A-

11

10.14 Titles and Headings. The titles and headings in the Plan are for convenience of reference only and, if any conflict, the Plan’s text, rather than such titles or headings, will control.

10.15 Conformity to Securities Laws. Participant acknowledges that the Plan is intended to conform to the extent necessary with Applicable Laws. Notwithstanding anything herein to the contrary, the Plan and all Awards will be administered only in conformance with Applicable Laws. To the extent Applicable Laws permit, the Plan and all Award Agreements will be deemed amended as necessary to conform to Applicable Laws.

10.16 Unfunded Status of Awards. The Plan is intended to be an “unfunded” plan for incentive compensation. With respect to any payments not yet made to a Participant pursuant to an Award, nothing contained in the Plan or any Award Agreement shall give the Participant any rights that are greater than those of a general creditor of the Company or any Subsidiary.

10.17 Relationship to Other Benefits. No payment under the Plan will be taken into account in determining any benefits under any pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company or any Subsidiary except as expressly provided in writing in such other plan or an agreement thereunder.

ARTICLE XI.

DEFINITIONS

As used in the Plan, the following words and phrases will have the following meanings:

11.1 “Administrator” means the Board or a Committee to the extent that the Board’s powers or authority under the Plan have been delegated to such Committee. Notwithstanding anything herein to the contrary, the Board shall conduct the general administration of the Plan with respect to Awards granted to non-employee Directors and, with respect to such Awards, the term “Administrator” as used in the Plan shall mean and refer to the Board.

11.2 “Agent” means the brokerage firm, bank or other financial institution, entity or person(s), if any, engaged, retained, appointed or authorized to act as the agent of the Company or a Participant with regard to the Plan.

11.3 “Applicable Laws” means the requirements relating to the administration of equity incentive plans under U.S. federal and state securities, tax and other applicable laws, rules and regulations, the applicable rules of any stock exchange or quotation system on which the Common Stock is listed or quoted and the applicable laws and rules of any foreign country or other jurisdiction where Awards are granted.

11.4 “Award” means, individually or collectively, a grant under the Plan of Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Dividend Equivalents, or Other Stock or Cash Based Awards.

11.5 “Award Agreement” means a written agreement evidencing an Award, which may be electronic, that contains such terms and conditions as the Administrator determines, consistent with and subject to the terms and conditions of the Plan.

11.6 “Board” means the Board of Directors of the Company.

11.7 “Cause” means, in respect of a Participant, either (i) the definition of “Cause” contained in the Participant’s Award Agreement or an effective, written service or employment agreement between the Participant and the Company or a Subsidiary of the Company; or (ii) if no such agreement exists or such agreement does not define Cause, then Cause shall mean (A) the Participant’s unauthorized use or disclosure of confidential information or trade secrets of the Company or any of its Subsidiaries or any material breach of a written agreement between the Participant and the Company or any of its Subsidiaries, including without limitation a material breach of any employment, confidentiality, non-compete, non-solicit or similar agreement; (B) the Participant’s commission of, indictment for or the entry of a plea of guilty or nolo contendere by the Participant to, a felony under the laws of the United States or any state thereof or any crime involving dishonesty or moral turpitude (or any similar crime in any jurisdiction outside the United States); (C) the Participant’s negligence or willful misconduct in the performance of the Participant’s duties or the Participant’s willful or repeated failure or refusal to substantially perform assigned duties; (D) any act of fraud, embezzlement, material misappropriation or dishonesty committed by the Participant against the Company or any of its Subsidiaries; or (E) any acts, omissions or statements by a Participant which the Company determines to be materially detrimental or damaging to the reputation, operations, prospects or business relations of the Company or any of its Subsidiaries. The findings and decision of the Administrator with respect to any Cause determination will be final and binding for all purposes.

11.8 “Change in Control” means the occurrence of any of the following events, in one or a series of related transactions:

(a) any “person,” as such term is used in Sections 13(d) and 14(d) of the Exchange Act, other than the Company, a Subsidiary of the Company or a Company employee benefit plan, including any trustee of such plan acting as trustee, is or

| 2023 Proxy Statement

| 2023 Proxy Statement

| 2023 Proxy Statement

| 2023 Proxy Statement

Notice of Annual Meeting of

Notice of Annual Meeting of

Corporate Governance Standards

Corporate Governance Standards

FOR

FOR

Committees*

Committees*

Ansys, Inc.

Ansys, Inc.

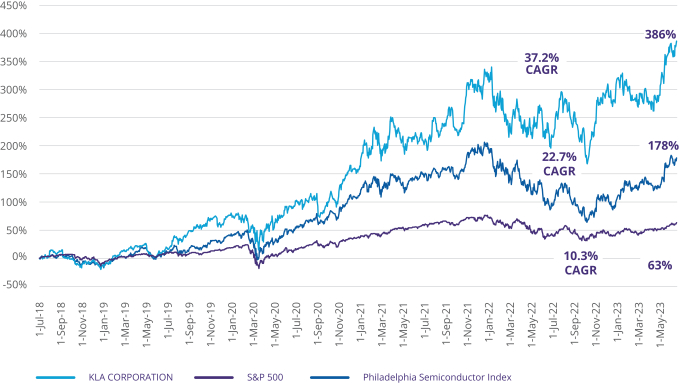

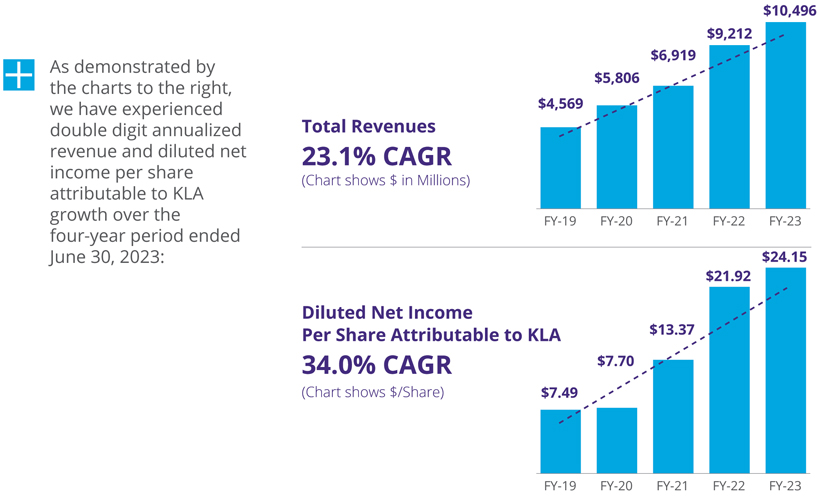

Fiscal Year 2023

Fiscal Year 2023  13.9% from FY22

13.9% from FY22 62.9% from FY22

62.9% from FY22 Proposal One: Election of

Proposal One: Election of

Information About the

Information About the

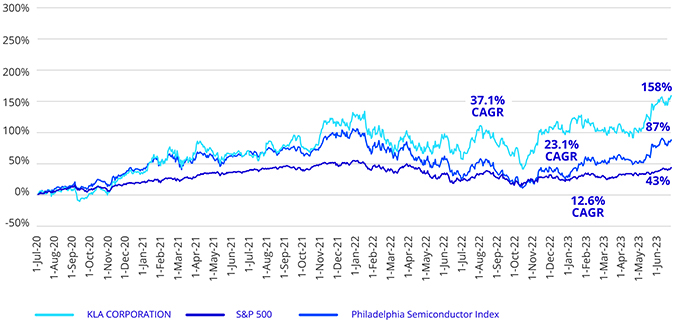

62.9% from FY22

62.9% from FY22

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.