Professional Division

Restructuring Department

| 3.16. | In the sale of the Allotted Shares by the Applying Rights Holders, the provisions of Section 104F of the Ordinance shall apply mutatis mutandis. With respect to the application of the provisions of Section 104F as aforesaid, the transferred shares shall be deemed a transferred asset. For the avoidance of doubt, it is clarified and agreed that with respect to the application of the provisions of Section 104F as aforesaid, only Orbotech shares substituted against KLA shares shall be deemed as the transferred asset. |

| 3.17. | For the purpose of calculating the capital gain per share held by the Interested Parties, on the first sale of the Allotted Shares, the original price of the Allotted Share shall be deemed as the original price of all of Orbotech shares held by the applying shareholder after deduction of the original price that was attributed to the Cash Consideration as defined in the Capital Market Tax Ruling (in Section 3.13 of the ruling there), all pursuant to the provisions of the Ordinance. |

For this purpose, the “shares substituted for the Stock Consideration” shall be the total quantity of Orbotech shares held by the applying shareholder less the total quantity of the sold Entitled Shares (as defined in the Capital Market Tax Ruling) (the “Substituted Shares”).

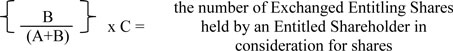

The calculation formula regarding considerations received by an Entitled Shareholder:

A – Cash Consideration

B – the value of 0.25 of a share of KLA common stock which was received according to the average of 30 trading days preceding the Closing Date

C – the number of the Company’s securities held by an Entitled Shareholder

| 3.18. | It is clarified that the cost of the Substituted Orbotech Shares, net of the cost which was attributed to the Cash Consideration (as provided in Section 3.13 of the Capital Market Tax Ruling) shall be attributed to the Allotted Shares (in the FIFO method). |

15