UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

KLA-Tencor Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 13, 2008

To the Stockholders:

YOUR VOTE IS IMPORTANT

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of KLA-Tencor Corporation (the “Company”), a Delaware corporation, will be held on Thursday, November 13, 2008 at 1:00 P.M., local time, in Multipurpose Rooms East and West in Building Three of the Company’s Milpitas facility, located at Three Technology Drive, Milpitas, California 95035, for the following purposes:

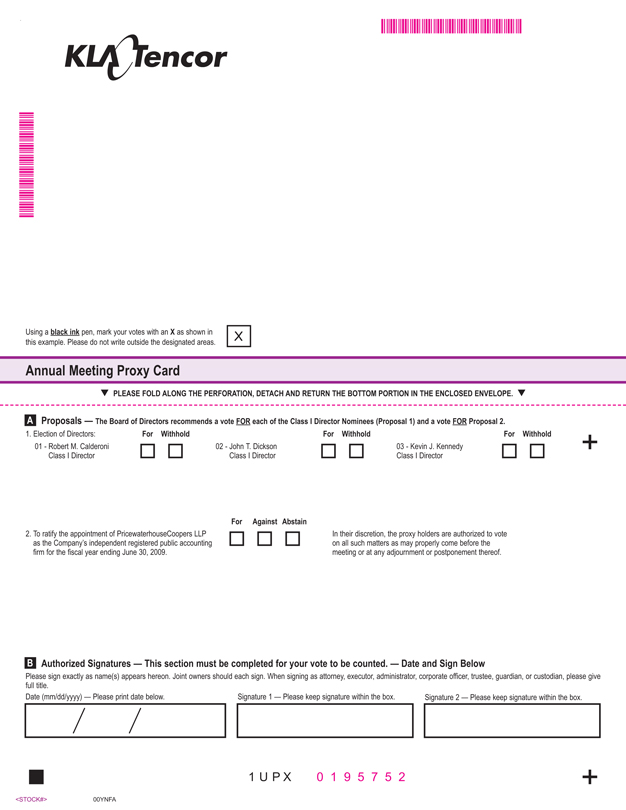

| 1. | To elect three Class I Directors to each serve for a three-year term, each until his successor is duly elected. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2009. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on September 30, 2008 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

| Sincerely, |

|

| Richard P. Wallace |

| Chief Executive Officer |

| Milpitas, California |

October 9, 2008

All stockholders are cordially invited to attend the Annual Meeting in person; however, to assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy card and return it in the enclosed envelope or follow the instructions on the enclosed proxy card to vote by telephone or via the Internet. Any stockholder attending the Annual Meeting may vote in person even if he or she previously returned a proxy card or voted by telephone or via the Internet.

ANNUAL MEETING OF STOCKHOLDERS

OF

KLA-TENCOR CORPORATION

To be held on November 13, 2008

PROXY STATEMENT

QUESTIONS AND ANSWERS REGARDING PROXY SOLICITATION AND VOTING

| Why am I receiving these |

The Board of Directors of KLA-Tencor Corporation (“KLA-Tencor,” the “Company” or “we”) is providing these proxy materials to you in connection with KLA-Tencor’s Annual Meeting of Stockholders to be held on Thursday, November 13, 2008 at 1:00 P.M., local time. As a stockholder of record, you are invited to attend the Annual Meeting, which will be held in Multipurpose Rooms East and West in Building Three of the Company’s Milpitas facility, located at Three Technology Drive, Milpitas, California 95035. The purposes of the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement. |

These proxy solicitation materials, together with the Company’s Annual Report for fiscal year 2008, were first mailed on or about October 9, 2008 to all stockholders entitled to vote at the Annual Meeting. KLA-Tencor’s principal executive offices are located at One Technology Drive, Milpitas, California 95035, and our telephone number is (408) 875-3000.

| How may I obtain |

A copy of our Annual Report on Form 10-K for fiscal year 2008 is available free of charge on the Internet from the Securities and Exchange Commission’s website at http://www.sec.gov, as well as on our website at http://ir.kla-tencor.com. |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Who may vote at the Annual Meeting? |

You may vote if our records showed that you owned shares of KLA-Tencor Common Stock as of September 30, 2008 (the “Record Date”). At the close of business on that date, we had a total of 170,627,492 shares of Common Stock issued and outstanding, which were held of record by approximately 698 stockholders. As of the Record Date, we had no shares of Preferred Stock outstanding. You are entitled to one vote for each share that you own. |

The Annual Meeting will be held if a majority of the outstanding Common Stock entitled to vote is represented at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting.

1

| What proposals are being |

In addition to such other business as may properly come before the Annual Meeting or any adjournment thereof, the following two proposals will be presented at the Annual Meeting: |

| 1. | Election of three Class I Directors to each serve for a three-year term; and |

| 2. | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2009. |

| How can I vote if I own |

If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you. You may vote in accordance with the instructions described below. If you hold your shares in your own name as a holder of record, you may instruct the proxy holders how to vote your shares in the following ways: |

| 1. | By Telephone: Use the toll-free telephone number provided on the proxy card prior to 11:59 P.M. EST on November 12, 2008 (specific instructions for using the telephone voting system are on the proxy card); |

| 2. | By Internet: Use the Internet voting site listed on the proxy card prior to 11:59 P.M. EST on November 12, 2008 (specific instructions for using the Internet voting system are on the proxy card); |

| 3. | By Mail: Complete, sign, date and mail the proxy card in the postage paid envelope that we have provided, for delivery to the Company prior to 11:59 P.M. EST on November 12, 2008 (specific instructions for mailing are on the proxy card); or |

| 4. | In Person: Attend the Annual Meeting and vote your shares in person. |

Whichever of these methods you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions.

If you vote by mail, telephone or Internet without giving specific voting instructions, your shares will be voted FOR Proposal One (the election of the nominees listed herein for the Board of Directors) and FOR Proposal Two (the ratification of our independent registered public accounting firm). When proxies are properly dated, executed and returned (whether by returned proxy card, telephone or Internet), the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting.

2

| How may I vote if my |

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and your broker or nominee is considered the stockholder of record with respect to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker on how to vote and you are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting. If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted. |

| Can I change my vote? |

You may change your vote at any time prior to the vote at the Annual Meeting. To change your proxy instructions if you are a stockholder of record, you must: |

| • | Advise our General Counsel in writing at our principal executive office, before the proxy holders vote your shares, that you wish to revoke your proxy instructions; or |

| • | Deliver proxy instructions dated after your earlier proxy instructions as follows: |

| a. | By Phone: Use the toll-free telephone number provided on the proxy card to vote again prior to 11:59 P.M. EST on November 12, 2008 (specific instructions for using the telephone voting system are on the proxy card); |

| b. | By Internet: Use the Internet voting site listed on the proxy card to vote again prior to 11:59 P.M. EST on November 12, 2008 (specific instructions for using the Internet voting system are on the proxy card); |

| c. | By Mail: Complete, sign and date another proxy card bearing a later date and deliver such proxy card prior to 11:59 P.M. EST on November 12, 2008 (specific instructions for mailing are on the proxy card); or |

| d. | In Person: Attend the Annual Meeting and vote your shares in person. |

| Who will bear the cost of this |

We will pay the cost of this proxy solicitation. KLA-Tencor has retained the services of D.F. King & Company to aid in the solicitation of proxies from brokers, bank nominees and other institutional owners. We estimate that we will pay D.F. King fees of approximately $7,500 for this solicitation activity, forwarding solicitation material to beneficial and registered stockholders and processing the results. Certain of our Directors, officers and regular employees, without additional compensation, may solicit proxies personally or by telephone. |

3

| Can my broker vote my |

Yes. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and your record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder, the record holder will be entitled to vote your shares in its discretion on Proposal One (Election of Directors) and Proposal Two (Ratification of Independent Registered Public Accounting Firm). |

| Are abstentions and broker |

Shares that are voted “FOR,” “AGAINST,” “WITHHELD” or “ABSTAIN” are treated as being present for purposes of determining the presence of a quorum and are also treated as shares entitled to vote at the Annual Meeting (“Votes Cast”). |

Since abstentions will be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of Votes Cast with respect to a proposal (other than the election of Directors), abstentions will have the same effect as a vote against the proposal (other than the election of Directors).

Shares that are subject to a broker non-vote are counted for purposes of determining whether a quorum exists but not for purposes of determining whether a proposal has passed.

| How does the Board of |

The Board of Directors recommends that stockholders vote as follows: |

| 1. | “FOR” the election of the three nominated Class I Directors to the Board of Directors: Robert M. Calderoni, John T. Dickson and Kevin J. Kennedy; and |

| 2. | “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2009. |

| Will any other business be |

We are not aware of any matters to be presented other than those described in this Proxy Statement. In the unlikely event that any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote. |

| What happens if the Annual |

If the Annual Meeting is adjourned or postponed, the proxy holders can vote your shares on the new meeting date as well, unless you have properly revoked your proxy instructions. |

4

| Can I present other business |

Any stockholder may present a matter from the floor of the meeting for consideration at a meeting of stockholders so long as certain procedures are followed. Under our bylaws, as amended, a stockholder notice must ordinarily be received by KLA-Tencor (Attention: General Counsel) at least 120 days prior to the anniversary of the mailing date of the prior year’s proxy statement. The deadline for submitting a stockholder notice with respect to a matter to be brought from the floor of the Annual Meeting, as provided in the proxy statement that we filed with the Securities and Exchange Commission (the “SEC”) on October 11, 2007, was June 13, 2008. For the annual meeting for the fiscal year ending June 30, 2009, a stockholder notice must be received by KLA-Tencor (Attention: General Counsel) no later than June 11, 2009. |

| What is required in a |

The stockholder’s notice must set forth, as to each proposed matter, the following: |

| 1. | A brief description of the proposed matter and reasons for conducting such business at the meeting; |

| 2. | Name and address of the stockholder, as they appear on KLA-Tencor’s books; |

| 3. | The class and number of shares of KLA-Tencor that are beneficially owned by the stockholder; |

| 4. | Any material interest of the stockholder in such business; and |

| 5. | Any other information that is required to be provided by such stockholder pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended. |

| Can I still present other |

If the stockholder notice is not in compliance with the requirements set forth in our bylaws, the presiding officer of the meeting may refuse to acknowledge the matter. |

| What is the deadline for |

Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the SEC and the provisions of our bylaws. We must receive stockholder proposals that are intended to be presented by such stockholders at our next Annual Meeting of Stockholders (related to our fiscal year ending June 30, 2009) no later than June 11, 2009 to be considered for inclusion in the Proxy Statement and form of Proxy relating to that meeting. |

Stockholder proposals that are not intended to be included in our proxy materials for such meeting, but that are to be presented by the stockholder from the floor of the meeting are subject to the advance notice provisions set forth above under “Can I present other business to be transacted from the floor at the Annual Meeting?” and other requirements set forth in the proxy rules established by the SEC and the provisions of our bylaws.

| How may I obtain a copy of |

For a free copy of KLA-Tencor’s bylaws, please contact our Investor Relations department at (408) 875-3600 or visit our website at http://ir.kla-tencor.com and fill out a request form. A copy of our bylaws is also available free of charge on the Internet from the SEC’s website at http://www.sec.gov. |

5

| What should I do if I receive |

You may request delivery of a single copy of our future proxy statements and annual reports by writing to the address below or calling our Investor Relations department at the telephone number below. Stockholders may also request electronic delivery of future proxy statements by writing to the address below, calling our Investor Relations department at (408) 875-3600 or via our website at http://ir.kla-tencor.com. |

| May I get additional copies of |

Certain stockholders who share an address are being delivered only one copy of this Proxy Statement. You may receive additional copies of this Proxy Statement without charge by sending a written request to KLA-Tencor Corporation, Attention: Investor Relations, One Technology Drive, Milpitas, California 95035. Requests may also be made by calling our Investor Relations department at (408) 875-3600. |

6

PROPOSAL ONE:

ELECTION OF DIRECTORS

The Company has a classified Board of Directors with three classes. At each annual meeting, a class of Directors is elected for a full term of three years to succeed those Directors whose terms expire at the annual meeting. At this Annual Meeting, the terms of the Class I Directors are expiring. If there is a nominee for a class other than the class which is up for election, such nominee, upon election, is added to the designated class and serves out the remainder of the term for that class.

The three incumbent Class I Directors that are up for re-election at the Annual Meeting are Robert M. Calderoni, John T. Dickson and Kevin J. Kennedy. Director Lida Urbanek also serves as a Class I Director as of the date of this Proxy Statement and will continue to serve in such capacity until the date of the Annual Meeting. However, on September 13, 2008, Ms. Urbanek notified the Company of her decision not to stand for re-election at the Annual Meeting.

The four incumbent Class II Directors are Robert P. Akins, Robert T. Bond, Kiran M. Patel and David C. Wang. The Class II Directors will serve until the annual meeting of stockholders to be held in 2009 or until their respective successors are duly elected and qualified.

The three incumbent Class III Directors are Edward W. Barnholt, Stephen P. Kaufman and Richard P. Wallace. The Class III Directors will serve until the annual meeting of stockholders to be held in 2010 or until their respective successors are duly elected and qualified.

| Nominees |

The term of the three current Class I Directors that are up for re-election at the Annual Meeting will expire on the date of the Annual Meeting. The three Class I Directors are nominated for election at the Annual Meeting. The Nominating and Governance Committee, consisting solely of independent Directors as determined under the rules of The NASDAQ Stock Market, recommended the Class I Director nominees, each of whom is an incumbent Director, as set forth in this Proposal One. Based on that recommendation, the members of the Board of Directors unanimously resolved to nominate such individuals for election. |

The three nominees for election as Class I Directors by the stockholders are:

| • | Robert M. Calderoni; |

| • | John T. Dickson; and |

| • | Kevin J. Kennedy. |

If elected, the nominees for Class I Directors will serve as Directors until the Company’s annual meeting of stockholders in 2011, each until his successor is duly elected and qualified. If any nominee declines to serve or becomes unavailable for any reason, or a vacancy occurs before the election, the proxies may be voted for such substitute nominees as the Board of Directors may designate. As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee who is unable or who will decline to serve as a Director.

7

| Vote Required and |

If a quorum is present and voting, the three nominees for Class I Directors receiving the highest number of affirmative votes will be elected as Class I Directors. Votes withheld from any Director and broker non-votes are counted for purposes of determining the presence or absence of a quorum but have no other legal effect on the selection of nominees for Directors. Anyone who is elected as a Director in any uncontested election by a plurality and not a majority of votes cast will promptly tender his or her resignation to the Board of Directors, subject to acceptance, after certification of the election results. The Nominating and Governance Committee will make a recommendation to the Board of Directors whether to accept or reject the resignation or take some other appropriate action, taking into account any stated reasons why stockholders withheld votes and any other factors which the Nominating and Governance Committee determines in its sole discretion are relevant to such decision. The Board of Directors will in its sole discretion act on the recommendation of the Nominating and Governance Committee within 90 days after the date of certification of the election results. The Director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board of Directors regarding his or her resignation. |

THE MEMBERS OF THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND A VOTE “FOR” EACH OF THE CLASS I DIRECTOR NOMINEES, WITH THE DIRECTORS WHO ARE NOMINEES ABSTAINING.

8

INFORMATION ABOUT THE DIRECTORS AND THE NOMINEES

The following table sets forth certain information with respect to the Company’s Board of Directors as of the date of this Proxy Statement:

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Nominees for Election as Class I Directors |

||||

| Robert M. Calderoni | Robert M. Calderoni has been a Director of KLA-Tencor since March 2007. He has served as Chairman of the Board of Directors of Ariba, Inc. since July 2003 and as Chief Executive Officer and a Director of Ariba since 2001. From 2001 to 2004, Mr. Calderoni also served as Ariba’s President and, before that, as Ariba’s Executive Vice President and Chief Financial Officer. From 1997 to 2001, he served as Chief Financial Officer at Avery Dennison Corporation. He is also a member of the Board of Directors of Juniper Networks, Inc. | 48 | ||

| John T. Dickson | John T. Dickson has been a Director of KLA-Tencor since May 2007. Mr. Dickson is the former President and Chief Executive Officer of Agere Systems, Inc., a position he held from August 2000 until October 2005. Prior to that, he held positions as the Executive Vice President and Chief Executive Officer of Lucent’s Microelectronics and Communications Technologies Group; Vice President of AT&T Corporation’s integrated circuit business unit; Chairman and Chief Executive Officer of Shographics, Inc.; and President and Chief Executive Officer of Headland Technology Inc. Mr. Dickson is also a member of the Boards of Directors of National Semiconductor Corporation, Mettler-Toledo International Inc. and Frontier Silicon, Ltd. | 62 | ||

| Kevin J. Kennedy | Kevin J. Kennedy has been a Director of KLA-Tencor since May 2007. Mr. Kennedy has been the Chief Executive Officer of JDS Uniphase Corporation since September 2003 and has served as a member of the Board of Directors of JDS Uniphase since November 2001. From August 2001 to September 2003, Mr. Kennedy was the Chief Operating Officer of Openwave Systems, Inc. Prior to joining Openwave, Mr. Kennedy served seven years at Cisco Systems, Inc., most recently as Senior Vice President of the Service Provider Line of Business and Software Technologies Division, and 17 years at Bell Laboratories. Mr. Kennedy also serves on the Board of Directors of Polycom, Inc. | 52 | ||

| Class I Director Not Standing for Re-Election |

||||

| Lida Urbanek | Lida Urbanek has been a Director of KLA-Tencor since April 1997. Ms. Urbanek is a private investor. She was a Director of Tencor Instruments from August 1991 until April 1997 (when it was merged into KLA-Tencor). On September 13, 2008, Ms. Urbanek notified the Company of her decision not to stand for re-election at the Annual Meeting. | 65 | ||

9

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Class II Directors | ||||

| Robert P. Akins | Robert P. Akins has been a Director of KLA-Tencor since May 2008. Mr. Akins is a co-founder of Cymer, Inc. and has served as Cymer’s Chairman and CEO since its inception in 1986. Cymer is a leading supplier of excimer light sources for deep ultraviolet photolithography systems used in the semiconductor manufacturing process. Mr. Akins also served as Cymer’s President from its inception until May 2000. He currently serves on the boards of directors of SEMI (Semiconductor Equipment and Materials International) and SEMI North America. | 57 | ||

| Robert T. Bond | Robert T. Bond has been a Director of KLA-Tencor since August 2000. From April 1996 to January 1998, Mr. Bond served as Chief Operating Officer of Rational Software Corporation. Prior to that, he held various executive positions at Rational Software Corporation. Mr. Bond was employed by Hewlett-Packard Company from 1967 to 1983 and held various management positions during his tenure there. Mr. Bond also serves on the Board of Directors of MontaVista Software. | 65 | ||

| Kiran M. Patel | Kiran M. Patel has been a Director of KLA-Tencor since May 2008. Mr. Patel serves as Senior Vice President and General Manager, Consumer Tax Group of Intuit Inc., a provider of personal finance and small business software. Mr. Patel previously served as Intuit’s Senior Vice President and Chief Financial Officer. Before Intuit, he was Executive Vice President and CFO of Solectron Corporation from August 2001 to September 2005. He previously worked for Cummins Inc. for 27 years in a variety of finance and business positions, most recently as CFO and Executive Vice President. | 60 | ||

| David C. Wang | David C. Wang has been a Director of KLA-Tencor since May 2006. Mr. Wang has served as President, Boeing-China, of The Boeing Company (“Boeing”) since 2002. Prior to joining Boeing, he spent 22 years at General Electric Company (“GE”), where he worked in various capacities, including most recently as Chairman and Chief Executive Officer of GE China. In addition, Mr. Wang served in executive positions with GE in Singapore, Malaysia and Mexico. Prior to joining GE, Mr. Wang held various engineering positions at Emerson Electric Co. He currently resides in Beijing and also serves on the Board of Directors of Terex Corporation, as well as a number of non-profit boards, including the Beijing International MBA Program Advisory Board at Beijing University and Junior Achievement China. | 64 | ||

10

| Principal Occupation of Board Members During the Past Five Years |

Age | |||

| Class III Directors | ||||

| Edward W. Barnholt | Edward W. Barnholt has been a Director of KLA-Tencor since 1995, and was named Chairman of the Board of Directors of KLA-Tencor in October 2006. From March 1999 to March 2005, Mr. Barnholt was President and Chief Executive Officer of Agilent Technologies, Inc. (“Agilent”) and from November 2002 to March 2005, he was Chairman of the Board of Directors of Agilent. On March 1, 2005, Mr. Barnholt retired as the Chairman, President and Chief Executive Officer of Agilent. Before being named Agilent’s Chief Executive Officer, Mr. Barnholt served as Executive Vice President and General Manager of Hewlett-Packard Company’s Measurement Organization from 1998 to 1999. From 1990 to 1998, he served as General Manager of Hewlett-Packard Company’s Test and Measurement Organization. He was elected Senior Vice President of Hewlett-Packard Company in 1993 and Executive Vice President in 1996. Mr. Barnholt also serves on the Boards of Directors of Adobe Systems Incorporated and eBay Inc. He also serves on the Board of Trustees of the Packard Foundation and the Boards of Directors of The Tech Museum of Innovation and Silicon Valley Leadership Group. | 65 | ||

| Stephen P. Kaufman | Stephen P. Kaufman has been a Director of KLA-Tencor since November 2002. Mr. Kaufman has been a Senior Lecturer at the Harvard Business School since January 2001. He was a member of the Board of Directors of Arrow Electronics, Inc. (“Arrow”) from 1984 to May 2003. From 1986 to June 2000, he was Chief Executive Officer of Arrow. From 1985 to June 1999, he was also Arrow’s President. From 1994 to June 2002, he was Chairman of the Board of Directors of Arrow. Mr. Kaufman also serves on the Boards of Directors of Harris Corporation and Thermo Fisher Scientific Inc. | 66 | ||

| Richard P. Wallace | Richard P. Wallace has been a Director and the Chief Executive Officer of KLA-Tencor since January 2006. Mr. Wallace was President and Chief Operating Officer from July 2005 through December 2005. He was Executive Vice President of the Customer Group from May 2004 to July 2005. Mr. Wallace was Executive Vice President of the Wafer Inspection Group from July 2000 to May 2004. From July 1999 to June 2000, he was the Group Vice President for Lithography and Films. From April 1998 to June 1999, he was Vice President and General Manager of the Mirage Group. From 1995 to March 1998, Mr. Wallace was Vice President and General Manager of the Wisard division. He currently serves as a member of the Board of Directors of Semiconductor Equipment and Materials International (SEMI), an industry trade association. Mr. Wallace joined KLA-Tencor in 1988 as an applications engineer. Earlier in his career, he held positions with Ultratech Stepper and Cypress Semiconductor. He earned his bachelor’s degree in electrical engineering from the University of Michigan and his master’s degree in engineering management from Santa Clara University, where he also taught strategic marketing and global competitiveness courses upon his graduation. | 48 | ||

11

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF

PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

THE FISCAL YEAR ENDING JUNE 30, 2009

| Audit Committee |

The Audit Committee has the sole authority to retain or dismiss our independent auditors. The Audit Committee has selected PricewaterhouseCoopers LLP, an independent registered public accounting firm, to audit the consolidated financial statements of the Company for its fiscal year ending June 30, 2009. Before making its determination, the Audit Committee carefully considered that firm’s qualifications as independent auditors. |

The Board of Directors, following the Audit Committee’s determination, unanimously recommends that the stockholders vote for ratification of such appointment.

Although ratification by stockholders is not required by law, the Board of Directors has determined that it is desirable to request approval of this selection by the stockholders. If the stockholders do not ratify the appointment of PricewaterhouseCoopers LLP, the Audit Committee may reconsider its selection.

| Attendance at the Annual |

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions. |

| Fees |

The aggregate fees billed by PricewaterhouseCoopers LLP, KLA-Tencor’s independent registered public accounting firm, in fiscal years 2008 and 2007 were as follows: |

| Services Rendered/Fees |

2008 | 2007 | ||||

| Audit Fees (1) |

$ | 3,450,318 | $ | 6,964,000 | ||

| Audit-Related Fees (2) |

$ | 175,500 | $ | 94,000 | ||

| Total Audit and Audit-Related Fees |

$ | 3,625,818 | $ | 7,058,000 | ||

| Tax Compliance |

$ | 686,378 | $ | 427,000 | ||

| Tax Planning and Consulting |

$ | 137,615 | $ | 97,000 | ||

| Total Tax Fees (3) |

$ | 823,993 | $ | 524,000 | ||

| All Other Fees (4) |

$ | 4,260 | $ | 2,000 | ||

| (1) | For professional services rendered for the audits of annual financial statements set forth in KLA-Tencor’s Annual Reports on Form 10-K for fiscal years 2008 and 2007, the review of quarterly financial statements included in KLA-Tencor’s Quarterly Reports on Form 10-Q for fiscal years 2008 and 2007, and fees for services related to statutory and regulatory filings or engagements. Fees for fiscal year 2007 include fees of $3.3 million for services rendered in connection with the restatement of previously filed financial statements to correct past accounting for stock options. |

12

| (2) | For fiscal years 2008 and 2007, assurance and related services related to accounting consultations and for services rendered in connection with acquisition due diligence. |

| (3) | For fiscal years 2008 and 2007, tax services for U.S. and foreign tax compliance, planning and consulting. |

| (4) | For fiscal years 2008 and 2007, fees for services other than those described above. |

| Pre-approval Policies and |

The Audit Committee has adopted a policy regarding non-audit services provided by PricewaterhouseCoopers LLP, our independent registered public accounting firm. First, the policy ensures the independence of our auditors by expressly naming all services that the auditors may not perform and reinforcing the principle of independence regardless of the type of service. Second, certain non-audit services such as tax-related services and acquisition advisory services are permitted but limited in proportion to the audit fees paid. Third, the Chair of the Audit Committee pre-approves non-audit services not specifically permitted under this policy and the Audit Committee reviews the annual plan and any subsequent engagements. Thus, all of the services described above under audit-related fees, tax fees and all other fees were approved by the Audit Committee pursuant to its pre-approval policies and procedures. |

On a quarterly basis, management provides written updates to the Audit Committee with regard to audit and non-audit services, the amount of audit and non-audit service fees incurred to date, and the estimated cost to complete such services.

| Independence Assessment by |

The Company’s Audit Committee considered and determined that the provision of the services provided by PricewaterhouseCoopers LLP as set forth herein is compatible with maintaining PricewaterhouseCoopers LLP’s independence and approved all non-audit related fees and services. |

| Vote Required and |

If a quorum is present and voting, the affirmative vote of the majority of Votes Cast is needed to ratify the appointment of PricewaterhouseCoopers LLP as KLA-Tencor’s independent registered public accounting firm, to audit the consolidated financial statements of the Company for its fiscal year ending June 30, 2009. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2009.

13

OUR CORPORATE GOVERNANCE PRACTICES

At KLA-Tencor, we believe that strong and effective corporate governance procedures and practices are an extremely important part of our corporate culture. In that spirit, we have summarized several of our corporate governance practices below.

| Adopting Governance |

The Board of Directors has adopted a set of corporate governance guidelines to establish a framework within which it will conduct its business and to guide management in its running of your Company. The governance guidelines can be found on our website at http://ir.kla-tencor.com and are summarized below. |

| Monitoring Board |

It is important that our Board of Directors and its Committees are performing effectively and in the best interests of the Company and its stockholders. The Board of Directors and each Committee are responsible for annually assessing their effectiveness in fulfilling their obligations. In addition, our Nominating and Governance Committee is charged with overseeing an annual review of the Board of Directors and its membership. |

| Conducting Formal |

At the conclusion of each regularly scheduled Board meeting, the independent Directors meet in executive session without KLA-Tencor management or any non-independent Directors. |

| Hiring Outside Advisors |

The Board and each of its Committees may retain outside advisors and consultants of their choosing at the Company’s expense, without management’s consent. |

| Avoiding Conflicts of Interest |

KLA-Tencor expects its Directors, executives and employees to conduct themselves with the highest degree of integrity, ethics and honesty. KLA-Tencor’s credibility and reputation depend upon the good judgment, ethical standards and personal integrity of each Director, executive and employee. In order to provide assurances to KLA-Tencor and its stockholders, KLA-Tencor has implemented standards of business conduct which provide clear conflict of interest guidelines to its employees, as well as an explanation of reporting and investigatory procedures. |

| Providing Transparency |

KLA-Tencor believes it is important that stockholders understand our governance practices. In order to help ensure transparency of our practices, we have posted information regarding our corporate governance procedures on our website at http://ir.kla-tencor.com. |

| Communications with the |

Although KLA-Tencor does not have a formal policy regarding communications with the Board of Directors, stockholders may communicate with the Board of Directors by writing to the Company at KLA-Tencor Corporation, Attention: Investor Relations, One Technology Drive, Milpitas, California 95035. Stockholders who would like their submission directed to a member of the Board may so specify, and the communication will be forwarded, as appropriate. |

14

| Standards of Business |

The Board of Directors has adopted Standards of Business Conduct for all of the Company’s employees and Directors, including the Company’s principal executive and senior financial officers. In addition, the Company has established a confidential hotline for use by employees to report actual or suspected wrongdoing and to answer questions about business conduct. You can obtain a copy of our Standards of Business Conduct via our website at http://ir.kla-tencor.com, or by making a written request to the Company at KLA-Tencor Corporation, Attention: Investor Relations, One Technology Drive, Milpitas, California 95035. We will disclose any amendments to the Standards of Business Conduct, or waiver of a provision therefrom, on our website at the same address. |

| Ensuring Auditor |

KLA-Tencor has taken a number of steps to ensure the continued independence of our outside auditors. Our independent auditors report directly to the Audit Committee, which also has the ability to pre-approve or reject any non-audit services proposed to be conducted by our outside auditors. |

| Compensation Committee |

The Compensation Committee currently consists of Mr. Kennedy (Chair), Mr. Akins (appointed August 6, 2008), Mr. Barnholt, Mr. Bond, Mr. Dickson and Ms. Urbanek. None of these individuals was an officer or employee of the Company at any time during fiscal year 2008 or at any other time. During fiscal year 2008, there was no instance where an executive officer of the Company served as a member of the Board of Directors or compensation committee of any entity and an executive officer of that entity served on the Company’s Board of Directors or Compensation Committee. |

| Stockholder Nominations to |

Please see “ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES—NOMINATING AND GOVERNANCE COMMITTEE.” |

| Majority Voting Policy |

Please see “PROPOSAL ONE: ELECTION OF DIRECTORS—Vote Required and Recommendation.” |

15

ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES

| The Board of Directors |

The Board of Directors of the Company held a total of 11 meetings during the fiscal year ended June 30, 2008. |

All Directors other than Mr. Wallace meet the definition of independence within the meaning of The NASDAQ Stock Market director independence standards.

The Board of Directors has three standing committees: the Audit Committee; the Compensation Committee; and the Nominating and Governance Committee. The Board of Directors has determined that each of the members of each of the Committees has no material relationship with the Company (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a Director) and is independent within the meaning of The NASDAQ Stock Market director independence standards, including in the case of the Audit Committee, the heightened “independence” standard required for such Committee members.

Each Committee meets regularly and has a written charter approved by the Board of Directors, all of which are available via our website at

http://ir.kla-tencor.com. The Board of Directors and each Committee regularly reviews the Committee charters. In addition, at each regularly scheduled Board of Directors’ meeting, a member of each Committee reports on any significant matters addressed by the Committee.

During the fiscal year ended June 30, 2008, each of the incumbent Directors, other than Mr. Dickson (who joined the Board of Directors in late fiscal year 2007, when the fiscal year 2008 Board and Committee meetings had already been scheduled, and informed the Company prior to his appointment that he would be unable to attend several of such meetings due to pre-existing commitments) and Mr. Wang, attended at least 75% of the aggregate of (a) the total number of meetings of the Board of Directors held during the period for which such person served as a Director and (b) the total number of meetings held by all Committees of the Board on which such Director served (during the periods that each such Director served).

Although we do not have a formal policy mandating attendance by members of the Board of Directors at our annual meetings of stockholders, we do have a formal policy encouraging their attendance at annual meetings of KLA-Tencor stockholders. Six of our then-current ten members of the Board of Directors attended our annual stockholder meeting held on November 15, 2007.

For more information regarding the responsibilities of our Board Committees, please refer to the various charters which can be found on our corporate governance website located at http://ir.kla-tencor.com.

16

| Audit Committee |

At the beginning of fiscal year 2008, the Audit Committee consisted of Messrs. Bingham, Bond, Calderoni and Kaufman, with Mr. Wang having observer status and Mr. Bingham serving as the Chairman of the Committee. On August 8, 2007, Mr. Wang was appointed as a member of the Audit Committee, replacing Mr. Bond. On November 15, 2007, Mr. Calderoni was appointed as the Chairman of the Audit Committee. On May 7, 2008, Mr. Patel was appointed as a member of the Audit Committee, replacing Mr. Bingham. From May 7, 2008 through the date of this Proxy Statement, the Audit Committee has consisted of Messrs. Calderoni, Kaufman, Patel and Wang, with Mr. Calderoni serving as the Chairman of the Committee. The Board of Directors has determined that, of the current members of the Audit Committee, both Mr. Calderoni and Mr. Patel are “audit committee financial experts” within the meaning of the rules and regulations promulgated by the SEC. |

The Audit Committee is responsible for appointing and overseeing the work of the Company’s independent auditors, approving the services performed by the Company’s independent auditors, and reviewing and evaluating the Company’s accounting principles and system of internal accounting controls. The Audit Committee held seven meetings during the fiscal year ended June 30, 2008 at which a quorum was present.

The Board of Directors has determined that each of the members of the Audit Committee: (1) meets the definition of independence within the meaning of NASDAQ’s director independence standards, (2) meets the definition of audit committee member independence within the meaning of Rule 10A-3 under the Securities Exchange Act of 1934 and (3) has no material relationship with the Company (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a Director).

| Compensation Committee |

At the beginning of fiscal year 2008, the Compensation Committee consisted of Mr. Barnholt, Mr. Bond and Ms. Urbanek, with Messrs. Dickson and Kennedy having observer status and Mr. Bond serving as the Chairman of the Committee. On August 8, 2007, Messrs. Dickson and Kennedy were appointed as members of the Compensation Committee. On November 15, 2007, Mr. Kennedy was appointed as the Chairman of the Compensation Committee. On August 6, 2008, following the conclusion of fiscal year 2008, Mr. Akins was appointed as a member of the Compensation Committee. From August 6, 2008 through the date of this Proxy Statement, the Compensation Committee has consisted of Mr. Akins, Mr. Barnholt, Mr. Bond, Mr. Dickson, Mr. Kennedy and Ms. Urbanek, with Mr. Kennedy serving as the Chairman of the Committee. |

17

The Compensation Committee reviews and either approves or recommends to the full Board of Directors (depending upon the category of the compensation and the executive involved) the Company’s executive compensation policy and administers the Company’s employee equity award plans. The Compensation Committee also reviews (and, in certain cases, approves) the cash and equity compensation for our executive officers, as well as for members of the Board of Directors. See “Compensation Discussion and Analysis—Compensation Approval Procedures” for more information concerning the procedures and processes the Compensation Committee follows in setting such compensation and implementing the various cash and equity compensation programs in effect for such individuals, including the retention of an independent compensation consultant to provide relevant market data and advice. The Compensation Committee held seven meetings during the fiscal year ended June 30, 2008.

| Nominating and Governance Committee |

At the beginning of fiscal year 2008, the Nominating and Governance Committee consisted of Messrs. Barnholt, Bingham and Kaufman, with Mr. Barnholt serving as the Chairman of the Committee. On May 7, 2008, Mr. Dickson was appointed as a member of the Nominating and Governance Committee, replacing Mr. Bingham. From May 7, 2008 through the date of this Proxy Statement, the Nominating and Governance Committee has consisted of Messrs. Barnholt, Dickson and Kaufman, with Mr. Barnholt serving as the Chairman of the Committee. |

The Nominating and Governance Committee is primarily responsible for identifying and evaluating the qualifications of all candidates for election to the Board of Directors, as well as reviewing corporate governance policies and procedures. The Nominating and Governance Committee held five meetings during the fiscal year ended June 30, 2008.

It is the Nominating and Governance Committee’s policy to consider candidates for the Board of Directors recommended by, among other persons, the Company’s stockholders. Stockholders wishing to submit recommendations must notify the Company’s General Counsel in writing of their intent to do so and provide the Company with certain information set forth in Article II, Section 11 of our bylaws and all other information regarding nominees that is required to be provided pursuant to Regulation 14A of the Securities Exchange Act of 1934, or as otherwise requested by the Nominating and Governance Committee. In addition, stockholders may nominate candidates for the Board of Directors pursuant to the provisions of Article II, Section 11 of our bylaws and in conformance with the requirements of Regulation 14A of the Securities Exchange Act of 1934.

18

In considering candidates for Director nomination, including evaluating any recommendations from stockholders as set forth above, the Nominating and Governance Committee considers only candidates who have demonstrated executive experience, have experience in an applicable industry, or have significant high level experience in accounting, legal or a technical field applicable to the Company. In addition, in evaluating Director candidates, the Nominating and Governance Committee considers all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity of experience and the extent to which the candidate would fill a present need on the Board of Directors.

During fiscal year 2007, the Board of Directors approved a recommendation by the Nominating and Governance Committee to adopt a new governance policy. Under this policy, anyone who is elected as a Director in any uncontested election by a plurality and not a majority of votes cast will promptly tender his or her resignation to the Board of Directors, subject to acceptance, after certification of the election results. The Nominating and Governance Committee will make a recommendation to the Board of Directors whether to accept or reject the resignation or take some other appropriate action, taking into account any stated reasons why stockholders withheld votes and any other factors which the Nominating and Governance Committee determines in its sole discretion are relevant to such decision. The Board of Directors will in its sole discretion act on the recommendation of the Nominating and Governance Committee within 90 days after the date of certification of the election results. The Director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board of Directors regarding his or her resignation.

The Nominating and Governance Committee regularly assesses the appropriate size and composition of the Board of Directors, and whether any vacancies on the Board are expected. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers potential candidates that may come to its attention through current members of the Board of Directors, professional search firms, stockholders or other persons. In evaluating properly submitted stockholder recommendations, the Nominating and Governance Committee uses the evaluation standards discussed above and seeks to achieve a balance of knowledge, experience and capability on the Board of Directors.

19

DIRECTOR COMPENSATION

| Employee Directors |

Members of the Board of Directors who are employees do not receive any additional compensation for their services as Directors. |

| Outside Directors |

Non-employee members of the Board (“Outside Directors”) receive a combination of equity and cash compensation as recommended by the Compensation Committee and approved by the Board of Directors. Equity compensation to Outside Directors is provided under the Company’s 2004 Equity Incentive Plan and, to the extent consisting of stock options, may also be provided under the Company’s 1998 Outside Director Option Plan, both of which plans were approved by the Company’s stockholders. |

| Outside Director Restricted |

In accordance with the Company’s current practice, each Outside Director was awarded restricted stock units at the November 15, 2007 Annual Meeting of Stockholders covering shares of the Company’s Common Stock with an aggregate fair market value of $100,000 based on the market price of the Company’s Common Stock at the time of the award ($49.11 per share). Accordingly, each Outside Director at that time received a restricted stock unit award covering 2,036 shares of Common Stock. The restricted stock units awarded to the Outside Directors at the November 15, 2007 Annual Meeting of Stockholders were made with respect to their Board service for fiscal year 2008. The restricted stock units will vest upon completion of one year of Board service measured from the date of grant, and the underlying shares will be issued immediately at that time. This policy will also be in effect with respect to the Annual Meeting. |

If a new Outside Director joins the Board after the date of an annual stockholders meeting, his or her first restricted stock unit award will be granted promptly after he or she joins the Board and will be prorated to take into account the period of time from the last annual stockholders meeting to the date the new Outside Director joined the Board.

| Cash Compensation |

For fiscal year 2008, each Outside Director received an annual fee of $75,000 (effective beginning November 15, 2007), paid quarterly, and meeting fees of $2,500 for each Board meeting attended in person, $1,250 for each Board meeting attended by telephone conference call, $1,500 for each Committee meeting attended, and $750 for each Committee meeting attended by telephone conference call. Each Committee Chair also received an additional annual retainer. Effective beginning November 15, 2007, the additional annual retainer paid to the Chairman of the Audit Committee is $30,000, the additional annual retainer paid to the Chairman of the Compensation Committee is $20,000, and the additional annual retainer paid to the Chairman of the Nominating and Governance Committee is $10,000. Outside Directors also are reimbursed for their reasonable expenses incurred in attending Board and Committee meetings. |

The cash compensation component of the Outside Director compensation program will continue to remain in effect unchanged for fiscal year 2009.

20

| Outside Director Stock |

Effective November 15, 2007, Outside Directors no longer receive stock options as a component of their compensation. |

However, in fiscal year 2008, during the period from July 1, 2007 through November 15, 2007, the Company issued non-statutory stock options to the Outside Directors pursuant to the terms of the Company’s director compensation program that continued in effect until November 15, 2007. On each of July 31 and October 30, 2007, the Company granted a 1,250-share option grant to each Outside Director then in office as part of the Company’s former annual option grant program, under which the Company would make such quarterly grants approximately two business days following the Company’s earnings release for the prior fiscal quarter. The options granted to the Outside Directors during fiscal year 2008 have a maximum term of seven years, subject to earlier termination following the cessation of Board service, and have an exercise price per share equal to the fair market value of the Common Stock on the grant date. Each such option was fully vested and immediately exercisable upon grant. Stock option grants are no longer a component of the Company’s compensation program for Outside Directors.

| Non-Executive Chairman |

For fiscal year 2008, the Company’s policy was that, if the Chairman of the Board of Directors was not an executive of the Company (as was the case, with Mr. Barnholt serving as Chairman), the Chairman’s annual retainer fee would be two times the regular level for Outside Directors, and the Chairman’s equity awards (both for stock options (to the extent granted) and restricted stock units) would be 1.5 times the regular level for Outside Directors. This policy will continue to remain in effect for fiscal year 2009. |

| Deferred Compensation |

Each Outside Director is entitled to defer all or a portion of his or her director fees, pursuant to the Company’s Executive Deferred Savings Plan, a nonqualified deferred compensation plan. Amounts credited to the plan may be allocated by the participant among 23 “deemed” investment alternatives. Of the current Outside Directors, only Mr. Barnholt, Mr. Bond and Ms. Urbanek participated in the Company’s plan during fiscal year 2008 (with only Mr. Barnholt and Ms. Urbanek making new contributions during the fiscal year). |

| Stock Ownership Guidelines |

The Company has adopted a program, approved by the Board of Directors, pursuant to which each Outside Director will be required to own a specified minimum number of shares of Common Stock of the Company. In August 2007, the Board of Directors established the requirement that, effective as of June 30, 2009, each Outside Director must own at least a number of shares of Common Stock of the Company with a market value of at least three (3) times the annual cash retainer paid to the Directors, as that retainer may be changed from time to time. Shares of Common Stock underlying restricted stock units held by the Directors will count toward this ownership requirement. |

21

Director Compensation Table

The following table sets forth certain information regarding the compensation earned by or awarded to each Outside Director during fiscal year 2008 who served on our Board of Directors during fiscal year 2008.

| Name |

Fees Earned or Paid in Cash ($) (1) |

Stock Awards ($) (2) |

Option Awards ($) (3) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

Total ($) | |||||||

| Robert P. Akins |

22,500 | 7,398 | — | — | 29,898 | |||||||

| Edward W. Barnholt |

179,000 | 149,388 | 67,324 | — | (4) | 395,712 | ||||||

| H. Raymond Bingham |

89,750 | 87,285 | (5) | 44,883 | — | 221,918 | ||||||

| Robert T. Bond |

100,250 | 99,579 | 44,883 | — | (4) | 244,712 | ||||||

| Robert M. Calderoni |

128,250 | 99,579 | 44,883 | — | 272,712 | |||||||

| John T. Dickson |

84,000 | 83,725 | 44,883 | — | 212,608 | |||||||

| Stephen P. Kaufman |

213,070 | 99,579 | 44,883 | — | 357,532 | |||||||

| Kevin J. Kennedy |

111,750 | 83,725 | 44,883 | — | 240,358 | |||||||

| Kiran M. Patel |

22,500 | 7,398 | — | — | 29,898 | |||||||

| Lida Urbanek (6) |

94,750 | 99,579 | 44,883 | — | (4) | 239,212 | ||||||

| David C. Wang |

165,560 | 115,259 | 44,883 | — | 325,702 | |||||||

| (1) | The amounts set forth in this column represent fees earned by each Outside Director during fiscal year 2008, regardless of whether the fees were actually paid during the fiscal year. The aggregate payment amounts include the following categories of payments: |

| Name |

Annual Retainer ($) |

Board Meeting Fees ($) |

Committee Meeting Fees ($) |

Non-Executive Chairman of the Board— Additional Retainer ($) |

Committee Chairperson— Additional Retainer ($) |

Special Committee Compensation ($) |

Total ($) | |||||||

| Robert P. Akins |

18,750 | 3,750 | — | — | — | — | 22,500 | |||||||

| Edward W. Barnholt |

66,250 | 20,000 | 16,500 | 66,250 | 10,000 | — | 179,000 | |||||||

| H. Raymond Bingham |

66,250 | 13,750 | 9,750 | — | — | — | 89,750 | |||||||

| Robert T. Bond |

66,250 | 21,250 | 12,750 | — | — | — | 100,250 | |||||||

| Robert M. Calderoni |

66,250 | 20,000 | 12,000 | — | 30,000 | — | 128,250 | |||||||

| John T. Dickson |

66,250 | 12,500 | 5,250 | — | — | — | 84,000 | |||||||

| Stephen P. Kaufman |

66,250 | 17,500 | 12,000 | — | — | 117,320 | 213,070 | |||||||

| Kevin J. Kennedy |

66,250 | 15,000 | 10,500 | — | 20,000 | — | 111,750 | |||||||

| Kiran M. Patel |

18,750 | 3,750 | — | — | — | — | 22,500 | |||||||

| Lida Urbanek |

66,250 | 18,750 | 9,750 | — | — | — | 94,750 | |||||||

| David C. Wang |

66,250 | 15,000 | 6,750 | — | — | 77,560 | 165,560 | |||||||

| (2) | The amounts shown are the compensation costs recognized in our financial statements for the 2008 fiscal year related to RSUs awarded to each Outside Director in the 2008, 2007 and prior fiscal years, to the extent we recognized compensation cost in the 2008 fiscal year for such awards in accordance with the provisions of Statement of Financial Accounting Standards No. 123 (revised 2004), Share- |

22

| Based Payment, referred to in this Proxy Statement as FAS 123R (except that the compensation cost amounts set forth below have not been reduced by the Company’s estimated forfeiture rate). The FAS 123R grant date fair value of each RSU award was calculated based on the fair market value of our Common Stock on the award date. The following table shows (a) for each RSU award for which compensation cost was recognized in our financial statements for the 2008 fiscal year, the RSU award date, the portion of the overall amount of the compensation cost in fiscal year 2008 attributable to that RSU award, and the grant date fair value of that award (as calculated in accordance with FAS 123R) and (b) for each Outside Director, the aggregate number of unvested shares of our Common Stock underlying all outstanding RSUs held by that Outside Director as of June 30, 2008: |

| Name |

RSU Award Date |

Compensation Cost Recognized For Award During Fiscal Year 2008 ($) |

FAS 123R Grant Date Fair Value ($) |

Aggregate Number of Unvested Shares of Common Stock Underlying All of Director’s RSU Awards as of June 30, 2008 (#) | ||||

| Robert P. Akins |

5/7/08 | 7,398 | 50,008 | 1,142 | ||||

| Edward W. Barnholt |

11/15/07 | 93,431 | 149,982 | 3,054 | ||||

| 3/29/07 | 55,956 | 75,018 | ||||||

| H. Raymond Bingham |

11/15/07 | 49,994 | 99,988 | — | ||||

| 3/29/07 | 37,291 | 49,994 | ||||||

| Robert T. Bond |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 3/29/07 | 37,291 | 49,994 | ||||||

| Robert M. Calderoni |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 3/29/07 | 37,291 | 49,994 | ||||||

| John T. Dickson |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 5/9/07 | 21,438 | 24,988 | ||||||

| Stephen P. Kaufman |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 3/29/07 | 37,291 | 49,994 | ||||||

| Kevin J. Kennedy |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 5/9/07 | 21,438 | 24,988 | ||||||

| Kiran M. Patel |

5/7/08 | 7,398 | 50,008 | 1,142 | ||||

| Lida Urbanek |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 3/29/07 | 37,291 | 49,994 | ||||||

| David C. Wang |

11/15/07 | 62,288 | 99,988 | 2,036 | ||||

| 3/29/07 | 37,291 | 49,994 | ||||||

| 2/14/07 | 15,681 | 24,993 | ||||||

| (3) | The amounts shown are the compensation costs recognized for financial statement reporting purposes for the fiscal year ended June 30, 2008, in accordance with FAS 123R, of stock options granted to each Outside Director during the 2008 fiscal year. The compensation expense reflects the fact that each option granted to an Outside Director is fully vested immediately upon grant, with no forfeiture adjustments. Assumptions used in the calculation of the FAS 123R grant date fair value of each of the options granted to the Outside Directors during the 2008 fiscal year are included in Note 7 to the Company’s consolidated financial statements for the fiscal year ended June 30, 2008 included in the Company’s Annual Report on Form 10-K filed with the SEC on August 7, 2008. The following table shows (a) for each option grant for which compensation cost was recognized in our financial statements |

23

| for the 2008 fiscal year, the grant date, the exercise price, and the grant date fair value of that option (as calculated in accordance with FAS 123R) and (b) for each Outside Director, the aggregate number of shares subject to all outstanding options held by that Outside Director as of June 30, 2008: |

| Name |

Grant Date | Exercise Price ($) |

FAS 123R Grant Date Fair Value ($) |

Number

of Shares Subject to All Outstanding Options Held as of June 30, 2008 (#) | ||||

| Edward W. Barnholt |

10/30/07 | 52.84 | 32,794 | 79,582 | ||||

| 7/31/07 | 56.79 | 34,529 | ||||||

| H. Raymond Bingham |

10/30/07 | 52.84 | 21,863 | 2,500 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| Robert T. Bond |

10/30/07 | 52.84 | 21,863 | 61,250 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| Robert M. Calderoni |

10/30/07 | 52.84 | 21,863 | 3,750 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| John T. Dickson |

10/30/07 | 52.84 | 21,863 | 2,500 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| Stephen P. Kaufman |

10/30/07 | 52.84 | 21,863 | 41,250 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| Kevin J. Kennedy |

10/30/07 | 52.84 | 21,863 | 2,500 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| Lida Urbanek |

10/30/07 | 52.84 | 21,863 | 82,916 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| David C. Wang |

10/30/07 | 52.84 | 21,863 | 6,250 | ||||

| 7/31/07 | 56.79 | 23,020 | ||||||

| (4) | During fiscal year 2008, the investment returns on the deferred compensation accounts under the Company’s Executive Deferred Savings Plan for these Outside Directors were negative and are therefore not considered above market for purposes of the Director Compensation Table and not reported in the Director Compensation Table above. |

| (5) | Mr. Bingham resigned from the Company’s Board effective as of May 7, 2008. In connection with Mr. Bingham’s resignation, in accordance with the Company’s policy adopted in February 2008 by the Compensation Committee of the Board (as set forth in the Current Report on Form 8-K filed by the Company with the SEC on May 8, 2008), the Company accelerated vesting of certain of Mr. Bingham’s unvested stock awards and cancelled certain other awards. The amount in the table set forth above reflects the actual charges taken by the Company with respect to Mr. Bingham’s stock awards during fiscal year 2008, excluding any compensation cost that was forfeited in connection with Mr. Bingham’s cessation of service. |

| (6) | Ms. Urbanek has notified the Company of her decision not to stand for re-election to the Company’s Board of Directors at the Annual Meeting. |

24

INFORMATION ABOUT EXECUTIVE OFFICERS

Set forth below are the names, ages and positions of the executive officers of KLA-Tencor as of the date of this Proxy Statement.

| Name and Position |

Principal Occupation of the Executive Officers During the Past Five Years |

Age | ||

| Richard P. Wallace Chief Executive Officer |

Please see “INFORMATION ABOUT THE DIRECTORS AND THE NOMINEES—Class III Directors.” |

48 | ||

| Mark P. Dentinger Executive Vice

President & |

Mark P. Dentinger joined KLA-Tencor in September 2008 as the Company’s Executive Vice President and Chief Financial Officer. Prior to joining KLA-Tencor, from February 2005 to April 2008, Mr. Dentinger most recently served as Executive Vice President and Chief Financial Officer for BEA Systems, Inc., until the company was acquired by Oracle Corporation. Mr. Dentinger was with BEA Systems for a total of nine years, during which he managed all aspects of finance, investor relations, legal, facilities, and information technology, among various other financial roles within the company. Prior to BEA Systems, Mr. Dentinger served in various financial management positions at Compaq Computer Corporation (now Hewlett-Packard) for six years, culminating in his appointment as director of finance, high performance systems manufacturing in 1996. Mr. Dentinger received his bachelor of science degree in economics from St. Mary’s College of California and his M.B.A. in finance from the University of California at Berkeley. He is a Certified Public Accountant in the State of California. | 45 | ||

| Brian M. Martin Senior Vice President, General Counsel & Corporate Secretary |

Brian M. Martin joined KLA-Tencor in April 2007 as the Company’s Senior Vice President, General Counsel and Corporate Secretary. Prior to joining KLA-Tencor, Mr. Martin served in senior legal positions at Sun Microsystems, Inc. for ten years, most recently as Vice President, Corporate Law Group, responsible for legal requirements associated with Sun’s corporate securities, mergers, acquisitions and alliances, corporate governance and Sarbanes-Oxley compliance, and litigation management. Mr. Martin also supported Sun’s worldwide sales activities and for several years served as its chief antitrust counsel. Prior to his career at Sun, Mr. Martin was in private practice where he had extensive experience in antitrust and intellectual property litigation. Mr. Martin earned his bachelor’s degree in economics from the University of Rochester and his J.D. from the State University of New York at Buffalo Law School. | 46 | ||

25

| Name and Position |

Principal Occupation of the Executive Officers During the Past Five Years |

Age | ||

| Virendra A. Kirloskar Chief Accounting Officer |

Virendra A. Kirloskar has served as the Company’s Chief Accounting Officer since March 2008. Mr. Kirloskar rejoined the Company as Vice President and Corporate Controller in May 2003 and served in that role until March 2008, other than the period from August 2006 to August 2007 during which he held management responsibilities within KLA-Tencor India. Prior to that, from June 2002 to April 2003, Mr. Kirloskar served as corporate controller of Atmel Corporation, a designer and manufacturer of semiconductor integrated circuits. Mr. Kirloskar also held various finance positions within KLA-Tencor from 1993 to 1999. Mr. Kirloskar received his bachelor’s degree in commerce from the University of Pune, India and his master’s degree in business administration from the University of Massachusetts Amherst. | 45 | ||

| John H. Kispert President & Chief Operating Officer |

John H. Kispert has been President and Chief Operating Officer since January 2006 and also served as the Company’s Chief Financial Officer from March 2008 to September 2008. Prior to that, from July 2000 to January 2006, Mr. Kispert served as Chief Financial Officer and Executive Vice President of the Company. From July 1999 to July 2000, he was Vice President of Finance and Accounting, and he was Vice President of Operations for the Wafer Inspection Group from February 1998 to July 1999. Mr. Kispert joined KLA-Tencor in February 1995 and has held a series of other management positions within the Company. Mr. Kispert received his bachelor’s degree in political science from Grinnell College and his master’s degree in business administration from the University of California, Los Angeles. Please note that, effective January 1, 2009, Mr. Kispert will no longer be an employee of the Company. | 45 | ||

26

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

Principal Stockholders

As of September 2, 2008, based on our review of filings made with the SEC, we are aware of the following entities being beneficial owners of more than 5% of the Company’s Common Stock:

| Name and Address (1) |

Number of Shares Beneficially Owned (1) |

Percent of Shares Beneficially Owned (2) |

|||

| Capital Group International, Inc. |

23,846,070 | 13.9 | % | ||

| 11100 Santa Monica Blvd. |

|||||

| Los Angeles, CA 90025 |

|||||

| Capital Guardian Trust Company |

12,681,580 | 7.4 | % | ||

| 11100 Santa Monica Blvd. |

|||||

| Los Angeles, CA 90025 |

|||||

| Capital International Limited |

9,666,660 | 5.6 | % | ||

| 11100 Santa Monica Blvd. |

|||||

| Los Angeles, CA 90025 |

|||||

| Capital Research Global Investors |

17,314,000 | 10.1 | % | ||

| 333 South Hope Street |

|||||

| Los Angeles, CA 90071 |

|||||

| The Growth Fund of America, Inc. |

12,940,000 | 7.5 | % | ||

| 333 South Hope Street |

|||||

| Los Angeles, CA 90071 |

|||||

| Janus Capital Management LLC |

14,380,819 | 8.4 | % | ||

| 141 Detroit Street |

|||||

| Denver, CO 80206 |

|||||

| (1) | Based on information provided pursuant to Schedules 13D and 13G filed with the SEC. |

| (2) | Based on 171,729,661 outstanding shares of the Company’s Common Stock as of September 2, 2008. |

Management

The following table sets forth the beneficial ownership of the Company’s Common Stock as of September 2, 2008 by all current Directors, each of the named executive officers set forth in the Summary Compensation Table, and all current Directors and executive officers as a group. Except for shares held in brokerage accounts which may from time to time, together with other securities held in those accounts, serve as collateral for margin loans made from those accounts, none of the shares reported as beneficially owned are currently pledged as security for any outstanding loan or indebtedness. Shares that become issuable under outstanding restricted stock units upon satisfaction of the applicable vesting requirements are not included in the table but are indicated in footnotes 15 and 16 to such table:

| Name of Beneficial Owner |

Number of Shares Beneficially Owned |

Percent of Outstanding Class (1) | ||

| Richard P. Wallace (2)(15) |

400,757 | * | ||

| Robert P. Akins (16) |

— | * | ||

| Edward W. Barnholt (3)(16) |

80,582 | * | ||

| Robert T. Bond (4)(16) |

63,250 | * |

27

| Name of Beneficial Owner |

Number of Shares Beneficially Owned |

Percent of Outstanding Class (1) |

|||

| Robert M. Calderoni (5)(16) |

3,750 | * | |||

| John T. Dickson (6)(16) |

2,500 | * | |||

| Stephen P. Kaufman (7)(16) |

42,250 | * | |||

| Kevin J. Kennedy (8)(16) |

2,500 | * | |||

| Kiran M. Patel (16) |

— | * | |||

| Lida Urbanek (9)(16) |

1,390,831 | * | |||

| David C. Wang (10)(16) |

6,250 | * | |||

| John H. Kispert (11)(15) |

315,390 | * | |||

| Brian M. Martin (15) |

301 | * | |||

| Virendra A. Kirloskar (12)(15) |

25,665 | * | |||

| Bin-ming Benjamin Tsai (15) |

3,942 | * | |||

| Jeffrey L. Hall (13) |

3,109 | * | |||

| All current Directors and executive officers as a group (15 persons) (14) |

2,334,026 | 1.35 | % |

| * | Less than 1%. |

| (1) | Based on 171,729,661 outstanding shares of the Common Stock of the Company as of September 2, 2008. In addition, shares of our Common Stock subject to options that are presently exercisable or will become exercisable within 60 days after September 2, 2008 are deemed to be outstanding for the purpose of computing the percentage ownership of a person or entity in this table, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person or entity. |

| (2) | Includes 343,627 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008, and 51,806 shares subject to restricted stock units that will vest and become deliverable within 60 days after September 2, 2008. |

| (3) | Includes 79,582 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (4) | Includes 61,250 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (5) | Includes 3,750 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (6) | Includes 2,500 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (7) | Includes 41,250 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (8) | Includes 2,500 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (9) | Includes 77,916 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. Of the 1,390,831 shares reflected as beneficially owned by Ms. Urbanek in the table above, 1,271,414 shares are held in trust for the benefit of Ms. Urbanek’s family, and 29,555 shares are held by the Urbanek Family Foundation. |

| (10) | Includes 6,250 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008. |

| (11) | Includes 251,533 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008, 55,417 shares subject to restricted stock units that will vest and become deliverable within 60 days after September 2, 2008, and 6,667 shares which are held in trust for the benefit of Mr. Kispert’s family. |

28

| (12) | Includes 20,801 shares subject to options which are presently exercisable or will become exercisable within 60 days after September 2, 2008, and 4,000 shares subject to restricted stock units that will vest and become deliverable within 60 days after September 2, 2008. |