UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

KLA Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Shareholder Outreach Business, Executive Compensation, and Governance Overview October 2019

Summary Proxy Highlights KLA Values Shareholder Engagement. Your perspectives are important to us, we value your feedback, and request your support ahead of our November 5th, 2019 Annual Meeting Transformational Year. Fiscal 2019 was transformational for KLA with the acquisition of Orbotech and the Board’s 2019 compensation decisions reflect an intention to drive strong outcomes for shareholders and align management pay with shareholder performance Exceptional TSR1 Performance and Track Record. KLA’s FY19 marked another successful year, and FY20 YTD performance has been very strong resulting in 1, 3, 5, and 10 year TSR1 of 80%, 144%, 241%, and 652% respectively KLA’s Compensation Program is Effective and Strategically Aligned. We aim to ensure our compensation programs are rigorous and effectively support the Company’s strategy KLA Maintains Leading Governance Practices. Our diverse and experienced Board actively engages in governance and compensation processes, ensuring effective, shareholder-friendly oversight 1 Measured with a 10/15/19 end date and assumes all dividends are reinvested

KLA’s Strategy has Consistently Driven TSR Outperformance KLA’s TSR1 has consistently outperformed the S&P 500, SOX Index, and Nasdaq over CEO’s tenure (CY06) as well as 1, 3, 5, and 10 years KLA’s TSRs for 1, 3, 5, 10 years rank in the top 15th percentile of all S&P 500 companies KLA’s 1 year TSR ranked #3 amongst all S&P 500 companies 1 TSR Calculations based on 10/15/19 closing price and assumes all dividends are reinvested

The KLA Operating Model

The KLA Operating Model - Building a Strong Foundation for the Future Focused on Driving Sustainable Profitability and Growth CONSISTENT STRATEGY AND EXECUTION Application of common processes and discipline Cascades throughout the organization Strong focus on talent development MANAGEMENT BY METRICS Culture of performance and accountability Expectation of continuous improvement Superior margins driven by market leadership and differentiation FINANCIAL DISCIPLINE AND RIGOR Exert efficiency and operating discipline in our investments Strong track record of high returns Focused on enhancing shareholder value

The KLA Operating Model Enables Sustainable Competitive Benefits Significant R&D investments drives technology leadership and creates differentiated products Home-grown, experienced management team Strong track record of effectively deploying capital and meeting deleveraging commitments Low capital requirements to efficiently operate the business Growing service business provides strong, recurring revenue Leadership positions with focus on penetration and share gains within new markets Integrating strategic acquisitions to diversify revenue streams and enhance profitable growth opportunities The KLA Operating Model instills culture of excellence with deep customer focus

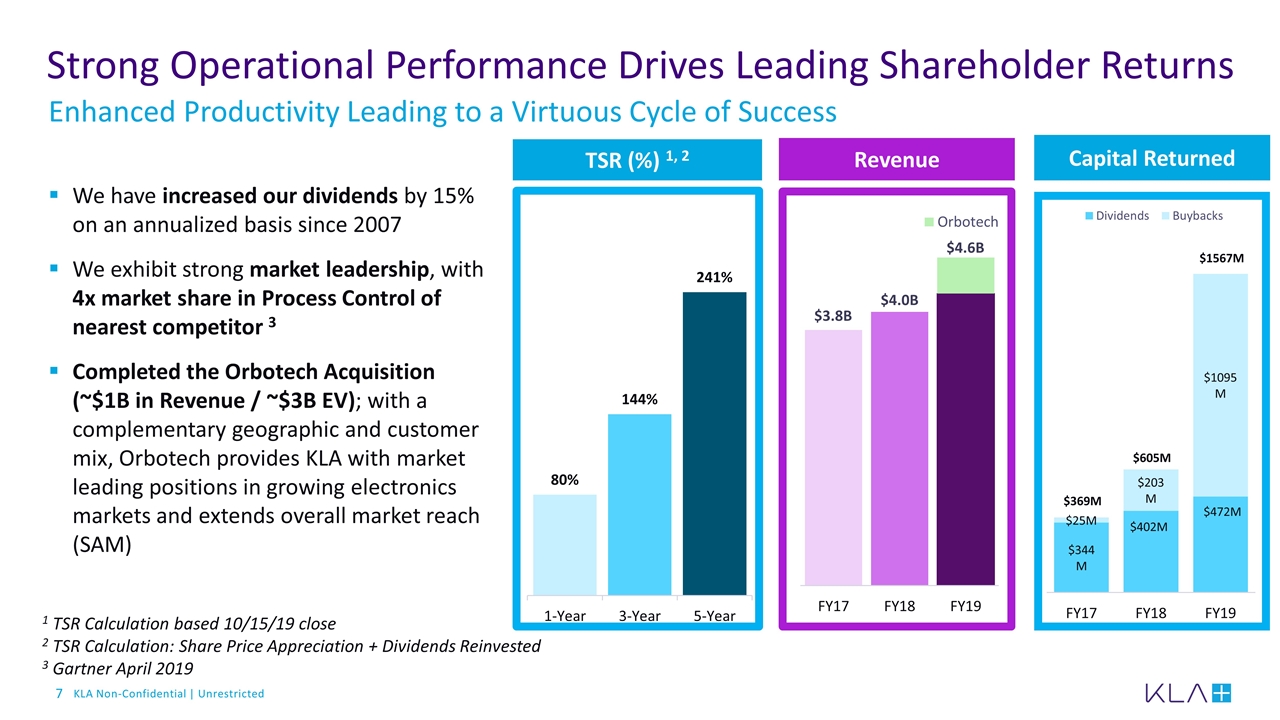

Strong Operational Performance Drives Leading Shareholder Returns Enhanced Productivity Leading to a Virtuous Cycle of Success We have increased our dividends by 15% on an annualized basis since 2007 We exhibit strong market leadership, with 4x market share in Process Control of nearest competitor 3 Completed the Orbotech Acquisition (~$1B in Revenue / ~$3B EV); with a complementary geographic and customer mix, Orbotech provides KLA with market leading positions in growing electronics markets and extends overall market reach (SAM) TSR (%) 1, 2 1 TSR Calculation based 10/15/19 close 2 TSR Calculation: Share Price Appreciation + Dividends Reinvested 3 Gartner April 2019 Revenue Capital Returned

Aligning Executives with Shareholders Drives our Compensation Philosophy

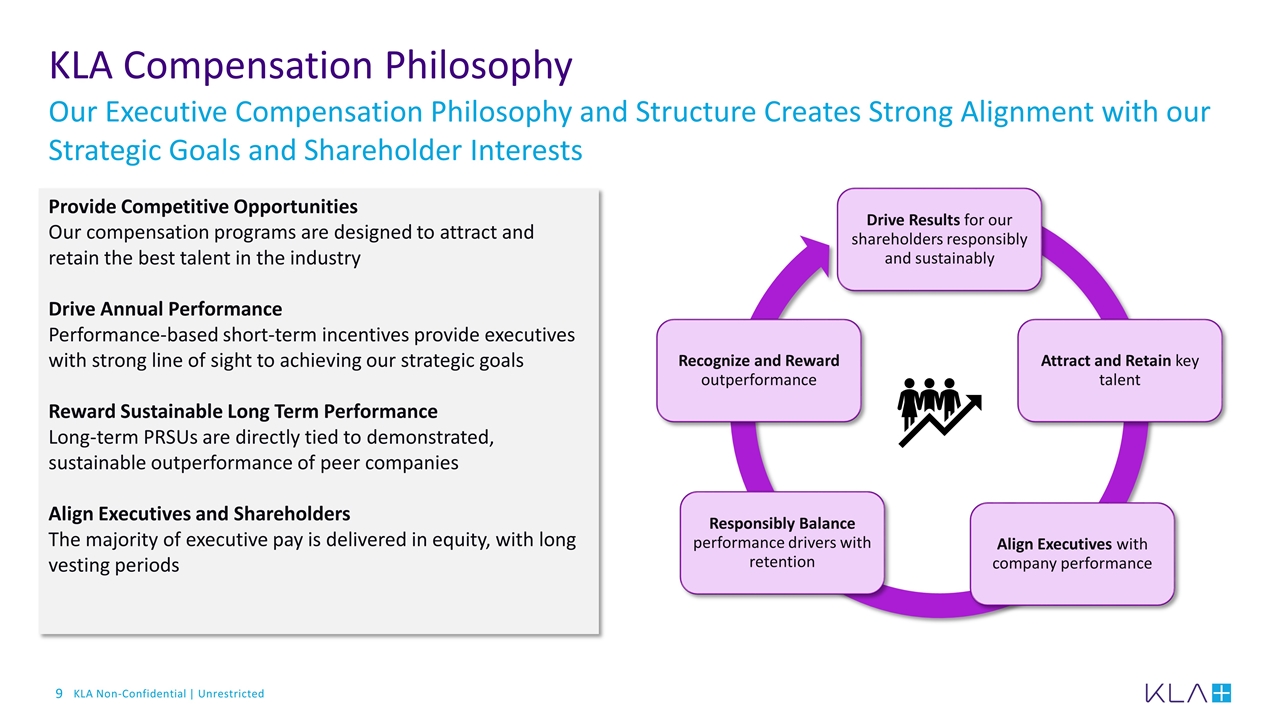

KLA Compensation Philosophy Our Executive Compensation Philosophy and Structure Creates Strong Alignment with our Strategic Goals and Shareholder Interests Provide Competitive Opportunities Our compensation programs are designed to attract and retain the best talent in the industry Drive Annual Performance Performance-based short-term incentives provide executives with strong line of sight to achieving our strategic goals Reward Sustainable Long Term Performance Long-term PRSUs are directly tied to demonstrated, sustainable outperformance of peer companies Align Executives and Shareholders The majority of executive pay is delivered in equity, with long vesting periods Drive Results for our shareholders responsibly and sustainably Attract and Retain key talent Align Executives with company performance Responsibly Balance performance drivers with retention Recognize and Reward outperformance

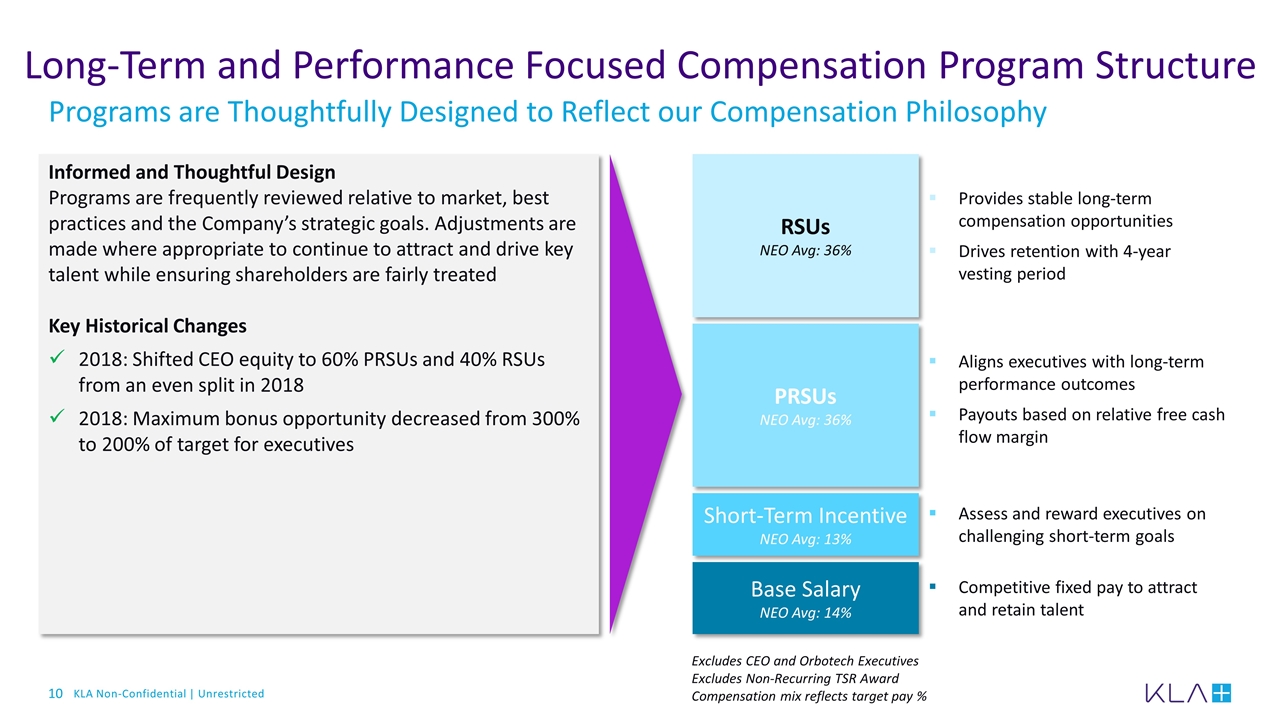

Long-Term and Performance Focused Compensation Program Structure Programs are Thoughtfully Designed to Reflect our Compensation Philosophy Informed and Thoughtful Design Programs are frequently reviewed relative to market, best practices and the Company’s strategic goals. Adjustments are made where appropriate to continue to attract and drive key talent while ensuring shareholders are fairly treated Key Historical Changes 2018: Shifted CEO equity to 60% PRSUs and 40% RSUs from an even split in 2018 2018: Maximum bonus opportunity decreased from 300% to 200% of target for executives Base Salary NEO Avg: 14% Short-Term Incentive NEO Avg: 13% RSUs NEO Avg: 36% PRSUs NEO Avg: 36% Provides stable long-term compensation opportunities Drives retention with 4-year vesting period Aligns executives with long-term performance outcomes Payouts based on relative free cash flow margin Assess and reward executives on challenging short-term goals Competitive fixed pay to attract and retain talent Excludes CEO and Orbotech Executives Excludes Non-Recurring TSR Award Compensation mix reflects target pay %

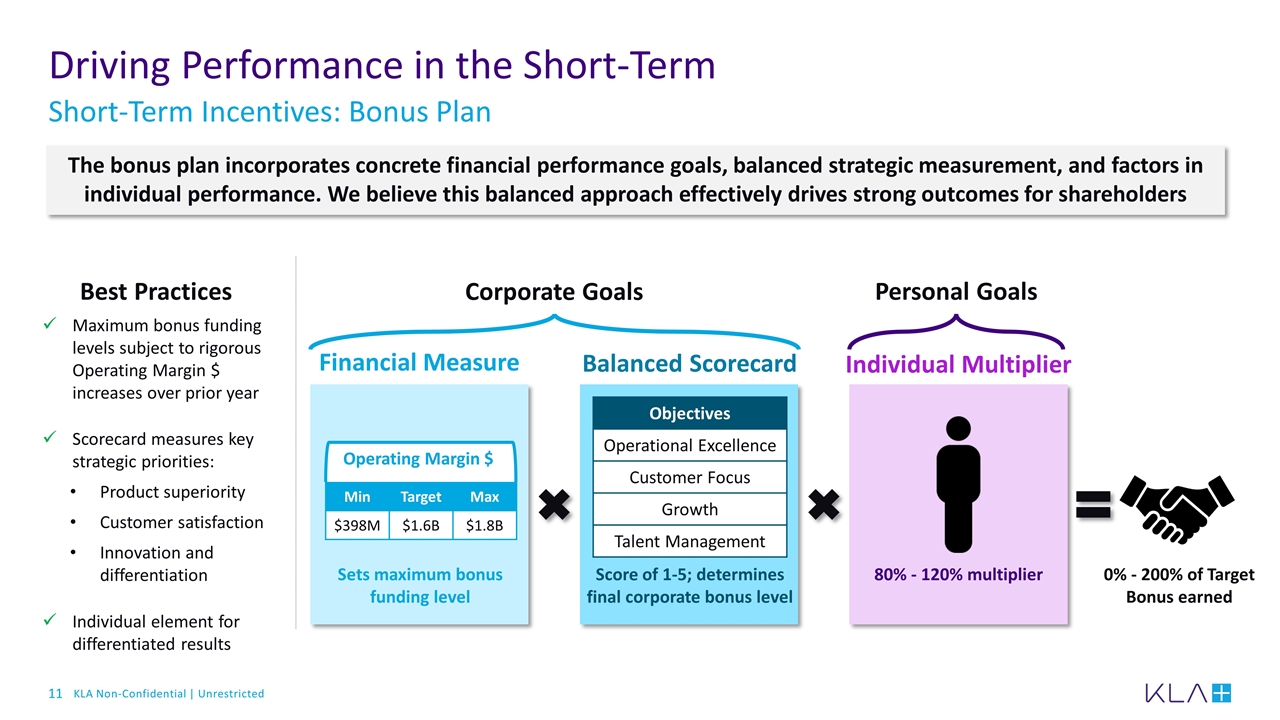

Driving Performance in the Short-Term Short-Term Incentives: Bonus Plan Min Target Max $398M $1.6B $1.8B Operating Margin $ Financial Measure Balanced Scorecard Objectives Operational Excellence Customer Focus Growth Talent Management Score of 1-5; determines final corporate bonus level 80% - 120% multiplier Corporate Goals Individual Multiplier Sets maximum bonus funding level Personal Goals 0% - 200% of Target Bonus earned The bonus plan incorporates concrete financial performance goals, balanced strategic measurement, and factors in individual performance. We believe this balanced approach effectively drives strong outcomes for shareholders Maximum bonus funding levels subject to rigorous Operating Margin $ increases over prior year Scorecard measures key strategic priorities: Product superiority Customer satisfaction Innovation and differentiation Individual element for differentiated results Best Practices

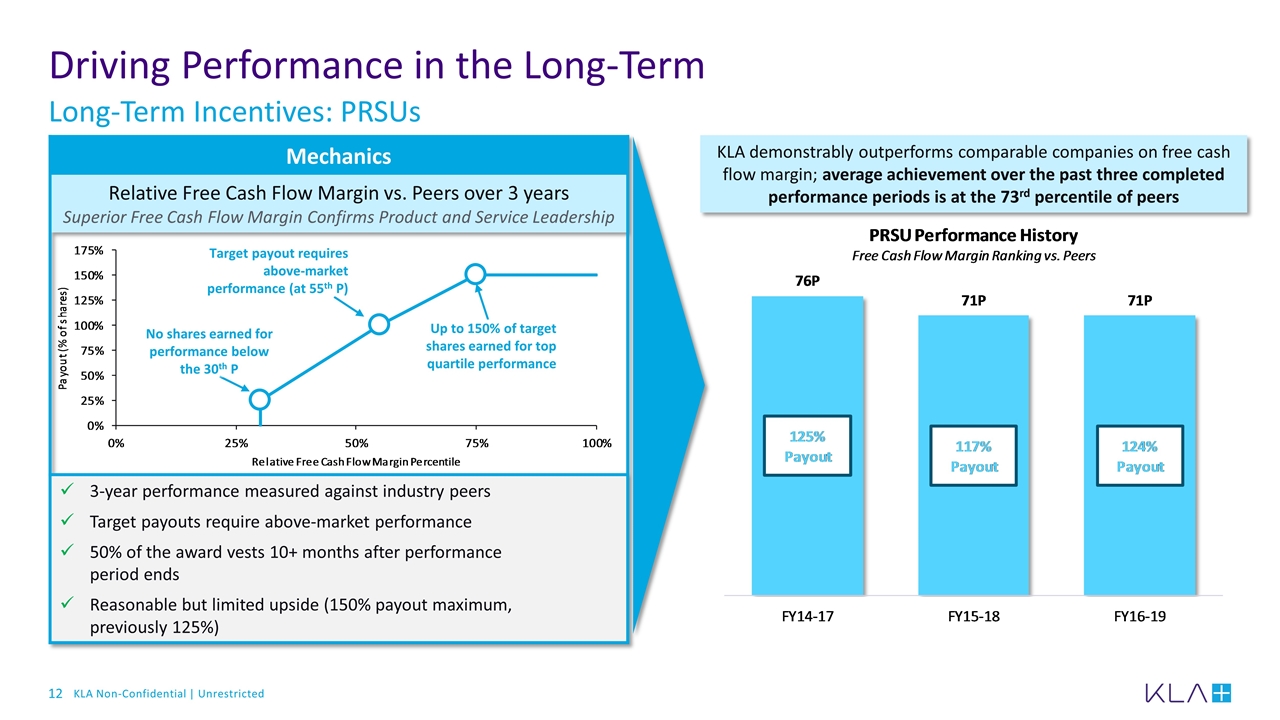

Mechanics Relative Free Cash Flow Margin vs. Peers over 3 years Superior Free Cash Flow Margin Confirms Product and Service Leadership 3-year performance measured against industry peers Target payouts require above-market performance 50% of the award vests 10+ months after performance period ends Reasonable but limited upside (150% payout maximum, previously 125%) Driving Performance in the Long-Term Long-Term Incentives: PRSUs No shares earned for performance below the 30th P Target payout requires above-market performance (at 55th P) Up to 150% of target shares earned for top quartile performance KLA demonstrably outperforms comparable companies on free cash flow margin; average achievement over the past three completed performance periods is at the 73rd percentile of peers

Special TSR Awards

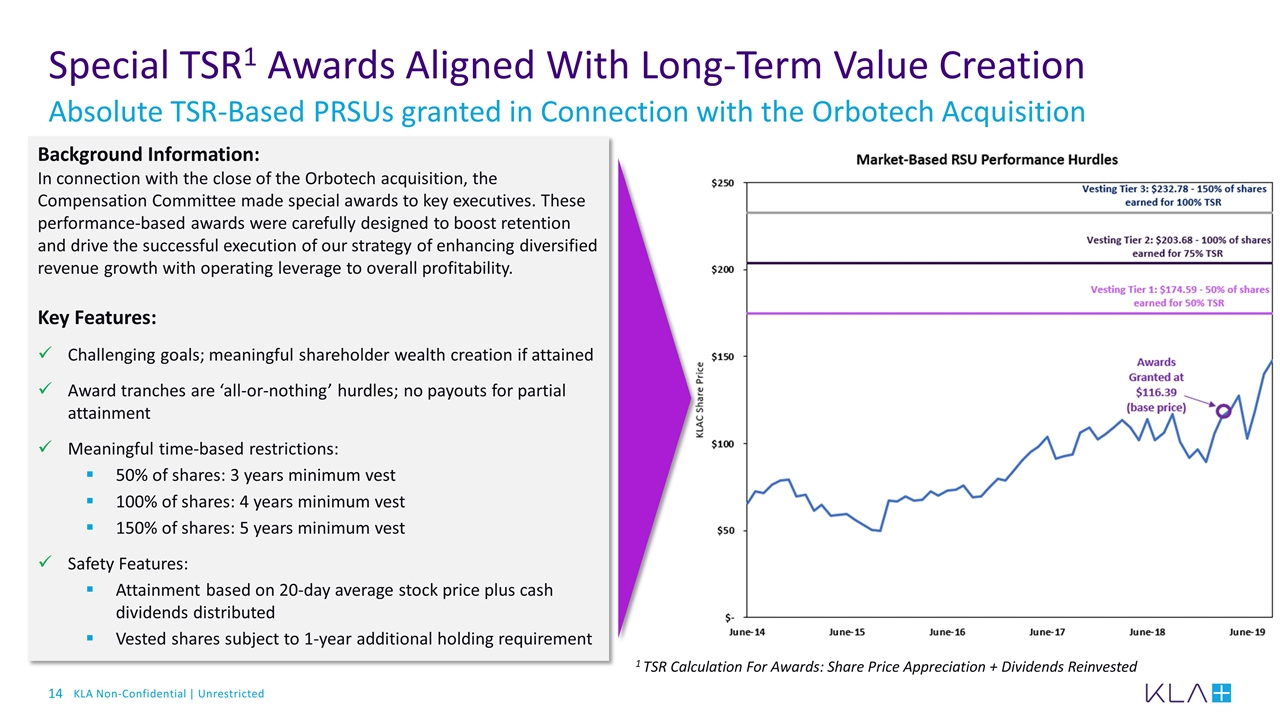

Special TSR1 Awards Aligned With Long-Term Value Creation Absolute TSR-Based PRSUs granted in Connection with the Orbotech Acquisition Background Information: In connection with the close of the Orbotech acquisition, the Compensation Committee made special awards to key executives. These performance-based awards were carefully designed to boost retention and drive the successful execution of our strategy of enhancing diversified revenue growth with operating leverage to overall profitability. Key Features: Challenging goals; meaningful shareholder wealth creation if attained Award tranches are ‘all-or-nothing’ hurdles; no payouts for partial attainment Meaningful time-based restrictions: 50% of shares: 3 years minimum vest 100% of shares: 4 years minimum vest 150% of shares: 5 years minimum vest Safety Features: Attainment based on 20-day average stock price plus cash dividends distributed Vested shares subject to 1-year additional holding requirement 1 TSR Calculation For Awards: Share Price Appreciation + Dividends Reinvested

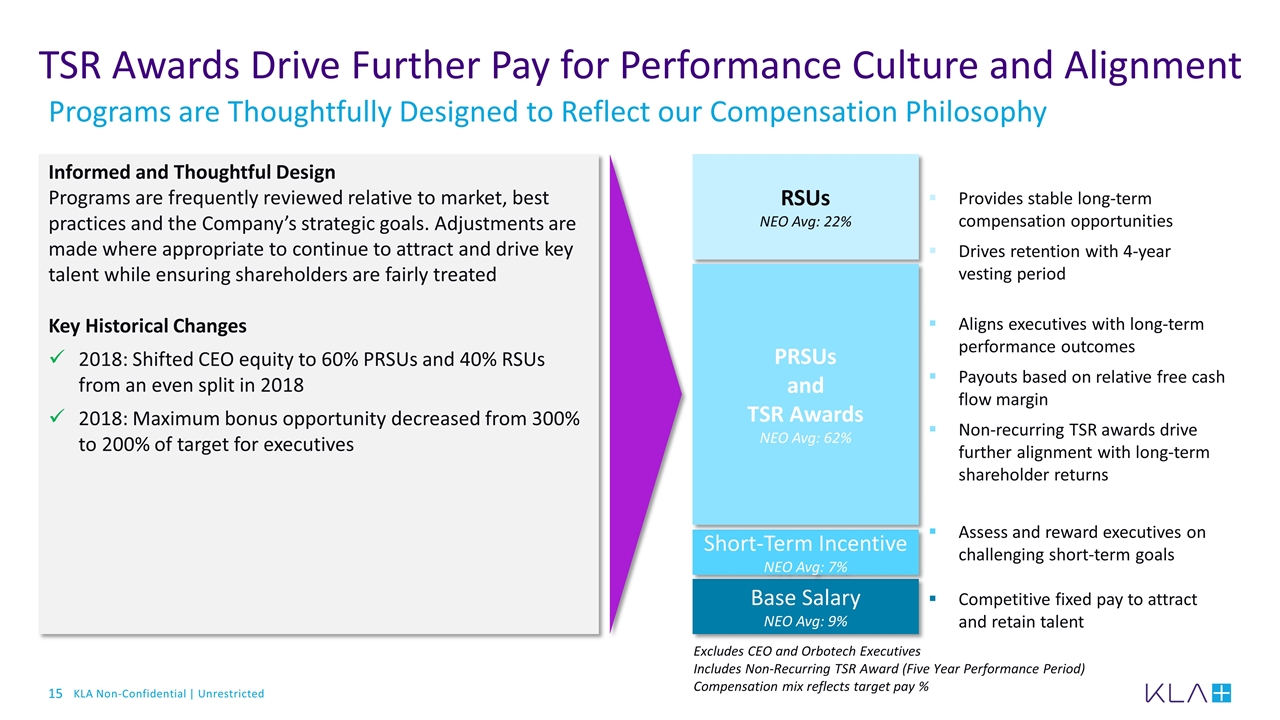

TSR Awards Drive Further Pay for Performance Culture and Alignment Programs are Thoughtfully Designed to Reflect our Compensation Philosophy Informed and Thoughtful Design Programs are frequently reviewed relative to market, best practices and the Company’s strategic goals. Adjustments are made where appropriate to continue to attract and drive key talent while ensuring shareholders are fairly treated Key Historical Changes 2018: Shifted CEO equity to 60% PRSUs and 40% RSUs from an even split in 2018 2018: Maximum bonus opportunity decreased from 300% to 200% of target for executives Base Salary NEO Avg: 9% Short-Term Incentive NEO Avg: 7% RSUs NEO Avg: 22% PRSUs and TSR Awards NEO Avg: 62% Provides stable long-term compensation opportunities Drives retention with 4-year vesting period Aligns executives with long-term performance outcomes Payouts based on relative free cash flow margin Non-recurring TSR awards drive further alignment with long-term shareholder returns Assess and reward executives on challenging short-term goals Competitive fixed pay to attract and retain talent Excludes CEO and Orbotech Executives Includes Non-Recurring TSR Award (Five Year Performance Period) Compensation mix reflects target pay %

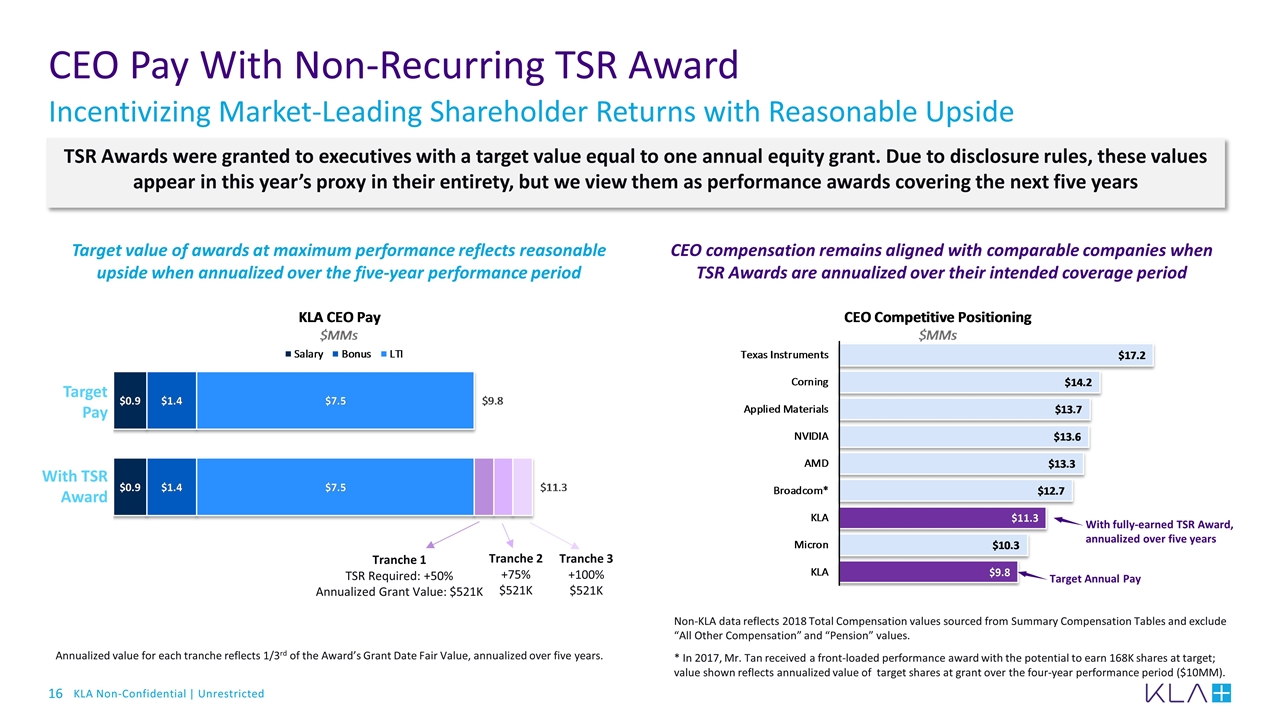

CEO Pay With Non-Recurring TSR Award Incentivizing Market-Leading Shareholder Returns with Reasonable Upside TSR Awards were granted to executives with a target value equal to one annual equity grant. Due to disclosure rules, these values appear in this year’s proxy in their entirety, but we view them as performance awards covering the next five years Non-KLA data reflects 2018 Total Compensation values sourced from Summary Compensation Tables and exclude “All Other Compensation” and “Pension” values. * In 2017, Mr. Tan received a front-loaded performance award with the potential to earn 168K shares at target; value shown reflects annualized value of target shares at grant over the four-year performance period ($10MM). CEO compensation remains aligned with comparable companies when TSR Awards are annualized over their intended coverage period Target value of awards at maximum performance reflects reasonable upside when annualized over the five-year performance period Target Annual Pay With fully-earned TSR Award, annualized over five years Target Pay With TSR Award Annualized value for each tranche reflects 1/3rd of the Award’s Grant Date Fair Value, annualized over five years. Tranche 1 TSR Required: +50% Annualized Grant Value: $521K Tranche 2 +75% $521K Tranche 3 +100% $521K

KLA Has Leading Governance Practices

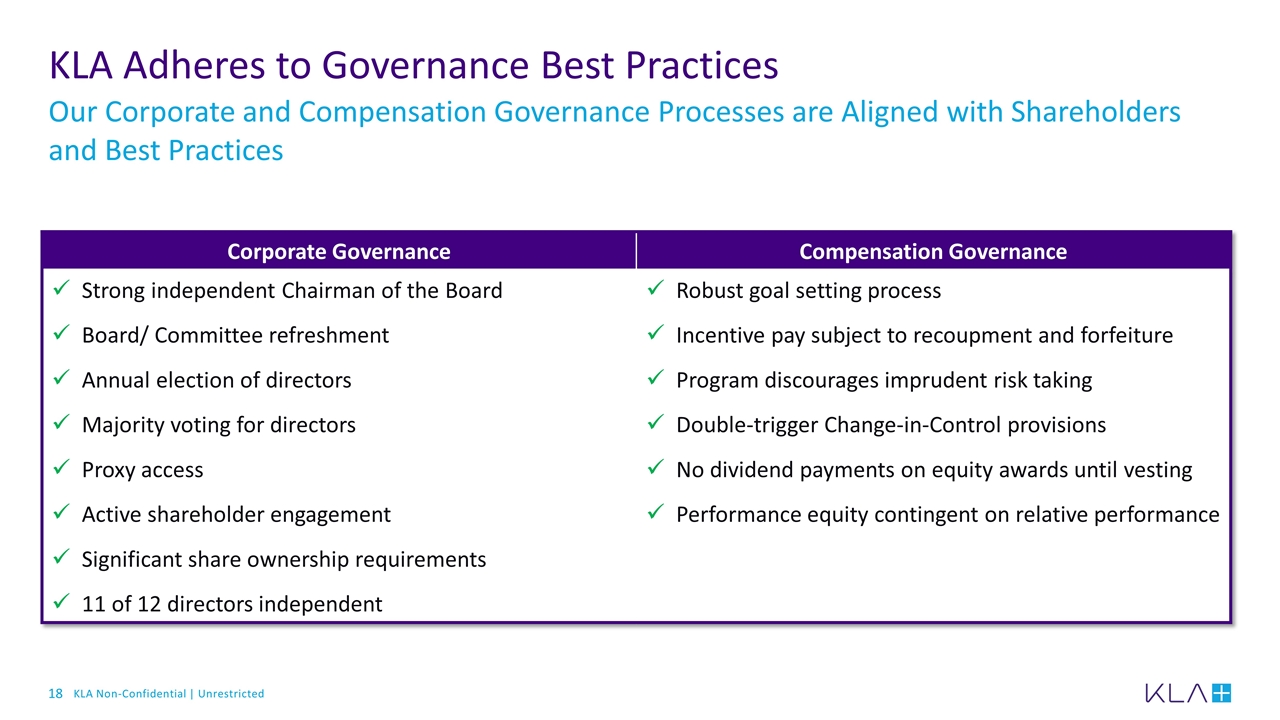

KLA Adheres to Governance Best Practices Our Corporate and Compensation Governance Processes are Aligned with Shareholders and Best Practices Corporate Governance Compensation Governance Strong independent Chairman of the Board Board/ Committee refreshment Annual election of directors Majority voting for directors Proxy access Active shareholder engagement Significant share ownership requirements 11 of 12 directors independent Robust goal setting process Incentive pay subject to recoupment and forfeiture Program discourages imprudent risk taking Double-trigger Change-in-Control provisions No dividend payments on equity awards until vesting Performance equity contingent on relative performance

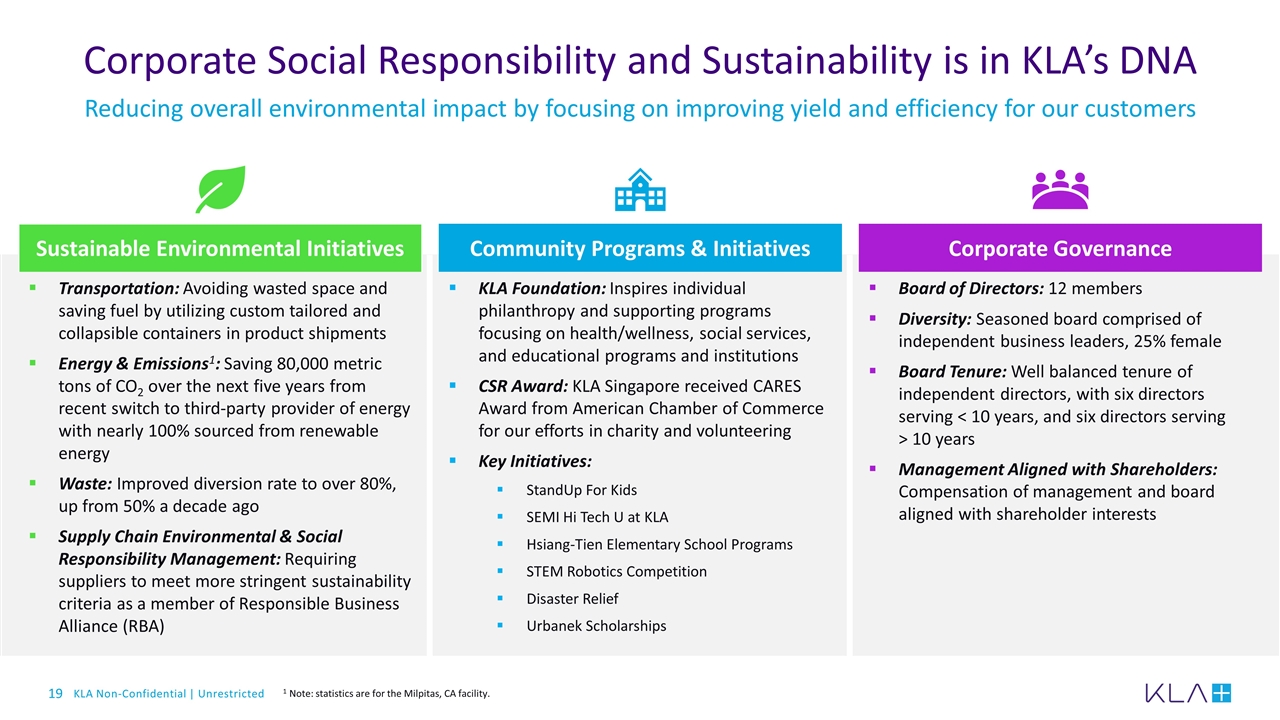

Corporate Social Responsibility and Sustainability is in KLA’s DNA Reducing overall environmental impact by focusing on improving yield and efficiency for our customers Sustainable Environmental Initiatives Transportation: Avoiding wasted space and saving fuel by utilizing custom tailored and collapsible containers in product shipments Energy & Emissions1: Saving 80,000 metric tons of CO2 over the next five years from recent switch to third-party provider of energy with nearly 100% sourced from renewable energy Waste: Improved diversion rate to over 80%, up from 50% a decade ago Supply Chain Environmental & Social Responsibility Management: Requiring suppliers to meet more stringent sustainability criteria as a member of Responsible Business Alliance (RBA) Community Programs & Initiatives KLA Foundation: Inspires individual philanthropy and supporting programs focusing on health/wellness, social services, and educational programs and institutions CSR Award: KLA Singapore received CARES Award from American Chamber of Commerce for our efforts in charity and volunteering Key Initiatives: StandUp For Kids SEMI Hi Tech U at KLA Hsiang-Tien Elementary School Programs STEM Robotics Competition Disaster Relief Urbanek Scholarships Corporate Governance Board of Directors: 12 members Diversity: Seasoned board comprised of independent business leaders, 25% female Board Tenure: Well balanced tenure of independent directors, with six directors serving < 10 years, and six directors serving > 10 years Management Aligned with Shareholders: Compensation of management and board aligned with shareholder interests 1 Note: statistics are for the Milpitas, CA facility.

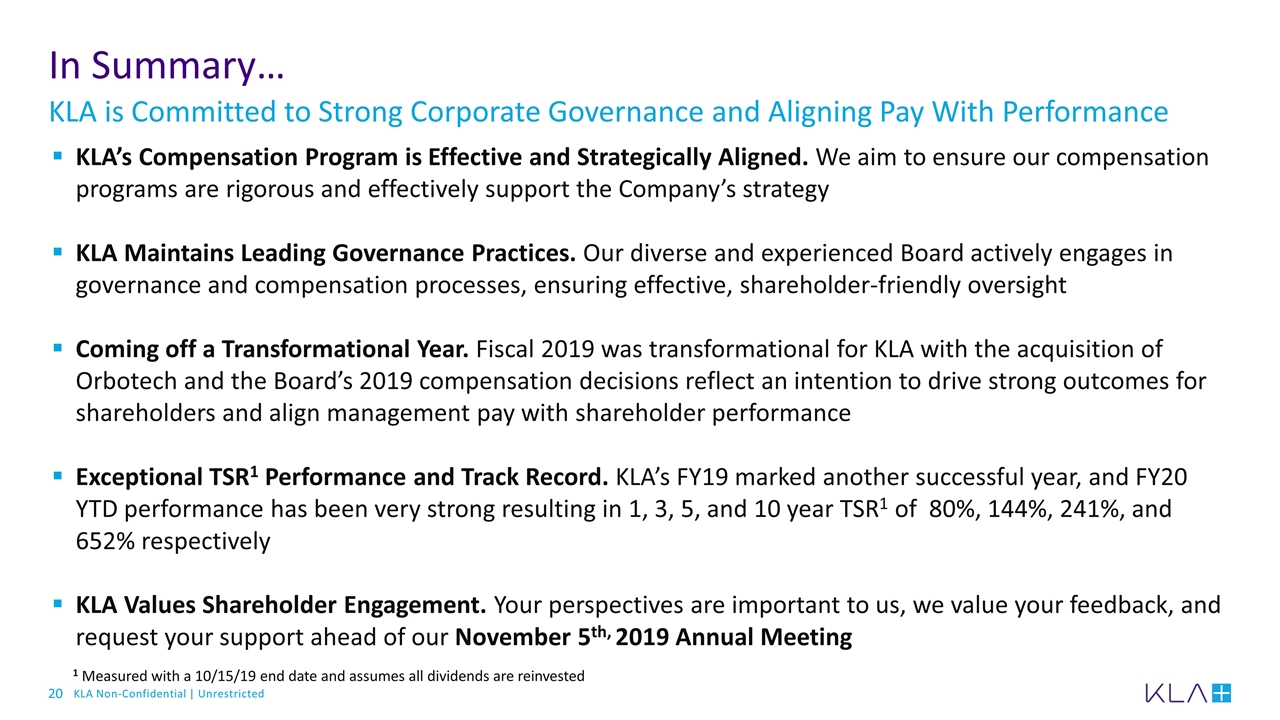

In Summary… KLA’s Compensation Program is Effective and Strategically Aligned. We aim to ensure our compensation programs are rigorous and effectively support the Company’s strategy KLA Maintains Leading Governance Practices. Our diverse and experienced Board actively engages in governance and compensation processes, ensuring effective, shareholder-friendly oversight Coming off a Transformational Year. Fiscal 2019 was transformational for KLA with the acquisition of Orbotech and the Board’s 2019 compensation decisions reflect an intention to drive strong outcomes for shareholders and align management pay with shareholder performance Exceptional TSR1 Performance and Track Record. KLA’s FY19 marked another successful year, and FY20 YTD performance has been very strong resulting in 1, 3, 5, and 10 year TSR1 of 80%, 144%, 241%, and 652% respectively KLA Values Shareholder Engagement. Your perspectives are important to us, we value your feedback, and request your support ahead of our November 5th, 2019 Annual Meeting KLA is Committed to Strong Corporate Governance and Aligning Pay With Performance 1 Measured with a 10/15/19 end date and assumes all dividends are reinvested

We Value And Appreciate Your Support On or Before November 5, 2019