Discounted Options, Section 409A & KLA-Tencor’s Tender Offer January, 2007 Exhibit (a)(5)(B) |

Discounted Options, Section 409A & KLA-Tencor’s Tender Offer January, 2007 Exhibit (a)(5)(B) |

1 Meeting Objectives • Understand – The § 409A issue – What KLA-Tencor is doing for the affected options – Your choices • Review your next steps |

2 Why are we here today? • KLA-Tencor has determined that you hold certain stock options that may be negatively affected by a recent law change. • KLA-Tencor has developed a solution that eliminates the problem, but which requires your participation and permission to implement. • If you do not participate, you may have adverse tax consequences. |

3 Tax Law Change: §409A • § 409A is a set of operating rules for items considered to be deferred compensation. • Certain stock options are now considered to be deferred compensation. • What are the consequences of § 409A? – Potential income taxation prior to exercise – 40% additional tax (20% federal & 20% CA) – Interest penalty |

4 Which options are affected? • Options granted at a price below the stock’s fair market value (FMV) on the actual grant date (“Discount Options”). • Only options that vest AFTER 12/31/04. • Thus, options granted prior to 409A’s enactment could be affected by this new law if they vested 1/1/05 and later. |

5 Example: – Option granted on Jan 1, 2003 – 10,000 shares – Option price = $32.50, but fair market value at grant date = $35.75 - Vesting: 2,500 options vest on Jan 1, 2004 2,500 options vest on a monthly basis during 2004 2,500 options vest on a monthly basis during 2005 2,500 options vest on a monthly basis during 2006 - CONCLUSION: - The 5,000 options that vested prior to 1/1/05 are NOT subject to §409A. - The 5,000 options that vest after 12/31/04 are subject to §409A because they were granted at a discount. |

6 Example: (continued) • Assume that the fair market value of the option shares on the applicable tax date is $52 and no options were exercised. §409A Estimated Impact • W-2 Income Inclusion: $97,500 (= 5,000 options subject to §409A x $19.50 ($52 FMV - $32.50 Option Price)) Fed Ordinary Income $34,125 (35%) CA Ordinary Income $ 9,067 (9.3%) Normal Stock Gain Rate $43,192 44.3% §409A Tax (Fed/CA) $39,000 (40%) §409A Interest $ 8,775 (9%) Tax Rate w/§409A $90,967 93.3% • This will occur until exercise or expiration of the option. |

7 What is the solution? |

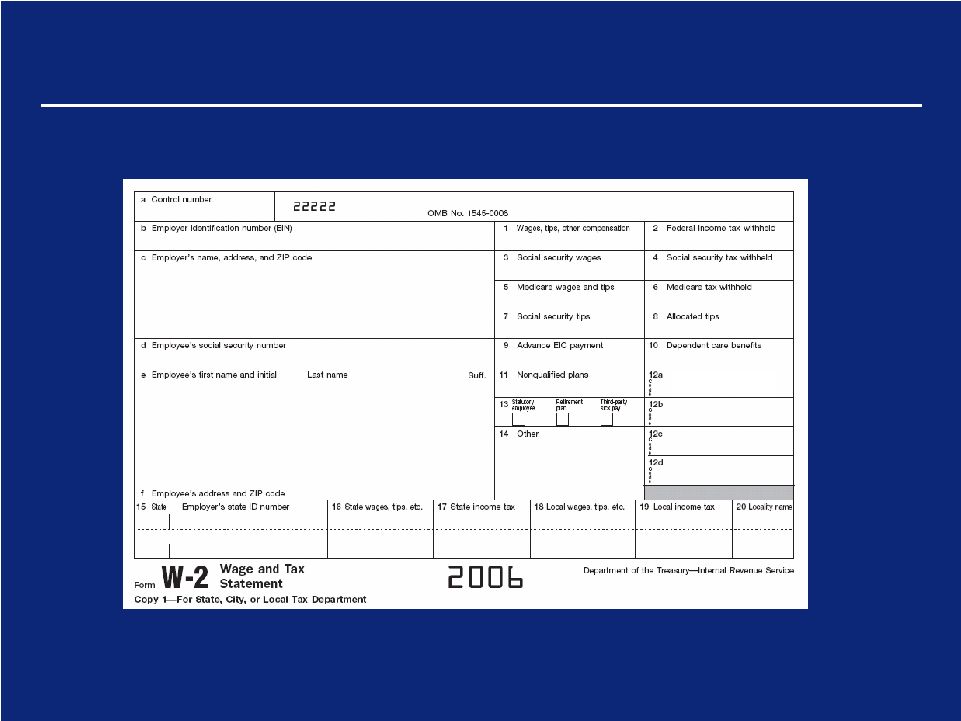

8 KLA-Tencor’s Program 1: 2006 W-2 • W-2 Reporting of 2006 exercises of discounted options in Box 12 (Code Z) AND • Provide a cash payment in 2007 to cover additional tax(es) on the exercises – Affected employees will pay 20% federal & 20% CA tax(es); these are not withheld – Payment is compensation and will be grossed-up for income/payroll taxes |

9 Sample 2006 Form W-2 Z $10,000 |

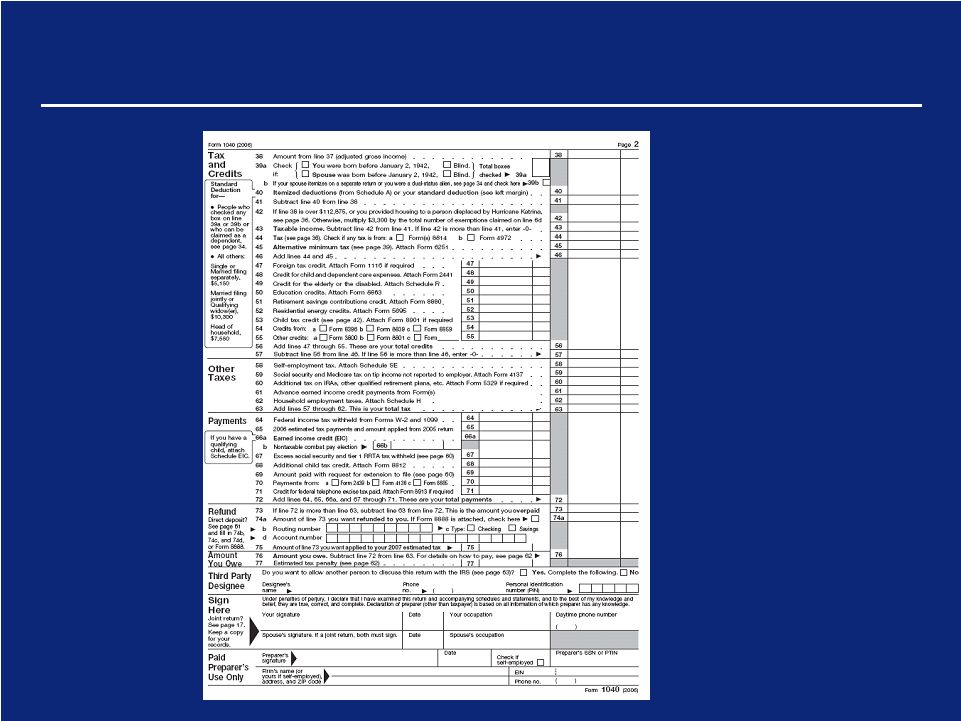

10 Sample 2006 Form 1040 NQDC $2,000 |

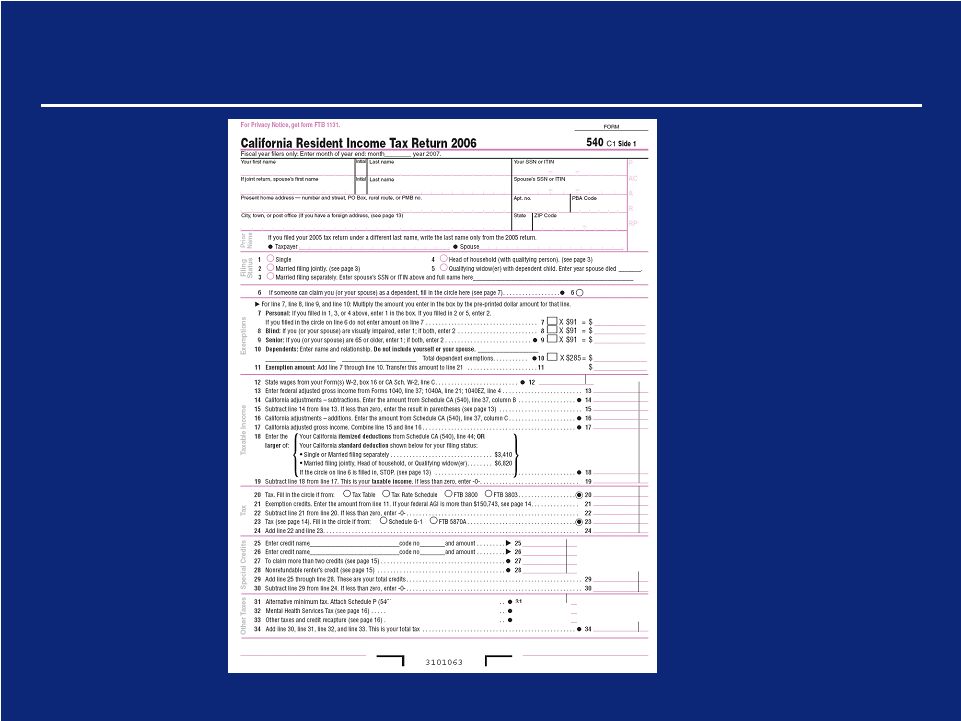

11 Sample 2006 CA Form 540 $2,000 NQDC |

12 Program 2: Tender Offer for Unexercised Options KLA-Tencor expects to commence a formal tender offer for certain outstanding stock options held by its employees. We will notify you when that tender offer commences. We advise you to read the tender statement when it is available because it will contain important information relating to your stock options. We will deliver the actual tender offer documents to all affected employees by via electronic website when the tender offer commences, and those documents will also be available for free at the Securities and Exchange Commission's public website. |

13 Program 2: Tender Offer for Unexercised Options • Amend option to potentially increase option price, AND • Provide a cash payment • Only options issued below market and that vest after 12/31/04 will be subject to the tender offer. |

14 KLA-Tencor’s Solution: Tender Offer Example: – Orig. Option Price: $30 – Adjusted Option Price: $32 – FMV at Tender Offer close: $50 Example: – Orig. Option Price: $48 – Adjusted Option Price: $58 – FMV at Tender Offer close: $50 Example: – Orig. Option Price: $30 – Adjusted Option Price: $32 – FMV at Tender Offer close: $28 |

15 KLA-Tencor’s Solution: Tender Offer Amend options to potentially increase the option price – Option price will be the lower of: • Fair market value on the actual grant date, or • Closing price of KLA-Tencor stock the day after the tender offer closes • Option price will never be lower than current exercise price – All other terms will remain the same (including the number of shares, vesting schedule and expiration date) |

16 KLA-Tencor’s Solution: Tender Offer Cash Bonus payment – Equal to the difference (if any) between the adjusted option price and original option price – Will be made in January 2008 per IRS requirement |

17 Example • Option for 8,000 shares granted on 1/1/03 with price = $32.50, but FMV = $35.75 • Vesting: – 2,000 vest on 1/1/04 – not subject to §409A – 2,000 vest monthly in 2004– not subject to §409A – 2,000 vest monthly in 2005 – subject to §409A – 2,000 vest monthly in 2006 – subject to §409A • Option Amendment: – 4,000 options vested on 12/31/04 – NO CHANGE – 4,000 options vesting 2005-2006 - amended price = $35.75 • No change to expiration date or vesting schedule • Cash Payment: – Employee receives cash payment of $13,000 = 4,000 options x ($35.75 - $32.50), (less bonus withholdings), paid in January 2008. |

18 Eligibility • Must be an employee at the close of the Tender Offer and subject to US income taxation. • Offer covers unexercised options that were granted at a discount and vest after 12/31/04. • You can select which of your affected grants to tender (i.e., participate with), but once selected, the entire unexercised portion must be tendered. |

19 What if I do nothing? |

20 What if I do nothing? • Tax Impact: – Income taxation before exercise – 20% additional federal tax on income amount – 20% additional California tax on income amount • Potentially other state additional taxes – Interest penalty on income amount • Will occur until exercise or expiration of the discounted options. • Tender offer is a one-time offer to prevent future adverse tax consequences. |

21 How do I participate? |

22 Tender Offer Expected Timeline • Tender Offer Begins: February 5, 2007 • Tender Offer Ends: March 6, 2007 – All elections MUST be received by 11:59PM Pacific Time on the expiration date – Late submissions will not be accepted • Option Amendment: March 7, 2006 • How to submit your election: E-mail with web based instructions will be sent to you. • Confirming e-mail will be sent to you upon completion of your acceptance of the Offer. |

23 What Information Have You Received? • Email that includes: – Description of Programs – Meeting announcements • Mailed Stock Option Statement – Your stock options • This presentation – Available on KLA-Tencor’s Stock Option Website |

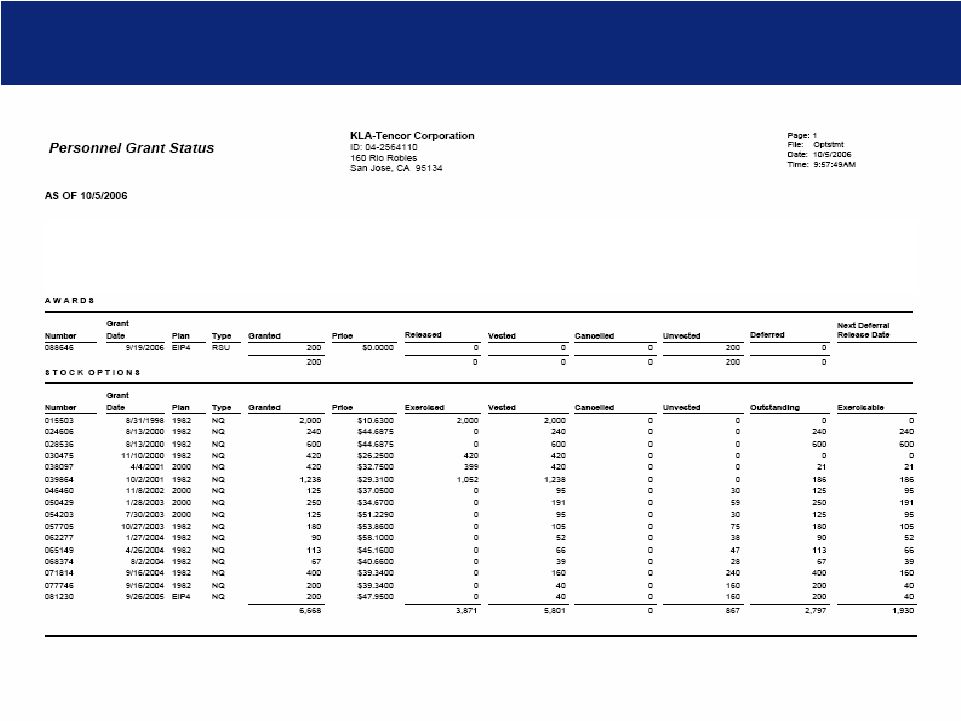

24 Sample Statement Your Name Here Your Address Here This will be important at the commencement of the tender offer. Please keep it available. This is a sample statement of an employee’s entire stock option portfolio

|

25 What if I still have questions? •Follow-up meetings: Watch your E-mail – 2/5 9:00 and 11:00 in Milpitas Multi-purpose – the 11 will also be available via Web-Ex – 2/5 1:30 and 3:30 in San Jose, Cafeteria 1:30 will be Web-Ex – 2/12 Milpitas Multi-Purpose 3:00 – 2/22 1:30 San Jose and 3:30 Milpitas We will add additional meetings if necessary •Any questions should be directed to 401k.stock@kla-tencor.com |

26 Tax Advice • Taxation of stock option transactions can be very complicated. • KLA-Tencor policy prohibits any employees from providing personal income tax advice to any other employee. • This presentation is general and you should consult with your personal tax advisor for advice relevant to your specific situation. |

27 Circular 230 Disclaimer Notice • Any tax advice included in this presentation was not intended or written to be used, and it cannot be used by the taxpayer, for the purpose of avoiding any penalties that may be imposed by any governmental taxing authority or agency; • This tax advice was written to support the promotion of the matter addressed by the presentation; and • The taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. |