☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

☒ No fee required. | ||||

☐ Fee paid previously with preliminary materials. | ||||

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

Cautionary Statement Regarding Forward-Looking Statements

This proxy statement contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact may be forward-looking statements. You can identify these and other forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expects,” “plans,” “anticipates,” “relies,” “believes,” “estimates,” “predicts,” “intends,” “potential,” “continues,” “thinks,” “seeks,” “commits,” “targets,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements, including unexpected delays, difficulties, and expenses in executing against our environmental, climate, diversity and inclusion or other Environmental, Social, and Governance (ESG) targets, goals and commitments outlined in this document, including, but not limited to, our efforts to reduce our greenhouse gas emissions, as well as changes in laws or regulations affecting us, such as changes in cybersecurity, data privacy, environmental, safety and health laws, and other risks as disclosed in our most recent annual report on Form 10-K and other filings with the Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements, and we expressly assume no obligation and do not intend to update the forward-looking statements in this report after the date hereof. In addition, some of the statements contained in this proxy statement may rely on third-party information and projections that management believes to be reputable; however, we do not independently verify or audit this information, and any inaccuracies or deviations in such information and projections may materially impact our ability to execute on our strategy, achieve our goals, or otherwise adversely impact our business.

This proxy statement contains ESG-related statements based on hypothetical scenarios and assumptions as well as estimates that are subject to a high level of uncertainty, and these statements should not necessarily be viewed as being representative of current or actual risk or performance, or forecasts of expected risk or performance. In addition, historical, current, and forward-looking environmental and social-related statements may be based on standards for measuring progress that are still developing, and internal controls and processes that continue to evolve. Forward-looking and other statements in this report, including regarding our corporate responsibility and sustainability progress, plans, and goals, are in some instances informed by various stakeholder expectations, including certain third-party standards and frameworks; as such, the inclusion of such statements is not an indication that these matters are necessarily material for the purposes of complying with or reporting pursuant to the U.S. federal securities laws and regulations, even if we use the word “material” or “materiality” in this report or elsewhere. We cannot guarantee strict adherence to framework recommendations or that our approach will strictly align with the preferences of any particular stakeholder. Our disclosures may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policy, or other factors, some of which may be beyond our control. In addition, non-financial information, such as that included in parts of this proxy statement, is subject to greater potential limitations than financial information, given the methods used for calculating or estimating such information. Historical, current, and forward-looking environmental and social-related statements are also based on standards and metrics, as well as standards for the preparation of any underlying data for those metrics, that are still developing and internal controls and processes that continue to evolve. For example, we note that standards and expectations regarding greenhouse gas (GHG) accounting and the processes for measuring and counting GHG emissions and GHG emission reductions are evolving, and it is possible that our approaches both to measuring our emissions and to reducing emissions and measuring those reductions may be, either currently by some stakeholders or at some point in the future, considered inconsistent with common or best practices with respect to measuring and accounting for such matters, and reducing overall emissions. While these are based on expectations and assumptions believed to be reasonable at the time of preparation, they should not be considered guarantees. If our approaches to such matters are perceived to fall out of step with common or best practice, we may be subject to additional scrutiny, criticism, regulatory and investor engagement or litigation, any of which may adversely impact our business, financial condition, or results of operations. Separately, the standards and performance metrics used, and the expectations and assumptions they are based on, have not, unless otherwise expressly specified, been verified by us or any third party.

Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

| 2024 Proxy Statement

| 2024 Proxy Statement

i

Notice of Annual Meeting of

Notice of Annual Meeting of

Stockholders

September 24, 2024

To our stockholders:

YOUR VOTE IS IMPORTANT

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of KLA Corporation (“KLA,” “we,” “us,” “our” or the “Company”), a Delaware corporation, will be held on Wednesday, November 6, 2024, at 12:00 p.m. PST, in the Plus Building of our Milpitas headquarters, located at One Technology Drive, Milpitas, California 95035, for the following purposes:

| 1. | To elect the nine candidates nominated by our Board of Directors (the “Board”) to serve as directors for one-year terms, each until his or her successor is duly elected and qualified. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2025. |

| 3. | To approve on a non-binding, advisory basis our named executive officer compensation. |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on September 12, 2024, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the Annual Meeting at the Company’s offices at One Technology Drive, Milpitas, California 95035.

For admission to the Annual Meeting, stockholders should come to the stockholder check-in table. Those who hold shares of our common stock in their own names should provide identification and have their ownership verified against the list of registered stockholders as of the close of business on the record date, September 12, 2024. Those who have beneficial ownership of stock through a broker, bank or other nominee must bring account statements or letters from the broker, bank or other nominee indicating that they owned our common stock as of the close of business on the record date, September 12, 2024. To vote at the meeting, those who have beneficial ownership of stock through a broker, bank or other nominee must bring a legal proxy, which can be obtained only from the broker, bank or other nominee.

| Sincerely,

|

||||||||||

|

|

Richard P. Wallace President and Chief Executive Officer Milpitas, California |

|

|

|

|

This Notice of Annual Meeting of Stockholders, Proxy Statement and form of proxy are being made available electronically and mailed on or about September 24, 2024.

|

All stockholders are cordially invited to attend the Annual Meeting in person; however, regardless of whether you expect to attend the Annual Meeting in person, we encourage you to vote as soon as possible. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the Annual Meeting regardless of whether you attend in person.

|

| 2024 Proxy Statement

| 2024 Proxy Statement

ii | Table of Contents

Table of Contents

Table of Contents

| 1 | ||

| 3 |

||

| 4 | ||

| 5 |

||

| 5 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 7 |

||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 10 | ||

| 11 | ||

| 12 |

||

| 20 | ||

| 23 | ||

| 23 |

||

| 23 | ||

| 23 |

||

| 23 | ||

| 23 | ||

| 23 | ||

| 24 |

Standards of Business Conduct; Whistleblower Hotline and Website | |

| 24 | ||

| 24 |

Compensation and Talent Committee Interlocks and Insider Participation | |

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 32 | ||

| 32 | ||

| 32 |

||

| 33 |

Proposal Three: Approval of Our Named Executive Officer Compensation | |

| 34 | ||

| 38 |

Security Ownership of Certain Beneficial Owners and Management | |

| 38 | ||

| 39 | ||

| 40 |

||

| 40 | ||

| 40 | ||

| 40 | ||

| 2024 Proxy Statement

| 2024 Proxy Statement

iii

| 62 |

||

| 64 | ||

| 64 | ||

| 66 |

||

| 71 | ||

| 74 |

||

| 75 |

||

| 76 | ||

| 77 | ||

| 83 |

Information for KLA Annual Meeting of Stockholders on November 6, 2024, 12:00 p.m. PST | |

Helpful Resources

Annual Meeting

Proxy Statement & Annual Report

Board of Directors

Investor Relations

Environmental Social Governance (ESG)

Governance Documents

Corporate governance documents and policies, including:

Corporate Governance Standards

Corporate Governance Standards

Committee Charters

Committee Charters

Standards of Business Conduct

Standards of Business Conduct

| 2024 Proxy Statement

| 2024 Proxy Statement

1

Proxy Summary

Proxy Summary

This summary does not contain all of the information you should consider when casting your vote. You should read the complete Proxy Statement before voting.

|

ANNUAL MEETING OF STOCKHOLDERS

|

||||||||||||||

|

|

Time and Date

12:00 p.m. PST November 6, 2024 |

|

Place

One Technology Drive, Milpitas, California 95035 |

|

Record Date

Close of business on September 12, 2024 |

|||||||||

|

STOCKHOLDER VOTING MATTERS

|

||||||||||||||

| Proposal |

Board’s Voting Recommendation |

Page Reference |

||||||||||||

|

|

Election of 9 Directors Named in this Proxy Statement |

|

FOR

FOREach Nominee |

|

4 | |||||||||

|

|

Ratification of Appointment of our Independent Registered Public Accounting Firm |

FOR

FOR |

31 | |||||||||||

|

|

Advisory Vote to Approve Named Executive Officer Compensation |

FOR

FOR |

33 | |||||||||||

| 2024 Proxy Statement

| 2024 Proxy Statement

2 | Proxy Summary

OUR DIRECTORS

| Directors and Principal Occupation |

Director Since |

Current Other Public Company Boards |

Committees*

Committees*

| |||||||||||

| Independent | Age | AC | CTC | NGC | ||||||||||

| Robert Calderoni Former Chairman and Interim President and Chief Executive Officer of Citrix Systems, Inc. |

Yes | 64 | 2007 |

|

🌑 | Chair | ||||||||

| Jeneanne Hanley Former Senior Vice President and President of E-Systems Division of Lear Corporation |

Yes | 51 | 2019 |

|

🌑 | |||||||||

| Emiko Higashi Founder of Tohmon Capital Partners, LLC |

Yes | 65 | 2010 |

|

🌑 | |||||||||

| Kevin Kennedy Former Chairman of Quanergy Systems, Inc. |

Yes | 68 | 2007 |

|

🌑 | 🌑 | ||||||||

| Michael McMullen Senior Advisor of Agilent Technologies, Inc. |

Yes | 63 | 2023 |

|

🌑 | |||||||||

| Gary Moore Former Executive Chairman and Chief Executive Officer of ServiceSource International, Inc. |

Yes | 75 | 2014 |

|

Chair | 🌑 | ||||||||

| Marie Myers** Executive Vice President and Chief Financial Officer of Hewlett Packard Enterprise Company |

Yes | 56 | 2020 |

|

Chair |

🌑 | ||||||||

| Victor Peng Former President, Adaptive, Embedded, and AI Group of Advanced Micro Devices, Inc. |

Yes | 64 | 2019 |

|

🌑 | |||||||||

| Robert Rango Former President and Chief Executive Officer of Enevate Corporation |

Yes | 66 | 2014 |

|

🌑 | |||||||||

| Richard Wallace President and Chief Executive Officer of KLA Corporation |

No | 64 | 2006 |

|

||||||||||

* As of September 12, 2024

** Ms. Myers is not standing for reelection to the Board at the Annual Meeting.

AC = Audit Committee CTC = Compensation and Talent Committee NGC = Nominating and Governance Committee

| 2024 Proxy Statement

| 2024 Proxy Statement

3

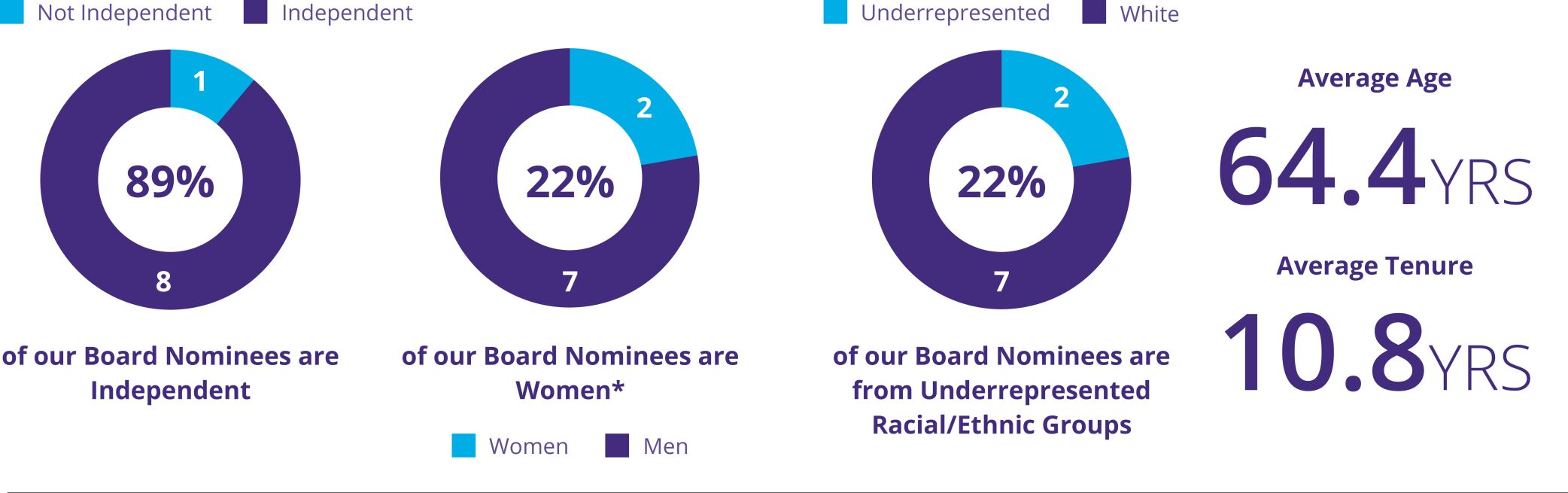

GOVERNANCE HIGHLIGHTS

| Board and Governance Information** |

||||||||

| Size of the Board |

9 | Independent Chair | Yes | |||||

| Number of Independent Directors |

8 | Proxy Access | Yes | |||||

| Average Age of Directors |

64.4 | Stockholder Action by Written Consent | No | |||||

| Average Tenure of Directors |

10.8 years | Stockholder Ability to Call Special Meeting | No | |||||

| Annual Election of Directors |

Yes | Poison Pill | No | |||||

| Women |

22% | Stock Ownership Guidelines for Directors and Executive Officers | Yes | |||||

| Ethnic/Racial Diversity |

22% | Anti-Hedging and Pledging Policies | Yes | |||||

| Majority Voting in Director Elections |

Yes | Clawback Policy | Yes | |||||

* Ms. Myers is not standing for reelection to the Board at the Annual Meeting, which will reduce the Board’s gender diversity from 30% to 22%. Our Board and Nominating and Governance Committee value gender diversity on the Board and are committed to increasing the number of female Board members. We are actively seeking highly qualified director candidates with the appropriate skills and experience to serve on the Board, and we expect to complete our search and appoint a new director by the next annual meeting.

** The information in this table reflects only the directors nominated

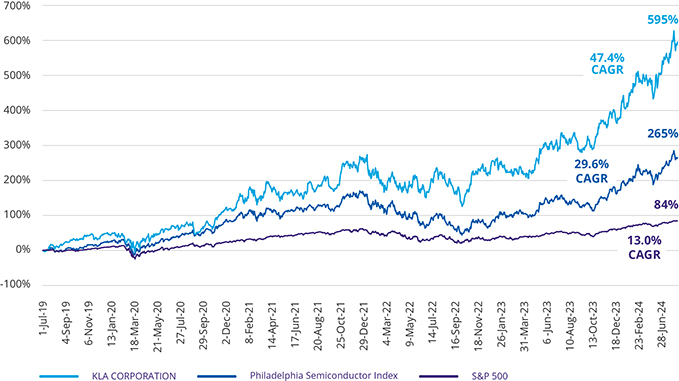

Fiscal Year 2024

Fiscal Year 2024

Performance Highlights

(Dollars in thousands)

| Total revenues

$9,812,247

|

Net income attributable to KLA

$2,761,896

|

Dividends and stock

$2,508,787

| ||||||

| 2024 Proxy Statement

| 2024 Proxy Statement

4 | Proposal One: Election of Directors

Proposal One: Election of

Proposal One: Election of

Directors

NOMINEES

Nine incumbent directors are nominated for election at the Annual Meeting. The Nominating and Governance Committee, consisting solely of independent directors as determined under the rules of the NASDAQ Stock Market, recommended the nominees listed in this Proposal One. Based on that recommendation, the members of the Board resolved to nominate such individuals for election.

Information regarding the business experience, qualifications, attributes and skills of each nominee is provided below under the section entitled “Nominees for Election at the 2024 Annual Meeting.”

There are no family relationships among our executive officers and directors.

The nine candidates nominated by the Board for election as directors by the stockholders are:

Robert Calderoni;

Robert Calderoni; |

| |||||

Jeneanne Hanley;

Jeneanne Hanley; |

| |||||

Emiko Higashi;

Emiko Higashi; |

Robert Rango; and

Robert Rango; and | |||||

Kevin Kennedy;

Kevin Kennedy; |

Richard Wallace.

Richard Wallace. | |||||

Michael McMullen;

Michael McMullen; |

||||||

If elected, each nominee will serve as a director for a one-year term expiring at our 2025 annual meeting of stockholders. Each director will hold office until his or her successor is duly elected and qualified, or until his or her death, resignation or removal. If any nominee declines to serve or becomes unavailable for any reason, or a vacancy occurs before the election, the proxies may be voted for such substitute nominees as the Board may designate. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or who will decline to serve as a director.

VOTE REQUIRED AND RECOMMENDATION

Under our bylaws, in any uncontested election of directors (an election in which the number of nominees does not exceed the number of directors to be elected), any nominee who receives a greater number of votes cast “FOR” his or her election than votes cast “AGAINST” his or her election will be elected. In accordance with our bylaws, the Nominating and Governance Committee has established procedures under which any director who is not elected shall offer to tender his or her resignation to the Board following certification of the stockholder vote. The Nominating and Governance Committee, composed entirely of independent directors, will consider the offer of resignation and recommend to the Board the action to be taken. The Board will take action on the recommendation, and we will publicly disclose the Board’s decision and the rationale behind it, within 90 days following certification of the stockholder vote. In making their respective decisions, the Nominating and Governance Committee and Board will take into consideration all factors they deem relevant. The director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board regarding his or her resignation.

|

The Board unanimously recommends a vote “FOR” each of the director nominees, with the Directors who are nominees abstaining with respect to their own nomination. |

| 2024 Proxy Statement

| 2024 Proxy Statement

5

Information About the

Information About the

Board of Directors and its

Committees

THE BOARD OF DIRECTORS

Our Board held a total of four meetings during the fiscal year ended June 30, 2024. All directors other than Mr. Wallace are independent within the meaning of the NASDAQ Stock Market director independence standards.

The Board has three standing committees: the Audit Committee, the Compensation and Talent Committee, and the Nominating and Governance Committee. Each committee is comprised entirely of independent directors, meets regularly and has a written charter approved by the Board, all of which are available on our website at http://ir.KLA.com, along with our Standards of Business Conduct, Corporate Governance Standards and other governance-related information. The Board and each committee periodically review the committee charters. In addition, at each quarterly Board meeting, a member of each committee reports on any significant matters addressed by the committee.

During the fiscal year ended June 30, 2024, each of the incumbent directors attended at least 75% of the aggregate of the total number of meetings (a) of the Board held during the period for which such person served as a director and (b) held by all Board committees on which such director served (during the periods that such director served).

Although we do not have a formal policy mandating attendance by members of the Board at our annual meetings of stockholders, we do have a formal policy encouraging their attendance at such meetings. All of the directors serving on our Board at the time attended last year’s annual meeting of stockholders.

Board Leadership Structure

KLA currently separates the positions of Chief Executive Officer and Chairman of the Board. Since November 2022, Robert Calderoni, one of our independent Directors, has served as our Chairman of the Board. The responsibilities of the Chairman of the Board include: setting the agenda for each Board meeting, in consultation with the Chief Executive Officer; chairing the meetings of the Board; presiding at executive sessions; facilitating and conducting, with the Nominating and Governance Committee, the annual self-assessments by the Board and each standing committee of the Board; and conducting, with the Compensation and Talent Committee, a formal evaluation of the Chief Executive Officer in the context of compensation reviews.

Separating the positions of Chief Executive Officer and Chairman of the Board allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board believes that having an independent director serve as Chairman of the Board is the appropriate leadership structure for KLA at this time.

However, our Corporate Governance Standards permit the roles of the Chairman of the Board and the Chief Executive Officer to be filled by the same or different individuals. This provides the Board with flexibility to determine whether the two roles should be combined in the future based on our needs and the Board’s assessment of our leadership from time to time. Our Corporate Governance Standards provide that, in the event the Chairman of the Board is not an independent Director, the independent members of the Board will designate a “lead independent director.”

The Board’s Role in Oversight of Risk

Our Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. The involvement of the Board in working with management to establish our business strategy at least annually is a key part of its oversight of risk management, its assessment of

| 2024 Proxy Statement

| 2024 Proxy Statement

6 | Information about the Board of Directors and its Committees

management’s appetite for risk and its determination of what constitutes an appropriate level of risk for KLA. In addition, the Board periodically conducts a comprehensive review of our overall risk environment and risk management efforts. The Board and its committees also regularly receive updates from management (including representatives of our legal and internal audit teams) regarding certain risks that we face, including industry, business, macroeconomic, litigation, cybersecurity and other operating risks.

While our Board is ultimately responsible for risk oversight, our Board has delegated to the Audit Committee the primary responsibility for the active oversight of our enterprise risk management activities. Our Audit Committee is not only responsible for overseeing risk management of financial matters, the adequacy of our risk-related internal controls, financial reporting and internal investigations, and cybersecurity, but its charter also provides that the Audit Committee will discuss at least annually KLA’s risk assessment, enterprise risk management processes and major financial risk exposures, as well as the steps our management has taken to monitor and control those exposures. Our Audit Committee reports its findings and activities to the Board at each quarterly Board meeting.

In addition, our other Board committees each oversee certain aspects of risk management. Our Compensation and Talent Committee oversees risks related to our compensation and human capital policies and practices, and our Nominating and Governance Committee oversees governance-related risks, such as Board independence, environmental, social and governance (“ESG”) matters, conflicts of interest and management and director succession planning. The committees report their findings and activities to the Board.

While the Board is responsible for risk oversight, management is responsible for risk management. KLA maintains an effective internal controls environment and has processes to identify and manage risk, including an executive risk committee comprised of representatives from our legal, human resources, finance, global operations, internal audit, procurement, and risk and compliance teams. This committee reports to our Chief Executive Officer and has oversight of the various risk assessment, monitoring and controls processes across the Company.

The current composition of the committees of the Board is as follows:

| Director |

Audit | Compensation and Talent |

Nominating and Governance | |||

| Robert Calderoni |

✓ | Chair | ||||

| Jeneanne Hanley |

✓ | |||||

| Emiko Higashi |

✓ | |||||

| Kevin Kennedy |

✓ | ✓ | ||||

| Michael McMullen |

✓ | |||||

| Gary Moore |

Chair | ✓ | ||||

| Marie Myers* |

Chair | ✓ | ||||

| Victor Peng |

✓ | |||||

| Robert Rango |

✓ | |||||

| Richard Wallace |

||||||

* Ms. Myers is not standing for reelection to the Board at the Annual Meeting.

AUDIT COMMITTEE

Current Members: Emiko Higashi, Kevin Kennedy, Marie Myers (Chair) and Robert Rango.

Meetings Held During Fiscal Year 2024: 8

Primary Responsibilities: The Audit Committee is responsible for appointing and overseeing the work of our independent registered public accounting firm, reviewing cybersecurity initiatives, approving the services performed by our independent registered public accounting firm, and reviewing and evaluating our accounting principles and system of internal accounting controls. In addition, the head of our Internal Audit function, who is supervised by our Chief Financial Officer, formally reports to the Audit Committee and provides updates at each quarterly meeting.

Independence: The Board has determined that each of the members of the Audit Committee meets the independence requirements (including the heightened requirements for Audit Committee members) of NASDAQ and under the rules and regulations of the SEC, and has no material relationship with KLA (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a director) outside of their service on the Board and its committees.

| 2024 Proxy Statement

| 2024 Proxy Statement

7

The Board has determined that each of Mr. Kennedy and Ms. Myers is an “audit committee financial expert” within the meaning of the rules and regulations promulgated by the SEC.

Ms. Myers is not standing for reelection to the Board at the Annual Meeting.

COMPENSATION AND TALENT COMMITTEE

Current Members: Robert Calderoni, Jeneanne Hanley, Michael McMullen, Gary Moore (Chair) and Victor Peng.

Meetings Held During Fiscal Year 2024: 6

Primary Responsibilities: The Compensation and Talent Committee reviews and either approves or recommends to the Board (depending upon the compensation plan and the executive involved) our executive compensation policies and programs and administers our employee equity award plans. The Compensation and Talent Committee also reviews and, except with respect to our Chief Executive Officer and Chairman of the Board, has the authority to approve the cash and equity compensation for our executive officers and for members of the Board. The Compensation and Talent Committee also reviews our human capital initiatives and administers our compensation recovery policy. See “Compensation Discussion and Analysis—Compensation and Talent Committee Decision Making-Approval Procedures Overview and Market Data” for more information concerning the procedures and processes the Compensation and Talent Committee follows in setting such compensation and implementing the various cash and equity compensation programs in effect for such individuals, including the retention of an independent compensation consultant to provide relevant market data and advice.

Independence: The Board has determined that each of the members of the Compensation and Talent Committee meets the independence requirements (including the heightened requirements for Compensation and Talent Committee members) of NASDAQ and under the rules and regulations of the SEC, and has no material relationship with KLA (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a director) outside of their service on the Board and its committees.

Following the Annual Meeting, Mr. Moore will remain the Compensation and Talent Committee Chair.

Risk Considerations in Our Compensation Programs

Our management conducted an extensive review and analysis of the design and operation of KLA’s compensation practices, policies and programs for all employees, including our NEOs (as that term is defined elsewhere in this Proxy Statement), to assess the risks associated with those practices, policies and programs. Our Compensation and Talent Committee has reviewed the results of that analysis, including the underlying plan data and a risk assessment of significant elements of our compensation program. Based on this review and assessment, we and our Compensation and Talent Committee do not believe our compensation program encourages excessive or inappropriate risk-taking for the following reasons:

|

Our use of different types of compensation provides a balance of short-term and long-term incentives with fixed and variable components; | |

|

Our equity awards (including awards of performance-based restricted stock units (“PRSUs”), to the extent earned) typically vest over a four-year period, encouraging participants to look to long-term appreciation in equity values; | |

|

The metrics used to determine the amount of a participant’s bonus under our incentive bonus plans and the number of shares earnable under PRSUs focus on Company-wide measures such as Operating Margin Dollars and relative free cash flow margin, metrics that the Compensation and Talent Committee believes encourage the generation of profitable revenue and drive long-term stockholder value; | |

|

Our bonus plans impose caps on bonus awards to limit windfalls; | |

|

Our system of internal control over financial reporting, Standards of Business Conduct and whistleblower processes, among other things, are intended to reduce the likelihood of manipulation of our financial performance to enhance payments under our performance-based compensation plans; and | |

|

Our insider trading policy provides that our employees may not enter into hedging transactions involving our common stock (“Common Stock”), in an effort to prevent employees who receive equity awards from insulating themselves from the effects of changes in our stock price. | |

| 2024 Proxy Statement

| 2024 Proxy Statement

8 | Information about the Board of Directors and its Committees

NOMINATING AND GOVERNANCE COMMITTEE

Current Members: Robert Calderoni (Chair), Kevin Kennedy, Gary Moore and Marie Myers.

Meetings Held During Fiscal Year 2024: 4

Primary Responsibilities: The Nominating and Governance Committee is primarily responsible for identifying and evaluating the qualifications of all candidates for election to the Board, as well as reviewing corporate governance policies and procedures and assessing stockholder proposals related to governance matters. The Nominating and Governance Committee assesses the appropriate size and composition of the Board, the effectiveness of its leadership structure, and whether any vacancies on the Board are expected, and monitors our ESG initiatives.

Independence: The Board has determined that each of the members of the Nominating and Governance Committee meets the independence requirements of NASDAQ, and has no material relationship with KLA (including any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment as a director) outside of their service on the Board and its committees.

Following the Annual Meeting, Mr. Calderoni will remain the Nominating and Governance Committee Chair.

Evaluation of Director Candidates

In the event that vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers potential candidates that may come to its attention through current members of the Board, professional search firms, management, stockholders or other persons. In evaluating properly submitted stockholder recommendations, the Nominating and Governance Committee uses the evaluation standards discussed in further detail below and seeks to achieve a balance of knowledge, background, diversity, experience and capability on the Board.

It is the Nominating and Governance Committee’s policy to consider candidates for the Board recommended by, among other persons, stockholders who have owned at least one percent of our outstanding shares for at least one year and who state that they have an intent to continue as a substantial stockholder for the long term. Stockholders wishing to nominate candidates for the Board must notify our Corporate Secretary in writing of their intent to do so and provide us with certain information set forth in Article II, Section Eleven of our bylaws and all other information regarding nominees that is required to be provided pursuant to Regulation 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), or as otherwise requested by the Nominating and Governance Committee.

Majority Vote Policy

We maintain a governance policy applicable to uncontested director elections (elections in which the number of nominees does not exceed the number of directors to be elected) requiring that directors receive majority support in such elections. Under our bylaws, in any uncontested director election, any nominee who receives a greater number of votes cast “FOR” his or her election than votes cast “AGAINST” his or her election will be elected. In accordance with our bylaws, the Nominating and Governance Committee has established procedures under which any director who is not elected shall offer to tender his or her resignation to the Board following certification of the stockholder vote. The Nominating and Governance Committee, composed entirely of independent directors, will consider the offer of resignation and recommend to the Board the action to be taken. The Board will take action on the recommendation, and we will publicly disclose the Board’s decision and the rationale behind it, within 90 days following certification of the stockholder vote. In making their respective decisions, the Nominating and Governance Committee and Board will take into consideration all factors they deem relevant. The director who tenders his or her resignation will not participate in the decisions of the Nominating and Governance Committee or the Board regarding his or her resignation.

Director Qualifications and Diversity

The Board believes that the skill set, backgrounds and qualifications of our directors, considered as a group, should provide a significant composite mix of diversity in experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. In addition, the Board believes that there are certain attributes that every director should possess, such as demonstrated business or academic achievements, the highest ethical standards and a strong sense of professionalism. Accordingly, the Board and the Nominating and Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and KLA’s current and future needs.

In considering candidates for director nomination, including evaluating any recommendations from stockholders as set forth above, the Nominating and Governance Committee considers candidates who have demonstrated executive

| 2024 Proxy Statement

| 2024 Proxy Statement

9

experience or significant high-level experience in accounting, finance or a technical field or industry applicable to KLA. As set forth in our Corporate Governance Standards, the Nominating and Governance Committee takes into account all factors it considers appropriate when evaluating director candidates, which include strength of character, mature judgment, career specialization and the extent to which the candidate would fill a present need on the Board. In addition, with every candidate search, the Board considers the value of diversity and inclusion, and actively seeks candidates who will enhance the diversity and inclusiveness of the Board. With respect to new Board members, it is the standard practice of the Nominating and Governance Committee to engage a third-party recruiting firm to identify a slate of individuals for consideration as Board candidates based on the above-mentioned criteria.

In addition, the Nominating and Governance Committee annually reviews with the Board the appropriate skills and characteristics required of directors in the context of the current composition of the Board. In seeking a diversity of backgrounds, the Nominating and Governance Committee seeks a variety of occupational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives. This annual assessment enables the Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as KLA’s needs evolve and change over time.

In evaluating director candidates, including incumbent directors for re-nomination to the Board, the Nominating and Governance Committee has considered all of the criteria described above. When assessing an incumbent director, the Nominating and Governance Committee also considers the director’s past performance on and contributions to the Board. Among other things, the Nominating and Governance Committee has determined that it is important to have individuals with the following skills and experiences on the Board:

|

Current or former executives who demonstrate strong leadership qualities and possess significant operating experience that together enable them to contribute practical business advice to the Board and management, strategies regarding change and risk management, and valuable insight into developing, implementing and assessing our operating plan and business strategy; | |

|

A deep understanding of the key issues relevant to technology companies, including specific knowledge regarding the semiconductor industry, which is vital in understanding and reviewing our business goals and challenges, as well as our product development and acquisition strategies; | |

|

Substantial international experience, which is particularly important given our global presence and the international nature of our customer base; | |

|

An understanding of finance and related reporting processes. In the case of members of our Audit Committee, we seek individuals with demonstrated financial expertise with which to evaluate our financial statements and capital structure; | |

|

Corporate governance experience obtained from service as Board members and/or executives for other publicly traded companies, which we believe results in a greater sense of accountability for management and the Board and enhanced protection of stockholder interests; and | |

|

Contribution to the Board’s overall diversity of background and viewpoint, including diversity with respect to race, ethnicity, gender, thought and areas of expertise. | |

| 2024 Proxy Statement

| 2024 Proxy Statement

10 | Information about the Board of Directors and its Committees

Director Nominee Skills Matrix

| Director Nominee Skills Matrix (as of September 12, 2024) |

|

|

|

|

|

|

|

|

| |||||||||

| Public Company. Experience with reporting obligations, investor interaction, corporate securities rules, and public company governance. |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Global Business. Broad exposure to companies or organizations having a significant global presence, including developing and managing business in markets around the world, communicating in different cultures, and understanding different geopolitical situations. |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Corporate Governance. Adhering to bylaws and charters; experience in setting and adhering to corporate governance agenda for a board of directors; knowledge and understanding of governance planning, implementation and review processes; experience in encouraging management accountability and protecting stockholder interests. |

● | ● | ● | ● | ● | ● | ¡ | ● | ● | |||||||||

| Corporate Financing/Capital Allocation. Experience in making capital allocation decisions; experience in financing or capital markets transactions. |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Financial Expertise/Literacy. Experience in accounting or financial reporting, including understanding of internal controls; experience in overseeing such reporting and controls. |

● | ● | ● | ● | ● | ¡ |

¡ |

● | ● | |||||||||

| Information Services and Technology. Experience, knowledge and understanding of information services industry; significant experience with technology, science and innovation; basic knowledge of various IT solutions, experience in overseeing the implementation of such solutions and using such solutions to improve business performance; particular experience with social media and developing online platforms. |

● | ¡ |

● | ● | ● | ● | ● | ● | ||||||||||

| Legal/Public/Regulatory. Expertise in compliance with applicable governmental regulations; experience in legal and regulatory matters, corporate compliance and ethics policies; experience in managing the effects of government policies and regulations. |

● | ¡ |

¡ |

● | ● | ¡ |

¡ |

¡ |

● | |||||||||

| Risk Management. Experience in the management of critical business and/or legal risk; understanding of risk management functions, including risk profiles and appetite statements, scenario planning, crisis management, risk identification/classification and similar functions; history of leadership roles in risk management across a number of organizations; ability to think strategically about risk across several organizations; ability to provide oversight and advice relating to risk. |

● | ● | ¡ |

● | ● | ● | ● | ● | ● | |||||||||

| Business Operations. Experience managing supply chain risk and functionality; operating within and through economic cycles; ramping up and ramping down significant employee base; appropriate staffing decisions across numerous functions and operational channels. |

● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Business Development and Strategic Planning. Superior knowledge and understanding of business development, strategic planning, implementation, and review processes; experience in leading strategy discussion at the board level; experience in strategy development with more than one organization; strategic agenda-setting experience; experience with developing and implementing strategies for growth and/or downsizing, including mergers and acquisitions, joint ventures, and divestitures. |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Human Resource, Executive Compensation and Talent Management. Broad experience in executive development, performance, and compensation; experience with HR processes and strategies and efforts to attract, motivate, and retain candidates for key positions; experience in talent development, including developing diversity, equity, and inclusion in workforce. |

● | ● | ¡ |

● | ● | ● | ● | ● | ● | |||||||||

| Cybersecurity/Data Privacy. Experience in overseeing and managing cybersecurity and data privacy risks; history of leadership roles in cybersecurity risk management; degrees, certifications, or other background in cybersecurity. |

¡ |

● | ¡ |

● | ¡ |

● | ● | |||||||||||

| Industry. Experience in the semiconductor industry; perspective and knowledge of semiconductor-related information, including insight into the industry’s challenges and opportunities. |

● | ¡ |

● | ● | ¡ |

● | ● | ● | ● | |||||||||

| ● | Denotes extensive experience, knowledge, and/or expertise and indicates a primary qualification supporting the Director’s nomination. | ¡ | Denotes an area in which the Director nominee has demonstrated proficiency and indicates an ancillary qualification supporting the Director’s nomination. | |||||||||||||||||||||||

| 2024 Proxy Statement

| 2024 Proxy Statement

11

Board Diversity Matrix

The Board Diversity Matrix below depicts the gender and ethnic composition of our Board nominees:

| Board Nominee Diversity Matrix (As of September 12, 2024) | ||||||||

| Total Number of Directors: |

9 | |||||||

|

|

Female | Male | Non-Binary | Did Not Disclose Gender | ||||

| Part I: Gender Identity |

||||||||

| Directors |

2 | 7 | ||||||

| Part II: Demographic Background |

||||||||

| African American or Black (not of Hispanic or Latinx origin) |

||||||||

| Alaska Native or Native American |

||||||||

| Asian |

1 | 1 | ||||||

| Hispanic or Latinx |

||||||||

| Native Hawaiian or Pacific Islander |

||||||||

| White (not of Hispanic or Latinx origin) |

1 | 6 | ||||||

| LGBTQ+ |

||||||||

| Did Not Disclose Demographic Background |

||||||||

Our Board and its Nominating and Governance Committee believe that all of the directors and nominees listed below are highly qualified and have the skills and experience required for service on our Board. Below is certain information with respect to our directors and nominees as of the date of this Proxy Statement, including, for each director and nominee, a biography and a summary of his or her significant experiences, qualifications and skills that are most pertinent to that individual’s service as a member of our Board.

| 2024 Proxy Statement

| 2024 Proxy Statement

12 | Information about the Board of Directors and its Committees

NOMINEES FOR ELECTION AT THE 2024 ANNUAL MEETING

| Robert Calderoni |

|

Director Since: 2007

Age: 64

Board Committees: Compensation and Talent Nominating and

|

Background

Mr. Calderoni has more than 30 years of executive experience in the technology industry. He is the former Chairman and Interim President and Chief Executive Officer of Citrix Systems, Inc., retiring in December 2022. Mr. Calderoni was appointed Interim President and CEO at Citrix in October 2021. Mr. Calderoni was the Executive Chairman at Citrix from July 2015 to December 2018. From October 2015 to January 2016, Mr. Calderoni served as the interim Chief Executive Officer and President of Citrix. Prior to that, he was President of SAP AG’s cloud business following SAP’s October 2012 acquisition of Ariba, Inc., a leading provider of cloud software solutions where he served as Chairman and Chief Executive Officer. Prior to the acquisition, Mr. Calderoni served as Chief Executive Officer and a member of the Board of Directors of Ariba from October 2001 until the company was acquired, and he also served as Ariba’s Chairman of the Board of Directors from July 2003 until the acquisition date. Before becoming Chief Executive Officer of Ariba, Mr. Calderoni served as Ariba’s Chief Financial Officer from January 2001 to October 2001. Prior to joining Ariba, Mr. Calderoni was Chief Financial Officer at Avery Dennison Corporation, a global manufacturing company. He also held numerous senior financial executive positions at major technology companies, including Senior Vice President Finance at Apple Inc., and Vice President Finance at IBM.

As a former senior executive officer of Citrix, SAP and Ariba, Mr. Calderoni provides our Board with extensive and relevant leadership and international operations experience in the technology industry. In addition, Mr. Calderoni is well-qualified to serve as Chairman of the Board as a result of his over 20 years of experience as a finance executive, including his past service as the Chief Financial Officer of two publicly traded technology companies. As a Board member of one other public company, Mr. Calderoni also has familiarity with a range of corporate governance issues.

Other U.S. Public Company Boards:

| |||||

| Ansys, Inc. (since 2020) Citrix Systems, Inc. (2014 to 2022) |

Juniper Networks, Inc. (2003 to 2019) Logmein, Inc. (2017 to 2020) | |||||

| 2024 Proxy Statement

| 2024 Proxy Statement

13

| Jeneanne Hanley |

|

Director Since: 2019

Age: 51

Board Committees: Compensation and Talent

|

Background

Ms. Hanley has held various positions at Lear Corporation, a designer and manufacturer of automotive seating systems and electrical distribution systems and related components, from 1994 until January 2019, most recently serving as Senior Vice President and President of the E-Systems Division. Other positions at Lear Corporation she has held include Corporate Vice President, Global Surface Materials, Corporate Vice President, Americas Seating Business Unit and Vice President, Global Strategy and Business Development. Ms. Hanley earned her bachelor’s degree in mechanical engineering in 1994 and her master’s degree in business administration in 2000 from the University of Michigan.

Ms. Hanley possesses significant operating and leadership skills, including extensive experience in electrical distribution systems and electronic modules used in the automotive industry. She offers significant experience pairing business strategy with organizational strategy in a complex global industry.

Other U.S. Public Company Boards:

QuantumScape Corporation (since 2021) |

| Emiko Higashi |

|

Director Since: 2010

Age: 65

Board Committees: Audit

|

Background

Ms. Higashi is a founder of Tohmon Capital Partners, LLC (formerly Tomon Partners, LLC), a strategy and M&A advisory firm based in San Francisco and primarily serving companies in technology- and healthcare-related fields since 2003. Ms. Higashi serves on the boards of Takeda Pharmaceutical Company Ltd. and Rambus, Inc. Prior to Tohmon Partners, she was a co-founder and Chief Executive Officer of Gilo Ventures, a technology-focused venture capital firm, from 2000 to 2002. Before that, Ms. Higashi spent 15 years in investment banking. After beginning her investment banking career at Lehman Brothers from 1985 to 1988, Ms. Higashi was a founding member of Wasserstein Parella and the head of that firm’s technology M&A business from 1988 to 1994, and subsequently served as a managing director in charge of Merrill Lynch’s global technology M&A practice from 1994 until 2000. Prior to her investment banking career, Ms. Higashi spent two years as a consultant at McKinsey & Co. in Tokyo, Japan. Ms. Higashi holds a Carnegie Mellon University Software Engineering Institute CERT Certificate for Cybersecurity Oversight.

As a result of her extensive career in technology-focused investment banking and finance, Ms. Higashi brings to the Board significant strategic, business development, mergers and acquisitions and financial experience related to the business and financial issues facing large global technology corporations, a comprehensive understanding of international business matters, particularly in Asia, and knowledge of the semiconductor industry. In addition, as a founder and partner of several consulting firms and a founding member of an investment banking firm, Ms. Higashi also possesses significant leadership and entrepreneurial experience.

Other U.S. Public Company Boards:

| |||||

| Takeda Pharmaceutical Company Ltd. Rambus, Inc. (since 2017) |

One Equity Partners Open Water I Corp. (2021 to 2023) | |||||

| 2024 Proxy Statement

| 2024 Proxy Statement

14 | Information about the Board of Directors and its Committees

| Kevin Kennedy |

|

Director Since: 2007

Age: 68

Board Committees: Audit Nominating and Governance

|

Background

Mr. Kennedy most recently served as Chairman of the Board of Directors of Quanergy Systems, Inc., a leading provider of LiDAR sensors, from March 2020 to December 2023. He previously served as the Chief Executive Officer of Quanergy from January 2020 to December 2022. In December 2022 Quanergy filed a voluntary petition for relief under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. From July 2018 through March 2020, Mr. Kennedy was a senior managing director at Blue Ridge Partners, a consulting firm that advises companies on accelerating profitable revenue growth. Prior to that, Mr. Kennedy previously served as President, Chief Executive Officer and member of the Board of Directors of Avaya Inc., a leading global provider of business communications applications, systems and services, positions he held from January 2009 to October 2017. In January 2017, Avaya Inc. filed a voluntary petition for relief under Chapter 11 of the Bankruptcy Code with the U.S. Bankruptcy Court for the Southern District of New York. Prior to joining Avaya, Mr. Kennedy was Chief Executive Officer of JDS Uniphase Corporation, a provider of optical products and test and measurement solutions for the communications industry, from September 2003 to December 2008, also serving as JDS Uniphase’s President from March 2004 to December 2008. From 2001 to 2003, he served as Chief Operating Officer of Openwave Systems, Inc., a provider of software solutions for the communication and media industries. Previously, Mr. Kennedy spent nearly eight years at Cisco Systems, Inc. and 17 years at Bell Laboratories. In 1987, Mr. Kennedy was a Congressional Fellow to the U.S. House of Representatives on Science, Space and Technology. In January 2012, Mr. Kennedy was appointed to the President’s National Security Telecommunications Advisory Committee by former President Barack Obama. Mr. Kennedy holds a Carnegie Mellon University Software Engineering Institute CERT Certificate for Cybersecurity Oversight.

As a member of the Board of Directors of UL Solutions Inc. (Underwriters Laboratories, Inc.) and a former senior executive at Avaya, JDS Uniphase, Quanergy and Openwave, Mr. Kennedy possesses a vast amount of leadership and operational experience with companies in high technology industries. Also, as the holder of a Ph.D. degree in engineering from Rutgers University, a member of President Obama’s National Security Telecommunications Advisory Committee, a former Congressional Fellow to the U.S. House of Representatives Committee on Science, Space and Technology, and the author of more than 30 papers on computational methods, data networking and technology management, Mr. Kennedy offers relevant expertise in a broad range of technology matters. Specifically, Mr. Kennedy has been associated with over 150 M&A transactions as part of building large and growing organizations. In addition, as a result of his experience on the Boards of Directors of several public companies, Mr. Kennedy offers our Board a deep understanding of corporate governance matters.

Other U.S. Public Company Boards:

| |||||

| Digital Realty Trust, Inc. (since 2013) Quanergy Systems, Inc. (2020 to 2023) |

Maxeon Solar Technologies, Ltd. (2020 to 2022) UL Solutions Inc. (since 2020) | |||||

| 2024 Proxy Statement

| 2024 Proxy Statement

15

| Michael McMullen |

|

Director Since: 2023

Age: 63

Board Committees: Compensation and Talent

|

Background

Mr. McMullen is the former Chief Executive Officer and President of Agilent Technologies (“Agilent”), a global leader in life sciences, diagnostics and applied chemical markets, providing application focused solutions that include instruments, software, services and consumables for the entire laboratory workflow, roles he held since 2015 and 2014, respectively, until his retirement in May 2024. Mr. McMullen currently serves as a senior advisor to Agilent. In his over twenty-year career at Agilent and its predecessor, Hewlett-Packard Company, Mr. McMullen held numerous leadership positions, including Chief Operating Officer from 2014 to 2015, and Senior Vice President, Agilent and President, Chemical Analysis Group from 2009 to 2014. Prior to that, he served in various capacities for Agilent, including Vice President and General Manager of the Chemical Analysis Solutions Unit of the Life Sciences and Chemical Analysis Group and Country Manager for Agilent’s China, Japan and Korea Life Sciences and Chemical Analysis Group. Prior to that, Mr. McMullen served as Controller for the Hewlett-Packard Company and Yokogawa Electric Joint Venture from 1996 to 1999. Mr. McMullen served as a member of the Boards of Directors of Agilent from 2015 to 2024 and Coherent, Inc. from 2018 to 2022.

As the former President and Chief Executive Officer of Agilent, Mr. McMullen brings to the Board extensive leadership experience, driving growth at a global scale in complex multinational equipment businesses. His experiences will provide valuable insight into challenges faced by a technology company with an international presence.

Other U.S. Public Company Boards:

| |||||

| Bristol-Myers Squibb Company (since 2024) Agilent Technologies, Inc. (2015 to 2024) Coherent, Inc. (2018 to 2022) |

||||||

| 2024 Proxy Statement

| 2024 Proxy Statement

16 | Information about the Board of Directors and its Committees

| Gary Moore |

|

Director Since: 2014

Age: 75

Board Committees: Compensation and Talent (Chair) Nominating and Governance

|

Background

Mr. Moore retired in July 2022 from his position as the Chief Executive Officer of ServiceSource International, Inc., a global leader in outsourced, performance-based customer success and revenue growth solutions, a position he had held since December 2018. He also held the position of the Executive Chairman of ServiceSource International, Inc. since November 2018. Mr. Moore previously retired in July 2015 from his positions as President and Chief Operating Officer of Cisco Systems, Inc., a leading global provider of networking and other products and services related to the communications and information technology industry, positions he had held from October 2012 to July 2015. Mr. Moore first joined Cisco in October 2001 as Senior Vice President, Advanced Services, and, in August 2007, he also assumed responsibility as co-lead of Cisco Services. From May 2010 to February 2011, he served as Executive Vice President, Cisco Services, and he was Cisco’s Executive Vice President and Chief Operating Officer from February 2011 until October 2012 when he was named President and Chief Operation Officer. Immediately before joining Cisco, Mr. Moore served for approximately two years as Chief Executive Officer of Netigy Corporation, a network consulting company. Prior to that, he was employed for 26 years by Electronic Data Systems (“EDS”), where he held a number of senior executive positions, including as the President and Chief Executive Officer of joint venture Hitachi Data Systems from 1989 to 1992.

As the former Executive Chairman and Chief Executive Officer of ServiceSource and a former senior executive with Cisco and other global companies (including roles as Cisco’s President and Chief Operating Officer, the head of Cisco Services, the creator and manager of EDS’s e-solutions global business unit and the President and Chief Executive Officer of the EDS joint venture Hitachi Data Systems), Mr. Moore brings to the Board extensive leadership experience, as well as expertise in matters relating to international operations in the technology industry. Mr. Moore’s experience managing large-scale operations and growing businesses enables him to provide the Board and the Company with valuable advice and guidance regarding operational and strategic issues faced by global technology companies.

Other U.S. Public Company Boards:

Finjan Holdings, Inc. (2015 to 2020) ServiceSource International, Inc. (2016 to 2022) |

| 2024 Proxy Statement

| 2024 Proxy Statement

17

| Victor Peng |

|

Director Since: 2019

Age: 64

Board Committees: Compensation and Talent

|

Background

Mr. Peng retired in August 2024 from his position as President, Adaptive, Embedded, and AI Group, of Advanced Micro Devices, Inc. (“AMD”), a developer of leadership high-performance and adaptive processor technologies, combining CPUs, GPUs, FPGAs, Adaptive SoCs and deep software expertise to enable leadership computing platforms for cloud, edge and end devices, a position he held since February 2022 when AMD acquired Xilinx, Inc. From January 2018 to February 2022, Mr. Peng served as President and Chief Executive Officer of Xilinx. He served on the Xilinx board of directors from October 2017 to February 2022. From April 2017 to January 2018, Mr. Peng served as Xilinx’s Chief Operating Officer. From July 2014 to April 2017, he served as Executive Vice President and General Manager of Products. Prior to joining Xilinx, Mr. Peng served as Corporate Vice President, Graphics Products Group at AMD from November 2005 to April 2008. Prior to joining AMD, Mr. Peng served in a variety of executive engineering positions at companies in the semiconductor and processor industries.

As the former President, Adaptive, Embedded, and AI Group, of AMD, the former Chief Executive Officer of Xilinx and former member of its board of directors, and with his over 30 years of experience in the semiconductor industry, Mr. Peng provides our Board with extensive and relevant leadership and international operations experience.

Other U.S. Public Company Boards:

Xilinx, Inc. (2017 to 2022) |

| 2024 Proxy Statement

| 2024 Proxy Statement

18 | Information about the Board of Directors and its Committees

| Robert Rango |

|

Director Since: 2014

Age: 66

Board Committees: Audit

|

Background

Mr. Rango retired in December 2022 from his position as President and Chief Executive Officer of Enevate Corporation, a company working on the development of next generation Lithium Ion (Li-ion) battery technology, after serving in those roles since May 2016. Prior to that, Mr. Rango served for over 12 years, from March 2002 to July 2014, as an executive at Broadcom Corporation, a leading fabless semiconductor company. He most recently served as Executive Vice President and General Manager of Broadcom’s Mobile and Wireless Group, a role he had held from February 2011 to July 2014. During his tenure with Broadcom, Mr. Rango held a number of senior management positions in the company’s Network Infrastructure Business Unit, Mobile and Wireless Group and Wireless Connectivity Group, including as Senior Vice President and General Manager, Wireless Connectivity Group from January 2006 to February 2010 and as Executive Vice President and General Manager, Wireless Connectivity Group from February 2010 to February 2011. From 1995 to 2002, Mr. Rango held several Vice President and General Manager positions at Lucent Microelectronics, a networking communications company, and Agere Systems, a leader in semiconductors and software solutions for storage, mobility and networking markets, in its Optical Access, New Business Initiatives and Modem/Multimedia Divisions. Mr. Rango holds a Carnegie Mellon University Software Engineering Institute CERT Certificate for Cybersecurity Oversight.

Mr. Rango possesses significant operating and leadership skills, including extensive experience in global semiconductor product marketing, development and sales. As a result of his past service as an operational executive and general manager of several large global organizations, Mr. Rango offers a broad understanding of mobile, wireless, semiconductor, optical, software and technology management, which enables him to make significant contributions as a member of our Board.

Other U.S. Public Company Boards:

Keysight Technologies, Inc. (since 2015) Microchip Technology, Inc. (since 2023) Integrated Device Technology, Inc. (2015 to 2019) |

| 2024 Proxy Statement

| 2024 Proxy Statement

19

| Richard Wallace |

|

Director Since: 2006

Age: 64

Board Committees: None

|

Background

Mr. Wallace currently serves as our President and Chief Executive Officer. He has been our Chief Executive Officer since January 2006 and has also served as our President since November 2008. He began at KLA Instruments in 1988 as an applications engineer and has held various general management positions throughout his 36 years with us, including positions as President and Chief Operating Officer from July 2005 to December 2005, Executive Vice President of the Customer Group from May 2004 to July 2005, and Executive Vice President of the Wafer Inspection Group from July 2000 to May 2004. Earlier in his career, he held positions with Ultratech Stepper and Cypress Semiconductor. Mr. Wallace previously served as a member of the Board of Directors of SEMI (Semiconductor Equipment and Materials International), a prominent industry association, including as SEMI’s Chairman of the Board. He earned his bachelor’s degree in electrical engineering from the University of Michigan and his master’s degree in engineering management from Santa Clara University, where he also taught strategic marketing and global competitiveness courses after his graduation.

As our President and Chief Executive Officer and a KLA employee for 36 years, Mr. Wallace brings to the Board extensive leadership and semiconductor industry experience, including a deep knowledge and understanding of our business, operations and employees, the opportunities and risks faced by KLA, and management’s strategy and plans for accomplishing our goals. In addition, Mr. Wallace’s current service as a member of the Boards of Directors of KLA and Marvell Technology, Inc., and his prior service as a member of the Boards of Directors of Splunk, NetApp and Proofpoint give him a strong understanding of his role as a Director and a broad perspective on key industry issues and corporate governance matters.

Other U.S. Public Company Boards:

Marvell Technology, Inc. (since 2024) Splunk, Inc. (2022 to 2024) NetApp, Inc. (2011 to 2019) Proofpoint, Inc. (2017 to 2021) |

| 2024 Proxy Statement

| 2024 Proxy Statement

20 | Information about the Board of Directors and its Committees

DIRECTOR COMPENSATION

Our Fiscal Year 2024 Director Compensation Program

Non-employee members of the Board (“Outside Directors”) receive a combination of equity and cash compensation as approved by the Compensation and Talent Committee (or, in the case of the compensation of the Chairman of the Board, as recommended by the Compensation and Talent Committee and approved by the Board). Equity compensation to Outside Directors is provided under our 2023 Incentive Award Plan (“2023 Plan”), which has been approved by our stockholders. Retainers and committee fees are paid in quarterly cash installments (unless the applicable director elects to defer such cash payments, as described below). The following table presents the key features of our fiscal year 2024 Outside Director compensation program:

| COMPENSATION ELEMENT

|

FISCAL YEAR 2024 PROGRAM

| |

| Cash Compensation

| ||

| Standard annual cash retainer | $100,000 | |

|

Committee member additional annual cash retainers (including Committee Chair)

|

$15,000 for Audit Committee $12,500 for Compensation and Talent Committee $7,500 for Nominating and Governance Committee | |

|

Committee Chair additional annual cash retainers |

$30,000 for Audit Committee $20,000 for Compensation and Talent Committee $10,000 for Nominating and Governance Committee | |

|

Annual cash retainer for non-executive Chairman (in lieu of standard retainer)

|

$155,000 | |

| Reimbursement for reasonable meeting attendance expenses |

Included | |

| Equity Compensation

| ||

| Market value of standard restricted stock unit (“RSU”) award granted at annual meeting |

$235,000 (to be granted at the Annual Meeting); dividend equivalents payable upon vesting | |

| Market value of non-executive Chairman RSU award granted at annual meeting in lieu of standard RSU award |

$290,000 (to be granted at the Annual Meeting); dividend equivalents payable upon vesting | |

|

Vesting period of Outside Director RSUs |

Awards vest in full annually; shares immediately issued upon vesting | |

Effective for fiscal year 2024, the Board increased (i) the standard annual cash retainer from $90,000 to $100,000; (ii) the annual cash retainer for our non-executive Chairman from $130,000 to $155,000; and (iii) the grant-date value of the annual RSU award from $220,000 to $235,000.

Other than as described above, members of the Board do not receive any additional compensation for their services as directors. The Board will separately determine the compensation payable to Outside Directors for service on special purpose committees of the Board, if such committees are created.

If a new Outside Director joins the Board after the date of an annual meeting of stockholders, his or her first RSU award will be granted at the time or promptly after he or she joins the Board and will be prorated to take into account the period of time from the last annual meeting of stockholders to the date the new Outside Director joined the Board.

Under the Outside Director compensation program, the RSU awards granted to our Outside Directors are issued with “dividend equivalent” rights pursuant to our 2023 Plan. Dividend equivalent rights entitle the recipient to receive credits, payable in cash, equal to the cash dividends that would have been received on the shares of our Common Stock had the shares subject to the RSUs been issued and outstanding on the dividend record date. The dividend equivalents are only payable to the recipient upon vesting and settlement of the underlying award.

| 2024 Proxy Statement

| 2024 Proxy Statement

21

We have had in effect since 2008 a policy of providing prorated vesting acceleration of RSUs held by Outside Directors who are in good standing, whose service on the Board terminates before their RSUs are vested and who, at the time of termination, have served on the Board for six years.

Deferred Compensation

Each Outside Director is entitled to defer all or a portion of his or her cash retainer pursuant to our Executive Deferred Savings Plan (“EDSP”), a nonqualified deferred compensation plan. Amounts credited to the EDSP may be allocated by the participant among a variety of investment funds. For further information regarding our EDSP, including the list of investment funds available under the EDSP during fiscal year 2024, please refer to the section of this Proxy Statement entitled “Compensation Discussion and Analysis - Nonqualified Deferred Compensation.” Of the Outside Directors who served in fiscal year 2024, only Ms. Myers and Kiran Patel participated in the EDSP.

Matching Program

Since August 2014, Outside Directors have been able to participate in a gift matching program, under which the KLA Foundation will generally match, dollar-for-dollar, gifts by Outside Directors to qualifying tax-exempt institutions up to $10,000 per calendar year.

Stock Ownership Guidelines

We have adopted a policy, pursuant to which each Outside Director is expected to own a specified minimum number of shares of our Common Stock. Under our current policy, each Outside Director, once he or she has served as an Outside Director for at least four years, is expected to own shares of our Common Stock with a market value of at least five (5) times the standard annual cash retainer paid to the Outside Directors. Shares of Common Stock underlying outstanding RSUs held by the directors count toward this ownership requirement.

The table below sets forth as of September 12, 2024, the compliance with our stock ownership guidelines by the eight Outside Directors who have served for at least four years. Value is based on the closing price of our Common Stock on June 28, 2024 ($824.51) (i.e., the last trading day of our last completed fiscal year). Ratio is equal to value divided by annual cash retainer.

| Name |

Total |

Value ($) | Ratio | |||||||||

| Robert Calderoni |

14,529.527 | 11,979,740 | 77.3x | |||||||||

| Jeneanne Hanley |

3,547.000 | 2,924,537 | 29.2x | |||||||||

| Emiko Higashi |

14,416.000 | 11,886,136 | 118.9x | |||||||||

| Kevin Kennedy |

7,482.000 | 6,168,984 | 61.7x | |||||||||

| Gary Moore |

14,678.000 | 12,102,158 | 121.0x | |||||||||

| Marie Myers |

3,530.000 | 2,910,520 | 29.1x | |||||||||

| Victor Peng |

5,262.000 | 4,338,572 | 43.4x | |||||||||

| Robert Rango |

11,343.000 | 9,352,417 | 93.5x | |||||||||

(1) Consists of: (i) shares owned, including shares indirectly owned by the Outside Directors through living trusts, and (ii) RSUs.

| 2024 Proxy Statement

| 2024 Proxy Statement

22 | Information about the Board of Directors and its Committees

Director Compensation Table

The following table sets forth certain information regarding the compensation earned by or awarded to each Outside Director during fiscal year 2024:

| Name |

Fees |

Stock |

Change in |

All Other |

Total |

|||||||||||||||

| Robert Calderoni |

185,000 | 289,730 | - | 4,826 | 479,556 | |||||||||||||||

| Jeneanne Hanley |

112,500 | 234,929 | - | 3,661 | 351,090 | |||||||||||||||

| Emiko Higashi |

115,000 | 234,929 | - | |

3,661 |

|

|

353,590 |

| |||||||||||

| Kevin Kennedy |

122,500 | 234,929 | - | |

3,661 |

|

361,090 | |||||||||||||

| Michael McMullen |

112,500 | 234,929 | - | 172 | 347,601 | |||||||||||||||

| Gary Moore |

140,000 | 234,929 | - | |

3,661 |

|

378,590 | |||||||||||||

| Marie Myers |

152,500 | 234,929 | - | |

3,661 |

|

391,090 | |||||||||||||

| Kiran Patel(5) |

30,625 | |

- |

|

- | |

3,661 |

|

34,286 | |||||||||||

| Victor Peng |

112,500 | |

234,929 |

|

- | |

3,661 |

|

351,090 | |||||||||||

| Robert Rango |

115,000 | |

234,929 |

|

- | |

3,661 |

|

353,590 | |||||||||||

(1) The amounts set forth in this column represent cash fees earned by each Outside Director during fiscal year 2024, regardless of whether the fees were actually paid during the fiscal year.

(2) The amounts shown represent the aggregate grant date fair value of RSUs awarded to each Outside Director during fiscal year 2024, computed in accordance with the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 718, referred to in this Proxy Statement as ASC 718 (except that the fair values set forth above have not been reduced by the Company’s estimated forfeiture rate). The ASC 718 grant date fair value of each RSU award was calculated based on the fair market value of our Common Stock on the award date. For further discussion regarding the assumptions used in calculating the grant date fair value for RSUs, please refer to Note 1 to the Company’s consolidated financial statements in Item 8 of the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024, filed with the SEC on August 5, 2024.

On November 1, 2023, each Outside Director then in office was granted an RSU award for 493 shares of our Common Stock (other than Mr. Calderoni who, as Chairman of the Board, received an RSU award for 608 shares, as described above under the heading “Our Fiscal Year 2024 Director Compensation Program”). The following table shows, for each Outside Director, the aggregate number of unvested shares of our Common Stock underlying all outstanding RSUs held by that Outside Director then in office as of June 30, 2024:

| Name |

Aggregate Number of |

|||

| Robert Calderoni |

604 | |||

| Jeneanne Hanley |