UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

KLA-Tencor Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 15, 2007

To the Stockholders:

YOUR VOTE IS IMPORTANT

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of KLA-Tencor Corporation (the “Company”), a Delaware corporation, will be held on Thursday, November 15, 2007 at 1:00 P.M., local time, in Multipurpose Rooms East and West in Building Three of the Company’s Milpitas facility, located at Three Technology Drive, Milpitas, California 95035, for the following purposes:

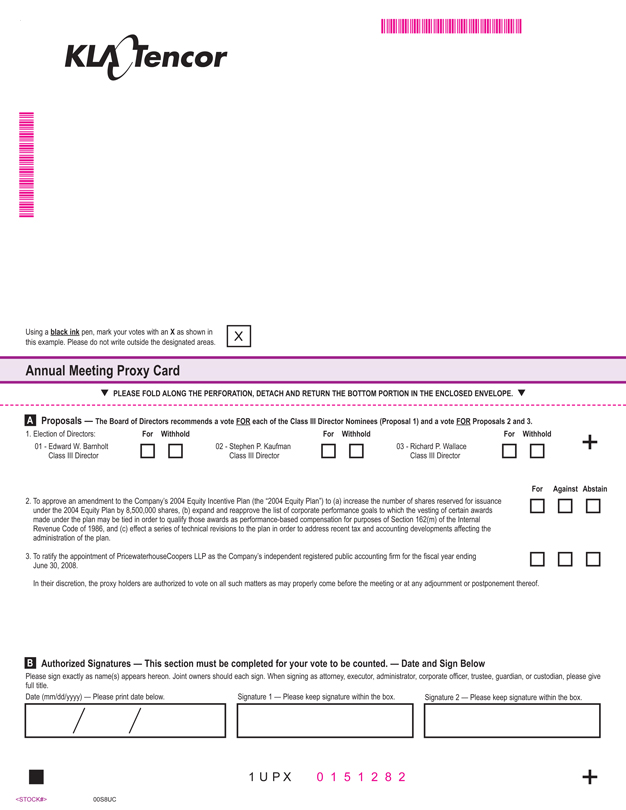

| 1. | To elect three Class III Directors to each serve for a three-year term, each until his successor is duly elected. |

| 2. | To approve an amendment to the Company’s 2004 Equity Incentive Plan (the “2004 Equity Plan”) to (a) increase the number of shares reserved for issuance under the 2004 Equity Plan by 8,500,000 shares, (b) expand and reapprove the list of corporate performance goals to which the vesting of certain awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986, and (c) effect a series of technical revisions to the plan in order to address recent tax and accounting developments affecting the administration of the plan. |

| 3. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2008. |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on October 2, 2007 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

| Sincerely, |

|

| Richard P. Wallace |

| Chief Executive Officer |

| Milpitas, California |

October 11, 2007

| All stockholders are cordially invited to attend the Annual Meeting in person; however, to assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy card and return it in the enclosed envelope or follow the instructions on the enclosed proxy card to vote by telephone or via the Internet. Any stockholder attending the Annual Meeting may vote in person even if he or she previously returned a proxy card or voted by telephone or via the Internet. |

ANNUAL MEETING OF STOCKHOLDERS

OF

KLA-TENCOR CORPORATION

To be held on November 15, 2007

PROXY STATEMENT

| QUESTIONS AND ANSWERS REGARDING PROXY SOLICITATION AND VOTING | ||

| Why am I receiving these materials? | The Board of Directors of KLA-Tencor Corporation (“KLA-Tencor,” the “Company” or “we”) is providing these proxy materials to you in connection with KLA-Tencor’s Annual Meeting of Stockholders to be held on Thursday, November 15, 2007 at 1:00 P.M. local time. As a stockholder of record, you are invited to attend the Annual Meeting, which will be held in Multipurpose Rooms East and West in Building Three of the Company’s Milpitas facility, located at Three Technology Drive, Milpitas, California 95035. The purposes of the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement.

These proxy solicitation materials, together with the Company’s Annual Report for fiscal year 2007, were first mailed on or about October 11, 2007 to all stockholders entitled to vote at the Annual Meeting. KLA-Tencor’s principal executive offices are located at One Technology Drive, Milpitas, California 95035, and our telephone number is (408) 875-3000. | |

| How may I obtain KLA-Tencor’s Annual Report? | A copy of our Annual Report on Form 10-K for fiscal year 2007 is available free of charge on the Internet from the Securities and Exchange Commission’s website at http://www.sec.gov, as well as on our website at http://ir.kla-tencor.com. | |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | ||

| Who may vote at the Annual Meeting? | You may vote if our records showed that you owned shares of KLA-Tencor Common Stock as of October 2, 2007 (the “Record Date”). At the close of business on that date, we had a total of 182,147,118 shares of Common Stock issued and outstanding, which were held of record by approximately 752 stockholders. As of the Record Date, we had no shares of Preferred Stock outstanding. You are entitled to one vote for each share that you own.

The Annual Meeting will be held if a majority of the outstanding Common Stock entitled to vote is represented at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting. | |

1

| What proposals are being voted on at the Annual Meeting? | In addition to such other business as may properly come before the Annual Meeting or any adjournment thereof, the following three proposals will be presented at the Annual Meeting:

1. Election of three Class III Directors to each serve for a three-year term;

2. Approval of an amendment to the Company’s 2004 Equity Incentive Plan (the “2004 Equity Plan”) to (a) increase the number of shares reserved for issuance under the 2004 Equity Plan by 8,500,000 shares, (b) expand and reapprove the list of corporate performance goals to which the vesting of certain awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986, and (c) effect a series of technical revisions to the plan in order to address recent tax and accounting developments affecting the administration of the plan; and

3. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2008. | |

| How can I vote if I own shares directly? | If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you. You may vote in accordance with the instructions described below. If you hold your shares in your own name as a holder of record, you may instruct the proxy holders how to vote your shares in the following ways:

1. By Telephone: Use the toll-free telephone number provided on the proxy card prior to 11:59 P.M. EST on November 14, 2007 (specific instructions for using the telephone voting system are on the proxy card);

2. By Internet: Use the Internet voting site listed on the proxy card prior to 11:59 P.M. EST on November 14, 2007 (specific instructions for using the Internet voting system are on the proxy card);

3. By Mail: Complete, sign, date and mail the proxy card in the postage paid envelope that we have provided, for delivery to the Company prior to 11:59 P.M. EST on November 14, 2007 (specific instructions for mailing are on the proxy card); or

4. In Person: Attend the Annual Meeting and vote your shares in person.

Whichever of these methods you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions.

If you vote by mail, telephone or Internet without giving specific voting instructions, your shares will be voted FOR Proposal One (the election of the nominees listed herein for the Board of Directors), FOR Proposal Two (the approval of an increase to the number of shares reserved under the Company’s 2004 Equity Incentive Plan), and FOR Proposal Three (the ratification of our independent registered public accounting firm). When proxies are properly dated, executed and returned (whether by returned proxy card, telephone or Internet), the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting. | |

2

| How may I vote if my shares are held in a stock brokerage account, or by a bank or other nominee? | If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and your broker or nominee is considered the stockholder of record with respect to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker on how to vote and you are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting. If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted. | |

| Can I change my vote? | You may change your vote at any time prior to the vote at the Annual Meeting. To change your proxy instructions if you are a stockholder of record, you must:

• Advise our General Counsel in writing at our principal executive office, before the proxy holders vote your shares, that you wish to revoke your proxy instructions; or

• Deliver proxy instructions dated after your earlier proxy instructions as follows:

a. By Phone: Use the toll-free telephone number provided on the proxy card to vote again prior to 11:59 P.M. EST on November 14, 2007 (specific instructions for using the telephone voting system are on the proxy card);

b. By Internet: Use the Internet voting site listed on the proxy card to vote again prior to 11:59 P.M. EST on November 14, 2007 (specific instructions for using the Internet voting system are on the proxy card);

c. By Mail: Complete, sign and date another proxy card bearing a later date and deliver such proxy card prior to 11:59 P.M. EST on November 14, 2007 (specific instructions for mailing are on the proxy card); or

d. In Person: Attend the Annual Meeting and vote your shares in person. | |

| Who will bear the cost of this proxy solicitation? | We will pay the cost of this proxy solicitation. KLA-Tencor has retained the services of D.F. King & Company to aid in the solicitation of proxies from brokers, bank nominees and other institutional owners. We estimate that we will pay D.F. King fees of approximately $8,500.00 for this solicitation activity, forwarding solicitation material to beneficial and registered stockholders and processing the results. Certain of our Directors, officers and regular employees, without additional compensation, may solicit proxies personally or by telephone. | |

3

| Can my broker vote my shares if I do not instruct him or her how I would like my shares voted? | Yes. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and your record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder, the record holder will be entitled to vote your shares in its discretion on Proposal One (Election of Directors), Proposal Two (Approval of Amendment to 2004 Equity Incentive Plan) and Proposal Three (Ratification of Independent Registered Public Accounting Firm). | |

| Are abstentions and broker non-votes counted? | Shares that are voted “FOR,” “AGAINST,” “WITHHELD” or “ABSTAIN” are treated as being present for purposes of determining the presence of a quorum and are also treated as shares entitled to vote at the Annual Meeting (“Votes Cast”).

Since abstentions will be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of Votes Cast with respect to a proposal (other than the election of Directors), abstentions will have the same effect as a vote against the proposal (other than the election of Directors).

Shares that are subject to a broker non-vote are counted for purposes of determining whether a quorum exists but not for purposes of determining whether a proposal has passed. | |

| How does the Board of Directors recommend that I vote? | The Board of Directors recommends that stockholders vote as follows:

1. “FOR” the election of the three nominated Class III Directors to the Board of Directors: Edward W. Barnholt, Stephen P. Kaufman and Richard P. Wallace, the Company’s Chief Executive Officer;

2. “FOR” the approval of an amendment to the 2004 Equity Plan to (a) increase the number of shares reserved for issuance under the 2004 Equity Plan by 8,500,000 shares, (b) expand and reapprove the list of corporate performance goals to which the vesting of certain awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986, and (c) effect a series of technical revisions to the plan in order to address recent tax and accounting developments affecting the administration of the plan; and

3. “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2007. | |

| Will any other business be transacted at the Annual Meeting? | We are not aware of any matters to be presented other than those described in this Proxy Statement. In the unlikely event that any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote. | |

4

| What happens if the Annual Meeting is adjourned or postponed? | If the Annual Meeting is adjourned or postponed, the proxy holders can vote your shares on the new meeting date as well, unless you have properly revoked your proxy instructions. | |

| Why is the Company holding two Annual Meetings during 2007? | As a result of our discovery that we had retroactively priced stock options (primarily from July 1, 1997 to June 30, 2002) and had not accounted for them correctly, we restated our historical financial statements to correct our past accounting for retroactively priced stock options. Due to the restatements, the filing of our Annual Report on Form 10-K for the fiscal year ended June 30, 2006 was delayed until January 29, 2007. As a result, because we could not schedule our annual meeting until that filing was completed and available for mailing to our stockholders, we had to delay the annual meeting that would typically have been held in November 2006 until March 29, 2007.

The Annual Meeting that is the subject of this Proxy Statement is the Company’s regularly scheduled annual meeting for the fiscal year ended June 30, 2007. | |

| Can I present other business to be transacted at the Annual Meeting? | Any stockholder may present a matter from the floor for consideration at a meeting of stockholders so long as certain procedures are followed. Under our bylaws, as amended, a stockholder notice must ordinarily be received by KLA-Tencor (Attention: General Counsel) at least 120 days prior to the anniversary of the mailing date of the prior year’s proxy statement. The deadline for submitting a stockholder notice with respect to the Annual Meeting, as provided in the proxy statement that we filed with the Securities and Exchange Commission on February 27, 2007, was September 9, 2007. For the annual meeting for the fiscal year ending June 30, 2008, a stockholder notice must be received by KLA-Tencor (Attention: General Counsel) no later than June 13, 2008. | |

| What is required in a stockholder’s notice to present other business to be transacted? | The stockholder’s notice must set forth, as to each proposed matter, the following:

1. A brief description of the proposed matter and reasons for conducting such business at the meeting;

2. Name and address of the stockholder, as they appear on KLA-Tencor’s books;

3. The class and number of shares of KLA-Tencor that are beneficially owned by the stockholder;

4. Any material interest of the stockholder in such business; and

5. Any other information that is required to be provided by such stockholder pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended. | |

| Can I still present other business to be transacted if my notice is deficient? | If the stockholder notice is not in compliance with the requirements set forth in our bylaws, the presiding officer of the meeting may refuse to acknowledge the matter. | |

5

| What is the deadline for stockholder proposals in connection with the next Annual Meeting? | Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the SEC and the provisions of our bylaws. We must receive stockholder proposals that are intended to be presented by such stockholders at our next Annual Meeting of Stockholders (related to our fiscal year ending June 30, 2008) no later than June 13, 2008 to be considered for inclusion in the Proxy Statement and form of Proxy relating to that meeting.

Stockholder proposals that are not intended to be included in our proxy materials for such meeting, but that are to be presented by the stockholder from the floor are subject to the advance notice provisions set forth above under “Can I present other business to be transacted at the Annual Meeting?” and other requirements set forth in the proxy rules established by the SEC and the provisions of our bylaws. | |

| How may I obtain a copy of KLA-Tencor’s Bylaws? | For a free copy of KLA-Tencor’s bylaws, please contact our Investor Relations department at (408) 875-3600 or visit our website at http://ir.kla-tencor.com and fill out a request form. A copy of our bylaws is also available free of charge on the Internet from the SEC’s website at http://www.sec.gov. | |

| What should I do if I receive more than one set of voting materials? | You may request delivery of a single copy of our future proxy statements and annual reports by writing to the address below or calling our Investor Relations department at the telephone number below. Stockholders may also request electronic delivery of future proxy statements by writing to the address below, calling our Investor Relations department at (408) 875-3600 or via our website at http://ir.kla-tencor.com. | |

| May I get additional copies of these materials? | Certain stockholders who share an address are being delivered only one copy of this Proxy Statement. You may receive additional copies of this Proxy Statement without charge by sending a written request to KLA-Tencor Corporation, Attention: Investor Relations, One Technology Drive, Milpitas, California 95035. Requests may also be made by calling our Investor Relations department at (408) 875-3600. | |

6

| PROPOSAL ONE: ELECTION OF DIRECTORS | ||

| The Company has a classified Board of Directors with three classes. At each annual meeting, a class of Directors is elected for a full term of three years to succeed those Directors whose terms expire at the annual meeting. At this Annual Meeting, the terms of the Class III Directors are expiring. If there is a nominee for a class other than the class which is up for election, such nominee, upon election, is added to the designated class and serves out the remainder of the term for that class.

The four incumbent Class I Directors are Robert M. Calderoni, John T. Dickson, Kevin J. Kennedy and Lida Urbanek. The Class I Directors will serve until the annual meeting of stockholders to be held in 2008 or until their respective successors are duly elected and qualified.

The three incumbent Class II Directors are H. Raymond Bingham, Robert T. Bond and David C. Wang. The Class II Directors will serve until the annual meeting of stockholders to be held in 2009 or until their respective successors are duly elected and qualified.

The three incumbent Class III Directors are Edward W. Barnholt, Stephen P. Kaufman and Richard P. Wallace. They are up for re-election at the Annual Meeting. | ||

| Nominees | The term of the three current Class III Directors will expire on the date of the Annual Meeting. The three Class III Directors are nominated for election at the Annual Meeting. The Nominating and Governance Committee, consisting solely of independent Directors as determined under the rules of The Nasdaq Stock Market, recommended the Class III Director nominees, each of whom is an incumbent Director, as set forth in this Proposal One. Based on that recommendation, the members of the Board of Directors unanimously resolved to nominate such individuals for election.

The three nominees for election as Class III Directors by the stockholders are:

• Edward W. Barnholt;

• Stephen P. Kaufman; and

• Richard P. Wallace.

If elected, the nominees for Class III Directors will serve as Directors until the Company’s annual meeting of stockholders in 2010, each until his successor is duly elected and qualified. If any nominee declines to serve or becomes unavailable for any reason, or a vacancy occurs before the election, the proxies may be voted for such substitute nominees as the Board of Directors may designate. As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee who is unable or who will decline to serve as a Director. | |

7

| Vote Required and Recommendation | If a quorum is present and voting, the three nominees for Class III Directors receiving the highest number of affirmative votes will be elected as Class III Directors. Votes withheld from any Director and broker non-votes are counted for purposes of determining the presence or absence of a quorum but have no other legal effect on the selection of nominees for Directors. Anyone who is elected as a Director in any uncontested election by a plurality and not a majority of votes cast will promptly tender his or her resignation to the Board of Directors, subject to acceptance, after certification of the election results. The Nominating and Governance Committee will make a recommendation to the Board of Directors whether to accept or reject the resignation or take some other appropriate action, taking into account any stated reasons why stockholders withheld votes and any other factors which the Nominating and Governance Committee determines in its sole discretion are relevant to such decision. The Board of Directors will in its sole discretion act on the recommendation of the Nominating and Governance Committee within 90 days after the date of certification of the election results. The Director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board of Directors regarding his or her resignation. | |

| THE MEMBERS OF THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND A VOTE “FOR” EACH OF THE CLASS III DIRECTOR NOMINEES, WITH THE DIRECTORS WHO ARE NOMINEES ABSTAINING. | ||

8

| INFORMATION ABOUT THE DIRECTORS AND THE NOMINEES | ||||

| The following table sets forth certain information with respect to the Company’s Board of Directors as of the date of this Proxy Statement: | ||||

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Nominees for Election as Class III Directors |

||||

| Edward W. Barnholt | Edward W. Barnholt has been a Director of KLA-Tencor since 1995, and was named Chairman of the Board of Directors of KLA-Tencor in October 2006. From March 1999 to March 2005, Mr. Barnholt was President and Chief Executive Officer of Agilent Technologies, Inc. (“Agilent”) and from November 2002 to March 2005, he was Chairman of the Board of Directors of Agilent. On March 1, 2005, Mr. Barnholt retired as the Chairman, President and Chief Executive Officer of Agilent. Before being named Agilent’s Chief Executive Officer, Mr. Barnholt served as Executive Vice President and General Manager of Hewlett-Packard Company’s Measurement Organization from 1998 to 1999. From 1990 to 1998, he served as General Manager of Hewlett-Packard Company’s Test and Measurement Organization. He was elected Senior Vice President of Hewlett-Packard Company in 1993 and Executive Vice President in 1996. Mr. Barnholt also serves on the Boards of Directors of Adobe Systems Incorporated and eBay Inc. He also serves on the Board of Trustees of the Packard Foundation and the Boards of Directors of The Tech Museum of Innovation and Silicon Valley Leadership Group. | 64 | ||

| Stephen P. Kaufman | Stephen P. Kaufman has been a Director of KLA-Tencor since November 2002. Mr. Kaufman has been a Senior Lecturer at the Harvard Business School since January 2001. He was a member of the Board of Directors of Arrow Electronics, Inc. (“Arrow”) from 1984 to May 2003. From 1986 to June 2000, he was Chief Executive Officer of Arrow. From 1985 to June 1999, he was also Arrow’s President. From 1994 to June 2002, he was Chairman of the Board of Directors of Arrow. Mr. Kaufman also serves on the Boards of Directors of Harris Corporation and Thermo Fisher Scientific Inc. | 65 | ||

9

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Nominees for Election as Class III Directors |

||||

| Richard P. Wallace | Richard P. Wallace has been a Director and the Chief Executive Officer of KLA-Tencor since January 2006. Mr. Wallace was President and Chief Operating Officer from July 2005 through December 2005. He was Executive Vice President of the Customer Group from May 2004 to July 2005. Mr. Wallace was Executive Vice President of the Wafer Inspection Group from July 2000 to May 2004. From July 1999 to June 2000, he was the Group Vice President for Lithography and Films. From April 1998 to June 1999, he was Vice President and General Manager of the Mirage Group. From 1995 to March 1998, Mr. Wallace was Vice President and General Manager of the Wisard division. He currently serves as a member of the Board of Directors of Semiconductor Equipment and Materials International (SEMI), an industry trade association. Mr. Wallace joined KLA-Tencor in 1988 as an applications engineer. Earlier in his career, he held positions with Ultratech Stepper and Cypress Semiconductor. He earned his bachelor’s degree in electrical engineering from the University of Michigan and his master’s degree in engineering management from Santa Clara University, where he also taught strategic marketing and global competitiveness courses upon his graduation. | 47 | ||

| Class I Directors | ||||

| Robert M. Calderoni | Robert M. Calderoni has been a Director of KLA-Tencor since March 2007. He has served as Chairman of the Board of Directors of Ariba, Inc. since July 2003 and as Chief Executive Officer and a Director of Ariba since 2001. From 2001 to 2004, Mr. Calderoni also served as Ariba’s President and, before that, as Ariba’s Executive Vice President and Chief Financial Officer. From 1997 to 2001, he served as Chief Financial Officer at Avery Dennison Corporation. He is also a member of the Board of Directors of Juniper Networks, Inc. | 47 | ||

| John T. Dickson | John T. Dickson has been a Director of KLA-Tencor since May 2007. Mr. Dickson is the former President and Chief Executive Officer of Agere Systems, Inc., a position he held from August 2000 until October 2005. Prior to that, he held positions as the Executive Vice President and Chief Executive Officer of Lucent’s Microelectronics and Communications Technologies Group; Vice President of AT&T Corporation’s integrated circuit business unit; Chairman and Chief Executive Officer of Shographics, Inc.; and President and Chief Executive Officer of Headland Technology Inc. Mr. Dickson is also a member of the Boards of Directors of National Semiconductor Corporation, Mettler-Toledo International Inc. and Frontier Silicon, Ltd. | 61 | ||

10

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Class I Directors | ||||

| Kevin J. Kennedy | Kevin J. Kennedy has been a Director of KLA-Tencor since May 2007. Mr. Kennedy has been the Chief Executive Officer of JDS Uniphase Corporation since September 2003 and has served as a member of the Board of Directors of JDS Uniphase since November 2001. From August 2001 to September 2003, Mr. Kennedy was the Chief Operating Officer of Openwave Systems, Inc. Prior to joining Openwave, Mr. Kennedy served seven years at Cisco Systems, Inc., most recently as Senior Vice President of the Service Provider Line of Business and Software Technologies Division, and 17 years at Bell Laboratories. Mr. Kennedy also serves on the Board of Directors of Rambus Corporation. | 51 | ||

| Lida Urbanek | Lida Urbanek has been a Director of KLA-Tencor since April 1997. Ms. Urbanek is a private investor. She was a Director of Tencor Instruments from August 1991 until April 1997 (when it was merged into KLA-Tencor). | 64 | ||

| Class II Directors | ||||

| H. Raymond Bingham | H. Raymond Bingham has been a Director of KLA-Tencor since August 2000. Since November 2006, Mr. Bingham has been a managing director of General Atlantic LLC, a global private equity firm, and head of the firm’s Palo Alto office. Mr. Bingham served as President and Chief Executive Officer of Cadence Design Systems, Inc. (“Cadence”) from April 1999 to April 2004. He was the Executive Chairman of the Board of Directors of Cadence from May 2004 to July 2005 and was a Director of Cadence from November 1997 to July 2005. From 1993 to April 1999, Mr. Bingham served as Executive Vice President and Chief Financial Officer of Cadence. Mr. Bingham also serves on the Boards of Directors of Flextronics International Ltd., Oracle Corporation and STMicroelectronics N.V. | 61 | ||

| Robert T. Bond | Robert T. Bond has been a Director of KLA-Tencor since August 2000. From April 1996 to January 1998, Mr. Bond served as Chief Operating Officer of Rational Software Corporation. Prior to that, he held various executive positions at Rational Software Corporation. Mr. Bond was employed by Hewlett-Packard Company from 1967 to 1983 and held various management positions during his tenure there. Mr. Bond also serves on the Board of Directors of MontaVista Software. | 64 | ||

11

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Class II Directors | ||||

| David C. Wang | David C. Wang has been a Director of KLA-Tencor since May 2006. Mr. Wang has served as President, Boeing-China, of The Boeing Company (“Boeing”) since 2002. Prior to joining Boeing, he spent 22 years at General Electric Company (“GE”), where he worked in various capacities, including most recently as Chairman and Chief Executive Officer of GE China. In addition, Mr. Wang served in executive positions with GE in Singapore, Malaysia and Mexico. Prior to joining GE, Mr. Wang held various engineering positions at Emerson Electric Co. He currently resides in Beijing and also serves on the Beijing International MBA Program Advisory Board at Beijing University and the Western Academy of Beijing Education Foundation. | 63 | ||

12

| PROPOSAL TWO: APPROVAL OF AN AMENDMENT TO THE 2004 EQUITY INCENTIVE PLAN | ||

| Our stockholders are being asked to approve an amendment to our 2004 Equity Incentive Plan (the “2004 Equity Plan”) that will (i) increase the maximum number of shares of our Common Stock authorized for issuance over the term of the plan by an additional 8,500,000 shares from 12,500,000 to 21,000,000 shares, (ii) expand and reapprove the list of corporate performance goals to which the vesting of certain awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) and (iii) effect a series of technical revisions to the plan in order to address recent tax and accounting developments affecting the administration of the plan.

We rely significantly on equity incentives to attract and retain key employees and other personnel essential to our long-term growth and future success and believe that such incentives are necessary for us to remain competitive in the marketplace for executive talent and other key employees. The proposed share increase will assure that a sufficient reserve of Common Stock remains available under the 2004 Equity Plan to allow us to continue to provide equity incentives to our key personnel on a competitive level.

The expansion and reapproval of the performance goals under the plan will allow us to continue to award equity incentives with meaningful performance milestones that will qualify as performance-based compensation, under Section 162(m) of the Code. Awards which so qualify will not be subject to the $1 million per person limitation on the income tax deductibility of compensation paid to certain executive officers that would otherwise be imposed under Section 162(m) of the Code.

The 2004 Equity Plan was approved by our stockholders on October 18, 2004 and became effective on such date. The 2004 Equity Plan replaced our 1982 Stock Option Plan and 2000 Nonstatutory Stock Option Plan (collectively, the “Replaced Plans”) and supplemented our 1998 Outside Director Option Plan. The share reserve of the 2004 Equity Plan includes approximately 1,500,000 shares transferred to the plan upon the expiration or forfeiture of options that were previously outstanding under the Replaced Plans. Our Board of Directors has approved the amendment to the 2004 Equity Plan that is the subject of this Proposal Two, subject to the approval of the Company’s stockholders at the Annual Meeting.

As of September 30, 2007, options to purchase 16,888,399 shares of common stock were outstanding, in the aggregate, under all Company plans, with a weighted-average exercise price of $42.70 and a weighted-average remaining term of 5.29 years. Also, as of September 30, 2007, 3,542,750 shares of unvested restricted stock and stock units were outstanding, in the aggregate, under all Company plans. As of September 30, 2007, 1,643,959 shares remained available for grant under the 2004 Equity Plan, and 1,472,299 shares remained available for grant under the Company’s 1998 Outside Director Option Plan. If the proposed amendments are approved, the 2004 Equity Plan will have an estimated 10,143,959 shares remaining available for grant. | ||

13

| The following is a summary of the material terms and provisions of the 2004 Equity Plan, as amended. The summary, however, does not purport to be a complete description of all the provisions of the 2004 Equity Plan, and is subject to, and qualified in its entirety by, the provisions of the 2004 Equity Plan. A copy of the actual plan document is attached as Appendix A to this Proxy Statement. |

| SUMMARY OF THE 2004 EQUITY INCENTIVE PLAN | ||

| General | The purposes of the 2004 Equity Plan are to attract and retain the best available personnel for positions of substantial responsibility, provide additional incentive to our employees, Board members and consultants, and promote the success of our business. | |

| Administration | The 2004 Equity Plan may be administered by our Board of Directors or by a committee of Board members appointed by our Board (the “Administrator”). Subject to the provisions of the 2004 Equity Plan, the Administrator has the authority to: (i) interpret the plan and apply its provisions; (ii) establish, amend or rescind rules and regulations relating to the 2004 Equity Plan; (iii) select the persons to whom awards are to be made; (iv) subject to individual fiscal year limits applicable to each type of award, determine the number of shares or equivalent units to be made the subject of each award; (v) determine when and to what extent awards are to be made; (vi) determine the terms and conditions applicable to awards generally and to each individual award (including the provisions of the award agreement to be entered into between the Company and the participant); (vii) amend any outstanding award subject to applicable legal restrictions (except that repricing of outstanding options or stock appreciation rights will generally require stockholder approval, as indicated below); (viii) approve the forms of agreement to evidence the awards made under the plan; (ix) allow participants to satisfy withholding tax obligations by electing to have us withhold from the shares otherwise issuable upon the exercise, vesting or settlement of an award that number of shares (or cash equivalent) with a fair market value equal to the minimum amount of taxes required to be withheld; and (x) subject to certain limitations, take any other actions deemed necessary or advisable for the administration of the 2004 Equity Plan. All decisions, interpretations and other actions of the Administrator will be final and binding on all holders of awards under the 2004 Equity Plan and on all persons deriving their rights therefrom. | |

| Types of Awards | The following types of awards may be made under the 2004 Equity Plan: incentive stock options under Section 422 of the Code, non-statutory stock options, stock appreciation rights (“SARs”), restricted stock units (“RSUs”), performance shares, performance units and deferred stock units. The principal features of each such award are described in more detail below. | |

| Plan Reserve and Shares Counted Against Such Reserve | The maximum number of shares of Common Stock authorized for issuance over the term of the plan is limited to 21,000,000 shares, including the 8,500,000-share increase for which stockholder approval is sought as part of this Proposal. Such shares may be drawn from shares of our authorized but unissued shares or, with the approval of our Board of Directors, from shares reacquired by us, including shares repurchased on the open market. Any shares issued under the 2004 Equity Plan pursuant to a restricted stock unit, | |

14

| performance share or performance unit award will reduce the total number of shares available for issuance under the plan at the rate of 1.8 shares for every one share issued pursuant to such award, unless those shares are issued for a cash consideration per share equal to 100% of the fair market value of our Common Stock on the award date. | ||

| Shares subject to any outstanding awards under the plan that expire or otherwise terminate before those shares are issued will be available for subsequent awards. Unvested shares issued under the plan that either are forfeited by the participants or repurchased by us (at not more than the original exercise or issue price paid per share) pursuant to our repurchase rights under the plan will be added back to the number of shares reserved for issuance under the plan and will accordingly be available for subsequent issuance.

Should the exercise price of an option or other stock purchase right under the plan be paid with shares of our Common Stock, then the authorized reserve under the plan will be reduced only by the net number of new shares issued under the award. Upon the exercise of any SAR granted under the plan, the share reserve will only be reduced by the net number of shares actually issued upon such exercise, and not by the gross number of shares as to which such SAR is exercised.

Should shares of Common Stock otherwise issuable under the plan be withheld by us in satisfaction of the withholding taxes incurred in connection with the issuance, exercise or settlement of an award under the plan, then the number of shares of Common Stock available for issuance under the plan will be reduced only by the net number of shares actually issued after such share withholding.

As of August 31, 2007, 3,689,799 shares of our Common Stock were subject to outstanding options under the 2004 Equity Plan, 3,581,216 shares were subject to outstanding RSU or performance share awards, 828,053 had been issued, and 10,035,959 shares remained available for future award under the 2004 Equity Plan, after taking into account the 8,500,000-share increase for which stockholder approval is sought as part of this Proposal. | ||

| Eligibility | Awards may be granted to our employees, consultants and members of our Board of Directors. Incentive stock options may only be granted to employees. As of August 31, 2007, all five of the Company’s executive officers, all nine of the Company’s non-employee members of the Board and approximately 6,000 other employees were eligible to participate in the 2004 Equity Plan. | |

| Code Section 162(m) Performance Goals | To assure that the compensation attributable to one or more awards of restricted stock units, performance shares, performance units or deferred stock units made under the plan will qualify as performance-based compensation for purposes of Section 162(m) of the Code, the Administrator has the authority to structure one or more of those awards so that they will vest only if certain pre-established corporate performance goals are attained. Awards which qualify as such performance-based compensation will not be subject to the $1.0 million limitation on the income tax deductibility of the compensation paid per covered executive officer that is otherwise imposed under Section 162(m). | |

15

| At the Administrator’s discretion, one or more of the following performance goals may be utilized for purposes of such performance vesting: (i) total stockholder return; (ii) earnings or net income per share; (iii) net income or operating income; (iv) earnings before interest, taxes, depreciation, amortization and/or stock-based compensation costs, or operating income before depreciation and amortization; (v) sales or annual revenue targets; (vi) return on assets, equity or sales; (vii) cash flow, operating cash flow or cash position; (viii) market share; (ix) cost reduction goals; (x) budget comparisons; (xi) operating margin; (xii) implementation or completion of projects or processes strategic or critical to our business operations; (xiii) measures of customer satisfaction; (xiv) any combination of, or a specified increase in, any of the foregoing; (xv) economic value added; and (xvi) the formation of joint ventures, research and development collaborations, marketing or customer service collaborations, or the completion of other corporate transactions intended to enhance our revenue or profitability or expand our customer base. The performance goals set forth in item (iv) and in items (viii) through (xvi) may only be used for purposes of structuring performance-based awards under Section 162(m) of the Code if this Proposal Two is approved by the stockholders at the Annual Meeting.

Each applicable performance goal may include a minimum threshold level of performance below which no award will be earned, levels of performance at which specified portions of an award will be earned and a maximum level of performance at which an award will be fully earned. Each applicable performance goal may be structured at the time of the award to provide for appropriate adjustment for one or more of the following items: (A) asset impairments or write-downs; (B) litigation judgments or claim settlements; (C) the effect of changes in tax laws, accounting principles or other laws or regulations affecting reported results; (D) accruals for reorganization and restructuring programs; (E) any extraordinary nonrecurring items as described in Accounting Principles Board Opinion No. 30 and/or in management’s discussion and analysis of financial condition and results of operations appearing in our annual report to stockholders for the applicable year; (F) the operations of any business we acquire; (G) divestiture of one or more business operations or the assets thereof; and (H) any other adjustment consistent with the operation of the plan.

Shareholder approval of this proposal will also constitute approval of the foregoing list of performance goals for purposes of Section 162(m) of the Code. Accordingly, any deductions to which we would otherwise be entitled with respect to any restricted stock unit, performance share, performance unit or deferred stock unit awards with vesting tied to the attainment of one or more of those approved performance goals will not be subject to the $1.0 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m).

No vesting requirements tied to the attainment of performance objectives may be waived or accelerated with respect to awards that are intended at the time of issuance to qualify as performance-based compensation under Code Section 162(m), except in the event of certain involuntary terminations or changes in control or ownership. |

16

| Restricted Stock Unit and Performance Share 162(m) Share Limit | No participant may be granted in any one fiscal year restricted stock units or performance shares for more than 200,000 shares in the aggregate, except that in the fiscal year the participant commences service with us, he or she may receive such awards for up to 600,000 shares in the aggregate. Shareholder approval of this proposal will also constitute approval of the 200,000 and 600,000 share limitations for purposes of Section 162(m) of the Code. Such share limitations will assure that any deductions to which we would otherwise be entitled with respect to any restricted stock unit or performance share awards with vesting tied to the attainment of one or more of the performance milestones specified above will not be subject to the $1.0 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m). | |

| Grant of Restricted Stock Units | Subject to the terms and conditions of the 2004 Equity Plan, restricted stock units may be granted to our employees, consultants and Board members at any time and from time to time at the discretion of the Administrator. Subject to the 162(m) share limits set forth above, the Administrator will have complete discretion to determine (i) the number of shares subject to each restricted stock unit award and (ii) the vesting provisions in effect for that award, which will typically be based on continued service but may include a performance-based component. Until the shares are actually issued following the vesting of the award, no right to vote or receive dividends or any other rights as a stockholder will exist with respect to the underlying shares. | |

| Restricted Stock Unit Award Agreement | Each restricted stock unit award will be evidenced by an agreement that will specify the cash consideration (if any) payable per underlying share of Common Stock, the applicable vesting schedule and such other terms and conditions as the Administrator will determine. | |

| Grant of Performance Shares | Subject to the terms and conditions of the 2004 Equity Plan, performance share awards may be made to our employees and consultants at any time and from time to time as will be determined at the discretion of the Administrator. Subject to the 162(m) share limits set forth above, the Administrator will have complete discretion to determine (i) the number of shares of our Common Stock subject to each performance share award and (ii) the vesting provisions in effect for that award, which will typically be based on achievement of performance milestones but may also include a service-based component. | |

| Performance Share Award Agreement | Each performance share award will be evidenced by an agreement that will specify the cash consideration (if any) payable per underlying share of Common Stock, the applicable vesting schedule and such other terms and conditions as the Administrator will determine. | |

| Grant of Performance Units | Performance units are similar to performance shares, except that they will be settled in a cash amount equal to the fair market value of the underlying shares of our Common Stock as measured as of the vesting date. The shares available for issuance under the 2004 Equity Plan will not be diminished as a result of the cash settlement of performance unit awards. | |

17

| Performance Unit Award Agreement | Each performance unit grant will be evidenced by an agreement that will specify the applicable vesting schedule and such other terms and conditions as the Administrator will determine. However, no participant will be granted a performance unit award in excess of $1 million in any fiscal year, except that an award of up to $3 million may be made to a participant in the fiscal year in which he or she commences service with us. Shareholder approval of this proposal will also constitute approval of the $1 million and $3 million limitations for purposes of Section 162(m) of the Code. Such dollar limitations will assure that any deductions to which we would otherwise be entitled with respect to any performance unit awards with vesting tied to the attainment of one or more of the performance milestones specified above will not be subject to the $1 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m). | |

| Deferred Stock Units | A deferred stock unit award will consist of a restricted stock unit, performance share or performance unit award that the Administrator, in its sole discretion, permits to be paid out in installments or on a deferred basis, in accordance with rules and procedures established by the Administrator in compliance with the applicable requirements of Section 409A of the Code. Deferred stock units are subject to the same individual annual limits that apply to each type of award. | |

| Terms and Conditions of Options | Each option granted under the 2004 Equity Plan will be evidenced by a written stock option agreement between the optionee and us that is subject to the following terms and conditions: | |

| a. Exercise Price. The exercise price may not be less than the fair market value of our Common Stock on the grant date of the option. | ||

| b. Form of Consideration. The exercise price may be paid in cash or by check or with other shares of our Common Stock owned by the optionee or through a special sale and remittance procedure pursuant to which the optionee makes an immediate sale of the purchased shares and remits a portion of the sale proceeds to us in payment of the exercise price and any applicable withholding taxes. | ||

| c. Exercise of the Option. Each stock option agreement will specify the term of the option and the date or dates when the option is to become exercisable. However, in no event will an option granted under the 2004 Equity Plan have a term in excess of 10 years. | ||

| d. Termination of Employment. If an optionee’s employment terminates for any reason (other than death or permanent disability), all options held by such optionee under the 2004 Equity Plan will expire upon the earlier of (i) the expiration of the limited post-employment exercise period set forth in his or her option agreement or (ii) the expiration date of the option term. The optionee may, at any time before the applicable expiration date, exercise the option for all or any part of the shares for which that option was exercisable at the time of his or her termination of employment. | ||

18

| e. Permanent Disability. If an optionee is unable to continue employment with us as a result of permanent and total disability (as defined in the Code), all options held by such optionee under the 2004 Equity Plan will expire upon the earlier of (i) 12 months after the termination date of the optionee’s employment or (ii) the expiration date of the option term. The optionee may, at any time before the applicable expiration date, exercise the option for all or any part of the shares for which that option was exercisable at the time of his or her termination of employment. | ||

| f. Death. If an optionee dies while employed by us, his or her options will expire upon the earlier of (i) 12 months after the date of his or her death or (ii) the expiration date of the option term. The executor or other legal representative of the optionee may, at any time before the applicable expiration date, exercise the option for all or any part of the option shares. | ||

| g. Extension. If at any time during the applicable post-employment exercise period, the exercise of an option or the sale of the underlying shares cannot be effected in compliance with applicable securities laws or regulations, then such exercise period shall be extended by the period of time for which such exercise or sale was precluded, but in no event beyond the expiration date of the maximum option term. | ||

| h. ISO Limitation. If the aggregate fair market value of all shares of Common Stock for which an optionee’s incentive stock options first become exercisable during any calendar year exceeds $100,000, then the excess will be treated and taxed as nonstatutory options. | ||

| i. Other Provisions. The stock option agreement may contain terms, provisions and conditions that are not inconsistent with the 2004 Equity Plan as determined by the Administrator. | ||

| Option and SAR 162(m) Share Limit | No participant may be granted stock options and SARs for more than 400,000 shares of our Common Stock in the aggregate in any fiscal year, except that options and SARs covering up to 1,200,000 shares in the aggregate may be granted to the participant in the fiscal year in which he or she commences service with us. Shareholder approval of this proposal will also constitute approval of the 400,000 and 1,200,000 share limitations for purposes of Section 162(m) of the Code. Such share limitations will assure that any deductions to which we would otherwise be entitled upon the exercise of stock options or SARs granted under the plan will not be subject to the $1.0 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m). | |

| Exercise Price and Other Terms of Stock Appreciation Rights | The exercise price of SARs may not be less than the fair market value of the Common Stock on the grant date. The Administrator, subject to the provisions of the 2004 Equity Plan (including the 162(m) share limits referred to above and the exercise price restrictions), will have complete discretion to determine the terms and conditions of SARs granted under the 2004 Equity Plan. | |

| Payment of Stock Appreciation Right Amount | Upon exercise of a SAR, the participant will be entitled to receive a payment in an amount equal to the product of (X) the amount by which the fair market value per share of our Common Stock on the exercise date exceeds the exercise price per share for that SAR and (Y) the number of shares as to which the SAR is exercised. | |

19

| Payment upon Exercise of Stock Appreciation Right | At the discretion of the Administrator, the payment due upon the exercise of the SAR may be made in cash, shares of our Common Stock or a combination thereof. To the extent that a SAR is settled in cash, the shares available for issuance under the 2004 Equity Plan will not be diminished as a result of the cash settlement. | |

| Stock Appreciation Right Agreement | Each SAR grant will be evidenced by an agreement that will specify the exercise price, the term of the SAR, the vesting schedule and such other terms and conditions as the Administrator may, in its sole discretion, determine. | |

| Expiration of Stock Appreciation Rights | SARs granted under the 2004 Equity Plan expire as determined by the Administrator, but in no event later than ten (10) years from date of grant. No SAR may be exercised by any person after its expiration date. | |

| Valuation | Our Common Stock is listed on the Nasdaq Global Select Market. Accordingly, the fair market value of our Common Stock on any relevant date will be deemed to be equal to the closing selling price per share of our Common Stock (or the closing bid if no sales were reported) on that date. On August 31, 2007, the fair market value of our Common Stock determined on such basis was $57.47 per share. | |

| No Repricing | The 2004 Equity Plan prohibits the reduction of the exercise price of an outstanding option or SAR, including a repricing by way of an exchange for another award under the plan, unless stockholder approval of the repricing is obtained.

We have not engaged in any repricing programs which have resulted in a reduction to the exercise price of outstanding options or SARs under the plan. However, during the 2007 fiscal year, we completed an investigation of our past equity award practices and concluded that certain stock options awarded under the 2004 Equity Plan were retroactively priced in that the exercise price of each such option was based on the fair market value of our Common Stock on a date earlier than the actual measurement date determined for that option for financial accounting purposes. As a result, the affected options were determined to have been granted with below-market exercise prices, which could potentially subject the portion of each such option that was not vested as of December 31, 2004 to adverse income taxation under Section 409A of the Code.

To provide our employees holding those options with an opportunity to avoid such adverse taxation, we commenced two tender offers, one on February 27, 2007 and another on May 16, 2007. The tender offers allowed those employees to tender options that were potentially subject to Section 409A for amendment or replacement. Following the completion of the offer, each tendered option was amended to increase the exercise price to the lower of (i) the closing selling price per share of our Common Stock on the revised measurement date determined for that option for financial accounting purposes or (ii) the closing selling price per share of our Common Stock on the amendment date. In addition, each employee whose tendered options were so amended is entitled to a cash bonus in January 2008 equal to the total increase to the exercise price in effect for his or her amended options. | |

20

| If the adjusted exercise price for any tendered option (as determined in accordance with the above formula) would have been the same or lower than the current exercise price in effect for that option, then that option was not amended. Instead, that option was cancelled immediately following the close of the offer and replaced with a new option for the same number of shares and with the same exercise price per share, expiration date and vesting schedule as the cancelled option, but with a new grant date. Such cancellation and regrant was necessary to evidence the remedial action required under Section 409A for a tendered option for which the exercise price was not increased. No cash bonus will be paid with respect to any such cancelled and regranted options.

Pursuant to the February 27, 2007 tender offer, we amended options covering approximately 5,068,200 shares of our Common Stock to increase the exercise price of each such option to the lower of (i) the fair market value per share of our Common Stock on the revised measurement date for that option or (ii) $53.35, the closing selling price per share of our Common Stock on the March 28, 2007 amendment date. In addition, the participants whose options were so amended are now eligible for special cash bonuses in the aggregate amount of approximately $20,173,800. In addition, we canceled tendered options covering approximately 27,200 shares of our Common Stock because the adjusted exercise price would have been the same or lower than the exercise price in effect for those options prior to the amendment and granted a new option that is exactly the same in replacement.

Pursuant to the May 16, 2007 tender offer, we amended options covering approximately 283,900 shares of our Common Stock to increase the exercise price of each such option to the lower of (i) the fair market value per share of our Common Stock on the revised measurement date for that option or (ii) $56.12, the closing selling price per share of our Common Stock on the June 15, 2007 amendment date. In addition, the participants whose options were so amended are now eligible for special cash bonuses in the aggregate amount of approximately $361,596.

During the three-day period from December 26, 2006 to December 28, 2006, the exercise prices of certain options held by some individuals then serving as executive officers were increased to the fair market value per share of our Common Stock on the revised measurement date determined for each such option in order to avoid adverse tax consequences to such executive officers under Section 409A of the Code. Each such executive officer is entitled to receive a cash bonus from us in January 2008 equal to the total increase to the exercise price in effect for his amended options. The only current executive officer who participated in that program was Richard P. Wallace, our Chief Executive Officer, who had the exercise price for options to purchase 24,376 shares of our Common Stock increased by an aggregate amount of $368,618, and who will receive a cash bonus in the amount of that increase in January 2008. |

21

| Non-Transferability of Awards | Unless determined otherwise by the Administrator, an award granted under the 2004 Equity Plan may not be sold, pledged, assigned, transferred or otherwise disposed of in any manner other than by will or by the laws of inheritance following the participant’s death and may be exercised, during the participant’s lifetime, only by such participant. If the Administrator makes an award granted under the 2004 Equity Plan transferable, such award will contain such additional terms and conditions as the Administrator deems appropriate. | |

| Leave of Absence | In the event a participant goes on a leave of absence, the vesting of each of his or her outstanding awards will cease until he or she returns to work, except as otherwise required by law or as otherwise determined by the Administrator. | |

| Part-Time Service | Unless the Administrator provides otherwise or except as otherwise required by law, the vesting of any service-vesting awards made to a participant under the 2004 Equity Plan will be extended on a proportionate basis in the event the participant transitions from a full-time to a part-time work schedule, or if not on a full-time work schedule, to a schedule requiring fewer hours of service. Such vesting will be proportionately re-adjusted prospectively in the event that the participant subsequently becomes regularly scheduled to work additional hours of service. | |

| Adjustment Upon Changes in Capitalization | In the event any change is made to our outstanding Common Stock by reason of any stock split, reverse stock split, stock dividend, combination or reclassification of our Common Stock, spin-off transaction or any other increase or decrease in the number of the outstanding shares of our Common Stock effected without receipt of consideration by us, or should the value of the outstanding shares of our Common Stock be substantially reduced as the result of a spin-off transaction or extraordinary dividend or distribution, equitable and proportional adjustments will be made to the number and class of securities issuable under the 2004 Equity Plan, the individual fiscal year limits applicable to restricted stock units, performance share awards, SARs and options, the number and class of securities subject to each outstanding award under the 2004 Equity Plan, the exercise price in effect for each outstanding option or SAR and the cash consideration (if any) payable per share with respect to the shares of our Common Stock underlying any other outstanding awards under the plan. Any such adjustment will be made by the Compensation Committee of our Board of Directors in such manner as it deems appropriate, and its determination will be conclusive. | |

| Change of Control | In the event of a change of control, the successor corporation (or its parent or subsidiary) will assume each outstanding award under the 2004 Equity Plan or replace that award with a substantially-equivalent award which preserves the economic value of the replaced award. To the extent the successor corporation refuses to assume the outstanding awards or to substitute equivalent awards, those awards will become 100% vested at the time of the change of control. The Administrator will also have the discretion to structure awards under the plan so that the awards will become 100% vested upon a change of control, regardless of whether or not the options are assumed or substituted, or upon the subsequent termination of the participant’s employment. | |

22

| A change of control will be deemed to occur for purposes of the 2004 Equity Plan in the event (a) we are acquired by merger or asset sale, (b) there occurs any transaction or series of related transactions pursuant to which any person or group of related persons becomes directly or indirectly the beneficial owner of securities possessing (or convertible into or exercisable for securities possessing) fifty percent (50%) or more of the total combined voting power of our outstanding securities or (c) there is a change in the majority of our Board of Directors as a result of one or more contested elections for Board membership. | ||

| Amendment, Suspensions and Termination of the 2004 Equity Plan | Our Board of Directors may amend, suspend or terminate the 2004 Equity Plan at any time; provided, however, that stockholder approval will be required for any amendment to the extent necessary to comply with applicable laws or regulations. The 2004 Equity Plan will terminate in June 2014. | |

| New Plan Benefits | As of October 2, 2007, no awards had been granted, and no shares had been issued, under the 2004 Equity Plan on the basis of the 8,500,000-share increase to the share reserve under the plan that forms part of this Proposal. | |

23

| OPTION TRANSACTIONS | |||||||

| The table below shows, as to each of the Named Executive Officers and the various other indicated individuals and groups, the number of shares of Common Stock subject to options granted under the 2004 Equity Plan during the period July 1, 2006 through August 31, 2007, together with the weighted average exercise price payable per share.

| |||||||

| Name and Position |

Number of Option Shares |

Weighted Average Exercise Price Per Share ($) | |||||

| Richard P. Wallace Chief Executive Officer |

— | — | |||||

| Jeffrey L. Hall Senior Vice President & Chief Financial Officer |

— | — | |||||

| John H. Kispert President & Chief Operating Officer |

— | — | |||||

| Jorge Luis Titinger Senior Vice President, Global Operations and Corporate Support Groups |

— | — | |||||

| Bin-ming Benjamin Tsai Executive Vice President & Chief Technology Officer |

— | — | |||||

| All current executive officers as a group (5 persons) |

— | — | |||||

| Edward W. Barnholt Chairman of the Board of Directors; Nominee for re-election to the Board of Directors at the Annual Meeting |

— | — | |||||

| Stephen P. Kaufman Director; Nominee for re-election to the Board of Directors at the Annual Meeting |

— | — | |||||

| All current directors (other than executive officers) as a group (9 persons) (1) |

— | — | |||||

| All current employees, including current officers who are not executive officers, as a group (143 persons) |

182,571 | $ | 41.45 | ||||

(1) All stock options granted to the non-employee members of the Company’s Board of Directors during this time were granted from the Company’s 1998 Outside Director Option Plan. | |||||||

24

| STOCK AWARDS |

| ||||

| The table below shows, as to each of the Named Executive Officers and the various other indicated individuals and groups, the number of shares of Common Stock subject to restricted stock unit and performance share awards made under the 2004 Equity Plan during the period July 1, 2006 through August 31, 2007. The vesting of such awards is tied to continued service and/or the attainment of specified performance goals, and no cash consideration is payable by the participants for the shares of Common Stock that actually become issuable under those awards. | |||||

| Name And Position |

Number of Underlying Shares |

||||

| Richard P. Wallace Chief Executive Officer |

150,000 | (1) | |||

| Jeffrey L. Hall Senior Vice President & Chief Financial Officer |

37,500 | (2) | |||

| John H. Kispert President & Chief Operating Officer |

150,000 | (1) | |||

| Jorge Luis Titinger Senior Vice President, Global Operations and Corporate Support Groups |

43,750 | (3) | |||

| Bin-ming Benjamin Tsai Executive Vice President & Chief Technology Officer |

68,750 | (4) | |||

| All current executive officers as a group (5 persons) |

438,937 | ||||

| Edward W. Barnholt Chairman of the Board of Directors; Nominee for re-election to the Board of Directors at the Annual Meeting |

1,403 | ||||

| Stephen P. Kaufman Director; Nominee for re-election to the Board of Directors at the Annual Meeting |

935 | ||||

| All current directors (other than executive officers) as a group (9 persons) |

8,387 | ||||

| All current employees, including current officers who are not executive officers, as a group (3,854 persons) |

2,635,009 | ||||

(1) Includes (a) 62,500 shares that have been earned and are now only subject to service vesting requirements and (b) an additional 87,500 shares representing the maximum number of shares that may be earned if certain performance goals are attained by the Company for fiscal year 2008 and the named executive officer completes the additional service-vesting component applicable to such award. (2) Includes (a) 18,750 shares that have been earned and are now only subject to service vesting requirements and (b) an additional 18,750 shares representing the maximum number of shares that may be earned if certain performance goals are attained by the Company for fiscal year 2008 and the named executive officer completes the additional service-vesting component applicable to such award. (3) Includes (a) 25,000 shares that have been earned and are now only subject to service vesting requirements and (b) an additional 18,750 shares representing the maximum number of shares that may be earned if certain performance goals are attained by the Company for fiscal year 2008 and the named executive officer completes the additional service-vesting component applicable to such award. (4) Includes (a) 50,000 shares that have been granted as a new hire award that are only subject to service vesting requirements and (b) an additional 18,750 shares representing the maximum number of shares that may be earned if certain performance goals are attained by the Company for fiscal year 2008 and the named executive officer completes the additional service-vesting component applicable to such award. |

| ||||

25

| FEDERAL TAX INFORMATION | ||

| Options | Options granted under the 2004 Equity Plan may be either incentive stock options which satisfy the requirements of Section 422 of the Code or non-statutory options which are not intended to meet such requirements. The Federal income tax treatment for the two types of options differs as described below:

Incentive Stock Options. No taxable income is recognized by the optionee at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised, although taxable income may arise at that time for alternative minimum tax purposes. The optionee will, however, recognize taxable income in the year in which the purchased shares are sold or otherwise made the subject of certain dispositions.

For Federal income tax purposes, dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. The optionee will make a qualifying disposition of the purchased shares if the sale or other disposition of such shares is made more than two (2) years after the date the option for the shares involved in such sale or disposition was granted and more than one (1) year after the date the option was exercised for those shares. If the sale or disposition occurs before these two requirements are satisfied, then a disqualifying disposition will result.

Upon a qualifying disposition, the optionee will recognize long-term capital gain in an amount equal to the excess of (i) the amount realized upon the sale or other disposition of the purchased shares over (ii) the exercise price paid for the shares. If there is a disqualifying disposition of the shares, then the excess of (i) the fair market value of those shares on the exercise date over (ii) the exercise price paid for the shares will be taxable as ordinary income to the optionee. Any additional gain recognized upon the disposition will be taxable as a capital gain.

If the optionee makes a disqualifying disposition of the purchased shares, then we will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal to the excess of (i) the fair market value of such shares on the option exercise date over (ii) the exercise price paid for the shares. In no other instance will we be allowed a deduction with respect to the optionee’s disposition of the purchased shares.

Non-Statutory Options. No taxable income is recognized by an optionee upon the grant of a non-statutory option. The optionee will in general recognize ordinary income, in the year in which the option is exercised, equal to the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares, and we must collect the withholding taxes applicable to such income.

We will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the optionee with respect to the exercised non-statutory option. The deduction will in general be allowed for the taxable year in which such ordinary income is recognized by the optionee. | |

26

| Deferred Stock Units | A participant will generally be subject to employment taxes (e.g., Social Security and Medicare taxes) on the vesting date of a deferred stock award equal to the value of the vested shares received minus any amount paid for the shares. A participant will generally recognize taxable income upon receipt of the shares subject to the deferred stock award, and that taxable income will be equal in an amount to the value of the issued shares minus any amount paid for the shares. We must collect the withholding taxes applicable to such income.

We will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the participant at the time the shares are issued. The deduction will in general be allowed for our taxable year in which such ordinary income is recognized by the participant. | |

| Restricted Stock Units and Performance Shares | No taxable income is recognized by the participant upon receipt of such an award. The participant will recognize ordinary income in the year in which the shares subject to the award are actually issued to him or her. The amount of that income will be equal to the fair market value of the shares on the date of issuance, and we must collect the withholding taxes applicable to such income.

We will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the participant at the time the shares are issued. The deduction will in general be allowed for our taxable year in which such ordinary income is recognized by the participant. | |