UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

KLA-Tencor Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

March 29, 2007

To the Stockholders:

YOUR VOTE IS IMPORTANT

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of KLA-Tencor Corporation (the “Company”), a Delaware corporation, will be held on Thursday, March 29, 2007 at 1:00 P.M., local time, in the Crystal B Room of the Crowne Plaza Hotel located at 777 Bellew, Milpitas, California 95035, for the following purposes:

| 1. | To elect three Class II Directors to each serve for a three-year term and one Class I Director to serve for a two-year term, each until his successor is duly elected. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2007. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on February 15, 2007 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

| Sincerely, |

|

| Richard P. Wallace |

| Chief Executive Officer |

| San Jose, California |

February 28, 2007

|

All stockholders are cordially invited to attend the Annual Meeting in person; however, to assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy card and return it in the enclosed envelope or follow the instructions on the enclosed proxy card to vote by telephone or via the Internet. Any stockholder attending the Annual Meeting may vote in person even if he or she previously returned a proxy card or voted by telephone or via the Internet.

|

ANNUAL MEETING OF STOCKHOLDERS

OF

KLA-TENCOR CORPORATION

To be held on March 29, 2007

PROXY STATEMENT

| QUESTIONS AND ANSWERS REGARDING PROXY SOLICITATION AND VOTING | ||

| Why am I receiving these materials? | The Board of Directors of KLA-Tencor Corporation (“KLA-Tencor,” the “Company” or “we”) is providing these proxy materials to you in connection with KLA-Tencor’s Annual Meeting of Stockholders to be held on Thursday, March 29, 2007 at 1:00 P.M. local time. As a stockholder of record, you are invited to attend the Annual Meeting, which will be held in the Crystal B Room of the Crowne Plaza Hotel located at 777 Bellew, Milpitas, CA 95035. The purposes of the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement.

These proxy solicitation materials, together with the Company’s Annual Report for fiscal year 2006, were first mailed on or about February 28, 2007 to all stockholders entitled to vote at the Annual Meeting. KLA-Tencor’s principal executive offices are located at 160 Rio Robles, San Jose, California 95134, and our telephone number is (408) 875-3000. | |

| How may I obtain KLA-Tencor’s Annual Report? | A copy of our Annual Report for fiscal year 2006 is also available free of charge on the Internet from the Securities and Exchange Commission’s website at http://www.sec.gov, as well as on our website at http://ir.kla-tencor.com. | |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | ||

| Who may vote at the Annual Meeting? | You may vote if our records showed that you owned shares of KLA-Tencor Common Stock as of February 15, 2007 (the “Record Date”). At the close of business on that date, we had a total of 224,837,996 shares of Common Stock issued and outstanding, which were held of record by approximately 810 stockholders. As of the Record Date, we had no shares of Preferred Stock outstanding. You are entitled to one vote for each share that you own.

The Annual Meeting will be held if a majority of the outstanding Common Stock entitled to vote is represented at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting. | |

| What proposals are being voted on at the Annual Meeting? | In addition to such other business as may properly come before the Annual Meeting or any adjournment thereof, the following two proposals will be presented at the Annual Meeting:

1. Election of three Class II Directors to each serve for a three-year term and of one Class I Director to serve for a two-year term, each until his successor is duly elected; and | |

1

| 2. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2007. | ||

| How can I vote if I own shares directly? | If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you. You may vote in accordance with the instructions described below. If you hold your shares in your own name as a holder of record, you may instruct the proxy holders how to vote your shares in the following ways:

1. By Telephone: Use the toll-free telephone number provided on the proxy card prior to 11:59 P.M. EST on March 28, 2007 (specific instructions for using the telephone voting system are on the proxy card);

2. By Internet: Use the Internet voting site listed on the proxy card prior to 11:59 P.M. EST on March 28, 2007 (specific instructions for using the Internet voting system are on the proxy card);

3. By Mail: Complete, sign, date and mail the proxy card in the postage paid envelope that we have provided for delivery to the Company prior to 11:59 P.M. EST on March 28, 2007 (specific instructions for mailing are on the proxy card); or

4. In Person: Attend the Annual Meeting and vote your shares in person.

Whichever of these methods you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions.

If you vote by mail, telephone or Internet without giving specific voting instructions, your shares will be voted FOR Proposal One (the election of the nominees listed herein for the Board of Directors) and FOR Proposal Two. When proxies are properly dated, executed and returned (whether by returned proxy card, telephone or Internet), the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting. | |

| How may I vote if my shares are held in a stock brokerage account, by a bank or other nominee? | If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and your broker or nominee is considered the stockholder of record with respect to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker on how to vote and you are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting. If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted. |

2

| Can I change my vote? | You may change your vote at any time prior to the vote at the Annual Meeting. To change your proxy instructions if you are a stockholder of record, you must:

• Advise our General Counsel in writing at our principal executive office, before the proxy holders vote your shares, that you wish to revoke your proxy instructions; or

• Deliver proxy instructions dated after your earlier proxy instructions as follows:

a. By Phone: Use the toll-free telephone number provided on the proxy card to vote again prior to 11:59 P.M. EST on March 28, 2007 (specific instructions for using the telephone voting system are on the proxy card);

b. By Internet: Use the Internet voting site listed on the proxy card to vote again prior to 11:59 P.M. EST on March 28, 2007 (specific instructions for using the Internet voting system are on the proxy card);

c. By Mail: Complete, sign and date another proxy card bearing a later date and deliver such proxy card prior to 11:59 P.M. EST on March 28, 2007 (specific instructions for mailing are on the proxy card); or

d. In Person: Attend the Annual Meeting and vote your shares in person. | |

| Who will bear the cost of this proxy solicitation? | We will pay the cost of this proxy solicitation. KLA-Tencor has retained the services of D.F. King & Company to aid in the solicitation of proxies from brokers, bank nominees and other institutional owners. We estimate that we will pay D.F. King fees of approximately $8,500.00 for this solicitation activity, forwarding solicitation material to beneficial and registered stockholders and processing the results. Certain of our Directors, officers and regular employees, without additional compensation, may solicit proxies personally or by telephone. | |

| Can my broker vote my shares if I do not instruct him or her how I would like my shares voted? | Yes. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and your record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder, the record holder will be entitled to vote your shares in its discretion on Proposal One (Election of Directors) and Proposal Two (Ratification of Independent Registered Public Accounting Firm). | |

| Are abstentions and broker non-votes counted? | Shares that are voted “FOR,” “AGAINST,” “WITHHELD” or “ABSTAIN” are treated as being present for purposes of determining the presence of a quorum and are also treated as shares entitled to vote at the Annual Meeting (“Votes Cast”). | |

3

| Since abstentions will be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of Votes Cast with respect to a proposal (other than the election of Directors), abstentions will have the same effect as a vote against the proposal (other than the election of Directors).

Shares that are subject to a broker non-vote are counted for purposes of determining whether a quorum exists but not for purposes of determining whether a proposal has passed. | ||

| How does the Board of Directors recommend that I vote? | The Board of Directors recommends that stockholders vote as follows:

1. “FOR” the election of the three nominated Class II Directors to the Board of Directors: H. Raymond Bingham, Robert T. Bond and David C. Wang; and the election of one nominated Class I Director to the Board of Directors: Robert M. Calderoni; and

2. “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2007. | |

| Will any other business be transacted at the Annual Meeting? | We are not aware of any matters to be presented other than those described in this Proxy Statement. In the unlikely event that any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote. | |

| What happens if the Annual Meeting is adjourned or postponed? | If the Annual Meeting is adjourned or postponed, the proxy holders can vote your shares on the new meeting date as well, unless you have properly revoked your proxy instructions. | |

| Why is the Annual Meeting being held in March this year? | As a result of our discovery that we had retroactively priced stock options (primarily from July 1, 1997 to June 30, 2002) and had not accounted for them correctly, we restated our historical financial statements to correct our past accounting for retroactively priced stock options. Due to the restatements, the filing of our Annual Report on Form 10-K for the fiscal year ended June 30, 2006 was delayed until January 29, 2007. We could not schedule our Annual Meeting until that filing was completed and available for mailing to our stockholders. | |

| Can I present other business to be transacted at the Annual Meeting? | Any stockholder may present a matter from the floor for consideration at a meeting of stockholders so long as certain procedures are followed. Under our bylaws, as amended, a stockholder notice must ordinarily be received by KLA-Tencor (Attention: General Counsel) at least 120 days prior to the anniversary of the mailing date of the prior year’s proxy statement. With the delay in holding this Annual Meeting for the fiscal year ended June 30, 2006, the deadline as provided in our bylaws was a reasonable time before we printed and mailed these proxy materials. For the annual meeting for the fiscal year ending June 30, 2007, a stockholder notice must be received by KLA-Tencor (Attention: General Counsel) no later than September 9, 2007. | |

| What is required in a stockholder’s notice to present other business to be transacted? | The stockholder’s notice must set forth, as to each proposed matter, the following:

1. A brief description of the proposed matter and reasons for conducting such business at the meeting; | |

4

| 2. Name and address of the stockholder, as they appear on KLA-Tencor’s books;

3. The class and number of shares of KLA-Tencor that are beneficially owned by the stockholder;

4. Any material interest of the stockholder in such business; and

5. Any other information that is required to be provided by such stockholder pursuant to Regulation 14A under the Securities Exchange Act of 1934. | ||

| Can I still present other business to be transacted if my notice is deficient? | If the stockholder notice is not in compliance with the requirements set forth in our bylaws, the presiding officer of the meeting may refuse to acknowledge the matter. | |

| What is the deadline for stockholder proposals in connection with the next Annual Meeting? | Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the SEC and the provisions of our bylaws. We must receive stockholder proposals that are intended to be presented by such stockholders at our next Annual Meeting of Stockholders (related to our fiscal year ending June 30, 2007) no later than September 9, 2007 to be considered for inclusion in the Proxy Statement and form of Proxy relating to that meeting.

Stockholder proposals that are not intended to be included in our proxy materials for such meeting, but that are to be presented by the stockholder from the floor are subject to the advance notice provisions set forth above under “Can I present other business to be transacted at the Annual Meeting?” and other requirements set forth in the proxy rules established by the SEC and the provisions of our bylaws. | |

| How may I obtain a copy of KLA-Tencor’s Bylaws? | For a free copy of KLA-Tencor’s bylaws, please contact our Investor Relations department at (408) 875-3600 or visit our website at http://ir.kla-tencor.com and fill out a request form. A copy of our bylaws is also available free of charge on the Internet from the SEC’s website at http://www.sec.gov. | |

| What should I do if I receive more than one set of voting materials? | You may request delivery of a single copy of our future proxy statements and annual reports by writing to the address below or calling our Investor Relations department at the telephone number below. Stockholders may also request electronic delivery of future proxy statements by writing to the address below, calling our Investor Relations department at (408) 875-3600 or via our website at http://ir.kla-tencor.com. | |

| May I get additional copies of these materials? | Certain stockholders who share an address are being delivered only one copy of this Proxy Statement. You may receive additional copies of this Proxy Statement without charge by sending a written request to KLA-Tencor Corporation, Attention: Investor Relations, 160 Rio Robles, San Jose, CA 95134. Requests may also be made by calling our Investor Relations department at (408) 875-3600. | |

5

| PROPOSAL ONE: ELECTION OF DIRECTORS | ||

| The Company has a classified Board of Directors with three classes. At each annual meeting, a class of Directors is elected for a full term of three years to succeed those Directors whose terms expire at the annual meeting. At this Annual Meeting, the terms of the Class II Directors are expiring. If there is a nominee for a class other than the class which is up for election, such nominee, upon election, is added to the designated class and serves out the remainder of the term for that class.

There is currently one incumbent Class I Director, Lida Urbanek, as Kenneth Levy retired as a Director on October 16, 2006 and Jon D. Tompkins resigned as a Director on December 21, 2006. Robert M. Calderoni, who is not an incumbent Director, has been nominated for election at the Annual Meeting to serve as a Class I Director by the Board of Directors. The Class I Directors will serve until the annual meeting of stockholders to be held in 2008 or until their respective successors are duly elected and qualified.

The three incumbent Class II Directors are H. Raymond Bingham, Robert T. Bond, and David C. Wang. They are up for re-election at the Annual Meeting.

The three incumbent Class III Directors are Edward W. Barnholt, Stephen P. Kaufman and Richard P. Wallace. The Class III Directors will serve until the annual meeting of stockholders to be held in the second half of 2007, or until their respective successors are duly elected and qualified. | ||

| Nominees | The term of the three current Class II Directors will expire on the date of the Annual Meeting. The three Class II Directors and one Class I Director of the Board of Directors are nominated for election at the Annual Meeting. The Nominating and Governance Committee, consisting solely of independent Directors as determined under the rules of The Nasdaq Stock Market, recommended the Class II Director nominees, each of whom is an incumbent Director, and the Class I Director nominee, as set forth in this Proposal One. Based on that recommendation, the members of the Board of Directors unanimously resolved to nominate such individuals for election.

The three nominees for election as Class II Directors by the stockholders are:

• H. Raymond Bingham;

• Robert T. Bond; and

• David C. Wang.

In addition, the nominee for election as a Class I Director by the stockholders is Robert M. Calderoni.

If elected, the nominees for Class II Directors will serve as Directors until the Company’s annual meeting of stockholders in 2009 and the nominee for Class I Director will serve as Director until the Company’s annual meeting of stockholders in 2008, each until his successor is duly elected and qualified. If | |

6

| any nominee declines to serve or becomes unavailable for any reason, or a vacancy occurs before the election, the proxies may be voted for such substitute nominees as the Board of Directors may designate. As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee who is unable or who will decline to serve as a Director. | ||

| Vote Required and Recommendation | If a quorum is present and voting, the three nominees for Class II Directors receiving the highest number of affirmative votes will be elected as Class II Directors and the nominee for Class I Director receiving the highest number of affirmative votes will be elected as a Class I Director. Votes withheld from any Director and broker non-votes are counted for purposes of determining the presence or absence of a quorum but have no other legal effect on the selection of nominees for Directors. Anyone who is elected as a Director in any uncontested election by a plurality and not a majority of votes cast will promptly tender his or her resignation to the Board of Directors, subject to acceptance, after certification of the election results. The Nominating and Governance Committee will make a recommendation to the Board of Directors whether to accept or reject the resignation or take some other appropriate action, taking into account any stated reasons why stockholders withheld votes and any other factors which the Nominating and Governance Committee determines in its sole discretion are relevant to such decision. The Board of Directors will in its sole discretion act on the recommendation of the Nominating and Governance Committee within 90 days after the date of certification of the election results. The Director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board of Directors regarding his or her resignation. | |

| THE MEMBERS OF THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND A VOTE “FOR” EACH OF THE CLASS II DIRECTOR NOMINEES AND THE CLASS I DIRECTOR NOMINEE LISTED ABOVE. | ||

7

| INFORMATION ABOUT THE DIRECTORS AND THE NOMINEES | ||||

| The following table sets forth certain information with respect to the Company’s Board of Directors as of the date of this proxy statement: | ||||

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Nominees for Election as Class II Directors | ||||

| H. Raymond Bingham | H. Raymond Bingham has been a Director of KLA-Tencor since August 2000. Since November 2006, Mr. Bingham has been a managing director of General Atlantic LLC, a global private equity firm, and head of the firm’s Palo Alto office. Mr. Bingham served as President and Chief Executive Officer of Cadence Design Systems, Inc. (“Cadence”) from April 1999 to April 2004. He was the Executive Chairman of the Board of Directors of Cadence from May 2004 to July 2005 and was a Director of Cadence from November 1997 to July 2005. From 1993 to April 1999, Mr. Bingham served as Executive Vice President and Chief Financial Officer of Cadence. Mr. Bingham also serves on the Boards of Directors of Flextronics International Ltd. and Oracle Corporation. | 61 | ||

| Robert T. Bond | Robert T. Bond has been a Director of KLA-Tencor since August 2000. From April 1996 to January 1998, Mr. Bond served as Chief Operating Officer of Rational Software Corporation. Prior to that, he held various executive positions at Rational Software Corporation. Mr. Bond was employed by Hewlett-Packard Company from 1967 to 1983 and held various management positions during his tenure there. Mr. Bond also serves on the Board of Directors of MontaVista Software, Inc. | 63 | ||

| David C. Wang | David C. Wang has been a Director of KLA-Tencor since May 2006. Mr. Wang has served as President, Boeing-China, of The Boeing Company (“Boeing”) since 2002. Prior to joining Boeing, he spent 22 years at General Electric Company (“GE”), where he worked in various capacities, including most recently as Chairman and Chief Executive Officer of GE China. In addition, Mr. Wang served in executive positions with GE in Singapore, Malaysia and Mexico. Prior to joining GE, Mr. Wang held various engineering positions at Emerson Electric Co. Mr. Wang is also a Director of Linktone, Ltd. He currently resides in Beijing and also serves on the Beijing International MBA Program Advisory Board at Beijing University and the Western Academy of Beijing Education Foundation. | 62 | ||

| Nominee for Election as Class I Director | ||||

| Robert M. Calderoni | Robert M. Calderoni, who is not an incumbent Director, has been nominated by the Board of Directors for election at the Annual Meeting by the stockholders to become a Class I Director of KLA-Tencor. He has served as Chairman of the Board of Directors of Ariba, Inc., since July 2003 and as Chief Executive Officer and a Director of Ariba since 2001. From 2001 to 2004, Mr. Calderoni also served as Ariba’s President and before that as Ariba’s Executive Vice President and Chief Financial Officer. From 1997 to 2001, he served as Chief Financial Officer at Avery Dennison Corporation. He is also a member of the Board of Directors of Juniper Networks, Inc. | 47 | ||

8

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Current Class I Director | ||||

| Lida Urbanek | Lida Urbanek has been a Director of KLA-Tencor since April 1997. Ms. Urbanek is a private investor. She was a Director of Tencor Instruments from August 1991 until April 1997 (when it was merged into KLA-Tencor). | 63 | ||

| Class III Directors | ||||

| Edward W. Barnholt | Edward W. Barnholt has been a Director of KLA-Tencor since 1995, and was named Chairman of the Board of Directors of KLA-Tencor in October 2006. From March 1999 to March 2005, Mr. Barnholt was President and Chief Executive Officer of Agilent Technologies, Inc. (“Agilent”) and from November 2002 to March 2005, he was Chairman of the Board of Directors of Agilent. On March 1, 2005, Mr. Barnholt retired as the Chairman, President and Chief Executive Officer of Agilent. Before being named Agilent’s Chief Executive Officer, Mr. Barnholt served as Executive Vice President and General Manager of Hewlett-Packard Company’s Measurement Organization from 1998 to 1999. From 1990 to 1998, he served as General Manager of Hewlett-Packard Company’s Test and Measurement Organization. He was elected Senior Vice President of Hewlett-Packard Company in 1993 and Executive Vice President in 1996. Mr. Barnholt also serves on the Boards of Directors of Adobe Systems Incorporated and eBay Inc. He also serves on the Board of Trustees of the Packard Foundation and the Board of Directors of The Tech Museum of Innovation. | 63 | ||

| Stephen P. Kaufman | Stephen P. Kaufman has been a Director of KLA-Tencor since November 2002. Mr. Kaufman has been a Senior Lecturer at the Harvard Business School since January 2001. He was a member of the Board of Directors of Arrow Electronics, Inc. (“Arrow”) from 1984 to May 2003. From 1986 to June 2000, he was Chief Executive Officer of Arrow. From 1985 to June 1999, he was also Arrow’s President. From 1994 to June 2002, he was Chairman of the Board of Directors of Arrow. Mr. Kaufman also serves on the Board of Directors of Harris Corporation. | 65 | ||

| Richard P. Wallace | Richard P. Wallace has been a Director and the Chief Executive Officer of KLA-Tencor since January 2006. Mr. Wallace was President and Chief Operating Officer from July 2005 through December 2005. He was Executive Vice President of the Customer Group from May 2004 to July 2005. Mr. Wallace was Executive Vice President of the Wafer Inspection Group from July 2000 to May 2004. From July 1999 to June 2000, he was the Group Vice President for Lithography and Films. From April 1998 to June 1999, he was Vice President and General Manager of the Mirage Group. From 1995 to March 1998, Mr. Wallace was Vice President and General Manager of the Wisard division. He currently serves on the Board of Directors of North American SEMI, an industry trade association. Mr. Wallace joined KLA-Tencor in 1988 as an applications engineer. Earlier in his career, he held positions with Ultratech Stepper and Cypress Semiconductor. He earned his bachelor’s degree in electrical engineering from the University of Michigan and his master’s degree in engineering management from Santa Clara University, where he also taught strategic marketing and global competitiveness courses upon his graduation. | 46 | ||

9

| PROPOSAL TWO: | ||||||||

| Audit Committee Recommendation | The Audit Committee has the sole authority to retain or dismiss our independent auditors. The Audit Committee has selected PricewaterhouseCoopers LLP, an independent registered public accounting firm, to audit the consolidated financial statements of the Company for its fiscal year ending June 30, 2007. Before making its determination, the Audit Committee carefully considered that firm’s qualifications as independent auditors.

The Board of Directors, following the Audit Committee’s determination, unanimously recommends that the stockholders vote for ratification of such appointment.

Although ratification by stockholders is not required by law, the Board of Directors has determined that it is desirable to request approval of this selection by the stockholders. If the stockholders do not ratify the appointment of PricewaterhouseCoopers LLP, the Audit Committee may reconsider its selection. | |||||||

| Attendance at the Annual Meeting | Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions. | |||||||

| Fees | The aggregate fees billed by PricewaterhouseCoopers LLP, KLA-Tencor’s independent registered public accounting firm, in fiscal years 2006 and 2005 were as follows: | |||||||

| Services Rendered/Fees |

2006 | 2005 | ||||||

| Audit Fees (1) |

$ | 3,170,000 | $ | 3,215,000 | ||||

| Audit-Related Fees (2) |

$ | 207,000 | $ | 32,000 | ||||

| Total Audit and Audit-Related Fees |

$ | 3,377,000 | $ | 3,247,000 | ||||

| Tax Compliance |

$ | 174,000 | $ | 371,000 | ||||

| Tax Planning and Consulting |

$ | 372,000 | $ | 462,000 | ||||

| Total Tax Fees (3) |

$ | 546,000 | $ | 833,000 | ||||

| All Other Fees (4) |

$ | 0 | $ | 91,000 | ||||

(1) For professional services rendered for the audits of annual financial statements set forth in KLA-Tencor’s Annual Report on Form 10-K for fiscal years 2006 and 2005, the review of quarterly financial statements included in KLA-Tencor’s Quarterly Reports on Form 10-Q for fiscal years 2006 and 2005 and fees for services related to statutory and regulatory filings or engagements. (2) For fiscal years ended 2006 and 2005, assurance and related services related to accounting consultations and for services rendered in connection with acquisition due diligence. | ||||||||

10

| (3) For fiscal years ended 2006 and 2005, tax services for U.S. and foreign tax compliance, planning and consulting. (4) For fiscal years ended 2006 and 2005, fees for services other that those described above. | ||

| Pre-approval Policies and Procedures | The Audit Committee has adopted a policy regarding non-audit services provided by PricewaterhouseCoopers LLP, our independent registered public accounting firm. First, the policy ensures the independence of our auditors by expressly naming all services that the auditors may not perform and reinforcing the principle of independence regardless of the type of service. Second, certain non-audit services such as tax-related services and acquisition advisory services are permitted but limited in proportion to the audit fees paid. Third, the Chair of the Audit Committee pre-approves non-audit services not specifically permitted under this policy and the Audit Committee reviews the annual plan and any subsequent engagements. Thus, all of the services described above under audit-related fees, tax fees and all other fees were approved by the Audit Committee pursuant to its pre-approval policies and procedures.

On a quarterly basis, management provides written updates to the Audit Committee with regard to audit and non-audit services, the amount of audit and non-audit service fees incurred to date, and the estimated cost to complete such services. | |

| Independence Assessment by Audit Committee | The Company’s Audit Committee considered and determined that the provision of the services provided by PricewaterhouseCoopers LLP as set forth herein is compatible with maintaining PricewaterhouseCoopers LLP’s independence and approved all non-audit related fees and services. | |

| Vote Required and Recommendation | If a quorum is present and voting, the affirmative vote of the majority of Votes Cast is needed to ratify the appointment of PricewaterhouseCoopers LLP as KLA-Tencor’s independent registered public accounting firm, to audit the consolidated financial statements of the Company for its fiscal year ending June 30, 2007. | |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2007. | ||

11

| OUR CORPORATE GOVERNANCE PRACTICES | ||

| At KLA-Tencor we have always believed in strong and effective corporate governance procedures and practices. In that spirit, we have summarized several of our corporate governance practices below. | ||

| Adopting Governance Guidelines | The Board of Directors has adopted a set of corporate governance guidelines to establish a framework within which it will conduct its business and to guide management in its running of your Company. The governance guidelines can be found on our website at http://ir.kla-tencor.com and are summarized below. | |

| Monitoring Board Effectiveness | It is important that our Board of Directors and its Committees are performing effectively and in the best interest of the Company and its stockholders. The Board of Directors and each Committee are responsible for annually assessing their effectiveness in fulfilling their obligations. In addition, our Nominating and Governance Committee is charged with annually reviewing the Board of Directors and its membership. | |

| Conducting Formal Independent Director Sessions | At the conclusion of each regularly scheduled Board meeting, the independent Directors meet without KLA-Tencor management or any non-independent Directors. | |

| Hiring Outside Advisors | The Board and each of its Committees may retain outside advisors and consultants of their choosing at the Company’s expense, without management’s consent. | |

| Avoiding Conflicts of Interest | KLA-Tencor expects its Directors, executives and employees to conduct themselves with the highest degree of integrity, ethics and honesty. KLA-Tencor’s credibility and reputation depend upon the good judgment, ethical standards and personal integrity of each Director, executive and employee. In order to provide assurances to KLA-Tencor and its stockholders, KLA-Tencor has implemented standards of business conduct which provide clear conflict of interest guidelines to its employees, as well as an explanation of reporting and investigatory procedures. | |

| Providing Transparency | KLA-Tencor believes it is important that stockholders understand our governance practices. In order to help ensure transparency of our practices, we have posted information regarding our corporate governance procedures on our website at http://ir.kla-tencor.com. | |

| Communications with the Board of Directors | Although KLA-Tencor does not have a formal policy regarding communications with the Board of Directors, stockholders may communicate with the Board of Directors by writing to the Company at KLA-Tencor Corporation, Attention: Investor Relations, 160 Rio Robles, San Jose, CA 95134. Stockholders who would like their submission directed to a member of the Board may so specify, and the communication will be forwarded, as appropriate. | |

| Standards of Business Conduct | The Board of Directors has adopted Standards of Business Conduct for all of the Company’s employees and Directors, including the Company’s principal executive and senior financial officers. You can obtain a copy of our Standards of Business Conduct via our website at http://ir.kla-tencor.com, or | |

12

| by making a written request to the Company at KLA-Tencor Corporation, Attention: Investor Relations, 160 Rio Robles, San Jose, CA 95134. We will disclose any amendments to the Standards of Business Conduct, or waiver of a provision therefrom, on our website at the same address. | ||

| Ensuring Auditor Independence | KLA-Tencor has taken a number of steps to ensure the continued independence of our outside auditors. Our independent auditors report directly to the Audit Committee, which also has the ability to pre-approve or reject any non-audit services proposed to be conducted by our outside auditors. | |

| Stockholder Nominations to the Board | Please see “ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES—NOMINATING AND GOVERNANCE COMMITTEE.” | |

| Majority Voting Policy | Please see “PROPOSAL ONE: ELECTION OF DIRECTORS—Vote Required and Recommendation.” | |

13

| ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES | ||

| The Board of Directors | The Board of Directors of the Company held a total of seven meetings during the fiscal year ended June 30, 2006.

All Directors other than Mr. Wallace meet the definition of independence within the meaning of The Nasdaq Stock Market director independence standards. None of the Company’s Directors falls outside of the SEC’s 10% ownership safe harbor.

The Board of Directors has three standing committees: the Audit Committee; the Compensation Committee; and the Nominating and Governance Committee. The Board of Directors has determined that each of the members of each of the standing Committees has no material relationship with the Company (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a Director) and is independent within the meaning of The Nasdaq Stock Market director independence standards, including in the case of the Audit Committee, the heightened “independence” standard required for such Committee members.

Each standing Committee meets regularly and has a written charter approved by the Board of Directors, all of which were attached as appendices to the Proxy Statement related to our 2003 Annual Meeting, which was filed with the SEC on September 23, 2003. All of the charters are available via our website at http://ir.kla-tencor.com. In addition, at each regularly scheduled Board of Directors’ meeting, a member of each standing Committee reports on any significant matters addressed by the Committee. In 2002, after reviewing the Sarbanes-Oxley Act of 2002 and the proposed rules of the SEC and the Nasdaq Stock Market, the Board of Directors revised all of its standing Committee charters to implement voluntarily the proposed standards and to expand the responsibilities of each Committee as well as establish independence and self-assessment requirements. The Board of Directors and each standing Committee regularly reviews the Committee charters.

During the fiscal year ended June 30, 2006, all incumbent Directors attended at least 80% of the total number of meetings of the Board of Directors and each Director attended at least 80% of the aggregate of the total number of meetings held by all Committees of the Board on which each such Director served (during the periods that each such Director served).

Although we do not have a formal policy mandating attendance by members of the Board of Directors at our annual meetings of stockholders, we do have a formal policy encouraging their attendance at annual meetings of KLA-Tencor stockholders.

For more information regarding the responsibilities of our Board Committees, please refer to the various charters which can be found on our corporate governance website located at http://ir.kla-tencor.com.

In addition to the three standing Committees, in May 2006 the Board appointed a Special Committee, consisting of Mr. Bingham and Mr. Kaufman, to conduct an independent investigation of the Company’s historical stock option practices, and in the fall of 2006, the Board of Directors appointed a | |

14

| Special Litigation Committee, consisting of Mr. Kaufman and Mr. Wang, to conduct an independent investigation of the claims asserted in the related stockholder derivative actions and to determine the Company’s position with respect to those claims. | ||

| Audit Committee | The Audit Committee consists of Mr. Bingham, Mr. Bond, and Mr. Kaufman, with Mr. Wang having observer status. Mr. Elkus was also on the Committee until he retired effective November 4, 2005. The Board of Directors has determined that Mr. Bingham is an “audit committee financial expert” within the meaning of the rules and regulations promulgated by the SEC. During fiscal year 2006, Mr. Bingham was the Chairman of the Audit Committee. The Audit Committee is responsible for appointing, compensating and overseeing the work of the Company’s independent auditors, approving the services performed by the Company’s independent auditors and for reviewing and evaluating the Company’s accounting principles and system of internal accounting controls. The Audit Committee held six meetings during the fiscal year ended June 30, 2006. The Board of Directors has determined that each of the members of the Audit Committee: (1) meets the definition of independence within the meaning of Nasdaq’s director independence standards, (2) meets the definition of audit committee member independence within the meaning of Rule 10A-3 under the Securities Exchange Act of 1934 and (3) has no material relationship with the Company (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a Director). | |

| Compensation Committee | The Compensation Committee consists of Mr. Barnholt, Mr. Bond, and Ms. Urbanek. During fiscal year 2006, Mr. Bond was the Chairman of the Compensation Committee. The Compensation Committee reviews and approves, subject to ratification by the Board of Directors, the Company’s executive compensation policy and administers the Company’s employee equity award plans. The Compensation Committee also reviews and approves the cash and equity compensation for our Chief Executive Officer and other executive officers, as well as for members of the Board of Directors. The Compensation Committee held six meetings during the fiscal year ended June 30, 2006. | |

| Nominating and Governance Committee | The Nominating and Governance Committee consists of Mr. Barnholt, Mr. Bingham and Mr. Kaufman. Mr. Barnholt served as the Chairman of the Nominating and Governance Committee during fiscal year 2006. The Nominating and Governance Committee is primarily responsible for identifying and evaluating the qualifications of all candidates for election to the Board of Directors, as well as reviewing corporate governance policies and procedures. The Nominating and Governance Committee held four meetings during the fiscal year ended June 30, 2006.

It is the Nominating and Governance Committee’s policy to consider candidates for the Board of Directors recommended by stockholders who have owned at least 1% of the Company’s outstanding shares for at least one year and who have evidenced intent to continue as substantial stockholders for the long term. Stockholders wishing to submit recommendations must notify the Company’s General Counsel in writing of their intent to do so and provide the Company with certain information set forth in Article II, Section 11 of our bylaws and all other information regarding nominees that is required to be | |

15

| provided pursuant to Regulation 14A of the Securities Exchange Act of 1934, or as otherwise requested by the Nominating and Governance Committee. In addition, stockholders may nominate candidates for the Board of Directors pursuant to the provisions of Article II, Section 11 of our bylaws and in conformance with the requirements of Regulation 14A of the Securities Exchange Act of 1934. | ||

| In considering candidates for Director nomination, including evaluating any recommendations from stockholders as set forth above, the Nominating and Governance Committee considers only candidates who have demonstrated executive experience, have experience in an applicable industry, or have significant high level experience in accounting, legal or a technical field applicable to the Company. In addition, in evaluating Director candidates, the Nominating and Governance Committee considers all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity of experience and the extent to which the candidate would fill a present need on the Board of Directors.

On August 3, 2006, the Board of Directors approved a recommendation by the Nominating and Governance Committee to adopt a new governance policy. Under this policy, anyone who is elected as a Director in any uncontested election by a plurality and not a majority of votes cast will promptly tender his or her resignation to the Board of Directors, subject to acceptance, after certification of the election results. The Nominating and Governance Committee will make a recommendation to the Board of Directors whether to accept or reject the resignation or take some other appropriate action, taking into account any stated reasons why stockholders withheld votes and any other factors which the Nominating and Governance Committee determines in its sole discretion are relevant to such decision. The Board of Directors will in its sole discretion act on the recommendation of the Nominating and Governance Committee within 90 days after the date of certification of the election results. The Director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board of Directors regarding his or her resignation.

The Nominating and Governance Committee regularly assesses the appropriate size and composition of the Board of Directors, and whether any vacancies on the Board are expected. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers potential candidates that may come to its attention through current members of the Board of Directors, professional search firms, stockholders who have owned at least 1% of the Company’s outstanding shares for at least one year and who have evidenced intent to continue as a substantial stockholder for the long term, or other persons. In evaluating properly submitted stockholder recommendations, the Nominating and Governance Committee uses the evaluation standards discussed above and seeks to achieve a balance of knowledge, experience and capability on the Board of Directors. | ||

16

| DIRECTOR COMPENSATION | ||

| Employee Directors | Members of the Board of Directors who are employees do not receive any additional compensation for their services as Directors. | |

| Outside Directors | Members of the Board who are not employees of the Company (“Outside Directors”) receive equity and cash compensation as recommended by the Compensation Committee and approved by the Board of Directors. Equity compensation to Outside Directors is provided under the Company’s 1998 Outside Director Plan and 2004 Equity Incentive Plan, both of which were approved by stockholders. | |

| Outside Director Stock Options | Each Outside Director will automatically be granted a series of non-statutory stock options each year to purchase 5,000 shares of Common Stock in the aggregate (the “Annual Option Grant”). Each Annual Option Grant will be provided to each Outside Director through an automatic 1,250-share option grant each quarter, approximately two business days following the Company’s earnings release for the prior fiscal quarter. Two such quarterly grants (following release of earnings for the quarters ended September 30, 2006 and December 31, 2006) were not made automatically due to the late filing of certain of the Company’s SEC reports; those grants were approved by the Board of Directors and issued on February 14, 2007, the date of the first regular Board meeting after such late reports were filed. The Chairman of the Audit Committee receives an additional non-statutory stock option grant to purchase another 2,500 shares of Common Stock on the date of each subsequent Annual Meeting of Stockholders on which such Director remains the Chairman of the Audit Committee. The term of each option granted under the 1998 Director Plan may not exceed 10 years. The 1998 Director Plan provides that the exercise price shall be equal to the fair market value of the Common Stock on the date of grant of the option. Options granted under the 1998 Director Plan are fully vested and immediately exercisable upon grant. | |

| Outside Director Restricted Stock Unit Awards | At each annual stockholders meeting, each Outside Director is awarded restricted stock units covering shares of the Company’s Common Stock with an aggregate fair market value of $50,000 based on the market price of the Company’s Common Stock at the time of the award. If a new Outside Director does not join the Board on the date of an annual stockholders meeting, his or her first restricted stock unit award will be granted promptly after he or she joins the Board and will be prorated to take into account the period of time from the last annual stockholders meeting to the date the new Outside Director joined the Board. Accordingly, Mr. Wang, who joined the Board approximately six months after the last annual stockholders meeting, received a restricted stock unit award for shares of the Company’s Common Stock having an aggregate fair market value of approximately $25,000 on February 14, 2007. All restricted stock units awarded to Outside Directors vest upon completion of one year of Board service measured from the date of grant, but the shares of Common Stock subject to the vested units are not delivered until the earlier of three years after the date of grant or the Director’s cessation of Board service. | |

17

| Cash Compensation | Each Outside Director receives an annual fee of $40,000, paid quarterly, and meeting fees of $2,500 for each Board meeting attended in person, $1,250 for each Board meeting attended by telephone conference call, and $1,500 for each standing Committee meeting attended. Each standing Committee Chair receives an additional annual retainer of $10,000. The members of the Special Committee and the Special Litigation Committee are compensated for their time in discharging the duties of such committees at the rate of $700 per hour (or at such other rate as may be determined from time to time by the Board). Outside Directors also are reimbursed for their reasonable expenses incurred in attending Board and Committee meetings. | |

| Non-Executive Chairman | If the Chairman of the Board of Directors is not an executive of the Company (as has been the case since October 16, 2006, when Mr. Barnholt was named Chairman), then the Chairman’s annual fee will be two times the regular level for Outside Directors, and the Chairman’s equity awards (both for stock options and restricted stock units) will be 1.5 times the regular level for Outside Directors. | |

18

| INFORMATION ABOUT EXECUTIVE OFFICERS | ||||

| Set forth below are the names, ages and positions of the executive officers of KLA-Tencor as of December 31, 2006. | ||||

| Name and Position |

Principal Occupation of the Executive Officers During the Past Five Years |

Age | ||

| Richard P. Wallace Chief Executive Officer |

Please see “INFORMATION ABOUT THE DIRECTORS AND THE NOMINEES—Class III Directors.” | 46 | ||

| John H. Kispert President & Chief Operating Officer |

John H. Kispert has been President and Chief Operating Officer since January 2006. Prior to that, Mr. Kispert served as Chief Financial Officer and Executive Vice President of the Company since July 2000. From July 1999 to July 2000, he was Vice President of Finance and Accounting. From February 1998 to July 1999, he was Vice President of Operations for the Wafer Inspection Group. Mr. Kispert joined KLA-Tencor in February 1995 and has held a series of other management positions within the Company. | 43 | ||

| Jeffrey L. Hall Senior Vice President & Chief Financial Officer |

Jeffrey L. Hall was appointed Senior Vice President and Chief Financial Officer of the Company in January 2006. From July 2004 until his appointment as Chief Financial Officer, Mr. Hall served as Vice President, Finance and Treasurer of the Company. From July 2003 to July 2004, Mr. Hall was Vice President, Finance and Accounting, and from April 2001 to July 2003, he was Vice President, Mergers & Acquisitions and Corporate Planning. Mr. Hall began his career at KLA-Tencor in January 2000 as Director, Mergers and Acquisitions. Before joining KLA-Tencor, Mr. Hall was Chief Financial Officer of Sonoma Resorts. He also held financial positions at The Walt Disney Company, AT&T, Inc. and NCR Corporation. Mr. Hall earned his bachelor’s degree in finance from Indiana University and his master’s degree in business administration from the University of Dayton. | 39 | ||

| Lawrence A. Gross Executive Vice President- Legal & Interim General Counsel |

Lawrence A. Gross was appointed Executive Vice President-Legal and Interim General Counsel of KLA-Tencor Corporation in October 2006. Mr. Gross joined the Company in September 2006 in an interim role to assist with the stock option investigation and related matters and with managing the Company’s legal function. From 1986 to March 2006, Mr. Gross was the chief counsel of SunGard Data Systems Inc., a global provider of software and processing solutions headquartered in Wayne, Pennsylvania. From 2005 to 2006, Mr. Gross was SunGard’s Senior Vice President—Chief Administrative Officer and Chief Legal Officer, and, from 1986 to 2004, Mr. Gross was SunGard’s General Counsel and Vice President or Senior Vice President. Before joining SunGard, Mr. Gross was a corporate attorney at Blank Rome LLP, a full-service law firm based in Philadelphia. Mr. Gross is a 1979 magna cum laude graduate of the University of Michigan Law School and also holds bachelor’s and master’s degrees from the University of Michigan. | 54 | ||

19

| Name and Position |

Principal Occupation of the Executive Officers During the Past Five Years |

Age | ||

| Jorge L. Titinger Senior Vice President & Chief Administrative Officer |

Jorge L. Titinger has served as Senior Vice President and Chief Administrative Officer of KLA-Tencor since January 2006; in this role, he is responsible for Information Technology, Corporate Learning & Development, Facilities, Security and the Company’s globalization initiative. From January 2005 until January 2006, Mr. Titinger was Senior Vice President and General Manager of the Company’s Global Support Services Group, and from January 2004 to January 2005, he was Vice President and General Manager of the Company’s Global Customer Operations Group. Mr. Titinger joined KLA-Tencor in December 2002 as Vice President and General Manager of the Texas Instruments Strategic Business Unit and the Central U.S. Business Unit. Prior to joining KLA-Tencor, Mr. Titinger held several executive positions at Applied Materials, Inc., including Vice President of Operations—Silicon Business Sector Products from July 2001 to December 2002, Vice President of Operations—Dielectric Systems & Modules from January 2000 to July 2001, and Vice President & General Manager—Global Service Parts and Logistics Division from December 1998 to January 2000. Before that, Mr. Titinger held executive positions at Insync Systems Inc., Silicon Graphics Inc. and Hewlett-Packard Company. Mr. Titinger holds a bachelor’s degree in electrical engineering, a master’s degree in electrical engineering, and a master’s degree in engineering management and business from Stanford University. | 45 | ||

| Benjamin Tsai Executive Vice President & Chief Technology Officer |

Bin-ming Benjamin Tsai rejoined KLA-Tencor in October 2006 as the Company’s Executive Vice President and Chief Technology Officer. Before returning to KLA-Tencor, Dr. Tsai held the position of Senior Vice President, Technology at Tokyo Electron Limited from January 2005 to October 2006. Previously, Dr. Tsai spent twenty years at KLA-Tencor in various positions. From 2000 to 2004, Dr. Tsai served as the Company’s Group Vice President, Chief Technology Officer of Systems; in this position, he was responsible for some of the Company’s key technology alliances for optics and sensors. From 1998 to 1999, he was General Manager of the WIN Division, and, from 1994 to 1998, he was Chief Technology Officer of KLA Instruments. Dr. Tsai holds over twenty patents in the areas of inspection and metrology. He received a bachelor’s degree in electrical engineering from the National Taiwan University and a master’s degree and Ph.D. in electrical engineering from the University of Illinois at Urbana-Champaign. | 48 | ||

20

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| ||||||

| Principal Stockholders | |||||||

| As of December 31, 2006, based on our review of filings made with the SEC, we are aware of the following entities being beneficial owners of more than 5% of the Company’s Common Stock: | |||||||

| Name and Address |

Number of Shares Beneficially Owned |

Percent of Shares Owned (1) |

|||||

| Capital Group International, Inc. (2) 11100 Santa Monica Blvd. Los Angeles, CA 90025 |

28,914,610 | 14.5 | % | ||||

| Capital Guardian Trust Company (2) 11100 Santa Monica Blvd. Los Angeles, CA 90025 |

12,681,580 | 6.4 | % | ||||

| Capital Research & Management Co. (2) 333 South Hope Street Los Angeles, CA 90071 |

17,623,820 | 8.9 | % | ||||

| The Growth Fund of America, Inc. (2) 333 South Hope Street Los Angeles, CA 90071 |

12,940,000 | 6.5 | % | ||||

| Fidelity Management Research (2) 82 Devonshire Street Boston, MA 02109 |

14,124,871 | 7.1 | % | ||||

(1) Based on 198,824,000 outstanding shares of Common Stock as of December 31, 2006. (2) Based on information provided pursuant to Schedules 13D and 13G filed with the Securities and Exchange Commission. |

| ||||||

21

| Management | |||||||

| The following table sets forth the beneficial ownership of the Company’s Common Stock as of December 31, 2006 by all Directors, each of the named executive officers set forth in the Summary Compensation Table, and all Directors and current executive officers as a group. Shares that become issuable under outstanding restricted stock units upon satisfaction of the applicable vesting requirements are not included in the table but are indicated in footnote 15 to such table: | |||||||

| Name of Beneficial Owner |

Number of Beneficially |

Percent of Outstanding Class (1) |

|||||

| Richard P. Wallace (2) |

231,919 | * | |||||

| Edward W. Barnholt (3) |

72,832 | * | |||||

| H. Raymond Bingham (4) |

61,000 | * | |||||

| Robert T. Bond (5) |

58,000 | * | |||||

| Stephen P. Kaufman (6) |

37,000 | * | |||||

| Lida Urbanek (7) |

1,385,581 | * | |||||

| David C. Wang |

— | — | |||||

| John H. Kispert (8) |

167,941 | * | |||||

| Jeffrey L. Hall (9) |

62,828 | * | |||||

| Kenneth Schroeder(10)(13) |

215,104 | * | |||||

| Avi Cohen(11)(13) |

175,777 | * | |||||

| Lance Glasser(12)(13) |

171,090 | * | |||||

| All Directors and current executive officers as a group |

2,147,924 | 1.07 | % | ||||

* Less than 1%. (1) Based on 199,086,000 outstanding shares of the Common Stock of the Company as of December 31, 2006. (2) Includes 227,794 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (3) Includes 70,832 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (4) Includes 60,000 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (5) Includes 55,000 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (6) Includes 35,000 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (7) Includes 81,666 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006, 1,271,414 shares of which are held in trust for the benefit of Ms. Urbanek’s family, and 29,555 shares of which are held by the Urbanek Family Foundation. (8) Includes 160,700 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006 and 7,241 shares which are held in trust for the benefit of Mr. Kispert’s family. (9) Includes 60,603 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (10) Includes 82,446 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (11) Includes 172,581 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. |

| ||||||

22

| (12) Includes 166,965 shares subject to options which are presently exercisable or will become exercisable within 60 days after December 31, 2006. (13) No longer an executive officer of the Company as of December 31, 2006. (14) Includes options to purchase an aggregate of 819,155 shares of Common Stock of the Company held by the current officers and Directors which are presently exercisable or will become exercisable within 60 days of December 31, 2006. Messrs. Schroeder, Cohen and Glasser are not included in this group as they were no longer executive officers of the Company as of December 31, 2006. Kenneth Levy is also not included in this group total; his position as Chairman Emeritus is honorary. (15) As of December 31, 2006, the executive officers listed below each held restricted stock units. Each restricted stock unit will entitle that officer to one share of the Company’s Common Stock upon satisfaction of the applicable service or performance vesting requirement in effect for that unit. | ||||||

| Name |

Number of Shares Subject to Restricted Stock Units | |

| Richard P. Wallace |

203,611 | |

| John H. Kispert |

160,833 | |

| Jeffrey L. Hall |

43,750 | |

| Jorge Titinger |

37,600 |

| Section 16(a) Beneficial Ownership Reporting Compliance | ||

| Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, Board members, and persons who own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the SEC, and such persons are also required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it, the Company believes that, with the exceptions noted below, during fiscal 2006 all executive officers, Board members and greater than ten percent stockholders of the Company complied with all applicable filing requirements. Due to an administrative error on the part of the Company, the following individuals failed to timely file a Form 4 for one option grant each: Richard J. Elkus and Robert T. Bond. Mr. Elkus reported his August 9, 2005 option exercises on September 6, 2006, and Mr. Bond reported his September 13, 2005 option exercises on September 21, 2005. Also due to an administrative error on the part of the Company, John H. Kispert failed to timely file a Form 4; on December 29, 2006, he reported the December 22, 2006 transaction to reprice his options that had been retroactively priced. | ||

23

| EXECUTIVE COMPENSATION AND OTHER MATTERS | ||||||||||||||||||

| Summary Compensation Table | ||||||||||||||||||

| The following table sets forth the compensation earned for services rendered in all capacities to the Company and its subsidiaries for the fiscal year ended June 30, 2006 and each of the preceding two fiscal years by each person who served as Chief Executive Officer during the fiscal year ended June 30, 2006 and each of the four other most highly compensated executive officers whose salary plus bonus for that fiscal year exceeded $100,000. The listed individuals will be referred to as the named executive officers. No executive officer terminated employment with the Company during fiscal year 2006.

| ||||||||||||||||||

| Annual Compensation | Long-Term Compensation | |||||||||||||||||||||||||

| Name and Principal |

Year | Salary(1) | Bonus(1)(2) | Other Annual Compensation |

Restricted Stock Award(s)(3) |

Securities Underlying Options/SARs |

All Other Compensation(4) | |||||||||||||||||||

| Richard P. Wallace |

2006 | $ | 555,293 | $ | 1,185,830 | — | $ | 5,138,500 | (5) | 175,000 | $ | 1,000 | ||||||||||||||

| Chief Executive Officer |

2005 | $ | 392,181 | $ | 791,653 | — | $ | 1,672,395 | (5) | 86,250 | $ | 1,000 | ||||||||||||||

| 2004 | $ | 336,501 | $ | 443,730 | — | — | 76,250 | $ | 1,000 | |||||||||||||||||

| John H. Kispert |

2006 | $ | 499,838 | $ | 908,519 | — | $ | 2,626,500 | (6) | 100,000 | $ | 1,000 | ||||||||||||||

| President & Chief Operating Officer |

2005 | $ | 447,066 | $ | 900,251 | — | $ | 1,966,186 | (6) | 86,250 | $ | 1,000 | ||||||||||||||

| 2004 | $ | 396,393 | $ | 658,700 | — | — | 76,250 | $ | 1,000 | |||||||||||||||||

| Jeffrey L. Hall |

2006 | $ | 272,677 | $ | 339,262 | — | $ | 787,950 | (8) | 45,000 | $ | 1,000 | ||||||||||||||

| Senior Vice President & |

2005 | $ | 240,614 | $ | 359,923 | — | $ | 419,500 | (8) | 21,950 | $ | 1,000 | ||||||||||||||

| Chief Financial Officer |

2004 | $ | 194,799 | $ | 184,738 | (7) | — | — | 14,300 | $ | 1,000 | |||||||||||||||

| Avi Cohen Former |

2006 | $ | 325,408 | $ | 440,199 | — | — | (10) | 75,000 | $ | 1,000 | |||||||||||||||

| Group Vice President |

2005 | $ | 303,288 | $ | 505,920 | $ | 34,279 | (9) | $ | 1,355,986 | (10) | 81,000 | $ | 1,000 | ||||||||||||

| 2004 | $ | 253,346 | $ | 295,975 | $ | 83,405 | (9) | — | 40,250 | $ | 1,000 | |||||||||||||||

| Lance Glasser |

2006 | $ | 325,393 | $ | 459,292 | $ | 2,896 | (11) | — | (12) | 75,000 | $ | 1,000 | |||||||||||||

| Former Chief Technical Officer |

2005 | $ | 300,606 | $ | 473,744 | $ | 1,480 | (11) | $ | 1,355,986 | (12) | 78,750 | $ | 1,000 | ||||||||||||

| 2004 | $ | 241,760 | $ | 267,046 | $ | 740 | (11) | — | 25,750 | $ | 1,000 | |||||||||||||||

| Kenneth L. |

2006 | $ | 750,090 | $ | 1,500,181 | — | — | 325,800 | $ | 1,000 | ||||||||||||||||

| Schroeder Former Chief Executive Officer (13) |

2005 | $ | 746,460 | $ | 2,018,130 | — | $ | 4,068,000 | 348,300 | $ | 1,000 | |||||||||||||||

| 2004 | $ | 581,195 | $ | 1,183,023 | — | — | 158,950 | — | ||||||||||||||||||

| (1) Includes amounts deferred by the named Executive Officer. (2) In addition to the amounts earned under the Company’s regular Executive Incentive Plan (“EIP”), this column includes amounts earned under the Company’s Outstanding Corporate Performance Executive Bonus Plan (“OCPB”). Thirty-four percent (34%) of the OCPB earned in 2006 was paid shortly after the close of the fiscal year ended June 30, 2006. The remaining 66% is automatically deferred into the Company’s Executive Deferred Savings Plan (“EDSP”) as a Company contribution and vests 50% after year one, and the remaining 50% after year two. Executives who terminate employment before the end of the vesting period will receive a pro-rata distribution of the deferred bonus amount. The total bonus amount earned by each named executive officer for fiscal year 2006 is comprised as follows: Mr. Wallace: 37% EIP Bonus and 63% OCPB Mr. Kispert: 37% EIP Bonus and 63% OCPB Mr. Hall: 37% EIP Bonus and 63% OCPB Mr. Cohen: 37% EIP Bonus and 63% OCPB Mr. Glasser: 39% EIP Bonus and 61% OCPB Mr. Schroeder: 50% EIP Bonus and 50% OCPB (3) These awards consist of restricted stock units (RSUs). Each unit represents the right to receive one share of the Company’s Common Stock upon the vesting of that unit. These RSUs vest 50% at four years from award date and the remaining 50% at five years from award date, with each installment contingent upon the executive’s continued employment with the Company through the applicable vesting date. The award does not include any dividend or dividend-equivalent rights with respect to the underlying shares of the Company’s Common Stock. |

24

| (4) These are the amounts contributed by the Company as a matching contribution to the 401(k) plan. (5) On June 30, 2006, Mr. Wallace held RSUs for 141,111 unvested shares of the Company’s Common Stock with an aggregate fair market value of $5,865,984 based on the $41.57 per share fair market value of the Common Stock on that date. RSU awards granted to Mr. Wallace for the respective fiscal years are as follows: 2006: 25,000 RSUs that had a fair market value per share of $47.95 when awarded on September 26, 2005; 75,000 RSUs that had a fair market value per share of $52.53 when awarded on February 17, 2006. 2005: 41,111 RSUs that had a fair market value per share of $40.68 when awarded on October 18, 2004. (6) On June 30, 2006, Mr. Kispert held RSUs for 98,333 shares of the Company’s Common Stock with an aggregate fair market value of $4,087,703 based on the $41.57 per share fair market value of the Common Stock on that date. RSU awards granted to Mr. Kispert for the respective fiscal years are as follows: 2006: 50,000 RSUs that had a fair market value per share of $52.53 when awarded on February 17, 2006. 2005: 48,333 RSUs that had a fair market value per share of $40.68 when awarded on October 18, 2004. (7) Includes $654 of profit sharing paid. (8) On June 30, 2006, Mr. Hall held RSUs for 25,000 shares of the Company’s Common Stock with an aggregate fair market value of $1,039,250 based on the $41.57 per share fair market value of the Common Stock on that date. RSU awards granted to Mr. Hall for the respective fiscal years are as follows: 2006: 15,000 RSUs that had a fair market value per share of $52.53 when awarded on February 17, 2006. 2005: 10,000 RSUs that had a fair market value per share of $41.95 when awarded on May 16, 2005. (9) In FY 2004, Mr. Cohen received a $62,257 housing allowance, a management retention award in the amount of $17,587, and $3,561 as reimbursement for relocation expenses. In FY 2005, Mr. Cohen received a management retention award in the amount of $33,539 as well as patent awards. (10) On June 30, 2006, Mr. Cohen held RSUs for 33,333 shares of the Company’s Common Stock with an aggregate fair market value of $1,385,653 based on the $41.57 per share fair market value of the Common Stock on that date. These RSUs were awarded to Mr. Cohen on October 18, 2004 when the fair market value per share of the underlying Common Stock was $40.68. (11) Represents amounts received by Mr. Glasser for patent awards. (12) On June 30, 2006, Mr. Glasser held RSUs for 33,333 shares of the Company’s Common Stock with an aggregate fair market value of $1,385,653 based on the $41.57 per share fair market value of the Common Stock on that date. These RSUs were awarded to Mr. Glasser on October 18, 2004 when the fair market value per share of the underlying Common Stock was $40.68. (13) Mr. Schroeder was the Chief Executive Officer until January 1, 2006. On June 30, 2006, Mr. Schroeder held RSUs for 100,000 shares of the Company’s Common Stock with an aggregate fair market value of $4,157,000 based on the $41.57 per share fair market value of the Common Stock on that date. These RSUs were awarded to Mr. Schroeder on October 18, 2004 when the fair market value per share of the underlying Common Stock was $40.68. As a result of the termination of Mr. Schroeder’s employment on October 16, 2006, vesting of his RSUs ceased and all of his outstanding RSUs (which were all unvested) were canceled. |

25

| OPTION/SAR GRANTS IN LAST FISCAL YEAR | ||||||||||||||||||

| The following tables set forth the number of securities underlying stock options granted to the named executive officers under the Company’s stock option plans and the options exercised by such named executive officers during the fiscal year ended June 30, 2006. No stock appreciation rights were granted to any of the named executive officers during the fiscal year ended June 30, 2006.

| ||||||||||||||||||

| Number of Securities Underlying Options (1) |

Percent of Total Options Granted to Employees in Fiscal Year (2) |

Exercise ($/share) |

Expiration Date |

Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term ($)(3) | ||||||||||||||

| 5% | 10% | |||||||||||||||||

| Richard P. Wallace Chief Executive Officer |

125,000 | $ | 47.95 | 9/26/2012 | $ | 2,440,058 | $ | 5,686,373 | ||||||||||

| 50,000 | $ | 52.53 | 2/17/2013 | $ | 1,069,249 | $ | 2,491,805 | |||||||||||

| Total |

175,000 | 3.60 | % | $ | 3,509,307 | $ | 8,178,179 | |||||||||||

| John H. Kispert President & Chief Operating Officer |

75,000 | $ | 47.95 | 9/26/2012 | $ | 1,464,035 | $ | 3,411,824 | ||||||||||

| 25,000 | $ | 52.53 | 2/17/2013 | $ | 534,625 | $ | 1,245,903 | |||||||||||

| Total |

100,000 | 2.06 | % | $ | 1,998,660 | $ | 4,657,727 | |||||||||||

| Jeffrey L. Hall |

30,000 | $ | 47.95 | 9/26/2012 | $ | 585,614 | $ | 1,364,730 | ||||||||||

| Senior Vice President & Chief Financial Officer |

15,000 | $ | 52.53 | 2/17/2013 | $ | 320,775 | $ | 747,542 | ||||||||||

| Total |

45,000 | 0.93 | % | $ | 906, 389 | $ | 2,112,271 | |||||||||||

| Avi Cohen Former Group Vice President |

75,000 | $ | 47.95 | 9/26/2012 | $ | 1,464,035 | $ | 3,411,824 | ||||||||||

| Total |

75,000 | 1.54 | % | $ | 1,464,035 | $ | 3,411,824 | |||||||||||

| Lance Glasser Former Chief Technical Officer |

75,000 | $ | 47.95 | 9/26/2012 | $ | 1,464,035 | $ | 3,411,824 | ||||||||||

| Total |

75,000 | 1.54 | % | $ | 1,464,035 | $ | 3,411,824 | |||||||||||

| Kenneth L. Schroeder Former Chief Executive Officer(4) |

75,000 | $ | 47.95 | 9/26/2015 | $ | 2,261,662 | $ | 5,731,496 | ||||||||||

| 175,000 | $ | 47.95 | 9/26/2015 | $ | 5,277,212 | $ | 13,373,491 | |||||||||||

| 75,800 | $ | 47.95 | 9/26/2015 | $ | 2,285,787 | $ | 5,792,632 | |||||||||||

| Total |

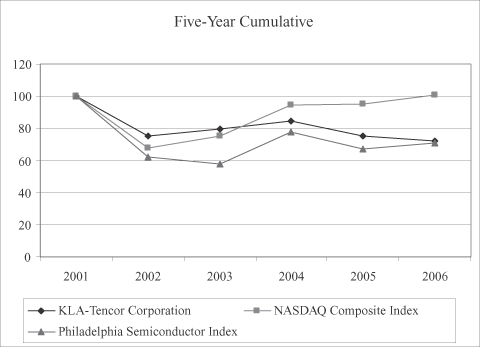

325,800 | 6.71 | % | $ | 9,824,661 | $ | 24,897,620 | |||||||||||