Compensation Committee Decision Making – Approval Procedures Overview and Market Data

The Compensation Committee takes

a broad-based approach in evaluating and making decisions with respect to executive compensation. The charter of the Compensation Committee gives the Compensation Committee full authority for determining the compensation of our executive officers,

other than the Chief Executive Officer, for whom the Compensation Committee makes recommendations to the Outside Directors for approval.

Advisor to the Compensation

Committee

The Compensation Committee retains Semler Brossy Consulting Group, LLC (“Semler Brossy”), an independent

compensation consultant, to provide the Compensation Committee with independent, objective analysis and advice on executive and director compensation matters. Semler Brossy reports directly to the Chair of the Compensation Committee and, aside from

its support of the Compensation Committee, performs no other work for the Company.

Semler Brossy generally attends all meetings of the Compensation

Committee in which evaluations of the effectiveness of overall executive compensation programs are conducted or in which compensation for executive officers is analyzed or approved. During fiscal year 2019, Semler Brossy’s duties included

providing the Compensation Committee with relevant market and industry data and analysis, as well as preparing and reviewing materials for the Compensation Committee’s meetings. In fulfilling these duties, Semler Brossy met, as

needed and at the direction of the Compensation Committee, with our Chief Executive Officer, Chief Human Resources Officer and other executive officers and members of our Human Resources department.

The Compensation Committee, in conducting its annual assessment in fiscal 2019 determined that Semler Brossy was independent and did not have any

conflicts of interest.

Approval Procedures

During

multiple meetings (both with and without Company management present) and with the assistance of Semler Brossy, the Compensation Committee engaged in extensive deliberation in developing the fiscal year 2019 executive compensation program, seeking to

establish compensation packages and target performance levels aimed at rewarding strong financial performance and long-term success of the Company. The Compensation Committee’s deliberations for all executive officers looked at a broad range of

market data (described below), individual performance reviews and total compensation reports for each officer, the historically cyclical nature of our business, internally appropriate levels and targets relative to the officer’s role, and

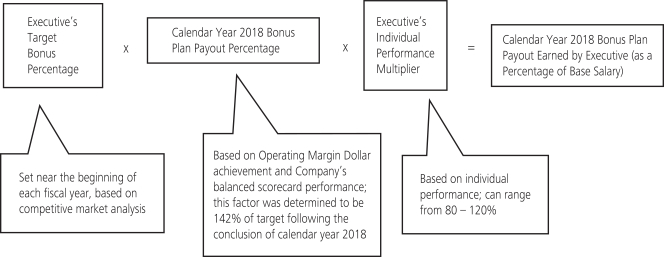

initial package recommendations from Semler Brossy and management. With regard to our Bonus Plan and the PRSUs granted to our NEOs, the proposed financial metrics and payout percentage recommendations were developed by management and approved by the

Compensation Committee, with review and guidance from Semler Brossy.

With respect to the Chief Executive Officer’s compensation, the

Compensation Committee considered recommendations prepared by Semler Brossy. Following extensive deliberation, the Compensation Committee recommended Mr. Wallace’s proposed fiscal year 2019 target compensation opportunities and RSU grants

to the Outside Directors. The Outside Directors then discussed and, in August 2018, approved Mr. Wallace’s fiscal year 2019 target compensation opportunities, PRSU and RSU grants as recommended. Mr. Wallace’s TSR Award was

approved by the Outside Directors in April 2019. Mr. Wallace was not present and did not participate in the discussions regarding his own compensation.

For the other NEOs, the Compensation Committee, after considering the performance reviews and recommendations of Mr. Wallace, as well as extensive

comparative compensation data provided by Semler Brossy, approved the target compensation opportunities, PRSU and RSU grants for the other NEOs in August 2018 and the TSR Awards in March 2019.

In each case, when establishing each element of compensation and the overall target compensation opportunities for the NEOs, the Compensation Committee

and the Outside Directors exercised their judgment based upon the data provided, and no specific formula was applied to determine the weight of each data point.

Market Data

Our ability to continue to attract and retain outstanding contributors, including our core executive team, is essential to our continuing success.

Therefore, the Compensation Committee reviews several different data sources (including the

47