Dividends and Share Repurchases

KLA has a proven track record of returning cash to shareholders, including a regular quarterly dividend and ongoing share repurchase program. We believe our track record of delivering strong capital returns offers predictable and compelling value creation for our shareholders.

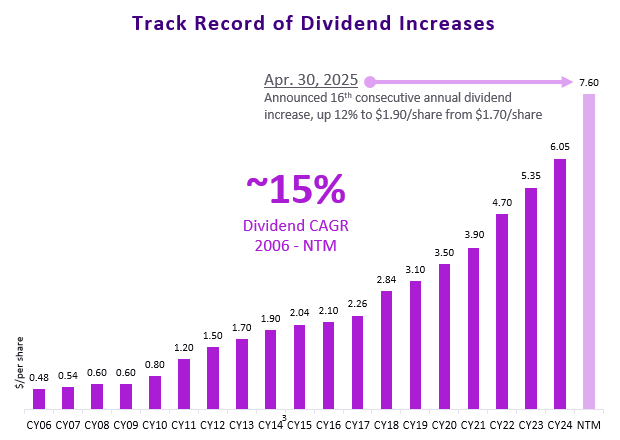

Dividends

The dividend is an integral piece of KLA’s disciplined approach to capital management and reflects the company's continued strength in free cash flow generation.

In April 2025, we raised our quarterly dividend to $1.90 per share, marking the 16th consecutive annual dividend increase. Our dividend history is available below.

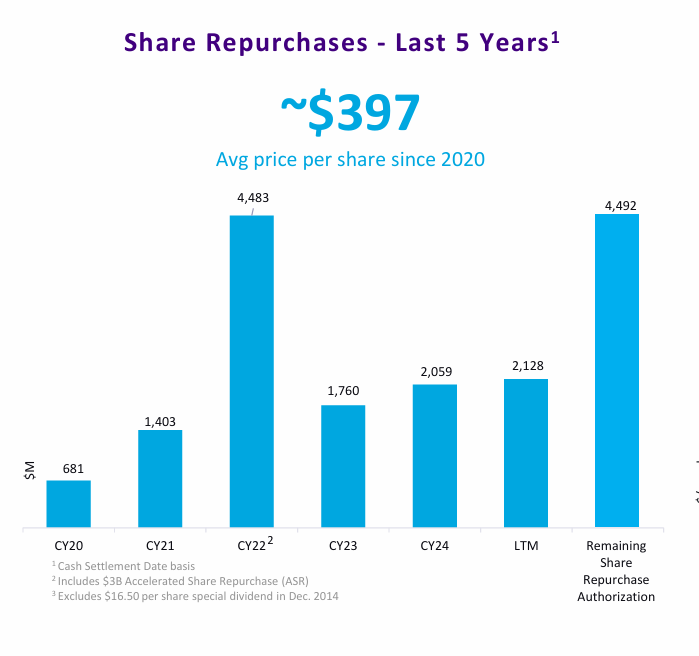

Share Repurchases

Share repurchases are part of KLA’s balanced approach to capital returns to shareholders, including dividends and share repurchases. We target total capital returns of 85% or more of free cash flow generated by the company over the long term.