12

Professional Division

Restructuring Department

| 3.9. | For the purpose of calculating the capital gains per share held by the Interested Public, on the first sale of the Allotted Shares, the original price of the shares which are exchanged for the Stock Consideration, as being in the hands of the seller prior to the transaction, shall be deemed as the original price of the Allotted Share, all pursuant to the provisions of the Ordinance. |

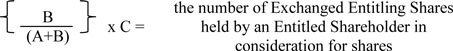

In this respect, the “Exchanged Orbotech Shares for the Consideration in KLA Shares” shall be determined according to the ratio between the total KLA Stock Consideration and the total Cash Consideration together with the value of KLA shares that were received within the Transaction (the Transaction Consideration), multiplied by the number of securities of the Entitling Shares held by the Entitled Shareholders (the “Exchanged Entitling Shares”).

The calculation formula regarding considerations received by an Entitled Shareholder:

A – Cash Consideration

B – the value of 0.25 of a share of KLA common stock which was received according to the average of 30 trading days preceding the Closing Date

C – the number of the Company’s securities held by an Entitled Shareholder

It is clarified that the cost of Exchanged Orbotech Shares, net of the cost which was attributed to the Cash Consideration (according to Section 3.13 of the Capital Market Tax Ruling) shall be attributed to the Allotted Shares (in the FIFO method).

| 3.10. | The charging of the tax in respect of the Exchanged Orbotech Shares for the Consideration in KLA Shares held by the Interested Public, calculation of the profit or loss and calculation of the tax deriving therefrom, which the Interested Public shall generate, shall be performed only on the date of the first sale of the Allotted Shares and in respect of each sold part. |

| 3.11. | It is clarified that if any shareholder of the Interested Public shall ask a TASE Member to deem the exchange of shares as a taxable event, it shall not be subject to the provisions of this tax ruling but rather to the provisions of any law and the provisions of the Capital Market Tax Ruling. |

125 Menachem Begin Road, Kiryat HaMemshalla, Tel Aviv 61070, P.O.B. 7008, Floor 18, Tel.: 03-7633060 Fax: 03-7633086