; 75,800 shares, of which 20% vests on October 2, 2004 with 1/48th of the balance each month thereafter; 75,800 shares, of which 20% vests on October 2, 2005 with 1/48th of the balance each month thereafter. |

AGGREGATED OPTION/SAR EXERCISES IN

LAST FISCAL YEAR AND YEAR-END VALUE

KLA-Tencor Corporation 1982 Stock Option Plan

| Number of Shares Acquired on |

Value | Total Number of Unexercised Options Held at Fiscal Year-End |

Total Value of Unexercised In-the-Money Options Held at Fiscal Year-End (2) |

||||||||||||||||

| Exercise | Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||||

| Kenneth Levy | 0 | $ | 0 | 853,814 | 130,414 | $ | 25,238,852 | $1,898,511 | |||||||||||

| Kenneth L. Schroeder | 180,000 | $ | 8,970,000 | 744,532 | 508,168 | $ | 19,562,184 | $7,086,390 | |||||||||||

| Gary E. Dickerson | 57,750 | $ | 2,580,140 | 165,706 | 231,659 | $ | 2,246,876 | $3,045,148 | |||||||||||

| John H. Kispert | 40,000 | $ | 1,546,153 | 46,989 | 121,211 | $ | 462,487 | $1,460,890 | |||||||||||

| Dennis J. Fortino | 20,750 | $ | 995,118 | 69,924 | 122,993 | $ | 553,058 | $1,409,938 | |||||||||||

______________

| (1) | The Company has not granted any stock appreciation rights. |

| (2) | Total value of vested options based on fair market value of Company’s Common Stock of $43.99 per share as of June 28, 2002. |

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Compensation Committee.

The Compensation Committee of the Board of Directors is comprised of three of the independent, non-employee members of the Board of Directors, none of whom have interlocking relationships as defined by the Securities and Exchange Commission. The Compensation Committee is responsible for setting and administering the policies governing annual compensation of executive officers, considers their performance and makes recommendations regarding their cash compensation and stock options to the full Board of Directors. The Compensation Committee periodically reviews its approach to executive compensation and makes changes as appropriate.

Compensation Philosophy.

The Compensation Committee of the Board of Directors establishes the overall executive compensation strategies of the Company and approves compensation elements for the Chairman of the Board, the Chief Executive Officer and other executive officers. The goals of the Company’s compensation policy are to attract, retain and reward executive officers who contribute to the overall success of the Company by offering compensation that is competitive in the industry, to motivate executive officers to achieve the Company’s business objectives and to align the interests of executive officers with the long-term interests of stockholders. The Company currently uses a compensation package which includes a salary, a management incentive plan and stock option grants to meet these goals.

The compensation philosophy of the Compensation Committee is to provide a comprehensive compensation package for each executive officer that is well suited to support accomplishment of the Company’s business strategies, objectives and initiatives. For incentive-based compensation, the Compensation Committee considers the desirability of structuring such compensation arrangements so as to qualify for deductions available under Section 162(m) of the Internal Revenue Code, which disallows a tax deduction for any publicly-held corporation for individual compensation exceeding one million U.S. Dollars in any taxable year for any of the named executive officers, other than compensation that is “performance based.” The Compensation Committee applies this compensation philosophy in determining appropriate executive compensation levels and other compensation factors, and the Compensation Committee reaches its decisions with a view towards the Company’s overall financial performance.

Chief Executive Officer Compensation.

For fiscal year 2002, Kenneth L. Schroeder served as Chief Executive Officer. In setting Mr. Schroeder’s compensation for fiscal year 2002, the Compensation Committee considered the Company’s revenue and profit in the prior fiscal year, the Company’s market capitalization and data from comparable companies supplied by the Company’s compensation consultants, in addition to Mr. Schroeder’s performance and continuing contributions to the Company. For fiscal year 2002, a bonus of $218,040 was paid to Mr. Schroeder, based on the Company’s performance as measured against a formula, which is based on meeting financial and strategic objectives as well as the Company’s revenue growth objectives as compared to a peer group. This bonus formula was approved by the Compensation Committee and the independent members of the Board of Directors last year.

Executive Officer Compensation.

The Compensation Committee’s executive compensation philosophy is based upon a belief that a substantial portion of aggregate annual compensation for executive officers should be contingent upon the Company’s performance and an individual’s contribution to the Company’s success. In addition, the Compensation Committee strives to align the interests of the Company’s executive officers with the long-term interests of stockholders through stock option grants that can result in ownership of the Company’s Common Stock. The Compensation Committee endeavors to structure each executive officer’s overall compensation package to be consistent with this approach and to enable the Company to attract, retain and reward personnel who contribute to the success of the Company.

In addition to stock option grants, the Company provides its executive officers with a compensation package consisting of base salary, variable incentive pay and participation in benefit plans generally available to

other employees. The Committee considers market information from published survey data provided to the Committee by the Company’s human resources staff. The market data consists primarily of base salary and total cash compensation rates, as well as incentive bonus and stock programs of other companies considered by the Committee to be peers in the Company’s industry.

For the Company’s previous fiscal year, the Committee reviewed and recommended a compensation structure, after considering a number of factors, including, the substantial economic and business challenges in the semiconductor and semiconductor capital equipment industries worldwide.

Base Salary.

Salaries for executive officers are set with reference to salaries for comparable positions among other companies in the Company’s industry or in industries that employ individuals of similar education and background to the executive officer based on data provided by the Company’s human resources staff. In addition, each person’s job responsibilities, level of experience, individual performance and contribution to the Company’s business are considered. In making base salary decisions, the Committee exercised its discretion and judgment based upon these factors. No specific formula was applied to determine the weight of each factor.

Management Incentive Plan.

Each year since fiscal 1979, the Company has adopted a management incentive plan (the “Incentive Plan”) which provides for payments to officers and key employees based on the financial performance of the Company or the relevant business unit, and on the achievement of key strategic objectives which are set by senior management and approved by the Board of Directors. The Incentive Plan is approved by the Compensation Committee and submitted to the Board of Directors for ratification. For fiscal year 2002, the Incentive Plan set goals for profitability, achievement of measurable objectives aimed at strategic corporate goals and achievement of objectives relating to managing the ratio of assets to sales. The target goals for fiscal year 2002 were not achieved as to 100% of the goals, and as a result 65% of the incentive plan amounts were paid. In the aggregate, $23,366,000 was distributed under the 2002 incentive plan to officers and key employees.

Outstanding Corporate Performance Executive Bonus Plan.

The Company continues to utilize its incentive plan for an additional bonus to executives in years when the Company achieves certain levels of profitability and growth (the “Outstanding Corporate Performance Plan”). For those executive officers that do not manage operating divisions, the performance measurements are based on the Company’s pre-tax margin and the growth of the Company’s aggregate revenues over the prior 12 months against a target group of public U.S. companies over the same period. For those executive officers who manage operating divisions, the performance measurements are based on certain specified growth objectives for the managed operating divisions, and the Company’s net operating margin. The target percentage for the Outstanding Corporate Performance Plan bonus is the same target percentage as utilized in determining the Incentive Plan bonus. For fiscal year 2002, no bonuses were paid pursuant to the Outstanding Corporate Performance Plan.

In years that the performance goals are met, half of each annual amount under the Outstanding Corporate Performance Plan is payable at the end of the fiscal year. The other half of each annual amount payable under the plan is contributed by the Company to the Executive Deferred Savings Plan (the “EDSP”) and vests over a one-year period. At the end of the one-year period, the executive officer has the choice of taking a cash payment or leaving the contribution in the EDSP. If the executive officer leaves during that one-year period, the contribution by the Company is forfeited. Although the executive officer is eligible to participate in both the Company’s profit sharing plan and the Outstanding Corporate Performance Plan, any amounts contributed by the Company pursuant to the Outstanding Corporate Performance Plan will be reduced by the amount of profit sharing paid to the executive by the Company during the fiscal year.

Long-term Incentives.

Long-term incentives are provided through the Stock Option Plan and the Excess Profit Stock Plan, each of which reward executive officers through the growth in value of the Company’s Common Stock. The Compensation Committee believes that employee equity ownership is highly motivating, provides a major

incentive for employees to build stockholder value and serves to align the interests of employees with those of stockholders.

Grants of stock options to executive officers are based upon each executive officer’s relative position, responsibilities, historical and expected contributions to the Company, and the executive officer’s existing stock ownership and previous option grants, with primary weight given to the executive officer’s relative position and responsibilities. Stock options are granted at market price on the date of grant and will provide value to the executive officers only when the price of the Company’s Common Stock increases over the exercise price.

| Members of the Compensation Committee | ||

| Edward W. Barnholt | ||

| Robert T. Bond | ||

| Lida Urbanek |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee are set forth in the preceding section. There are no members of the Compensation Committee who were officers or employees of the Company or any of its subsidiaries during the fiscal year, formerly officers of the Company, or had any relationship otherwise requiring disclosure hereunder.

REPORT OF THE AUDIT COMMITTEE

The Company’s Audit Committee is composed of independent directors, all of whom meet the standards of independence set forth in Rule 4200(a)(14) of the National Association of Securities Dealers listing standards. For fiscal year 2002, H. Raymond Bingham, Richard J. Elkus, Jr. and Dean O. Morton served as members on the Audit Committee. Mr. Morton resigned effective July 31, 2002, and Robert T. Bond was appointed to the Audit Committee. Mr. Bingham was Chairman of the Audit Committee for fiscal year 2002, and Mr. Elkus is Chairman for fiscal year 2003. The Chairman is responsible for preparing an agenda for each meeting. No member of the Audit Committee attended fewer than 75% of the Audit Committee meetings. Attached as Appendix I to this Proxy Statement is a copy of the Audit Committee Charter, as amended September 19, 2002.

During fiscal year 2002, the Audit Committee met with the senior members of the Company’s financial management team, the Company’s independent auditors and the Company’s General Counsel when appropriate. The Audit Committee also met separately with the Company’s independent auditors and separately with the Company’s Chief Financial Officer. The parties candidly discussed financial management, accounting and internal controls.

The Audit Committee recommended to the Board of Directors the engagement of PricewaterhouseCoopers LLP as the Company’s independent auditors and reviewed with the Company’s financial managers and the independent auditors the overall audit scopes and plans, the results of internal and external audit examinations, evaluations by the auditors of the Company’s internal controls and the quality of the Company’s financial reporting.

The Audit Committee reviewed and discussed the audited financial statements included in the Company’s Annual Report with the Company’s management including, without limitation, a discussion of the quality and not just the acceptability of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements as well as in Management’s Discussion and Analysis of Results of Operations and Financial Condition. In addressing the reasonableness of management’s accounting judgments, members of the Audit Committee asked for management’s representations that the audited consolidated financial statements of the Company have been prepared in conformity with generally accepted accounting principles, and have expressed to both management and auditors their general preference for conservative policies when a range of accounting options is available.

In its meetings with representatives of the independent auditors, the Audit Committee asked the representatives to address and discuss their responses to several questions that the Audit Committee believes are particularly relevant to its oversight. These questions included (i) whether there were any significant accounting judgments made by management in preparing the financial statements that would have been made differently had the auditors themselves prepared and been responsible for the financial statements; (ii) whether, based on the auditor’s experience and their knowledge of the Company, the Company’s financial statements fairly present to investors, with clarity and completeness, the Company’s financial position and performance for the reporting period in accordance with generally accepted accounting principles and SEC disclosure requirements; and (iii) whether, based on their experience and their knowledge of the Company, they believe the Company has implemented internal controls and internal audit procedures that are appropriate for the Company.

The Audit Committee also discussed the independence of the independent auditors with them and the matters required to be discussed by Statement on Auditing Standards No. 61, (Communication With Audit Committees). The Audit Committee considered the non-audit services performed by PricewaterhouseCoopers, and approved such services keeping in mind the appropriateness of the additional services. The Audit Committee received from the auditors the written disclosures and the letter from the auditors required by Independence Standards Board Standard No. 1, (Independence Discussions With Audit Committees).

In performing all of these functions, the Audit Committee acts only in an oversight capacity. The Audit Committee does not complete its reviews prior to the Company’s public announcement of financial results and, necessarily, in its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent auditors, who, in their report, express an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors approved, the audited financial statements included in the Company’s Annual Report for the fiscal year ended June 30, 2002, filed with the Securities and Exchange Commission on September 20, 2002.

| Members of the Audit Committee | ||

| Richard J. Elkus, Jr., Chairman | ||

| H. Raymond Bingham | ||

| Robert T. Bond |

AUDIT AND RELATED FEES

Audit Fees : The aggregate fees billed or to be billed by PricewaterhouseCoopers LLP for professional services rendered for (i) the audit of the Company’s annual financial statements set forth in the Company’s Annual Report for the fiscal year ended June 30, 2002, and (ii) the review of the Company’s quarterly financial statements set forth in the Company’s Quarterly Reports on Form 10-Q were approximately $627,000.

All Other Fees : The aggregate fees billed by PricewaterhouseCoopers LLP for services other than those described above for the fiscal year ended June 30, 2002 were approximately $2,899,000.

All other fees include fees for services such as tax consulting and compliance, expatriate compliance, statutory audits in certain locations outside the United States and other audit related services. Audit related services include work associated with auditing and accounting consultations regarding new accounting standards, SEC filings and acquisitions related accounting assistance.

The Company’s Audit Committee considered and determined that the provision of the services provided by PricewaterhouseCoopers LLP as set forth herein are compatible with maintaining PricewaterhouseCoopers’ independence and approved all non-audit related fees and services.

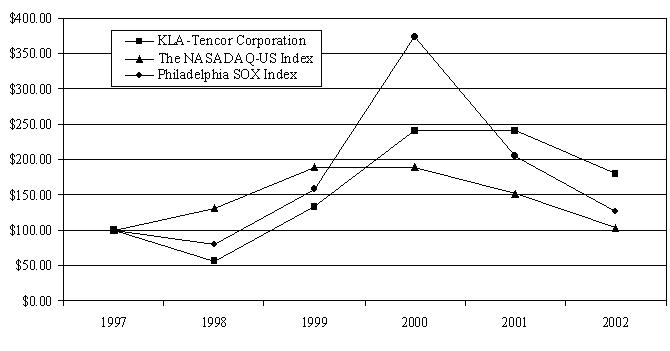

PERFORMANCE GRAPH

The stock price performance shown on the following graph is not necessarily indicative of future price performance.

Comparison of Five Year Cumulative Total Return Among KLA-Tencor Corporation,

the NASDAQ - US Index and the Philadelphia SOX Index*

| 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | ||||||||||||||

| KLA-Tencor Corporation | 100 | 57 | 133 | 240 | 240 | 180 | |||||||||||||

| NASDAQ-US Index | 100 | 132 | 189 | 189 | 152 | 103 | |||||||||||||

| Philadelphia SOX Index | 100 | 80 | 158 | 373 | 204 | 127 | |||||||||||||

______________

| * | Assumes $100 invested on June 30, 1997. The Company’s fiscal year end is June 30 |

Previously, the Company had reflected The Hambrecht & Quist Technology Index on this comparative chart. Since that index was discontinued on April 20, 2002, the Company now uses the Philadelphia SOX Index in its comparative chart

CERTAIN TRANSACTIONS

In connection with the merger between KLA Instruments Corporation and Tencor Instruments (effective April 30, 1997) the Company entered into identical employment arrangements, subsequently amended, with Messrs. Levy and Schroeder. The arrangements, as amended, provide that certain benefits would be paid if certain events took place after April 30, 1997. The purpose of these arrangements was to retain the services of Messrs. Levy and Schroeder to ensure the continued smooth transition associated with the merger. The terms of those arrangements provide that if an individual were to leave the Company after April 30, 1998, subject to releasing the Company from all claims, and in connection with working part-time for 36 months, he will receive (i) his base salary for the first 24 months of part-time employment, (ii) a mutually agreeable level of compensation per month for the final 12 months of part-time employment, (iii) an annual bonus (based on an achievement of 100% of bonus objectives) in the fiscal year of his transition to part-time employment, (iv) a bonus paid in the fiscal year following the payment of the annual bonus above, (based on achievement of 100% of his individual bonus objectives) and (v) a pro-rated bonus for the fiscal year in which part-time employment ended. During the periods of part-time employment, all options to exercise stock of the Company, which were granted more than 12 months prior to the termination of full-time employment, will continue to vest. The same benefits shall be payable in the event the Company terminates his employment without cause. If he is terminated for cause (defined as (i) gross negligence or willful misconduct in connection with the performance of duties, (ii) conviction of or plea of nolo contendere to any felony, or (iii) the embezzlement or misappropriation of Company property) then he will receive a lump-sum payment equal to 25% of his base salary.

In December 2000, the Company made a loan to John H. Kispert, the Company’s Chief Financial Officer, in the amount of $300,000. The loan was evidenced by a promissory note (“Note”). The Note incurs interest at a rate of 6.3% per annum and is repayable in December 2020. The Note is secured by a Third Deed of Trust on Mr. Kispert’s real property.

In fiscal year 2001, the Company entered into a Bonus Agreement with Mr. Kispert, whereby Mr. Kispert will receive payments of $93,000 a year, for the next four years.

Change in Control Agreements

In fiscal year 2002, the Board of Directors approved individual “change-in-control” agreements for Messrs. Schroeder, Dickerson and Kispert (each, an “Executive”). The change-in-control provisions of these agreements take effect if the Executive’s employment is terminated involuntarily or constructively within two years after a change in control of the Company. If the provisions become effective, the Executive becomes eligible to receive: (i) an amount equal to two times his annual compensation; (ii) an amount equal to two times his bonus amount; (iii) continuation of health benefits for two years; and (iv) full acceleration of vesting for all options held. In addition, in the case of Mr. Schroeder, he would receive an option grant equal to his planned option grants for the forthcoming four years. For the purpose of these agreements, a change in control occurs upon merger of the Company with or into another corporation, or a change in more than half of the total voting power of the Company, or upon the sale of substantially all of the assets of the Company.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended requires the Company’s executive officers, directors, and persons who own more than ten percent of a registered Class of the Company’s equity securities to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Maureen Lamb, the Company’s Vice President, Finance, timely reported on a Form 4 the sale of 1,000 shares in April 2001, however, due to a clerical error, the Form 4 incorrectly reflected the number of shares. The error was noted on the Form 5 timely filed by Ms. Lamb for the 2002 fiscal year.

OTHER MATTERS

Delivery of Documents to Stockholders Sharing an Address

Certain stockholders who share an address are being delivered only one copy of this Proxy Statement and the Company’s Annual Report unless the Company or one of its mailing agents has received contrary instructions.

Upon the written or oral request of a stockholder at a shared address to which a single copy of this Proxy Statement and Annual Report was delivered, the Company will promptly deliver a separate copy of such documents to such stockholder. Written requests should be made to KLA-Tencor Corporation, Attention: Investor Relations, 160 Rio Robles, San Jose, CA 95134, and oral requests may be made by calling Investor Relations of KLA-Tencor at (408) 875-3600. In addition, if such a stockholder wishes to receive a separate copy of the proxy statement and annual report in the future, such stockholder should notify the Company either in writing addressed to the foregoing address or by calling the foregoing telephone number.

Stockholders sharing an address who are receiving multiple copies of the proxy statements and annual reports may request delivery of a single copy of the future proxy statements and annual reports by writing to the address above or calling the telephone number above. Stockholders may also request electronic delivery of the Company’s annual report and proxy statement by writing to the address above, calling the telephone number above or by linking directly to the Company’s website at www.icsdelivery.com/klatencor/index.html.

Stockholder Proposals to Be Presented at Next Annual Meeting

Proposals of stockholders that are intended for inclusion in the Company’s proxy statement relating to the 2003 Annual Meeting of the Stockholders must be received by the Company at its offices at 160 Rio Robles, San Jose, CA 95134, Attention: General Counsel, not later than May 31, 2003 and must satisfy the conditions established by the Securities and Exchange Commission for stockholder proposals in order to be included in KLA-Tencor’s proxy statement for that meeting. Stockholder proposals that are not intended to be included in KLA-Tencor’s proxy materials for such meeting but that are intended to be presented by the stockholder from the floor are subject to the advance notice procedures described below under “Transaction of Other Business.”

Transaction of Other Business

At the date of this Proxy Statement, the only business that the Board of Directors intends to present or knows that others will present at the meeting is as set forth above. If any other matter or matters are properly brought before the meeting it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

Any stockholder may present a matter from the floor for consideration at a meeting so long as certain procedures are followed. Under KLA-Tencor’s Bylaws, as amended, in order for a matter to be deemed properly presented by a stockholder, timely notice must be delivered to, or mailed and received by, KLA-Tencor not later than 120 days prior to the next annual meeting of stockholders (under the assumption that the next annual meeting of stockholders will occur on the same calendar day as the day of the most recent annual meeting of stockholders). The stockholder’s notice must set forth, as to each proposed matter, the following: (i) a brief description of the business desired to be brought before the meeting and reasons for conducting such business at the meeting; (ii) the name and address, as they appear on KLA-Tencor’s books, of the stockholder proposing such business; (iii) the class and number of shares of KLA-Tencor that are beneficially owned by the stockholder; (iv) any material interest of the stockholder in such business; and (v) any other information that is required to be provided by such stockholder pursuant to Regulation 14A under the Securities Exchange Act of 1934. The presiding officer of the meeting may refuse to acknowledge any matter not made in compliance with the foregoing procedure.

| The Board of Directors |

September 27, 2002

Audit Committee Charter

KLA-Tencor Corporation, a Delaware Corporation

Purpose

The purpose of the Audit Committee of the Board of Directors (the “ Board ”) of KLA-Tencor Corporation (the “ Company ”) shall be to:

- Oversee the accounting and financial reporting processes of the Company and audits of the financial statements of the Company;

- Assist the Board in oversight and monitoring of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications, independence and performance, and (iv) the Company’s internal accounting and financial controls;

- Prepare the report that the rules of the Securities and Exchange Commission (the “ SEC ”) require be included in the Company’s annual proxy statement;

- Provide the Company’s Board with the results of its monitoring and recommendations derived therefrom; and

- Provide to the Board such additional information and materials as it may deem necessary to make the Board aware of significant financial matters that require the attention of the Board.

In addition, the Audit Committee will undertake those specific duties and responsibilities listed below and such other duties as the Board of Directors may from time to time prescribe.

Membership and Meetings

The Audit Committee shall be comprised of not less than three non-employee members of the Board. The Board shall appoint the members of the Audit Committee, one of whom shall be designated a chairman of the Audit Committee, and such members shall serve at the discretion of the Board. Members of the Audit Committee must meet the following criteria (as well as any criteria required by the SEC or Nasdaq):

- Each member will be an independent director, as defined in (i) Nasdaq Rule 4200 and (ii) the rules of the SEC;

- Each member will be able to read and understand fundamental financial statements, in accordance with the Nasdaq National Market Audit Committee requirements; and

- At least one member will have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a principal financial officer or other senior officer with financial oversight responsibilities.

The Audit Committee shall meet at least four times annually or more frequently as the Audit Committee may deem appropriate.

The Audit Committee will meet separately with the Chief Executive Officer and separately with the Chief Financial Officer of the Company at such times as are appropriate to review the financial affairs of the Company. The Audit Committee will meet separately with the independent auditors of the Company, at such times as it deems appropriate, but not less than quarterly to fulfill the responsibilities of the Audit Committee under this charter.

Key Responsibilities

The responsibilities of the Audit Committee shall include:

- Reviewing on a continuing basis the adequacy of the Company’s system of internal controls, including meeting periodically with the Company’s management and the independent auditors to

- review the adequacy of such controls and to review before release the disclosure regarding such system of internal controls required under SEC rules to be contained in the Company’s periodic filings and the attestations or reports by the independent auditors relating to such disclosure;

- Appointing, compensating and overseeing the work of the independent auditors (including resolving disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work;

- Pre-approving audit and non-audit services provided to the Company by the independent auditors (or subsequently approving non-audit services in those circumstances where a subsequent approval is necessary and permissible); in this regard, the Audit Committee shall have the sole authority to approve the hiring and firing of the independent auditors, all audit engagement fees and terms and all non-audit engagements, as may be permissible, with the independent auditors;

- Reviewing and providing guidance with respect to the external audit and the Company’s relationship with its independent auditors by (i) reviewing the independent auditors’ proposed audit scope, approach and independence; (ii) obtaining on a periodic basis a statement from the independent auditors regarding relationships and services with the Company which may impact independence and presenting this statement to the Board of Directors, and to the extent there are relationships, monitoring and investigating them; (iii) discussing with the Company’s independent auditors the financial statements and audit findings, including any significant adjustments, management judgments and accounting estimates, significant new accounting policies and disagreements with management and any other matters described in SAS No. 61, as may be modified or supplemented; and (iv) reviewing reports submitted to the audit committee by the independent auditors in accordance with the applicable SEC requirements;

- Reviewing and discussing with management and the independent auditors the annual audited financial statements and quarterly unaudited Financial Statements, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations to be included in the Company’s Annual Report on Form 10K (or the Annual Report to Shareholders if distributed prior to the filing of Form 10K) and Quarterly Reports on Form 10-Q, respectively, prior to their filing with the SEC.

- Conducting a post-audit review of the financial statements and audit findings, including any significant suggestions for improvements provided to management by the independent auditors;

- Reviewing before release the unaudited quarterly operating results in the Company’s quarterly earnings release;

- Overseeing compliance with the requirements of the SEC for disclosure of auditor’s services and audit committee members, member qualifications and activities;

- Reviewing, approving and monitoring the Company’s code of ethics for its senior financial officers;

- Reviewing, in conjunction with counsel, any legal matters that could have a significant impact on the Company’s financial statements;

- Reviewing and approving in advance any proposed related party transactions;

- Reviewing its own charter, structure, processes and membership requirements;

- Providing a report in the Company’s proxy statement in accordance with the rules and regulations of the SEC; and

- Establishing procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

In addition to the above responsibilities, the Audit Committee will undertake such other duties as the Board delegates to it, and will report, at least annually, to the Board regarding the Audit Committee’s examinations and recommendations.

The Audit Committee is authorized to conduct any investigation appropriate to fulfilling its responsibilities, with full access to all books, records, facilities and personnel of the Company, and may retain, at the Company’s expense, legal, accounting and other experts as it deems necessary to assist it in conducting any such investigation.

Minutes

The Audit Committee will maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

Compensation

Members of the Audit Committee shall receive such fees, if any, for their service as Audit Committee members as may be determined by the Board in its sole discretion. Such fees may include retainers or per meeting fees. Fees may be paid in such form of consideration as is determined by the Board.

Members of the Audit Committee may not receive any compensation from the Company except the fees that they receive for service as a member of the Board or any committee thereof.

Delegation of Authority

The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to pre-approve audit and permissible non-audit services, provided such pre-approval decision is presented to the full Audit Committee at its scheduled meetings.

KLA-TENCOR CORPORATION C/O EQUISERVE 150 ROYALL STREET CANTON, MA 02021 |

VOTE BY INTERNET - http://www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on November 7, 2002. Have your proxy card in hand when you access the web site. You will be prompted to enter your 12-digit Control Number which is located below to obtain your records and to create an electronic voting instruction form. |

||

| VOTE BY TELEPHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on November 7, 2002. Have your proxy card in hand when you call. You will be prompted to enter your 12-digit Control Number which is located below and then follow the simple instructions the Vote Voice provides you. |

|||

| VOTE BY MAIL

Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to KLA-Tencor Corporation, c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

|||

| YOUR VOTE IS IMPORTANT | |||

All stockholders are cordially invited to attend the meeting |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | |||||

| KLAPRX | KEEP THIS PORTION FOR YOUR RECORDS | ||||

| DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

KLA-TENCOR CORPORATION. The Board Recommends a Vote “FOR” all Nominees for Director and “FOR” Proposal 2. Vote On Directors |

|||||||||||

| 1. | To elect three Class I directors to each serve for a three year term and until their successors are duly elected. | For All |

Withhold All |

For All Except |

To withhold authority to vote, mark “For All Except” and write the nominee's number on the line below. | ||||||

| 1) Kenneth Levy | |||||||||||

| 2) Jon D. Tompkins | 0 | 0 | 0 | ||||||||

| 3) Lida Urbanek | |||||||||||

| To elect one Class III director to serve the remaining two years of a three year term and until his successor is duly elected. 4) Stephen P. Kaufman |

|||||||||||

| For | Against | Abstain | |||||||

| Vote On Proposal | |||||||||

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants of the Company for the fiscal year ending June 30, 2003. | 0 | 0 | 0 | |||||

| To transact such other business as may properly come before the meeting or any adjournment or adjournment thereof. | |||||||||

| In their discretion, the proxy holders are authorized to vote on all such other matters as may properly come before the meeting or any adjournment or postponement thereof. | ||||||||

| Please sign exactly as your name appears on your stock certificate(s), date and return this Proxy promptly in the reply envelope provided. Please correct your address before returning this Proxy. Persons signing in a fiduciary capacity should so indicate. If shares are held by joint tenants or as community property, both should sign. |

| MARK HERE FOR ADDRESS CHANGE AND NOTE AT RIGHT |

0 | ||||||||||

| MARK HERE IF YOU PLAN TO ATTEND THE MEETING |

0 |

| Signature [PLEASE SIGN WITHIN BOX] | Date | Signature (Joint Owners) | Date |

| Vote by Telephone | Vote by Internet |

| Call Toll-Free on a Touch-Tone Phone 1-800-690-6903. |

|||

| Follow these four easy steps: | Follow these four easy steps: | ||

| 1. Read the accompanying Proxy Statement and Proxy Card. |

1. Read the accompanying Proxy Statement and Proxy Card. |

||

| 2. Call the toll-free number 1-800-690-6903. | 2. Go to the Website: http://www.proxyvote.com. | ||

| 3. Enter your 12-digit Control Number located on the reverse side. |

3. Enter your 12-digit Control Number located on the reverse side. |

||

| 4. Follow the recorded instructions. | 4. Follow the instructions provided. | ||

| Your vote is important! Call 1-800-690-6903! |

Your vote is important! Go to http://www.proxyvote.com any time! |

Do not return your Proxy Card if you are voting by Telephone or Internet.

DETACH PROXY CARD HERE

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

KLA-TENCOR CORPORATION

Notice of Annual Meeting of Stockholders

November 8, 2002

To the Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of KLA-Tencor Corporation (the “Company”), a Delaware corporation, will be held on Friday, November 8, 2002 at 11:00 a.m., local time, at the Company’s offices located at Three Technology Drive, Milpitas, California 95035, for the purposes stated on the reverse side.

The undersigned hereby appoints John H. Kispert and Stuart J. Nichols, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side, all of the shares of Common Stock of KLA-Tencor Corporation that the undersigned is entitled to vote at the Annual Meeting of Stockholders, and any adjournment or postponement thereof.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED STOCKHOLDER. IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE NOMINEES LISTED ON THE REVERSE SIDE FOR THE BOARD OF DIRECTORS AND FOR PROPOSAL 2.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE

CONTINUED AND TO BE SIGNED ON REVERSE SIDE