UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

KLA-Tencor Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 4, 2009

To the Stockholders:

YOUR VOTE IS IMPORTANT

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of KLA-Tencor Corporation (“we” or the “Company”), a Delaware corporation, will be held on Wednesday, November 4, 2009 at 1:00 P.M., local time, in Multipurpose Rooms East and West in Building Three of our Milpitas facility, located at Three Technology Drive, Milpitas, California 95035, for the following purposes:

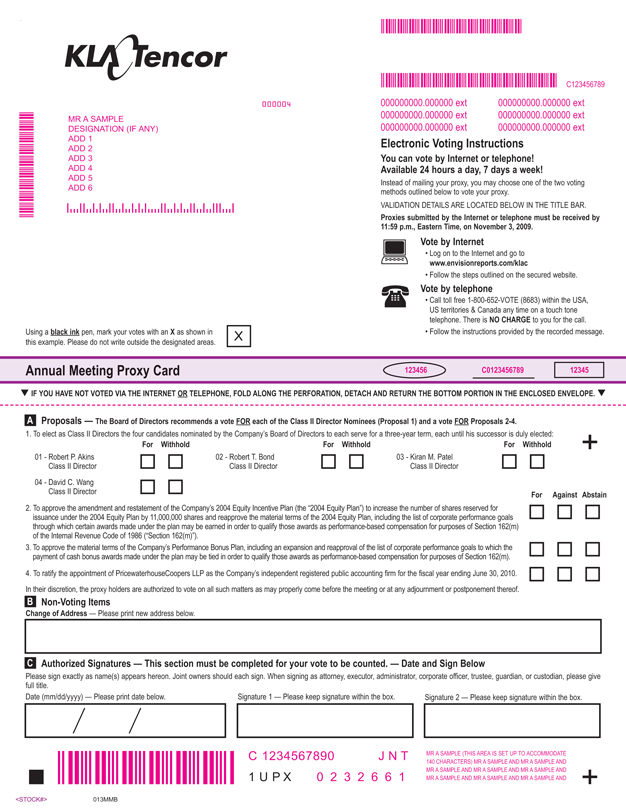

| 1. | To elect as Class II Directors the four candidates nominated by our Board of Directors to each serve for a three-year term, each until his successor is duly elected. |

| 2. | To approve the amendment and restatement of our 2004 Equity Incentive Plan (the “2004 Equity Plan”) to increase the number of shares reserved for issuance under the 2004 Equity Plan by 11,000,000 shares and reapprove the material terms of the 2004 Equity Plan, including the list of corporate performance goals through which certain awards made under the plan may be earned in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986 (“Section 162(m)”). |

| 3. | To approve the material terms of our Performance Bonus Plan, including an expansion and reapproval of the list of corporate performance goals to which the payment of cash bonus awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m). |

| 4. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2010. |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on September 15, 2009 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

| Sincerely, |

|

| Richard P. Wallace |

| President and Chief Executive Officer |

| Milpitas, California |

This Notice of Annual Meeting of Stockholders, Proxy Statement and form of proxy are being distributed and made available on or about September 24, 2009.

All stockholders are cordially invited to attend the Annual Meeting in person; however, regardless of whether you expect to attend the Annual Meeting in person, we encourage you to vote as soon as possible. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the Annual Meeting regardless of whether you attend in person.

2009 ANNUAL MEETING OF STOCKHOLDERS – PROXY STATEMENT

TABLE OF CONTENTS

| 1 | ||

| 2 | ||

| QUESTIONS AND ANSWERS REGARDING PROXY SOLICITATION AND VOTING |

3 | |

| 6 | ||

| 8 | ||

| 10 | ||

| PROPOSAL TWO: APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE 2004 EQUITY INCENTIVE PLAN |

13 | |

| 28 | ||

| 35 | ||

| 37 | ||

| 39 | ||

| 42 | ||

| 47 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

49 | |

| 52 | ||

| 52 | ||

| 75 | ||

| 76 | ||

| 76 | ||

| 79 | ||

| 81 | ||

| 85 | ||

| 86 | ||

| 88 | ||

| 92 | ||

| 93 | ||

| 94 | ||

i

ANNUAL MEETING OF STOCKHOLDERS

OF

KLA-TENCOR CORPORATION

To be held on November 4, 2009

PROXY STATEMENT

QUESTIONS AND ANSWERS REGARDING PROXY MATERIALS

| 1. Why am I receiving these materials? |

The Board of Directors of KLA-Tencor Corporation (“KLA-Tencor,” the “Company” or “we”) is providing these proxy materials to you in connection with KLA-Tencor’s Annual Meeting of Stockholders to be held on Wednesday, November 4, 2009 at 1:00 P.M., local time. As a stockholder of record, you are invited to attend the Annual Meeting, which will be held in Multipurpose Rooms East and West in Building Three of our Milpitas facility, located at Three Technology Drive, Milpitas, California 95035. The purposes of the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement. |

These proxy solicitation materials, together with our Annual Report for fiscal year 2009, were first made available on or about September 24, 2009 to all stockholders entitled to vote at the Annual Meeting. KLA-Tencor’s principal executive offices are located at One Technology Drive, Milpitas, California 95035, and our telephone number is (408) 875-3000.

| 2. How may I obtain KLA-Tencor’s Annual Report? |

A copy of our Annual Report on Form 10-K for fiscal year 2009 is available free of charge on the Internet from the Securities and Exchange Commission’s website at http://www.sec.gov, as well as on our website at http://ir.kla-tencor.com. |

| 3. Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials? |

This year, relying on the Securities and Exchange Commission rule that allows companies to furnish their proxy materials over the Internet, we are mailing to our stockholders a notice about the Internet availability of the proxy materials instead of a paper copy of the proxy materials. All stockholders will have the ability to access the proxy materials over the Internet and request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the notice. In addition, the notice contains instructions on how you may request to access proxy materials in printed form by mail or electronically on an ongoing basis. |

| 4. How can I access the proxy materials over the Internet? |

Your notice about the Internet availability of the proxy materials, proxy card or voting instruction card will contain instructions on how to: |

| • | View our proxy materials for the Annual Meeting on the Internet; and |

| • | Instruct us to send our future proxy materials to you electronically by e-mail. |

1

Our proxy materials are also available on our website at the following address: http://www.kla-tencor.com/annualmeeting.

Your notice of Internet availability of proxy materials, proxy card or voting instruction card will contain instructions on how you may request to access proxy materials electronically on an ongoing basis. Choosing to access your future proxy materials electronically will help us conserve natural resources and reduce the costs of printing and distributing our proxy materials. If you choose to access future proxy materials electronically, you will receive an e-mail with instructions containing a link to the website where those materials are available and a link to the proxy voting website. Your election to access proxy materials by e-mail will remain in effect until you terminate it.

| 5. How may I obtain a paper copy of the proxy materials? |

Stockholders receiving a notice about the Internet availability of the proxy materials will find instructions about how to obtain a paper copy of the proxy materials on their notice. Stockholders receiving notice of the availability of the proxy materials by e-mail will find instructions about how to obtain a paper copy of the proxy materials as part of that e-mail. Stockholders who have previously submitted a standing request to receive paper copies of our proxy materials will receive a paper copy of the proxy materials by mail. |

| 6. What should I do if I receive more than one set of voting materials? |

You may request delivery of a single copy of our future proxy statements and annual reports by writing to the address provided in the answer to Question 7 below or calling our Investor Relations department at the telephone number below. Stockholders may also request electronic delivery of future proxy statements by writing to the address below, calling our Investor Relations department at (408) 875-3600 or via our website at http://ir.kla-tencor.com. |

| 7. I received one copy of these materials. May I get additional copies? |

Certain stockholders who share an address are being delivered only one copy of this Proxy Statement. You may receive additional copies of this Proxy Statement without charge by sending a written request to KLA-Tencor Corporation, Attention: Investor Relations, One Technology Drive, Milpitas, California 95035. Requests may also be made by calling our Investor Relations department at (408) 875-3600. |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| 8. Who may vote at the Annual Meeting? |

You may vote at the Annual Meeting if our records showed that you owned shares of KLA-Tencor Common Stock as of September 15, 2009 (the “Record Date”). At the close of business on that date, we had a total of 170,717,818 shares of Common Stock issued and outstanding, which were held of record by approximately 667 stockholders. As of the Record Date, we had no shares of Preferred Stock outstanding. You are entitled to one vote for each share that you own. |

The Annual Meeting will be held if a majority of the outstanding Common Stock entitled to vote is represented at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting.

2

| 9. What proposals are being |

In addition to such other business as may properly come before the Annual Meeting or any adjournment thereof, the following four proposals will be presented at the Annual Meeting: |

| A. | Election of four candidates nominated by our Board of Directors to each serve for a three-year term; |

| B. | Approval of the amendment and restatement of our 2004 Equity Incentive Plan (the “2004 Equity Plan”) to increase the number of shares reserved for issuance under the 2004 Equity Plan by 11,000,000 shares and reapprove the material terms of the plan, including the list of corporate performance goals through which certain awards made under the plan may be earned in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986 (“Section 162(m)”); |

| C. | Approval of the material terms of our Performance Bonus Plan, including an expansion and reapproval of the list of corporate performance goals to which the payment of cash bonus awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m); and |

| D. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2010. |

QUESTIONS AND ANSWERS REGARDING PROXY SOLICITATION AND VOTING

| 10. How can I vote if I own shares directly? |

If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you. You may vote in accordance with the instructions described below. If you hold your shares in your own name as a holder of record, you may instruct the proxy holders how to vote your shares in the following ways: |

| A. | By Telephone: Votes may be cast by telephone prior to 11:59 P.M. EST on November 3, 2009. Stockholders of record who have received a notice of availability of the proxy materials by mail must have the control number that appears on their notice available when voting. Stockholders of record who received notice of the availability of the proxy materials by e-mail must have the control number included in the e-mail available when voting. Stockholders of record who have received a proxy card by mail must have the control number that appears on their proxy card available when voting. Most stockholders who are beneficial owners of their shares living in the United States or Canada and who have received a voting instruction card by mail may vote by phone by calling the number specified on the voting instruction card provided by their broker, trustee or nominee. Those stockholders should check the voting instruction card for telephone voting availability; |

3

| B. | By Internet: Votes may be cast through the Internet voting site prior to 11:59 P.M. EST on November 3, 2009. Stockholders who have received a notice of the availability of the proxy materials by mail may submit proxies over the Internet by following the instructions on the notice. Stockholders who have received notice of the availability of the proxy materials by e-mail may submit proxies over the Internet by following the instructions included in the e-mail. Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies over the Internet by following the instructions on the proxy card or voting instruction card; |

| C. | By Mail: Votes may also be cast by mail, as long as the proxy card or voting instruction card is delivered to the Company prior to 11:59 P.M. EST on November 3, 2009. Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies by completing, signing and dating their proxy card or voting instruction card and mailing it in the accompanying pre-addressed envelope; or |

| D. | In Person: Attend the Annual Meeting and vote your shares in person. |

Whichever of these methods you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions.

If you vote by mail, telephone or Internet without giving specific voting instructions, your shares will be voted FOR Proposal One (the election of the four nominees listed herein for the Board of Directors), FOR Proposal Two (the approval of the amendment and restatement of the 2004 Equity Plan to increase the number of shares reserved and the reapproval of the material terms of the plan, including the list of corporate performance goals permitted under such plan for purposes of Section 162(m)), FOR Proposal Three (the approval of the material terms of our Performance Bonus Plan for purposes of Section 162(m)), and FOR Proposal Four (the ratification of our independent registered public accounting firm). When proxies are properly dated, executed and returned (whether by returned proxy card, telephone or Internet), the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting.

| 11. How may I vote if my shares are held in a stock brokerage account, or by a bank or other nominee? |

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held “in street name,” and your broker or nominee is considered the stockholder of record with respect to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker on how to vote, and you are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting. If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted. |

4

| 12. Can I change my vote? |

You may change your vote at any time prior to the vote at the Annual Meeting. To change your proxy instructions if you are a stockholder of record, you must: |

| • | Advise our General Counsel in writing at our principal executive offices, before the proxy holders vote your shares, that you wish to revoke your proxy instructions; or |

| • | Deliver proxy instructions dated after your earlier proxy instructions, in any of the voting methods described in the response to Question #10 above. |

| 13. Who will bear the cost of this proxy solicitation? |

KLA-Tencor is making this proxy solicitation, and we will pay the entire cost of this solicitation, including preparing, assembling, printing, mailing and distributing the notices and these proxy materials and soliciting votes. We have retained the services of D.F. King & Company to aid in the solicitation of proxies from brokers, bank nominees and other institutional owners. We estimate that we will pay D.F. King fees of approximately $8,000 for this solicitation activity, forwarding solicitation material to beneficial and registered stockholders and processing the results. Certain of our Directors, officers and regular employees, without additional compensation, may solicit proxies personally or by telephone. |

| 14. Can my broker vote my shares if I do not instruct him or her how I would like my shares voted? |

Yes. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial” owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and your record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder, the record holder will be entitled to vote your shares in its discretion on Proposal One (Election of Directors) and Proposal Four (Ratification of Independent Registered Public Accounting Firm). |

The Securities and Exchange Commission recently approved a rule amendment that will eliminate your record holder’s discretion to vote your shares on the election of directors, in the absence of specific instructions from you (the beneficial owner). However, that rule amendment is effective for stockholder meetings held on or after January 1, 2010, so the existing rules regarding discretionary voting (as described in the preceding paragraph) will remain in effect for the Annual Meeting.

| 15. Are abstentions and broker non-votes counted? |

Shares that are voted “FOR,” “AGAINST,” “WITHHELD” or “ABSTAIN” are treated as being present for purposes of determining the presence of a quorum and are also treated as shares entitled to vote at the Annual Meeting (“Votes Cast”). |

Since abstentions will be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of Votes Cast with respect to a proposal (other than the election of Directors), abstentions will have the same effect as a vote against the proposal (other than the election of Directors).

Shares that are subject to a broker non-vote are counted for purposes of determining whether a quorum exists but not for purposes of determining whether a proposal has passed.

5

| 16. How does the Board of Directors recommend that I vote? |

The Board of Directors recommends that stockholders vote as follows: |

| A. | “FOR” the election of the four Class II Director candidates nominated by our Board of Directors: Robert P. Akins, Robert T. Bond, Kiran M. Patel and David C. Wang; |

| B. | “FOR” the amendment and restatement of the 2004 Equity Plan to increase the number of shares reserved for issuance under the plan by 11,000,000 shares and reapprove the material terms of the plan, including the list of corporate performance goals through which certain awards may be earned in order to qualify those awards as performance-based compensation for purposes of Section 162(m); |

| C. | “FOR” the material terms of our Performance Bonus Plan, including the expansion and reapproval of the list of corporate performance goals to which the payment of cash bonus awards made under the plan may be tied in order to qualify those awards as performance-based compensation for purposes of Section 162(m); and |

| D. | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2010. |

| 17. Will any other business be transacted at the Annual Meeting? |

We are not aware of any matters to be presented other than those described in this Proxy Statement. In the unlikely event that any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote. |

| 18. What happens if the Annual Meeting is adjourned or postponed? |

If the Annual Meeting is adjourned or postponed, the proxy holders can vote your shares on the new meeting date as well, unless you have properly revoked your proxy instructions. |

QUESTIONS AND ANSWERS REGARDING STOCKHOLDER PROPOSALS, DIRECTOR NOMINATIONS BY STOCKHOLDERS AND RELATED BYLAW PROVISIONS

| 19. Can I present other business to |

A stockholder may only present a matter from the floor of a meeting of stockholders for consideration at that meeting if certain procedures set forth in our bylaws are followed, including delivery of advance notice by such stockholder to us. We have not received any timely notices with respect to the Annual Meeting regarding the presentation by any stockholders of business from the floor of the meeting. Accordingly, we do not expect to acknowledge any business presented from the floor at the Annual Meeting. |

| 20. What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders? |

You may submit proposals for consideration at future stockholder meetings. For a stockholder proposal to be considered for inclusion in our proxy statement for the annual meeting next year (which is expected to be held in November 2010), our Corporate Secretary must receive the written proposal at our principal executive offices no later than May 26, 2010. Such proposals also must comply with Securities and Exchange Commission (“SEC”) |

6

| regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to: |

Corporate Secretary

KLA-Tencor Corporation

One Technology Drive

Milpitas, California 95035

Fax: (408) 875-4144

For a stockholder proposal that is not intended to be included in our proxy statement under Rule 14a-8, the stockholder must provide the information required by our bylaws and give timely notice to our Corporate Secretary in accordance with our bylaws, which, in general, require that the notice be received by our Corporate Secretary:

| • | Not earlier than the close of business on July 7, 2010, and |

| • | Not later than the close of business on August 6, 2010. |

If the date of the stockholder meeting is moved more than 30 days before or 60 days after November 4, 2010, then notice of a stockholder proposal that is not intended to be included in our proxy statement under Rule 14a-8 must be received no earlier than the close of business 120 days prior to the meeting and not later than the close of business on the later of the following two dates:

| • | 90 days prior to the meeting; and |

| • | 10 days after public announcement of the meeting date. |

| 21. How may I recommend or nominate individuals to serve as directors? |

You may propose director candidates for consideration by the Board’s Nominating and Governance Committee. Any such recommendations should include the nominee’s name and qualifications for Board membership and should be directed to our Corporate Secretary at the address of our principal executive offices set forth in Question 20 above. |

In addition, our bylaws permit stockholders to nominate directors for election at an annual stockholder meeting. To nominate a director, the stockholder must deliver the information required by our bylaws and a statement by the nominee acknowledging that he or she will owe a fiduciary obligation to KLA-Tencor and its stockholders.

| 22. What is the deadline to propose or nominate individuals to serve as directors? |

A stockholder may send a proposed director candidate’s name and information to the Board at any time. Generally, such proposed candidates are considered at the first or second Board meeting prior to the annual meeting. |

To nominate an individual for election at an annual stockholder meeting, the stockholder must give timely notice to our Corporate Secretary in accordance with our bylaws, which, for our annual meeting next year, will generally require that the notice be received by our Corporate Secretary between the close of business on July 7, 2010 and the close of business on August 6, 2010, unless the annual meeting is moved by more than 30 days before or 60 days after November 4, 2010, in which case the deadline will be as described in Question 20.

| 23. How may I obtain a copy of |

For a free copy of our bylaws, please contact our Investor Relations department at (408) 875-3600. A copy of our bylaws is also available free of charge on the Internet our website at http://ir.kla-tencor.com and from the SEC’s website at http://www.sec.gov. |

7

ELECTION OF DIRECTORS

| Background |

We have a classified Board of Directors with three classes. At each annual meeting, a class of Directors is elected for a full term of three years to succeed those Directors whose terms expire at the annual meeting. At this Annual Meeting, the terms of the Class II Directors are expiring. |

The three incumbent Class I Directors are Robert M. Calderoni, John T. Dickson and Kevin J. Kennedy. The Class I Directors will serve until the annual meeting of stockholders to be held in 2011 or until their respective successors are duly elected and qualified.

The four incumbent Class II Directors are Robert P. Akins, Robert T. Bond, Kiran M. Patel and David C. Wang. They are up for re-election at the Annual Meeting.

The three incumbent Class III Directors are Edward W. Barnholt, Stephen P. Kaufman and Richard P. Wallace. The Class III Directors will serve until the annual meeting of stockholders to be held in 2010 or until their respective successors are duly elected and qualified.

| Nominees |

The term of the four current Class II Directors will expire on the date of the Annual Meeting. The four incumbent Class II Directors are nominated for election at the Annual Meeting. The Nominating and Governance Committee, consisting solely of independent Directors as determined under the rules of the NASDAQ Stock Market, recommended the Class II Director nominees, each of whom is an incumbent Director, as set forth in this Proposal One. Based on that recommendation, the members of the Board of Directors unanimously resolved to nominate such individuals for election. |

The four candidates nominated by the Board of Directors for election as Class II Directors by the stockholders are:

| • | Robert P. Akins; |

| • | Robert T. Bond; |

| • | Kiran M. Patel; and |

| • | David C. Wang. |

If elected, the nominees for Class II Directors will serve as Directors until our annual meeting of stockholders in 2012, each until his successor is duly elected and qualified. If any nominee declines to serve or becomes unavailable for any reason, or a vacancy occurs before the election, the proxies may be voted for such substitute nominees as the Board of Directors may designate. As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee who is unable or who will decline to serve as a Director.

| Vote Required and |

If a quorum is present and voting, the four nominees for Class II Directors receiving the highest number of affirmative votes will be elected as Class II Directors. Votes withheld from any Director and broker non-votes are counted for purposes of determining the presence or absence of a quorum but have no |

8

| other legal effect on the selection of nominees for Directors. In accordance with our corporate governance policies, anyone who is elected as a Director in any uncontested election by a plurality and not a majority of votes cast will promptly tender his or her resignation to the Board of Directors, subject to acceptance, after certification of the election results. The Nominating and Governance Committee will make a recommendation to the Board of Directors whether to accept or reject the resignation or take some other appropriate action, taking into account any stated reasons why stockholders withheld votes and any other factors which the Nominating and Governance Committee determines in its sole discretion are relevant to such decision. The Board of Directors will in its sole discretion act on the recommendation of the Nominating and Governance Committee within 90 days after the date of certification of the election results. The Director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board of Directors regarding his or her resignation. |

THE MEMBERS OF THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND A VOTE “FOR” EACH OF THE CLASS II DIRECTOR NOMINEES, WITH THE DIRECTORS WHO ARE NOMINEES ABSTAINING.

9

INFORMATION ABOUT THE DIRECTORS AND THE NOMINEES

The following table sets forth certain information with respect to our Board of Directors as of the date of this Proxy Statement:

| Principal Occupation of Board Members |

Age | |||

| Nominees for Election as Class II Directors | ||||

| Robert P. Akins | Robert P. Akins has been a Director of KLA-Tencor since May 2008. Mr. Akins is a co-founder of Cymer, Inc. and has served as Cymer’s Chairman and CEO since its inception in 1986. Cymer is a leading supplier of excimer light sources for deep ultraviolet photolithography systems used in the semiconductor manufacturing process. Mr. Akins also served as Cymer’s President from its inception until May 2000. He currently serves on the boards of directors of SEMI (Semiconductor Equipment and Materials International) and SEMI North America. | 58 | ||

| Robert T. Bond | Robert T. Bond has been a Director of KLA-Tencor since August 2000. From April 1996 to January 1998, Mr. Bond served as Chief Operating Officer of Rational Software Corporation. Prior to that, he held various executive positions at Rational Software Corporation. Mr. Bond was employed by Hewlett-Packard Company from 1967 to 1983 and held various management positions during his tenure there. | 66 | ||

| Kiran M. Patel | Kiran M. Patel has been a Director of KLA-Tencor since May 2008. Mr. Patel serves as Executive Vice President and General Manager, Small Business Group of Intuit Inc., a provider of personal finance and small business software. Mr. Patel previously served as Intuit’s Senior Vice President and General Manager, Consumer Tax Group and as its Senior Vice President and Chief Financial Officer. Before joining Intuit, he was Executive Vice President and Chief Financial Officer of Solectron Corporation from August 2001 to September 2005. He previously worked for Cummins Inc. for 27 years in a variety of finance and business positions, most recently as Chief Financial Officer and Executive Vice President. | 61 | ||

| David C. Wang | David C. Wang has been a Director of KLA-Tencor since May 2006. Mr. Wang has served as President of Boeing-China and Vice President of International Relations of The Boeing Company since 2002. Prior to joining Boeing, he spent 22 years at General Electric Company (“GE”), where he worked in various capacities, including most recently as Chairman and Chief Executive Officer of GE China. In addition, Mr. Wang served in executive positions with GE in Singapore, Malaysia and Mexico. Prior to joining GE, Mr. Wang held various engineering positions at Emerson Electric Co. He currently resides in Beijing and also serves on the Board of Directors of Terex Corporation, as well as a number of non-profit boards, including the Beijing International MBA Program Advisory Board at Beijing University and Junior Achievement China. | 65 | ||

10

| Principal Occupation of Board Members |

Age | |||

| Class I Directors | ||||

| Robert M. Calderoni | Robert M. Calderoni has been a Director of KLA-Tencor since March 2007. He has served as Chairman of the Board of Directors of Ariba, Inc. since July 2003 and as Chief Executive Officer and a Director of Ariba since October 2001. From 2001 to 2004, Mr. Calderoni also served as Ariba’s President and, before that, as Ariba’s Executive Vice President and Chief Financial Officer. From 1997 to 2001, he served as Chief Financial Officer at Avery Dennison Corporation. He is also a member of the Board of Directors of Juniper Networks, Inc. | 49 | ||

| John T. Dickson | John T. Dickson has been a Director of KLA-Tencor since May 2007. Mr. Dickson is the former President and Chief Executive Officer of Agere Systems, Inc., a position he held from August 2000 until October 2005. Prior to that, he held positions as the Executive Vice President and Chief Executive Officer of Lucent’s Microelectronics and Communications Technologies Group; Vice President of AT&T Corporation’s integrated circuit business unit; Chairman and Chief Executive Officer of Shographics, Inc.; and President and Chief Executive Officer of Headland Technology Inc. Mr. Dickson is also a member of the Boards of Directors of National Semiconductor Corporation and Frontier Silicon, Ltd. | 63 | ||

| Kevin J. Kennedy | Kevin J. Kennedy has been a Director of KLA-Tencor since May 2007. Mr. Kennedy is President and Chief Executive Officer of Avaya Inc., a leading global provider of business communications applications, systems and services. Prior to joining Avaya in January 2009, Mr. Kennedy was President and Chief Executive Officer of JDS Uniphase Corporation, a position he held since September 2003. From 2001 to 2003, he served as Chief Operating Officer of Openwave Systems, Inc. Previously, Mr. Kennedy spent nearly eight years at Cisco Systems, Inc. and 17 years at Bell Laboratories. In 1987, Mr. Kennedy was a Congressional Fellow to the U.S. House of Representatives Committee on Science, Space and Technology. Mr. Kennedy is also a member of the Board of Directors of JDS Uniphase Corporation. | 53 | ||

11

| Principal Occupation of Board Members |

Age | |||

| Class III Directors | ||||

| Edward W. Barnholt | Edward W. Barnholt has been a Director of KLA-Tencor since 1995, and was named Chairman of the Board of Directors of KLA-Tencor in October 2006. From March 1999 to March 2005, Mr. Barnholt was President and Chief Executive Officer of Agilent Technologies, Inc., and he was Chairman of the Board of Directors of Agilent from November 2002 to March 2005. In March 2005, Mr. Barnholt retired as the Chairman, President and Chief Executive Officer of Agilent. Before being named Agilent’s Chief Executive Officer, Mr. Barnholt served as Executive Vice President and General Manager of Hewlett-Packard Company’s Measurement Organization from 1998 to 1999. From 1990 to 1998, he served as General Manager of Hewlett-Packard’s Test and Measurement Organization. He was elected Senior Vice President of Hewlett-Packard in 1993 and Executive Vice President in 1996. Mr. Barnholt also serves on the Boards of Directors of Adobe Systems Incorporated and eBay Inc. He also serves on the Board of Trustees of the Packard Foundation and the Board of Directors of The Tech Museum of Innovation. | 66 | ||

| Stephen P. Kaufman | Stephen P. Kaufman has been a Director of KLA-Tencor since November 2002. Mr. Kaufman has been a Senior Lecturer at the Harvard Business School since January 2001. He was a member of the Board of Directors of Arrow Electronics, Inc. from 1984 to May 2003. From 1986 to June 2000, he was Chief Executive Officer of Arrow. From 1985 to June 1999, he was also Arrow’s President. From 1994 to June 2002, he was Chairman of the Board of Directors of Arrow. Mr. Kaufman also serves on the Boards of Directors of Harris Corporation and Thermo Fisher Scientific Inc. | 67 | ||

| Richard P. Wallace | Richard (Rick) P. Wallace currently serves as the President and Chief Executive Officer of KLA-Tencor. Mr. Wallace has been a Director and the Chief Executive Officer of KLA-Tencor since January 2006 and has also served as KLA-Tencor’s President since November 2008. He began at KLA Instruments in 1988 as an applications engineer and has held various general management positions throughout his 21 years with us, including positions as President and Chief Operating Officer from July 2005 to December 2005, Executive Vice President of the Customer Group from May 2004 to July 2005, and Executive Vice President of the Wafer Inspection Group from July 2000 to May 2004. He also currently serves as Vice-Chairman of the Board of Directors of SEMI. Earlier in his career, he held positions with Ultratech Stepper and Cypress Semiconductor. He earned his bachelor’s degree in electrical engineering from the University of Michigan and his master’s degree in engineering management from Santa Clara University, where he also taught strategic marketing and global competitiveness courses after his graduation. | 49 | ||

12

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE 2004 EQUITY INCENTIVE PLAN

Our stockholders are being asked to approve the amendment and restatement of our 2004 Equity Incentive Plan (the “2004 Equity Plan”) that will increase the maximum number of shares of our Common Stock authorized for issuance over the term of the plan by an additional 11,000,000 shares from 21,000,000 to 32,000,000 shares and reapprove the material terms of the 2004 Equity Plan, including the list of corporate performance goals through which certain awards made under the plan may be earned in order to qualify those awards as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

We rely significantly on equity incentives to attract and retain key employees and other personnel essential to our long-term growth and future success and believe that such incentives are necessary for us to remain competitive in the marketplace for executive talent and other key employees. The proposed share increase will assure that a sufficient reserve of Common Stock remains available under the 2004 Equity Plan to allow us to continue to provide equity incentives to our key personnel on a competitive level.

The reapproval of the material terms of the plan will allow us to continue to award equity incentives with meaningful performance milestones that will qualify as performance-based compensation under Section 162(m) of the Code. Awards which so qualify will not be subject to the $1 million per person limitation on the income tax deductibility of compensation paid to certain executive officers that would otherwise be imposed under Section 162(m) of the Code.

The 2004 Equity Plan was approved by our stockholders on October 18, 2004 and became effective on such date. The 2004 Equity Plan replaced our 1982 Stock Option Plan and 2000 Nonstatutory Stock Option Plan (collectively, the “Replaced Plans”) and supplemented our 1998 Outside Director Option Plan. The share reserve of the 2004 Equity Plan includes approximately 1,500,000 shares that were transferred to the plan upon the expiration or forfeiture of options that were previously outstanding under the Replaced Plans. On November 15, 2007, our stockholders approved an amendment to the 2004 Equity Plan that, among other things, added 8,500,000 shares of our Common Stock to the maximum number of shares authorized for issuance under the terms of the plan. Our Board of Directors has approved the amendment and restatement of the 2004 Equity Plan that is the subject of this Proposal Two, subject to the approval of our stockholders at the Annual Meeting.

The following is a summary of the material terms and provisions of the 2004 Equity Plan, as amended. The summary, however, does not purport to be a complete description of all the provisions of the 2004 Equity Plan, and is subject to, and qualified in its entirety by, the provisions of the 2004 Equity Plan. A copy of the actual plan document is attached as Appendix A to this Proxy Statement.

13

Summary of the 2004 Equity Plan

General

The purposes of the 2004 Equity Plan are to attract and retain the best available personnel for positions of substantial responsibility, provide additional incentive to our employees, Board members and consultants, and promote the success of our business.

Administration

The 2004 Equity Plan may be administered by our Board of Directors or by a committee of Board members appointed by our Board (the “Administrator”). Subject to the provisions of the 2004 Equity Plan, the Administrator has the authority to: (i) interpret the plan and apply its provisions; (ii) establish, amend or rescind rules and regulations relating to the 2004 Equity Plan; (iii) select the persons to whom awards are to be made; (iv) subject to individual fiscal year limits applicable to each type of award, determine the number of shares or equivalent units to be made the subject of each award; (v) determine when and to what extent awards are to be made; (vi) determine the terms and conditions applicable to awards generally and to each individual award (including the provisions of the award agreement to be entered into between the Company and the participant); (vii) amend any outstanding award subject to applicable legal restrictions (except that repricing of outstanding options or stock appreciation rights will generally require stockholder approval, as indicated below); (viii) approve the forms of agreement to evidence the awards made under the plan; (ix) allow participants to satisfy withholding tax obligations by electing to have us withhold from the shares otherwise issuable upon the exercise, vesting or settlement of an award that number of shares (or cash equivalent) with a fair market value equal to the minimum amount of taxes required to be withheld (rounded up to the nearest whole share); and (x) subject to certain limitations, take any other actions deemed necessary or advisable for the administration of the 2004 Equity Plan. All decisions, interpretations and other actions of the Administrator will be final and binding on all holders of awards under the 2004 Equity Plan and on all persons deriving their rights therefrom.

Types of Awards

The following types of awards may be made under the 2004 Equity Plan: incentive stock options under Section 422 of the Code, non-statutory stock options, stock appreciation rights (“SARs”), restricted stock units (“RSUs”), performance shares, performance units and deferred stock units. The principal features of each such award are described in more detail below.

Plan Reserve and Shares Counted Against Such Reserve

The maximum number of shares of Common Stock authorized for issuance over the term of the plan is limited to 32,000,000 shares, including the 11,000,000-share increase for which stockholder approval is sought as part of this Proposal. Such shares may be drawn from shares of our authorized but unissued shares or, with the approval of our Board of Directors, from shares reacquired by us, including shares repurchased on the open market. Any shares issued under the 2004 Equity Plan pursuant to a restricted stock unit,

14

performance share or performance unit award will reduce the total number of shares available for issuance under the plan at the rate of 1.8 shares for every one share issued pursuant to such award, unless those shares are issued for a cash consideration per share equal to 100% of the fair market value of our Common Stock on the award date.

Shares subject to any outstanding awards under the plan that expire or otherwise terminate before those shares are issued will be available for subsequent awards. Unvested shares issued under the plan that either are forfeited by the participants or repurchased by us (at not more than the original exercise or issue price paid per share) pursuant to our repurchase rights under the plan will be added back to the number of shares reserved for issuance under the plan and will accordingly be available for subsequent issuance.

Should the exercise price of an option or other stock purchase right under the plan be paid with shares of our Common Stock, then the authorized reserve under the plan will be reduced only by the net number of new shares issued under the award. Upon the exercise of any SAR granted under the plan, the share reserve will only be reduced by the net number of shares actually issued upon such exercise, and not by the gross number of shares as to which such SAR is exercised.

Should shares of Common Stock otherwise issuable under the plan be withheld by us in satisfaction of the withholding taxes incurred in connection with the issuance, exercise or settlement of an award under the plan (as has been our practice, for example, in connection with the vesting of restricted stock units issued under the plan), then the number of shares of Common Stock available for issuance under the plan will be reduced only by the net number of shares actually issued after such share withholding.

As of August 31, 2009, 2,589,524 shares of our Common Stock were subject to outstanding options under the 2004 Equity Plan, 5,695,692 shares were subject to outstanding RSU or performance share awards, 1,793,388 shares had been issued, and 5,632,746 shares remained available for future award under the 2004 Equity Plan (which does not take into account the 11,000,000 share increase for which stockholder approval is sought as part of this Proposal).

Eligibility

Awards may be granted to our employees, consultants and members of our Board of Directors. Incentive stock options may only be granted to employees. As of August 31, 2009, all four of our executive officers, all nine of our non-employee members of the Board and approximately 5,037 other employees were eligible to participate in the 2004 Equity Plan.

Code Section 162(m) Performance Goals

To assure that the compensation attributable to one or more awards of restricted stock units, performance shares, performance units or deferred stock units made under the plan will qualify as performance-based compensation for purposes of Section 162(m) of the Code, the Administrator has the authority to

15

structure one or more of those awards so that they are earned or eligible to be earned only if certain pre-established corporate performance goals are attained. Awards which qualify as such performance-based compensation will not be subject to the $1 million limitation on the income tax deductibility of the compensation paid per covered executive officer that is otherwise imposed under Section 162(m).

At the Administrator’s discretion, one or more of the following performance goals may be utilized for purposes of such performance vesting: (i) total stockholder return; (ii) earnings or net income per share; (iii) net income or operating income; (iv) earnings before interest, taxes, depreciation, amortization and/or stock-based compensation costs, or operating income before depreciation and amortization; (v) sales or annual revenue targets; (vi) return on assets, equity or sales; (vii) cash flow, operating cash flow or cash position; (viii) market share; (ix) cost reduction goals; (x) budget comparisons; (xi) operating margin; (xii) implementation or completion of projects or processes strategic or critical to our business operations; (xiii) measures of customer satisfaction; (xiv) any combination of, or a specified increase in, any of the foregoing; (xv) economic value added; and (xvi) the formation of joint ventures, research and development collaborations, marketing or customer service collaborations, or the completion of other corporate transactions intended to enhance our revenue or profitability or expand our customer base.

Each applicable performance goal may include a minimum threshold level of performance below which no award will be earned, levels of performance at which specified portions of an award will be earned and a maximum level of performance at which an award will be fully earned. Each applicable performance goal may be structured at the time of the award to provide for appropriate adjustment for one or more of the following items: (A) asset impairments or write-downs; (B) litigation judgments or claim settlements; (C) the effect of changes in tax laws, accounting principles or other laws or regulations affecting reported results; (D) accruals for reorganization and restructuring programs; (E) any extraordinary nonrecurring items as described in Accounting Principles Board Opinion No. 30 and/or in management’s discussion and analysis of financial condition and results of operations appearing in our annual report to stockholders for the applicable year; (F) the operations of any business we acquire; (G) divestiture of one or more business operations or the assets thereof; and (H) any other adjustment consistent with the operation of the plan.

Stockholder approval of this Proposal Two will also constitute reapproval of the foregoing list of performance goals for purposes of Section 162(m) of the Code, which requires that such performance goals, along with certain other material terms of such plans, be reapproved at least every five years. Accordingly, any deductions to which we would otherwise be entitled with respect to any restricted stock unit, performance share, performance unit or deferred stock unit awards that may be earned (or eligible to be earned) subject to the attainment of one or more of those approved performance goals will not be subject to the $1 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m) of the Code.

16

Restricted Stock Unit and Performance Share 162(m) Share Limit

No participant may be granted in any one fiscal year restricted stock units or performance shares for more than 200,000 shares in the aggregate, except that in the fiscal year the participant commences service with us, he or she may receive such awards for up to 600,000 shares in the aggregate. Stockholder approval of this Proposal Two will also constitute reapproval of the 200,000 and 600,000 share limitations for purposes of Section 162(m) of the Code. Such share limitations will assure that any deductions to which we would otherwise be entitled with respect to any restricted stock unit or performance share awards with vesting tied to the attainment of one or more of the performance milestones specified above will not be subject to the $1 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m) of the Code.

Grant of Restricted Stock Units

Subject to the terms and conditions of the 2004 Equity Plan, restricted stock units may be granted to our employees, consultants and Board members at any time and from time to time at the discretion of the Administrator. Subject to the Section 162(m) share limits set forth above, the Administrator will have complete discretion to determine (i) the number of shares subject to each restricted stock unit award and (ii) the vesting provisions in effect for that award, which will typically be based on continued service but may include a performance-based component. Until the shares are actually issued following the vesting of the award, no right to vote or receive dividends or any other rights as a stockholder will exist with respect to the underlying shares.

Restricted Stock Unit Award Agreement

Each restricted stock unit award will be evidenced by an agreement that will specify the cash consideration (if any) payable per underlying share of Common Stock, the applicable vesting schedule and such other terms and conditions as the Administrator will determine.

Grant of Performance Shares

Subject to the terms and conditions of the 2004 Equity Plan, performance share awards may be made to our employees and consultants at any time and from time to time as will be determined at the discretion of the Administrator. Subject to the Section 162(m) share limits set forth above, the Administrator will have complete discretion to determine (i) the number of shares of our Common Stock subject to each performance share award and (ii) the vesting provisions in effect for that award, which will typically be based on achievement of performance milestones but may also include a service-based component.

Performance Share Award Agreement

Each performance share award will be evidenced by an agreement that will specify the cash consideration (if any) payable per underlying share of Common Stock, the applicable vesting schedule and such other terms and conditions as the Administrator will determine.

17

Grant of Performance Units

Performance units are similar to performance shares, except that they will be settled in a cash amount equal to the fair market value of the underlying shares of our Common Stock as measured as of the vesting date. The shares available for issuance under the 2004 Equity Plan will not be diminished as a result of the cash settlement of performance unit awards.

Performance Unit Award Agreement

Each performance unit grant will be evidenced by an agreement that will specify the applicable vesting schedule and such other terms and conditions as the Administrator will determine. However, no participant will be granted a performance unit award in excess of $1 million in any fiscal year, except that an award of up to $3 million may be made to a participant in the fiscal year in which he or she commences service with us. Stockholder approval of this Proposal Two will also constitute reapproval of the $1 million and $3 million limitations for purposes of Section 162(m) of the Code. Such dollar limitations will assure that any deductions to which we would otherwise be entitled with respect to any performance unit awards with vesting tied to the attainment of one or more of the performance milestones specified above will not be subject to the $1 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m) of the Code.

Deferred Stock Units

A deferred stock unit award will consist of a restricted stock unit, performance share or performance unit award that the Administrator, in its sole discretion, permits to be paid out in installments or on a deferred basis, in accordance with rules and procedures established by the Administrator in compliance with the applicable requirements of Section 409A of the Code. Deferred stock units are subject to the same individual annual limits that apply to each type of award.

Terms and Conditions of Options

Each option granted under the 2004 Equity Plan will be evidenced by a written stock option agreement between the optionee and us that is subject to the following terms and conditions:

i. Exercise Price

The exercise price may not be less than the fair market value of our Common Stock on the grant date of the option.

ii. Form of Consideration

The exercise price may be paid in cash or by check or with other shares of our Common Stock owned by the optionee or through a special sale and remittance procedure pursuant to which the optionee makes an immediate sale of the purchased shares and remits a portion of the sale proceeds to us in payment of the exercise price and any applicable withholding taxes.

18

iii. Exercise of the Option

Each stock option agreement will specify the term of the option and the date or dates when the option is to become exercisable. However, in no event will an option granted under the 2004 Equity Plan have a term in excess of 10 years.

iv. Termination of Employment

If an optionee’s employment terminates for any reason (other than death or permanent disability), all options held by such optionee under the 2004 Equity Plan will expire upon the earlier of (i) the expiration of the limited post-employment exercise period set forth in his or her option agreement or (ii) the expiration date of the option term. The optionee may, at any time before the applicable expiration date, exercise the option for all or any part of the shares for which that option was exercisable at the time of his or her termination of employment.

v. Permanent Disability

If an optionee is unable to continue employment with us as a result of permanent and total disability (as defined in the Code), all options held by such optionee under the 2004 Equity Plan will expire upon the earlier of (i) 12 months after the termination date of the optionee’s employment or (ii) the expiration date of the option term. The optionee may, at any time before the applicable expiration date, exercise the option for all or any part of the shares for which that option was exercisable at the time of his or her termination of employment.

vi. Death

If an optionee dies while employed by us, his or her options will expire upon the earlier of (i) 12 months after the date of his or her death or (ii) the expiration date of the option term. The executor or other legal representative of the optionee may, at any time before the applicable expiration date, exercise the option for all or any part of the option shares.

vii. Extension

If at any time during the applicable post-employment exercise period, the exercise of an option or the sale of the underlying shares cannot be effected in compliance with applicable securities laws or regulations, then such exercise period shall be extended by the period of time for which such exercise or sale was precluded, but in no event beyond the expiration date of the maximum option term.

viii. ISO Limitation

If the aggregate fair market value of all shares of Common Stock for which an optionee’s incentive stock options first become exercisable during any calendar year exceeds $100,000, then the excess will be treated and taxed as non-statutory options.

ix. Other Provisions

The stock option agreement may contain terms, provisions and conditions that are not inconsistent with the 2004 Equity Plan as determined by the Administrator.

19

Option and SAR 162(m) Share Limit

No participant may be granted stock options and SARs for more than 400,000 shares of our Common Stock in the aggregate in any fiscal year, except that options and SARs covering up to 1,200,000 shares in the aggregate may be granted to the participant in the fiscal year in which he or she commences service with us. Stockholder approval of this Proposal Two will also constitute reapproval of the 400,000 and 1,200,000 share limitations for purposes of Section 162(m) of the Code. Such share limitations will assure that any deductions to which we would otherwise be entitled upon the exercise of stock options or SARs granted under the plan will not be subject to the $1 million limitation on the income tax deductibility of compensation paid per covered executive officer that would otherwise be imposed under Section 162(m).

Exercise Price and Other Terms of Stock Appreciation Rights

The exercise price of SARs may not be less than the fair market value of the Common Stock on the grant date. The Administrator, subject to the provisions of the 2004 Equity Plan (including the Section 162(m) share limits referred to above and the exercise price restrictions), will have complete discretion to determine the terms and conditions of SARs granted under the 2004 Equity Plan.

Payment of Stock Appreciation Right Amount

Upon exercise of a SAR, the participant will be entitled to receive a payment in an amount equal to the product of (X) the amount by which the fair market value per share of our Common Stock on the exercise date exceeds the exercise price per share for that SAR and (Y) the number of shares as to which the SAR is exercised.

Payment upon Exercise of Stock Appreciation Right

At the discretion of the Administrator, the payment due upon the exercise of the SAR may be made in cash, shares of our Common Stock or a combination thereof. To the extent that a SAR is settled in cash, the shares available for issuance under the 2004 Equity Plan will not be diminished as a result of the cash settlement.

Stock Appreciation Right Agreement

Each SAR grant will be evidenced by an agreement that will specify the exercise price, the term of the SAR, the vesting schedule and such other terms and conditions as the Administrator may, in its sole discretion, determine.

Expiration of Stock Appreciation Rights

SARs granted under the 2004 Equity Plan expire as determined by the Administrator, but in no event later than ten (10) years from the date of grant. No SAR may be exercised by any person after its expiration date.

Valuation

Our Common Stock is listed on the NASDAQ Global Select Market. Accordingly, the fair market value of our Common Stock on any relevant date

20

will be deemed to be equal to the closing selling price per share of our Common Stock (or the closing bid if no sales were reported) on that date. On August 31, 2009, the fair market value of our Common Stock determined on such basis was $31.20 per share.

No Repricing

The 2004 Equity Plan prohibits the reduction of the exercise price of an outstanding option or SAR, including a repricing by way of an exchange for another award under the plan, unless stockholder approval of the repricing is obtained. We have not engaged in any repricing programs which have resulted in a reduction to the exercise price of outstanding options or SARs under the plan.

Non-Transferability of Awards

Unless determined otherwise by the Administrator, an award granted under the 2004 Equity Plan may not be sold, pledged, assigned, transferred or otherwise disposed of in any manner other than by will or by the laws of inheritance following the participant’s death and may be exercised, during the participant’s lifetime, only by such participant. If the Administrator makes an award granted under the 2004 Equity Plan transferable, such award will contain such additional terms and conditions as the Administrator deems appropriate.

Leave of Absence

In the event a participant goes on a leave of absence, the vesting of each of his or her outstanding awards will cease until he or she returns to work, except as otherwise required by law or as otherwise determined by the Administrator.

Part-Time Service

Under the terms of the 2004 Equity Plan, unless the Administrator provides otherwise or except as otherwise required by law, the vesting of any service-vesting awards (other than restricted stock units and performance share awards) made to a participant under the 2004 Equity Plan will be extended on a proportionate basis in the event the participant transitions from a full-time to a part-time work schedule, or if not on a full-time work schedule, to a schedule requiring fewer hours of service. Such vesting will be proportionately re-adjusted prospectively in the event that the participant subsequently becomes regularly scheduled to work additional hours of service.

Under the terms of the 2004 Equity Plan, unless the Administrator provides otherwise or except as otherwise required by law, the vesting of any restricted stock units and performance share awards (to the extent earned) will continue unchanged and unaffected (i.e., they will vest in accordance with their original vesting schedules), notwithstanding whether the participant is at a full-time or part-time work schedule.

Adjustment Upon Changes in Capitalization

In the event any change is made to our outstanding Common Stock by reason of any stock split, reverse stock split, stock dividend, combination or reclassification of our Common Stock, spin-off transaction or any other increase or decrease in the number of the outstanding shares of our Common Stock effected without receipt of consideration by us, or should the value of

21

the outstanding shares of our Common Stock be substantially reduced as the result of a spin-off transaction or extraordinary dividend or distribution, equitable and proportional adjustments will be made to the number and class of securities issuable under the 2004 Equity Plan, the individual fiscal year limits applicable to restricted stock units, performance share awards, SARs and options, the number and class of securities subject to each outstanding award under the 2004 Equity Plan, the exercise price in effect for each outstanding option or SAR and the cash consideration (if any) payable per share with respect to the shares of our Common Stock underlying any other outstanding awards under the plan. Any such adjustment will be made by the Compensation Committee of our Board of Directors in such manner as it deems appropriate, and its determination will be conclusive.

Change of Control

In the event of a change of control, the successor corporation (or its parent or subsidiary) will assume each outstanding award under the 2004 Equity Plan or replace that award with a substantially equivalent award which preserves the economic value of the replaced award. To the extent the successor corporation refuses to assume the outstanding awards or to substitute equivalent awards, those awards will become 100% vested at the time of the change of control. The Administrator will also have the discretion to structure awards under the plan so that the awards will become 100% vested upon a change of control, regardless of whether or not the options are assumed or substituted, or upon the subsequent termination of the participant’s employment.

A change of control will be deemed to occur for purposes of the 2004 Equity Plan in the event (a) we are acquired by merger or asset sale, (b) there occurs any transaction or series of related transactions pursuant to which any person or group of related persons becomes directly or indirectly the beneficial owner of securities possessing (or convertible into or exercisable for securities possessing) fifty percent (50%) or more of the total combined voting power of our outstanding securities or (c) there is a change in the majority of our Board of Directors as a result of one or more contested elections for Board membership.

Amendment, Suspensions and Termination of the 2004 Equity Plan

Our Board of Directors may amend, suspend or terminate the 2004 Equity Plan at any time; provided, however, that stockholder approval will be required for any amendment to the extent such approval is necessary to comply with applicable laws or regulations. The 2004 Equity Plan will terminate in June 2014.

New Plan Benefits

As of September 15, 2009, no awards had been granted, and no shares had been issued, under the 2004 Equity Plan on the basis of the 11,000,000 share increase to the share reserve under the plan that forms part of this Proposal.

| Option Transactions |

During the period from July 1, 2008 through August 31, 2009, no stock options were granted under the 2004 Equity Plan. Accordingly, during such |

22

| period, no stock options were granted to any of the following groups for which the SEC requires disclosure: |

| • | Any of the Named Executive Officers (Richard P. Wallace. Mark P. Dentinger, Brian M. Martin, Virendra A. Kirloskar and John H. Kispert); |

| • | Any of the current executive officers (four persons); |

| • | Any of the nominees for re-election to the Board of Directors at the Annual Meeting (Robert P. Akins, Robert T. Bond, Kiran M. Patel and David C. Wang); |

| • | Any of the current directors (nine persons); or |

| • | Any of the current employees of the Company. |

| Stock Awards |

The table below shows, as to each of the Named Executive Officers and the various other indicated individuals and groups, the number of shares of Common Stock subject to restricted stock unit and performance share awards made under the 2004 Equity Plan during the period July 1, 2008 through August 31, 2009. The vesting of such awards is tied to continued service and/or the attainment of specified performance goals, and no cash consideration is payable by the participants for the shares of Common Stock that actually become issuable under those awards. |

| NAME AND POSITION |

NUMBER OF UNDERLYING SHARES |

||

| Richard P. Wallace |

289,000 | (1) | |

| President & Chief Executive Officer |

|||

| Mark P. Dentinger |

123,000 | (2) | |

| Executive Vice President & Chief Financial Officer |

|||

| Brian M. Martin Senior |

71,500 | (3) | |

| Vice President, General Counsel & Corporate Secretary |

|||

| Virendra A. Kirloskar |

38,200 | (4) | |

| Senior Vice President & Chief Accounting Officer |

|||

| John H. Kispert Former |

— | ||

| President, Chief Operating Officer & Chief Financial Officer |

|||

| All current executive officers as a group (4 persons) |

521,700 | ||

| Robert P. Akins |

5,333 | ||

| Director; Nominee for re-election to the Board of Directors at the Annual Meeting |

|||

| Robert T. Bond |

5,333 | ||

| Director; Nominee for re-election to the Board of Directors at the Annual Meeting |

|||

| Kiran M. Patel |

5,333 | ||

| Director; Nominee for re-election to the Board of Directors at the Annual Meeting |

|||

| David C. Wang |

5,333 | ||

| Director; Nominee for re-election to the Board of Directors at the Annual Meeting |

|||

| All current directors (other than executive officers) as a group (9 persons) |

50,664 | ||

23

| All current employees (as of August 31, 2009), including current officers who are not executive officers, as a group (2,450 persons) |

2,403,365 | ||

| (1) | Consists of the following: (a) fiscal year 2009 base and supplemental performance share awards of 100,000 shares (the maximum number of shares achievable under such awards), none of which shares will be issued to Mr. Wallace based on the Company’s failure to achieve the threshold level of operating margin during fiscal year 2009; and (b) 189,000 shares, representing the maximum aggregate number of shares that may be issued to Mr. Wallace under his service-based and performance-based share awards for fiscal year 2010. The vesting of Mr. Wallace’s performance-based fiscal year 2010 share awards is subject to achievement of the applicable objectives, and the vesting of all of Mr. Wallace’s fiscal year 2010 share awards (both his performance-based and exclusively service-based awards) is subject to Mr. Wallace’s completion of the service-vesting component applicable to such awards. For more information regarding Mr. Wallace’s fiscal year 2009 and 2010 share awards, including the allocation of fiscal year 2010 awards between performance-based and service-based awards, please refer to “Compensation Discussion and Analysis–Elements of Executive Officer Compensation–Long-Term Awards.” |

| (2) | Consists of the following: (a) 40,000 shares subject to a restricted stock unit award that was granted to Mr. Dentinger as a new hire award in November 2008, which shares are only subject to service-vesting requirements and (b) 83,000 shares, representing the maximum aggregate number of shares that may be issued to Mr. Dentinger under his service-based and performance-based share awards for fiscal year 2010. The vesting of Mr. Dentinger’s performance-based fiscal year 2010 share awards is subject to achievement of the applicable objectives, and the vesting of all of Mr. Dentinger’s fiscal year 2010 share awards (both his performance-based and exclusively service-based awards) is subject to Mr. Dentinger’s completion of the service-vesting component applicable to such awards. For more information regarding Mr Dentinger’s fiscal year 2009 and 2010 share awards, including the allocation of fiscal year 2010 awards between performance-based and service-based awards, please refer to “Compensation Discussion and Analysis–Elements of Executive Officer Compensation–Long-Term Awards.” |

| (3) | Consists of the following: (a) a fiscal year 2009 base performance share award of 15,000 shares (the maximum number of shares achievable under such award), none of which shares will be issued to Mr. Martin based on the Company’s failure to achieve the threshold level of operating margin during fiscal year 2009; (b) a fiscal year 2009 supplemental service-based restricted stock unit award of 15,000 shares; and (c) 41,500 shares, representing the maximum aggregate number of shares that may be issued to Mr. Martin under his service-based and performance-based share awards for fiscal year 2010. The vesting of Mr. Martin’s performance-based fiscal year 2010 share awards is subject to achievement of the applicable objectives, and the vesting of all of Mr. Martin’s fiscal year 2010 share awards (both his performance-based and exclusively service-based awards) is subject to Mr. Martin’s completion of the service-vesting component applicable to such awards. For more information regarding Mr. Martin’s fiscal year 2009 and 2010 share awards, including the allocation of fiscal year 2010 awards between performance-based and service-based awards, please refer to “Compensation Discussion and Analysis–Elements of Executive Officer Compensation–Long-Term Awards.” |

| (4) | Consists of the following: (a) a fiscal year 2009 base performance share award of 8,000 shares (the maximum number of shares achievable under such award), none of which shares will be issued to Mr. Kirloskar based on the Company’s failure to achieve the threshold level of operating margin during fiscal year 2009; (b) a fiscal year 2009 supplemental service-based restricted stock unit award of 8,000 shares; and (c) 22,200 shares, representing the maximum aggregate number of shares that may be issued to Mr. Kirloskar under his service-based and performance-based share awards for fiscal year 2010. The vesting of Mr. Kirloskar’s performance-based fiscal year 2010 share awards is subject to achievement of the applicable objectives, and the vesting of all of Mr. Kirloskar’s fiscal year 2010 share awards (both his performance-based and exclusively service-based awards) is subject to Mr. Kirloskar’s completion of the service-vesting component applicable to such awards. For more information regarding Mr. Kirloskar’s fiscal year 2009 and 2010 share awards, including the allocation of fiscal year 2010 awards between performance-based and service-based awards, please refer to “Compensation Discussion and Analysis–Elements of Executive Officer Compensation–Long-Term Awards.” |

24

Federal Tax Information

Options

Options granted under the 2004 Equity Plan may be either incentive stock options which satisfy the requirements of Section 422 of the Code or non-statutory options which are not intended to meet such requirements. The Federal income tax treatment for the two types of options differs as described below:

i. Incentive Stock Options

No taxable income is recognized by the optionee at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised, although taxable income may arise at that time for alternative minimum tax purposes. The optionee will, however, recognize taxable income in the year in which the purchased shares are sold or otherwise made the subject of certain dispositions.